Overview

Building on our Principal Token Risk Oracle framework outlined here, we propose risk parameters for PT-USDe-5APR2026 and PT-sUSDe-5APR2026, including recommended initialDiscountRatePerYear and maxDiscountRatePerYear values based on the dynamic linear discount rate oracle methodology described here.

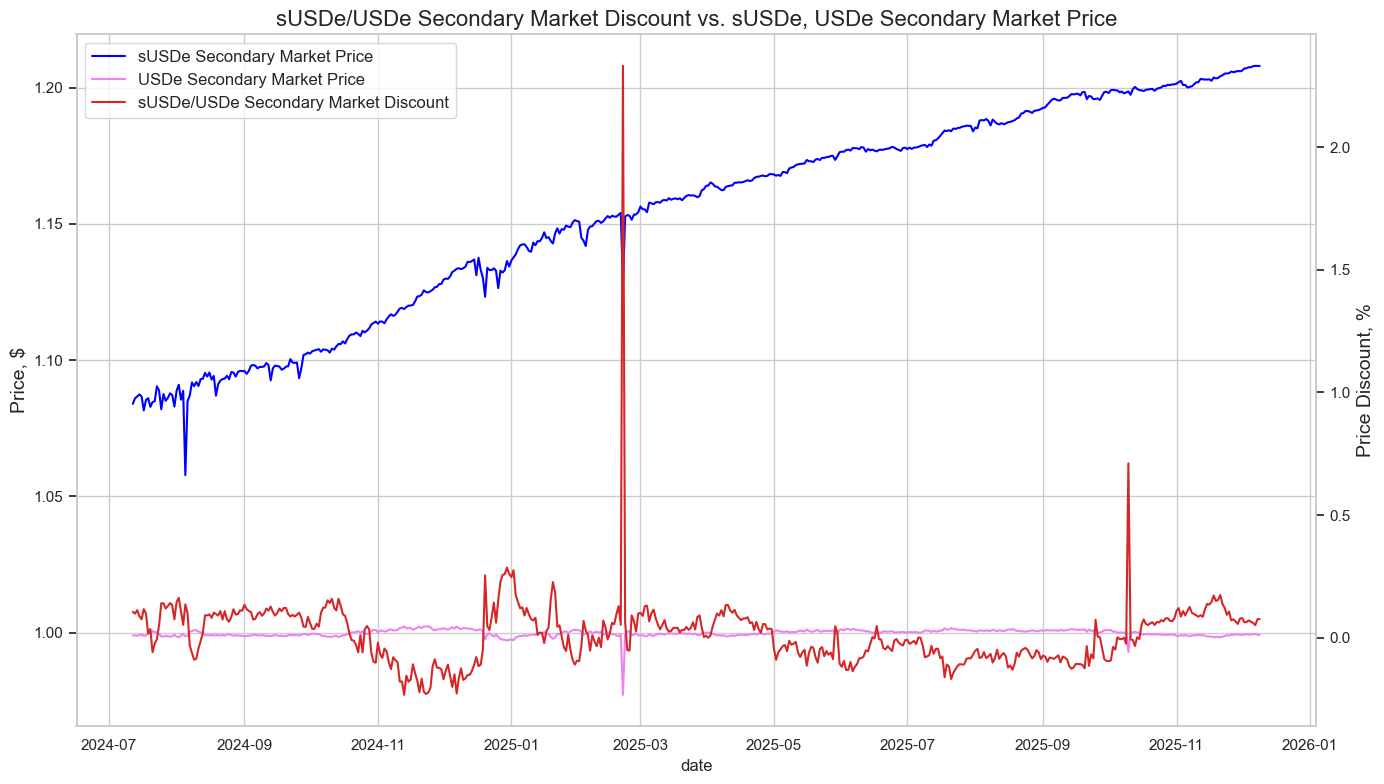

Our paper Stress Testing Ethena: A Quantitative Look at Protocol Stability examines how growth in USDe, sUSDe, and Pendle PTs affects Aave’s collateral and funding, identifying liquidity and backing-side tail risks. Scenario analysis and Monte-Carlo simulations show that current risk-oracle floors, eMode, and liquidation controls are robust, while the upcoming native strategy to offload Ethena-collateralized debt (via Aave’s whitelisted redeemer status) further improves exit capacity for duration-risk positions such as PTs, as detailed here.

Separately, Aave’s Growing Exposure to Ethena: Risk Implications Throughout the Growth and Contraction Cycles of USDe shows that contraction phases are broadly self-stabilizing: lower sUSDe yields trigger leveraged unwind and stablecoin repayments, while PT/USDe borrowers rotate into other stablecoins, supporting USDe prices during redemptions. Net stablecoin liquidity from unwinders typically exceeds PT debt migration, creating a buffer that helps Aave absorb stress. The proposed listings and parameters are calibrated to these dynamics.

Motivation

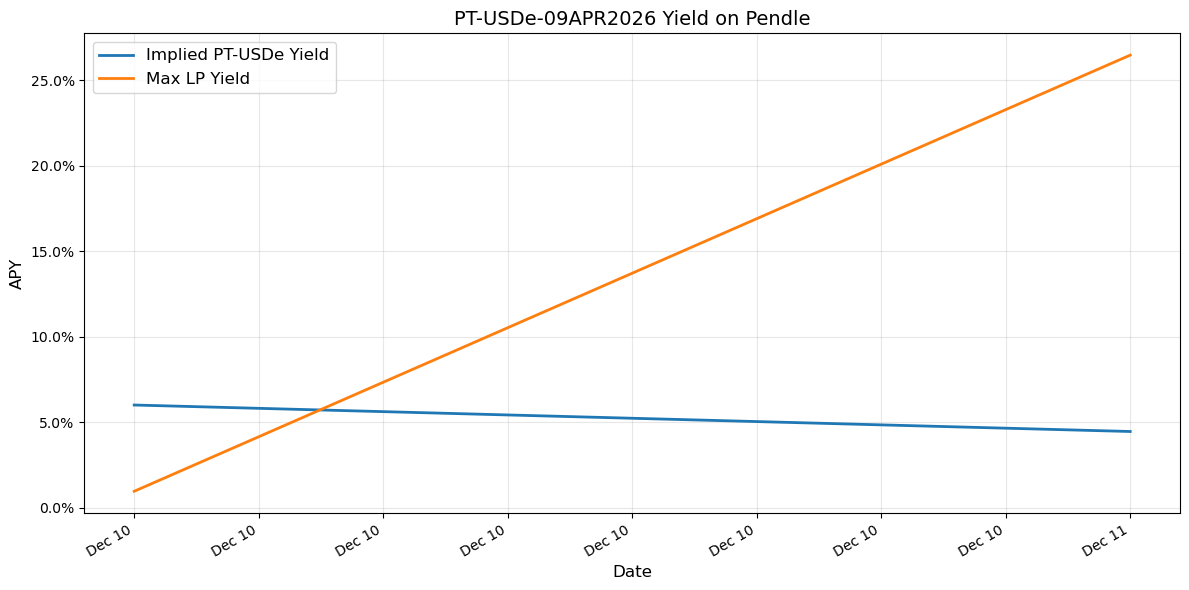

Akin to the Ethena-based PT assets previously onboarded across Aave v3 instances limited-duration runway, adding a new maturity is expected to extend and sustain the principal-token-driven borrowing demand. Specifically, these assets have consistently benefited Aave as they enable substantial stablecoin strategies looping at scale: users deposit PTs as collateral, tokens that accrete toward par as maturity approaches, borrow stablecoins at variable rates, and recycle that liquidity into additional PT exposure.

The resulting position is effectively a leveraged spread trade between the PT’s implied rate and the instantaneous stablecoin borrowing costs on Aave. When that spread is positive, loopers can scale exposure efficiently, driving persistent demand for USDT/USDe borrowing and supporting higher utilization. This behavior has historically translated into meaningful increases in borrow volumes and borrow rates, improving supply yields and protocol revenue. To an extent, stablecoin borrowing demand can be expressed as a function of the spread between the implied rates of the Ethena-based PTs and the borrowing costs of stablecoins: as long as the spread remains positive (net of fees, slippage, and liquidation risk), users have sufficient incentive to lever and loop these assets. This dynamic is further amplified by the highly capital-efficient E-Modes, which increase attainable leverage and reduce the amount of unproductive collateral required per unit of borrowed stablecoins, thereby strengthening the feedback loop between PT demand and stablecoin utilization.

Given the strong demand for PT looping strategies, we expect the April-maturity PTs to drive incremental stablecoin borrowing demand, sustain target stablecoin utilization, and improve both supplier yields and DAO revenue while expanding utility for leverage users.

Risk Oracle Parameter Evolution

Stablecoin E-Modes

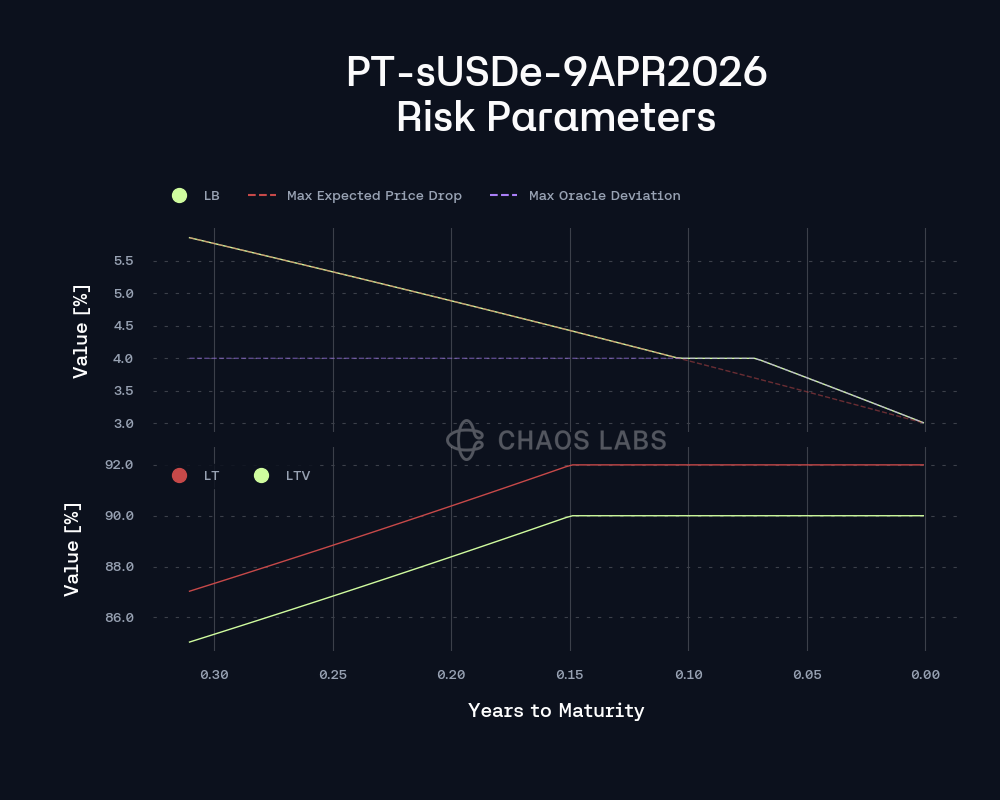

Through our rigorous quantification of the algorithm, we find that the integration risk decays as the PT approaches maturity. This justifies the use of progressively less conservative risk parameters over time. Taking into account the underlying configuration of USDe E-mode within Aave, we outline the projected evolution of the LT, LTV, and LB, with the initial parameterization proximately as follows:

PT-USDe-9APR2026

LTV: 86.4%

LT: 88.4%

LB: 4.7%

PT-sUSDe-9APR2026

LTV: 85.5%

LT: 87.5%

LB: 5.7%

The collateral parameters will continue to become more permissive, evolving in accordance with the plot above. This set of parameters explicitly refers to E-mode, and we recommend setting non-E-mode parameters such that the asset is effectively prohibited from borrowing uncorrelated assets. The underlying configuration will follow our previous listings of related PT assets, applying a minimum liquidation bonus of 2% and a maximum liquidation threshold of 93%.

USDe E-Modes

To further enhance capital efficiency, we propose a dedicated USDe E-mode for PT-USDe-9APR2026 and PT-sUSDe-9APR2026. Given that both the PT token’s underlying asset (USDe) and the debt asset share the same collateral base, the risk parameterization should not be constrained by typical considerations of the underlying asset. Instead, the parameterization should be driven by the Pendle AMM’s liquidity dynamics, aligning more closely with the PT’s inherent pricing structure. We outline the projected evolution of the LT, LTV, and LB, with the initial parameterization approximately as follows:

PT-USDe-9APR2026

LTV: 87.2%

LT: 89.2%

LB: 3.7%

PT-sUSDe-9APR2026

LTV: 87.2%

LT: 89.2%

LB: 3.7%

The approach is justified by the correlation between the PT’s underlying and the debt asset, as both are effectively anchored to the same stable asset — USDe. As a result, this E-Mode would allow for more efficient capital utilization. This configuration aligns with our broader Principal Token Risk Oracle framework, which emphasizes parameter flexibility for pairs where the PT’s underlying asset is also the debt asset, ultimately supporting deeper liquidity and optimized capital efficiency.

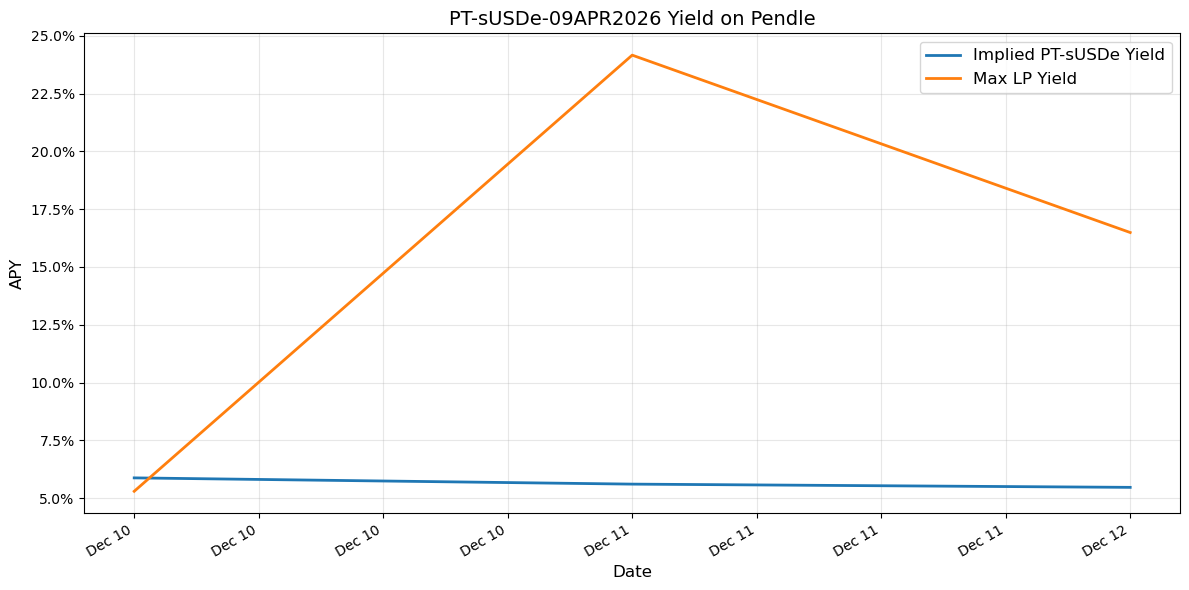

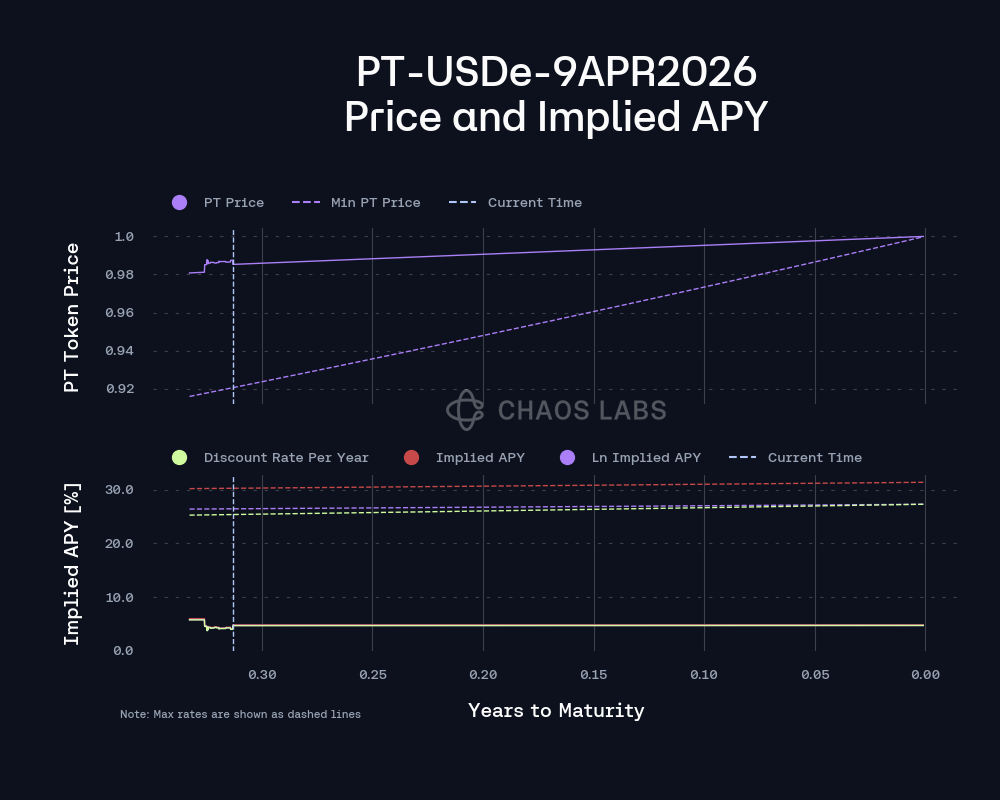

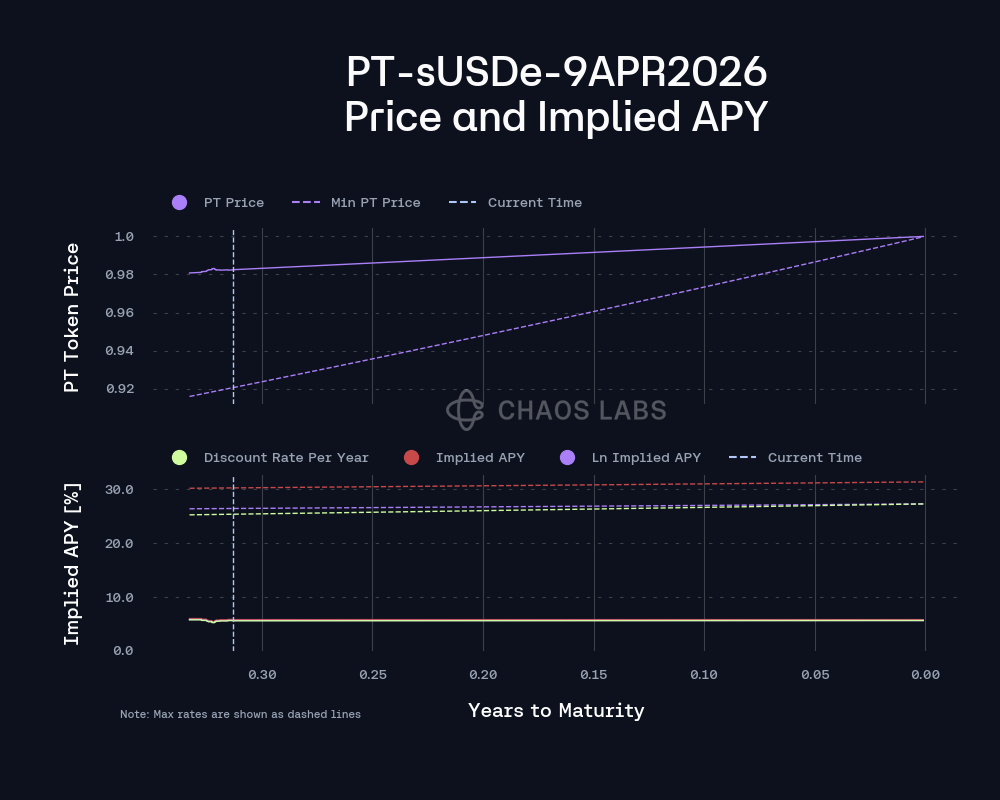

Discount Rates

Based on historical observed data and the pricing configuration of the market, our initial recommendations for the discountRatePerYear and maxDiscountRatePerYear are as follows:

PT-USDe-9APR2026

Initial discountRatePerYear: 4.701%

maxDiscountRatePerYear: 27.276%

PT-sUSDe-9APR2026

Initial discountRatePerYear: 5.596%

maxDiscountRatePerYear: 27.276%

If pricing dynamics change before the listing, such that the discount rate per year requires an update, we will implement the adjustment accordingly upon listing.

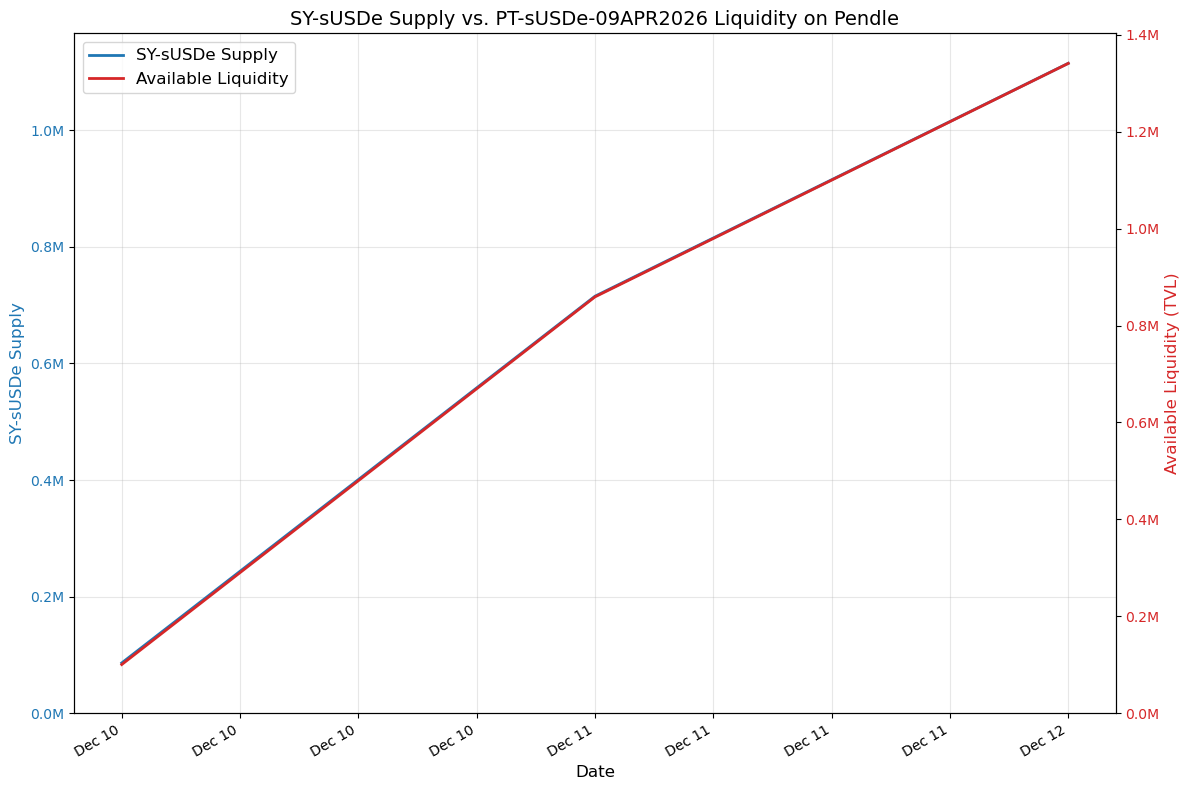

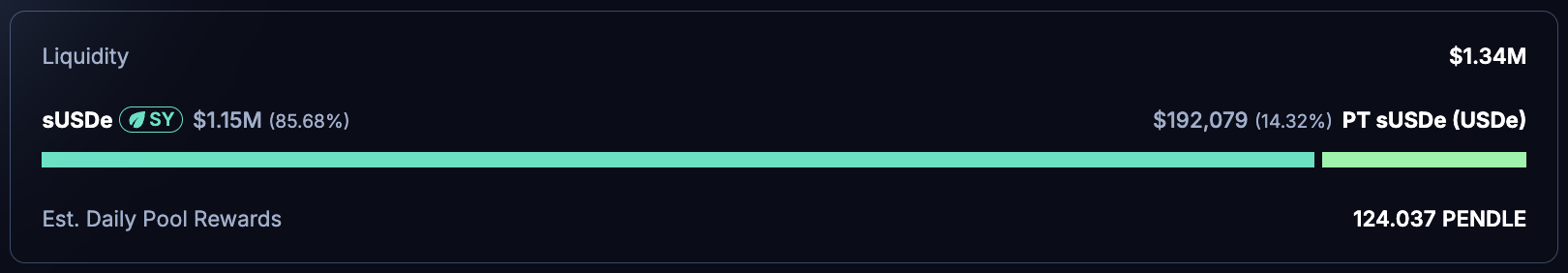

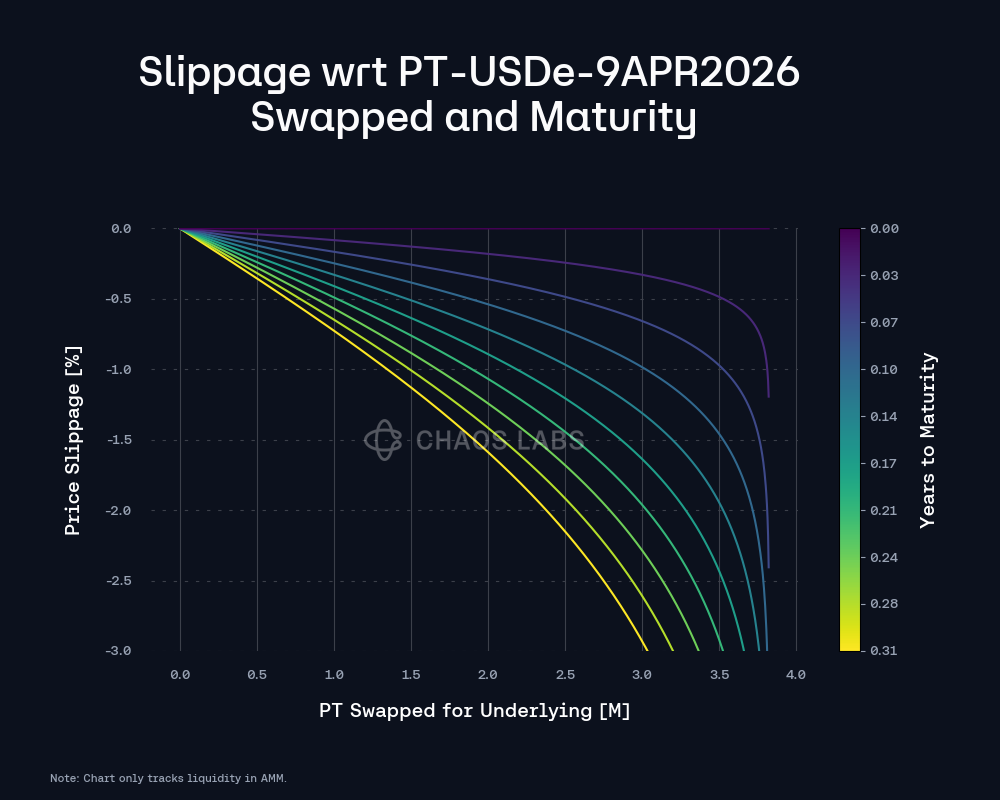

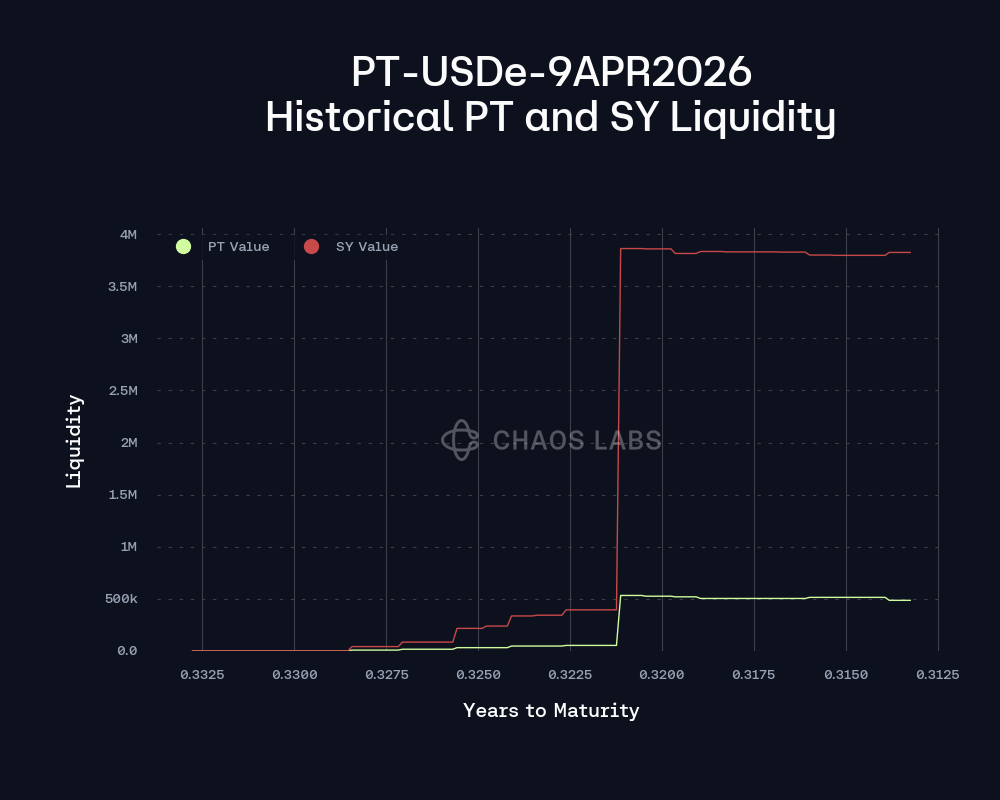

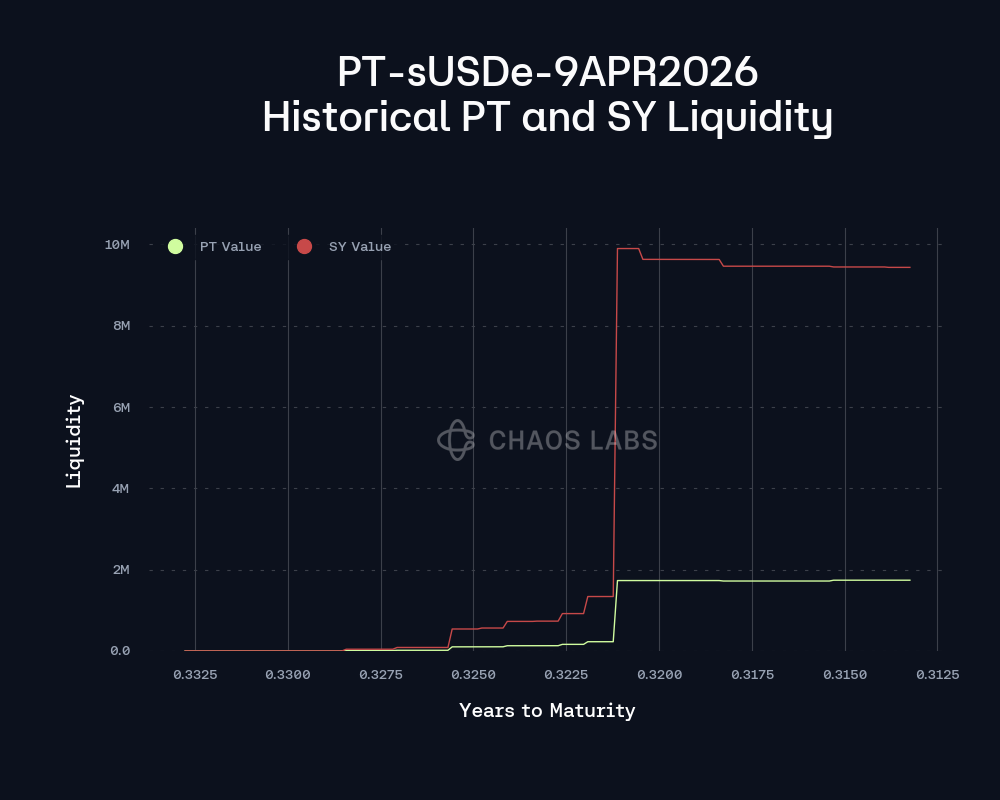

Supply Caps

With PT-sUSDe-9APR2026 and PT-USDe-9APR2026, liquidity depends on both the underlying USDe markets and Pendle’s PT/SY AMM pool. Considering the fact that the market emerged approximately seven days ago, the liquidity depth profiles can be characterized as strong. The plots below represent the amount of liquidity available under 3% slippage as the market approaches expiry, given the current liquidity distribution in the AMM. With the maturity of the market, the price impact associated with swapping PT becomes less extreme. This trend is especially pronounced for assets with lower scalarRoot values, i.e., a greater expected implied yield fluctuation, and they tend to have more variance in liquidity concentration. Supported by on-chain liquidity in the Pendle AMM, the market currently facilitates swaps of up to $10 million and $4 million with less than 3% slippage in sUSDe and USDe PTs, respectively.

The SY Liquidity in PT-sUSDe-9APR2026 and PT-USDe-9APR2026’s AMM has reached just $10 and 4 million within the first week of launch, indicating a substantial level of LP support, and has remained at that level since.

Migration of Existing PTs

To support a seamless migration from other PT-USDe-15JAN2026 and PT-sUSDe-15JAN2026 assets maturing in mid-January to PT-sUSDe-9APR2026 and PT-USDe-9APR2026, we recommend including PT-USDe-15JAN2026 and PT-sUSDe-15JAN2026 in the newly created respective E-Modes.

Specification

| Parameter |

Value |

Value |

| Asset |

PT-sUSDe-9APR2026 |

PT-USDe-9APR2026 |

| Isolation Mode |

No |

No |

| Borrowable |

No |

No |

| Collateral Enabled |

Yes |

Yes |

| Supply Cap |

100,000,000 |

40,000,000 |

| Borrow Cap |

- |

- |

| Debt Ceiling |

- |

- |

| LTV |

0.05% |

0.05% |

| LT |

0.1% |

0.1% |

| Liquidation Penalty |

7.50% |

7.50% |

| Liquidation Protocol Fee |

10.00% |

10.00% |

| E-Mode Category |

PT-USDe Stablecoins, PT-USDe USDe |

PT-sUSDe Stablecoins, PT-sUSDe USDe |

PT-USDe-9APR2026

Initial E-mode Risk Oracle

| Parameter |

Value |

Value |

| E-Mode |

Stablecoins |

USDe |

| LTV |

86.4% |

87.2% |

| LT |

88.4% |

89.2% |

| LB |

4.7% |

3.7% |

Linear Discount Rate Oracle

| Parameter |

Value |

| discountRatePerYear |

4.701% |

| maxDiscountRatePerYear |

27.276% |

PT-USDe Stablecoins E-mode

| Asset |

PT-USDe-9APR2026 |

PT-USDe-15JAN2026 |

USDe |

USDT0 |

| Collateral |

Yes |

Yes |

Yes |

No |

| Borrowable |

No |

No |

Yes |

Yes |

| LTV |

Subject to Risk Oracle |

Subject to Risk Oracle |

Subject to Risk Oracle |

- |

| LT |

Subject to Risk Oracle |

Subject to Risk Oracle |

Subject to Risk Oracle |

- |

| Liquidation Bonus |

Subject to Risk Oracle |

Subject to Risk Oracle |

Subject to Risk Oracle |

- |

PT-USDe USDe E-mode

| Asset |

PT-USDe-9APR2026 |

PT-USDe-15JAN2026 |

USDe |

| Collateral |

Yes |

Yes |

Yes |

| Borrowable |

No |

No |

Yes |

| LTV |

Subject to Risk Oracle |

Subject to Risk Oracle |

Subject to Risk Oracle |

| LT |

Subject to Risk Oracle |

Subject to Risk Oracle |

Subject to Risk Oracle |

| Liquidation Bonus |

Subject to Risk Oracle |

Subject to Risk Oracle |

Subject to Risk Oracle |

PT-sUSDe-9APR2026

Initial E-mode Risk Oracle

| Parameter |

Value |

Value |

| E-Mode |

Stablecoins |

USDe |

| LTV |

85.5% |

87.2% |

| LT |

87.5% |

89.2% |

| LB |

5.7% |

3.7% |

Linear Discount Rate Oracle

| Parameter |

Value |

| discountRatePerYear (Initial) |

5.596% |

| maxDiscountRatePerYear |

27.276% |

PT-sUSDe Stablecoins E-mode

| Asset |

PT-sUSDe-9APR2026 |

PT-sUSDe-15JAN2026 |

sUSDe |

USDT0 |

USDe |

| Collateral |

Yes |

Yes |

Yes |

No |

No |

| Borrowable |

No |

No |

No |

Yes |

Yes |

| LTV |

Subject to Risk Oracle |

Subject to Risk Oracle |

Subject to Risk Oracle |

- |

- |

| LT |

Subject to Risk Oracle |

Subject to Risk Oracle |

Subject to Risk Oracle |

- |

- |

| Liquidation Bonus |

Subject to Risk Oracle |

Subject to Risk Oracle |

Subject to Risk Oracle |

- |

- |

PT-sUSDe USDe E-mode

| Asset |

PT-sUSDe-9APR2026 |

PT-sUSDe-15JAN2026 |

sUSDe |

USDe |

| Collateral |

Yes |

Yes |

Yes |

No |

| Borrowable |

No |

No |

No |

Yes |

| LTV |

Subject to Risk Oracle |

Subject to Risk Oracle |

Subject to Risk Oracle |

- |

| LT |

Subject to Risk Oracle |

Subject to Risk Oracle |

Subject to Risk Oracle |

- |

| Liquidation Bonus |

Subject to Risk Oracle |

Subject to Risk Oracle |

Subject to Risk Oracle |

- |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0