Context and Motivation

As DeFi protocols evolve to accommodate increasingly complex and hybridized asset types, the need for verifiable, high-integrity data has become fundamental. Assets today are no longer simple on-chain primitives. They represent claims to staking flows, custody arrangements, or collateralized debt positions that span both onchain and offchain domains. In such environments, Proof of Reserve (PoR) mechanisms provide the connective tissue that allows protocols to reason about external states with onchain confidence.

The recent efforts to classify assets under structured frameworks such as AAcA highlight the importance of consistent categorization and risk differentiation. Yet, orthogonal to those frameworks lies an even more critical layer: how to verify the foundational truths on which those classifications depend? PoR feeds serve this exact purpose. They enable Aave and similar systems to verify the existence, solvency, and composition of assets whose value cannot be fully observed onchain. In this sense, PoR represents the infrastructural foundation upon which all further risk modeling rests.

Why Proof of Reserve Feeds Matter

At their core, PoR feeds function as independently verifiable signals that confirm an asset’s underlying backing, liquidity, or solvency. They bridge the informational gap between the onchain economy and the real-world systems or permissioned environments that many assets depend on. Without such external verification, any assumption of collateral sufficiency or redemption parity becomes a matter of trust rather than a verifiable fact.

For example, a fiat-backed stablecoin may hold treasury assets in an offchain custodian. In contrast, a strategy-based synthetic asset might rely on off-chain collateralized debt positions or portfolios whose valuation and status must be continuously verified. In each case, a PoR mechanism provides a data-driven way to attest that what exists onchain corresponds to what is claimed offchain. This enables the protocol to base its risk parameters on objective truth rather than abstract assumptions. The absence of such verification introduces structural opacity and undermines the protocol’s ability to enforce solvency guarantees or capital adequacy constraints.

Consider a protocol that tokenizes U.S. Treasury bills. Without a live PoR feed confirming that each token corresponds to an actual T-bill held in custody, users must trust the issuer’s word. A proper PoR attestation, however, enables anyone to verify that the on-chain supply aligns with the real-world holdings, thereby restoring transparency and measurable trust.

Architectural Alignment and Systemic Integrity

Direct and verifiable access to reserve data is the foundation of any credible PoR system. Without first-hand visibility into the underlying assets and balances, any downstream attestation risks relying on opaque or delayed intermediaries, undermining the integrity of the proof itself.

Simply having access to reserve data is not sufficient, however. A PoR system must be architected in a way that respects and mirrors the underlying mechanics of the system it is attesting to. Misaligned or superficial attestations can create false confidence and shift systemic risk to unseen layers of the stack.

For instance, if a proof of reserves feed verifies total custodial balances but ignores specific liabilities or fails to incorporate duration-based components stemming from the underlying protocol’s mechanism design (i.e., mint/burn), it presents an incomplete picture of solvency. The verification process must be anchored at the correct point of economic exposure, where the actual risk to tokenholders or the protocol resides. It must also operate within the same logical and temporal parameters as the system it measures, reflecting withdrawal constraints, batch settlements, and delayed reporting where relevant. A well-designed PoR does not abstract away the complexity of the system; it captures that complexity faithfully within its attestation logic.

For example, certain liquid BTC implementations have exhibited sharp, temporary spikes in their reserve attestations due to delays between minting, burning, and reserve settlement. These mismatches can momentarily create the appearance of overcollateralization even though the underlying asset value remains unchanged. Without incorporating such timing effects into the attestation logic, a PoR system risks over- or understating solvency and introducing artificial volatility into dependent markets. Properly aligning attestations with these temporal dynamics ensures the proof reflects economic reality rather than mechanical lags.

Calibration and Quantitative Design

The accuracy and reliability of PoR mechanisms depend heavily on calibration, how the feed interprets timing, aggregation, and edge cases within the system it represents. Each asset class introduces its own set of quantitative challenges. In staking-based systems, for example, the delay between withdrawal requests and settlement finality creates windows where reserve data may appear stale. For strategy-based systems, PoR mechanisms must account for evolving collateral compositions and varying levels of liquidity across debt positions, taking into consideration the varying assumptions about underlying protocol dependancies.

A well-calibrated PoR feed does not simply broadcast a binary “backed/unbacked” signal. It quantifies confidence within an economically meaningful range, integrating latency, exposure concentration, and dependency tracking to provide a comprehensive assessment. This transforms PoR into a risk-aware oracle layer, not just a reporting mechanism, but an analytical tool that allows the protocol to interpret the state of reserves as a continuous input to its risk model. Quantitative rigor ensures that these signals are not just transparent but also economically coherent.

From Verification to Actionability

Verification alone is not the end goal. The purpose of integrating PoR feeds is to enable protocols to act upon verified data in automated and predictable ways. Once a deviation or discrepancy is detected between the claimed reserves and the verified state, the system must translate this information into tangible risk management actions.

Depending on the asset and its integration path, these actions can range from temporary freezes and LTV reductions to liquidity cap adjustments or even dynamic changes to liquidation thresholds. The design space is vast, encompassing both binary circuit breakers and gradual parameter decay mechanisms. What matters is that PoR signals become actionable inputs within the governance and risk control stack, rather than passive data points. This establishes a self-reinforcing feedback loop where verifiable data drives protective responses, ensuring that solvency risk is not only observed but also contained.

Operational Modalities Across Proof of Reserve Asset Classes

The notion of a “Proof of Reserve” mechanism encompasses a spectrum of implementations rather than a single standard. Each asset class introduces its own topology of risk, custody, and composability, which dictates how reserve verification should function in practice. The goal of any PoR design is to reconcile informational asymmetry between the asset’s economic source of value and its on-chain representation. To achieve this, the verification model must be constructed in a manner that mirrors the system’s own internal mechanics, including issuance logic, redemption flow, and settlement boundary conditions.

The correct design of a PoR mechanism thus depends on the nature of the asset and the mechanics of its issuance. For liquid staking and restaking tokens, reserve verification involves understanding validator economics, underlying exchange-rate oracles, and staking contract flows. For permissioned staking tokens, it requires mapping validator ownership, custody segregation, and validator-to-supply reconciliation. Fiat- and treasury-backed stablecoins depend on frequent and verifiable attestations of off-chain reserve quality, liquidity horizon, and custody structure. Meanwhile, credit-, fund-, and strategy-backed assets demand integration across both on- and off-chain domains, reconciling portfolio composition, leverage, and reporting cadence. In all cases, credible PoR design hinges on a deep grasp of protocol-level mechanism design: how issuance, redemption, and settlement interact to define true solvency.

Fiat- and Treasury-Backed Stablecoins

For fiat-backed stablecoins and tokenized cash instruments, the Proof of Reserve function is both familiar and indispensable. These assets derive their value from off-chain reserves, including cash, short-term treasuries, or bank deposits, which are custodied by regulated financial institutions or trust entities. The primary objective of PoR in this context is to verify that the aggregate reserve equals or exceeds the total on-chain supply, and that these reserves are held in transparent, auditable accounts under the issuer’s exclusive control.

A robust PoR framework, however, extends beyond verifying the existence of funds. It must also attest to the composition, location, and liquidity readiness of those reserves. A stablecoin backed entirely by demand deposits exhibits a fundamentally different liquidity profile than one collateralized by longer-duration treasuries or commercial paper. Under stress conditions, the speed at which those assets can be liquidated to meet redemptions becomes a critical factor in determining risk. Thus, the quality and liquidity horizon of reserves must be reflected in the PoR feed, not merely their nominal value.

From a risk-management standpoint, Aave treats fiat-backed stablecoins as borrowable but not necessarily collateral-eligible assets, unless accompanied by frequent and verifiable Proof of Reserve attestations. This distinction reflects an asymmetry of risk: in an adverse scenario where reserve integrity fails and the stablecoin’s value collapses, the corresponding debt obligation within Aave also devalues, limiting systemic exposure. Conversely, allowing such an asset as collateral without a reliable PoR mechanism introduces direct solvency risk to the protocol.

To mitigate this, collateral eligibility for fiat-backed stablecoins should be contingent on the existence of a PoR mechanism that updates on a continuous or near-real-time cadence. Monthly attestations, often published four to six weeks after the reporting date, are insufficient for risk-sensitive integration. Without a timely PoR feed, the protocol cannot react quickly enough to off-chain reserve deterioration or liquidity shocks. Regularized, cryptographically verifiable updates, potentially aggregated from multiple attesters, are therefore essential prerequisites for any stablecoin seeking collateral status within Aave.

Real-World Assets (RWAs)

For traditional real-world assets, Proof of Reserve mechanisms serve as the connective tissue between on-chain representations and the complex, multi-jurisdictional legal and financial structures that anchor them off-chain. RWAs encompass tokenized instruments such as short-term treasuries, private credit, trade finance, and real estate debt, each with distinct custody models, reporting standards, and liquidity constraints. Unlike on-chain-native assets, the reserves underlying RWAs exist entirely within traditional financial infrastructure, often distributed across custodians, trust entities, or SPVs.

In such a class, a PoR framework must function as both an audit and a synchronization layer. It should verify not only that the aggregate on-chain token supply is backed by equivalent real-world assets but also that those assets meet the eligibility, valuation, and seniority criteria defined by the issuer’s structure. This includes validating fund NAVs, outstanding liabilities, lien positions, and the timeliness of custodian reporting. The system must also incorporate latency tolerance, recognizing that off-chain reconciliations and legal settlements operate on slower timeframes than on-chain markets.

High-quality RWA PoR design requires a hybrid data model that fuses cryptographic attestations from custodians and trustees with automated on-chain monitoring of supply and redemption activity. This allows protocols to maintain a continuously updated view of backing composition, maturity distribution, and liquidity readiness. By embedding these verifications directly into oracle or risk-control infrastructure, DeFi protocols can dynamically adjust collateral parameters in response to real-world asset performance, for example, tightening borrowing limits if the liquidity horizon of the underlying portfolio extends or if NAV deviates beyond tolerance.

Ultimately, PoR for RWAs represents the synthesis of DeFi’s transparency standards with traditional financial audit discipline. It is what transforms tokenized instruments from static wrappers around off-chain assets into trust-minimized, continuously verified collateral primitives that can safely integrate into permissionless systems like Aave.

Credit-, Fund-, and Strategy-Backed Synthetic Assets

Credit-based, strategy-based, and tokenized fund assets represent an increasingly convergent class of collateral types in DeFi. Whether structured as collateralized debt positions (CDPs), synthetic dollars, or tokenized yield funds, these systems share a typical architecture: reserves that span both on-chain and off-chain domains, managed dynamically through rebalancing strategies, credit exposure, and liquidity buffers. The economic integrity of such instruments depends on the continuous alignment between the issued token supply and the value of the underlying collateral or asset portfolio.

In this context, a PoR mechanism serves as a real-time solvency oracle. It continuously verifies that the aggregate value of the reserves across custody accounts, lending positions, and strategy deployments meets or exceeds the circulating supply of the token. Unlike staking or fiat-backed models, these structures often rely on external custodians and asset managers to hold and manage underlying collateral. A robust PoR solution must therefore integrate data from both sides of the boundary: off-chain custody attestations and asset-manager reporting, combined with on-chain debt accounting, oracle pricing, and redemption logic.

For these hybrid systems, the PoR oracle serves as a data fusion layer, aggregating heterogeneous information into a single, verifiable on-chain signal. It continuously monitors reserve accounts, validates collateral composition rules, and generates cryptographic proofs of solvency that can be publicly audited. In doing so, it transforms Proof of Reserve from a static audit function into a living risk control system. For protocols like Aave, such a feed provides actionable signals: if a PoR oracle detects under-collateralization, delayed recognition of losses, or discrepancies in NAV reporting, the protocol can automatically restrict borrowing, reduce collateral factors, or freeze the associated markets until solvency is restored.

However, an additional layer of oversight is required for credit- and strategy-backed assets, as the underlying portfolio strategies are not enforced on-chain. This creates a structural dependency on off-chain asset managers and custodians, whose decisions directly affect solvency but may not be visible to smart contracts. As seen in recent events with Stream and Elixir, unmonitored changes to off-chain strategies or deviations from disclosed mandates can introduce hidden risks that only become evident after losses occur. To mitigate this, every onboarded asset must come with explicit strategy definitions, off-chain monitoring hooks, and a requirement for ongoing validation of adherence to the approved investment strategy.

Furthermore, if a strategy evolves or deviates from its initial configuration, it must undergo a formal re-approval process. This ensures that any change in collateral composition, leverage, counterparty exposure, or liquidity profile is evaluated and authorized before being reflected in the PoR system or accepted as valid collateral. The oracle layer must therefore not only monitor solvency but also track compliance with approved investment policies.

Many of these synthetic assets also behave as tokenized funds, whose portfolios consist of yield-bearing or credit-exposed instruments such as treasuries, repo agreements, or off-chain loans. Here, the PoR layer serves as a NAV verifier, ensuring that the on-chain representation of fund value aligns with the net asset value of its underlying holdings. This requires continuous reconciliation across multiple off-chain data sources, including custodian attestations, fund audits, asset price feeds, and transaction-level settlement data, while accounting for latency, reporting frequency, and liquidity horizons.

The principal challenge in this domain is not the availability of data but its structural coherence: designing an oracle that accurately reflects how these portfolios evolve in the real world. The PoR mechanism must respect the natural cadence of traditional finance, daily or weekly reporting cycles, while providing on-chain consumers with timely, tamper-resistant updates.

By embedding Proof of Reserve verification into the core of these credit- and fund-backed systems, DeFi protocols move from reactive transparency toward algorithmic solvency enforcement. The token supply becomes a continuously validated representation of the underlying economic value, and market participants gain confidence through real-time visibility. Systemic exposure to latent credit or liquidity risk is substantially reduced.

Liquid Staking and Restaking Tokens

For liquid staking tokens (LSTs) and liquid restaking tokens (LRTs), the concept of Proof of Reserve diverges fundamentally from that of offchain or custodial assets. In these systems, the reserve is not held by a third-party custodian but represented directly by on-chain validator balances, liquid buffers, and staking contract states. The entire reserve structure, deposits, validator performance, accrued rewards, and pending withdrawals are generally publicly observable on-chain. As a result, the exchange rate oracle used to price the token relative to its base asset effectively operates as a vertically integrated proof-of-reserve mechanism. It encodes the protocol’s full internal accounting of underlying assets and yield generation, serving as a live attestation of solvency.

Because the oracle itself performs the reserve translation function, the core risk in these systems is not informational opacity but oracle integrity. Many LST or LRT exchange rate feeds are hypothetically susceptible to manipulation via compromised externally owned accounts (EOAs), centralized oracle dependencies, upgradable contract logic, or even donation attacks that artificially inflate the token’s value relative to its base asset. In such cases, a malicious or compromised feed could distort Aave’s perception of an asset’s fundamental value, enabling overcollateralization and extracting risk-free borrowing capacity through mispriced leverage.

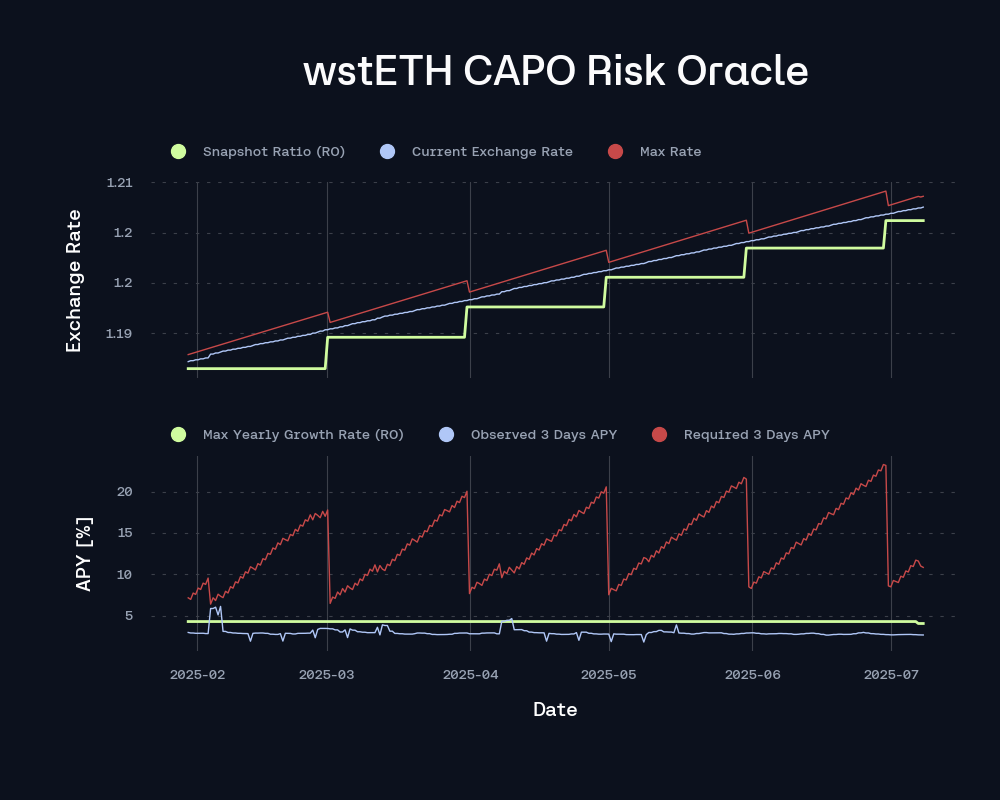

To mitigate this class of exposure, Aave introduced the Correlated Asset Price Oracle (CAPO): a deterministic framework that constrains the relationship between correlated assets such as wstETH and stETH. CAPO enforces a time-weighted upper bound on exchange-rate growth, capturing the maximum organic yield accrual consistent with the underlying staking mechanism. This design limits artificial inflation and oracle manipulation while preserving natural, yield-driven appreciation. Chaos Labs’ CAPO risk oracle, described in depth here, aims to precisely automate the economic components of this system in real-time, ensuring that the minimization of such rate inflation is aligned with market conditions.

Economically, it is rational to treat such “proof of reserve” exchange-rate mechanisms as optimal pricing implementations, since they operate as continuous, algorithmic systems vertically integrated at the asset issuer level. There is no temporal discretization; state transitions occur naturally through on-chain events, such as reward accrual, validator exits, and withdrawals, resulting in a real-time valuation surface rather than a snapshot. Moreover, the underlying mint and redeem logic of these assets is fully permissionless and algorithmically defined, allowing markets to arbitrate and converge toward equilibrium pricing continuously. This dynamic convergence naturally suppresses artificial deviations, reducing the likelihood of manipulation or reflexive liquidations across correlated debt positions.

Note: Where necessary, exogenous risk logic can be incorporated to account for tail scenarios, such as the delay associated with slashing events stemming from correlation penalties, or prolonged withdrawal queues during distressed market conditions. Integrating such external data into the PoR framework ensures that the system remains not only internally consistent but externally responsive, balancing continuous economic truth with defensive risk controls.

Permissioned or Institutional Staking Tokens

Permissioned LSTs introduce a distinct verification challenge. In these systems, custody and validator operation are centralized under a controlled entity, typically a custodial exchange or institutional staking provider. The purpose of a Proof of Reserve mechanism here is to validate the custodial integrity of the system and establish an accurate mapping between user-facing derivative supply and the underlying validator infrastructure that supports it.

Because a single institution mediates the underlying staking activity, the PoR framework must confirm that the total derivative supply is fully backed by a corresponding quantity of ETH either staked or held in reserve, and that these holdings are segregated from the entity’s proprietary operations. In the case of wbETH, for example, verification requires identifying the specific deposit addresses on the Beacon Chain associated with wbETH staking activity, as well as the addresses or sub-accounts holding idle ETH, such as vaults used for user deposits, redemption buffers, or operational liquidity. A meaningful PoR implementation must confirm that Binance’s wbETH validators are distinct from any validators used for the exchange’s internal staking and that the corresponding validator public keys or IDs are attributable exclusively to wbETH.

A properly designed Proof of Reserve system can perform this reconciliation automatically, continuously mapping validator balances, pending withdrawals, and idle ETH reserves against the total supply of the permissioned LST. If this system operates responsively in real time, it effectively creates its own exchange-rate function between the permissioned LST and ETH, similar to the model used by traditional LSTs and LRTs. This dynamic relationship not only reflects the true underlying stake composition but also enables market participants to price wbETH based on verifiable, on-chain collateral data, minimizing informational asymmetry and supporting stable collateral valuation within protocols like Aave.

Closing Perspective

Proof of Reserve infrastructure represents a fundamental evolution in DeFi’s information architecture. It provides the epistemic foundation necessary for large-scale financial systems to operate without centralized trust assumptions. As protocols like Aave continue to onboard assets that span both digital and traditional finance, the need for verifiable, third-party-validated data becomes increasingly existential.

The quality of that integration is paramount. A “dumb” reserve quote, i.e., a simple balance check divorced from context, timing, or liability structure, offers little more than surface-level assurance. A high-quality PoR, by contrast, embeds risk awareness directly into its construction. It interprets data rather than merely displaying it, ensuring that attestations convey economic truth, not just numeric equivalence. The sophistication of this integration determines whether a PoR functions as a living risk control system or a static audit artifact.

Ultimately, PoR should not be viewed as a compliance mechanism or a defensive feature. It is an economic alignment primitive; a way to ensure that the protocol’s internal accounting, logic, and market assumptions remain synchronized with the actual state of the world. By embedding verification directly into protocol-level risk management, PoR transforms risk control from a reactive process into a continuous, self-correcting system.

This is how DeFi evolves from a closed-loop network of contracts into a self-verifying financial infrastructure, capable of interfacing with the external world without sacrificing the principles of transparency, autonomy, and trust minimization.

Disclosure

Chaos Labs currently provides Proof of Reserve infrastructure and attestation services to existing assets such as USDe. This involvement does not influence our risk assessment, and all recommendations presented in this post are based solely on objective data, and protocol safety considerations, in line with Aave’s decentralized risk framework.

Copyright

Copyright and related rights waived via CC0.