A primary challenge is the absence of a reliable, external price feed, as there is no secondary market for armmWXDAI. This makes establishing a manipulation-resistant price for liquidations difficult. Relying solely on an internal token exchange rate is not a fully robust solution, as it may not account for the real-time risks of the lending market, such as potential bad debt, and would only reflect the interest accrued by the token.

The nature of the underlying collateral and its governance framework warrant careful consideration. The project’s financials and real estate assets have not yet undergone a public audit, and the process for property appraisals appears to be discretionary. This lack of transparency makes the token’s Net Asset Value (NAV) difficult to verify independently. The collateral composition, which includes assets like “Construction Tokens” and “Loan Tokens”, could also benefit from greater clarity through a formal mandate defining what can be included. The legal review also noted areas for potential enhancement, such as introducing an independent escrow for investor funds and strengthening shareholder rights to mitigate potential conflicts of interest.

From a technological standpoint, the RealT Money Market (RMM) involves significant custom code built on top of an Aave V3 fork. An audit of these custom contracts by ABDK Consulting revealed a high volume of findings (112 Minor and Informational issues), which, while not critical, underscores the substantial complexity and novelty of the wrapper contracts—the lack of an active bug bounty program compounds this risk.

Furthermore, protocol control is currently centralized. A single EOA manages administrative functions and contract upgradeability without a timelock. This structure introduces a central risk point, as changes can be implemented immediately.

To facilitate a more in-depth analysis, it would be helpful for the RealT team to provide clarification on several points: the methodology for including tokens in the RMM, specific details on how appraisals are conducted, potential plans for a bug bounty program, and the strategy for handling bad debt should it accrue in RMM v3.

To strengthen a future proposal and align the asset with Aave’s risk parameters, we recommend considering the following enhancements:

This constructive feedback will guide RealT in addressing these points for a potential future proposal. We are open to reassessing the asset if these significant risks are mitigated and will work directly with the RealT team to clarify these points if the proposal advances.

See full Collateral Risk Assessment

1. Asset Fundamental Characteristics

1.1 Asset

armmWXDAI, like other Aave aTokens which represent user supply positions in the Aave protocol, represents a XDAI supply position on RMM (RealT Money Market), a “whitelabel” Aave V3 Market for RealT Tokens on Gnosis Chain. armmWXDAI is an interest-bearing token that automatically accrues interest to its holders.

As of June 25, 2025, armmWXDAI has a circulating supply of approximately 6.46M on Gnosis Chain. The token was deployed on January 22, 2024, and in the last year, it has offered an average APR of 7.1% and since inception, it has seen a 12.08% increase, currently worth 1.12086 XDAI.

1.2 Architecture

RealT provides a platform for the tokenization of primarily real estate, allowing investors to hold fractional ownership of properties through tokens. RealT has also developed RealT RMM, a money market where users can use their tokenized assets to borrow stablecoins.

The RealT ecosystem allows anyone to mint armmWXDAI by depositing XDAI into the RealT RMM (RealToken Money Market). Once deposited, RealT’s tokenized property holders can use their property tokens as collateral to borrow this XDAI.

The main RealT model is the ‘Classic’ property token. When individuals purchase one of these tokens, they acquire common shares in a purpose-specific Delaware C-Corporation, available only to non-US KYC’d users. This corporation’s sole function is to own and manage a single rental property. In addition to this core model, RealT has expanded its offerings to include several other types of asset-backed tokens:

Loan Tokens: Instead of equity, these tokens represent a Platform Note (an IOU) in a BVI Segregated Portfolio Company. Investors receive returns from the fixed interest payments made by the borrower, rather than from rental income.

Construction Tokens represent an equity stake in a Panama SPV managing a real estate development project. Returns are realized upon the project’s completion and sale, and by depositing part of the capital into RMM v3.

Factoring Tokens: These tokens represent equity in a BVI Segregated Portfolio Company that purchases and collects commercial invoices. The return is generated from the profit made when the debtor pays off the invoices. It is important to note that, at present, these Factoring tokens are not available for use as collateral on the RMM marketplace.

Consequently, holders of the ‘Classic’ tokens receive a weekly airdrop of USDC directly to their wallets, corresponding to the rent earned by the property. This yield typically ranges from 8-11% annualized. To enable borrowing against these tokens, RealT first launched RMM v2 in April 2022, which was a fork of Aave v2. This allowed RealToken holders to use their tokenized properties to borrow stablecoins. However, with RealT issuing over 700 different tokens, RMM v2 was limited as it could only support 128 tokens.

In February 2024, RealT introduced RMM v3. In addition to being a fork of Aave v3, it included the “RMM Wrapper”. This feature allows users to lock their various RealTokens in exchange for RTW-1-usd, a token representing $1 worth of property value. This RTW-1-usd can then be used as collateral in RMM v3, enabling the platform to have 623 different property tokens being used as collateral currently.

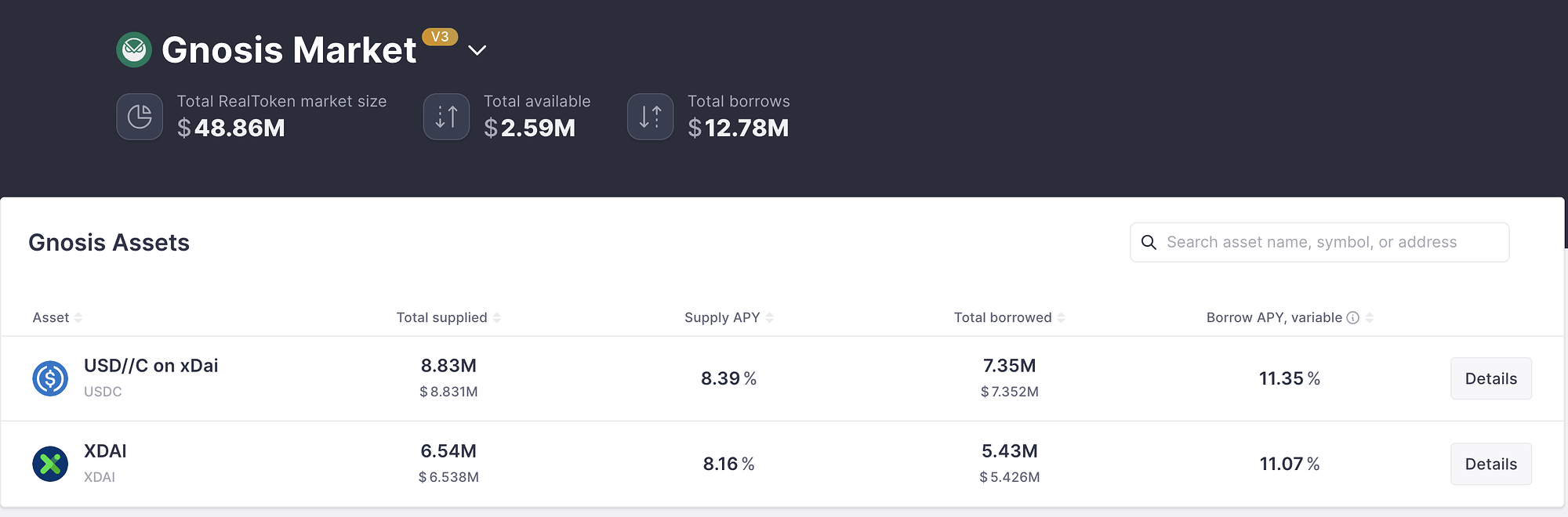

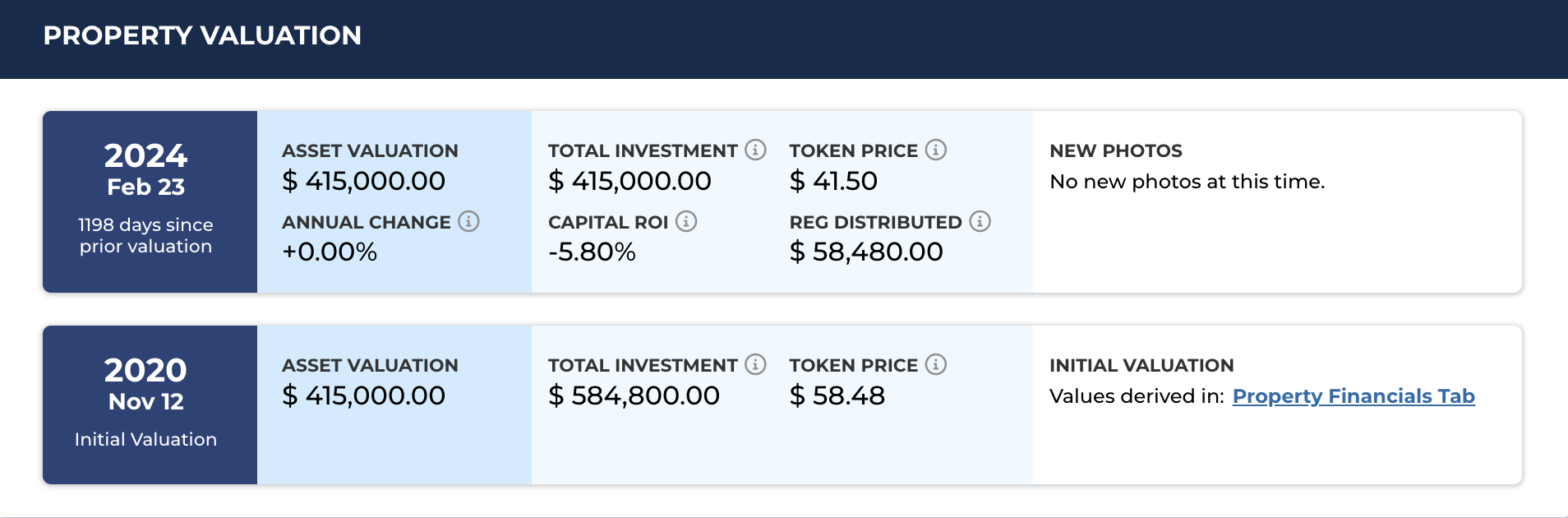

Source: RMM v3, June 27, 2025

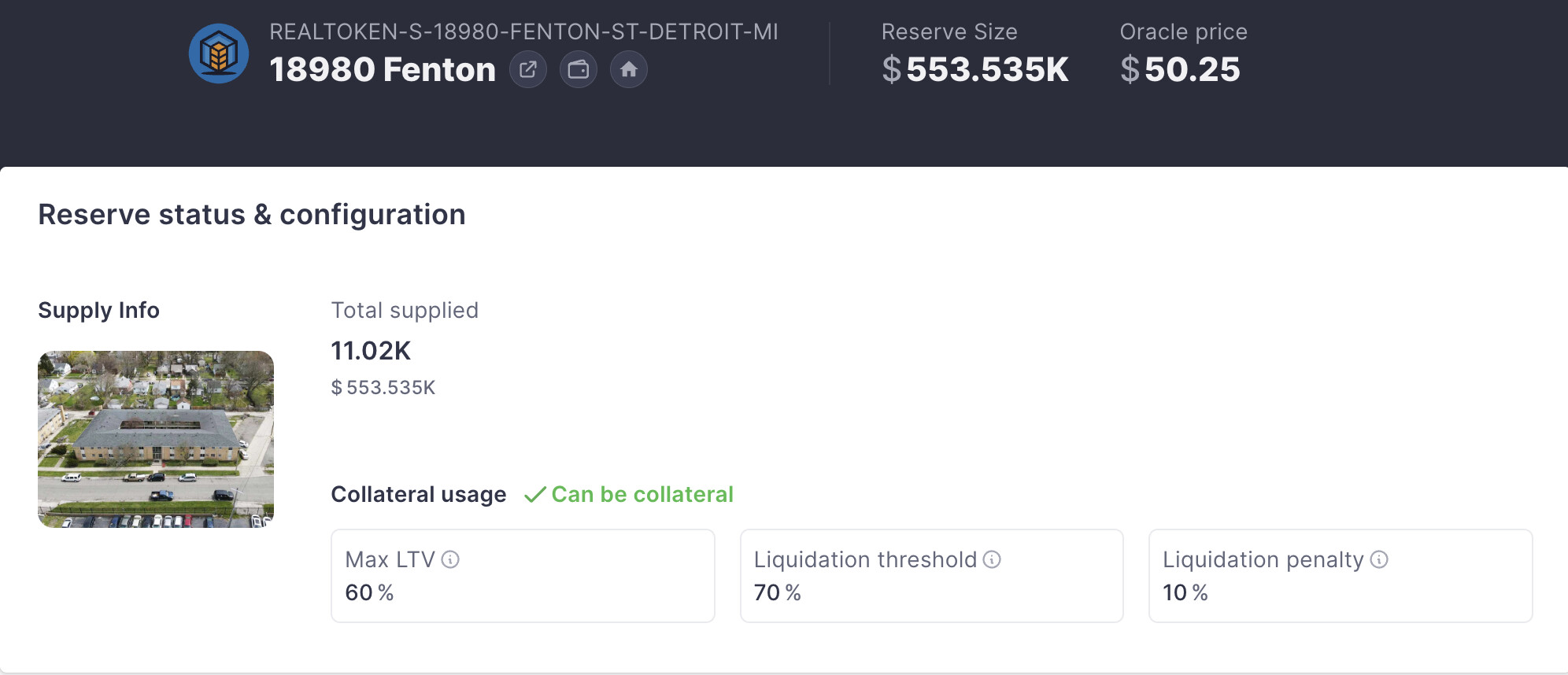

Currently, because users deposit the “wrapped” dollar equivalent (RTW-1-usd) of their property tokens rather than the tokens themselves, all properties share the same risk parameters within the RMM: a 60% Maximum LTV (Loan-to-Value), a 70% Liquidation Threshold (LT), and a 10% liquidation penalty.

Token Liquidity and Price Scenarios

Price Decrease Scenario

Approximately every one to two years from the property’s initial issuance, RealT may conduct a new appraisal. This process is discretionary and not guaranteed to occur at regular intervals. If an appraisal happens, the price used for the token in RMM v3 is updated to reflect the new valuation (the previous price being the original sale price).

If the new appraisal results in a higher price, holders with their tokens locked in exchange for RTW-1-usd will receive additional RTW-1-usd, by increasing their aRTW-1-usd balance, to align with the increased property value.

Source: RealT, 9200 Harvard Rd, Detroit, MI 48224, June 27, 2025

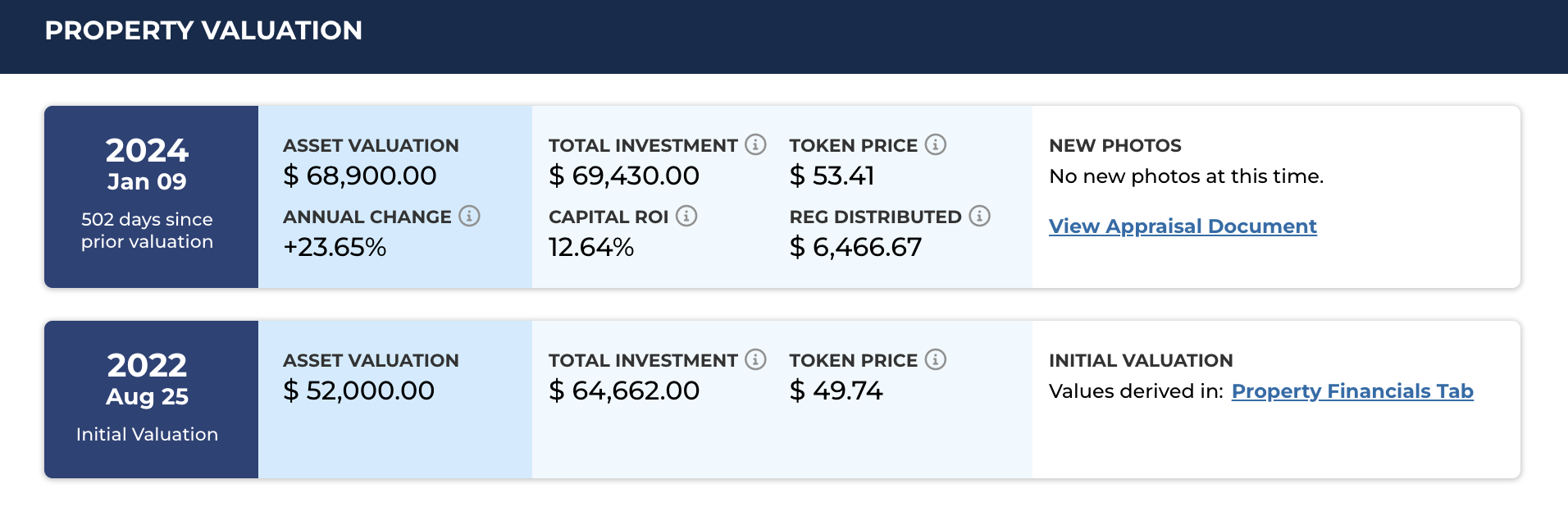

Conversely, if the new price is lower than the previous token price, the user’s RTW-1-usd will be reduced. This ensures that each RTW-1-usd token continues representing one dollar of the underlying property’s value. The image below shows a token that decreased in value from an original price of $58.48 to $41.50 due to a fire incident at the underlying property.

Source: RealT, 581 587 Jefferson Ave, Rochester, NY 14611, June 27, 2025

Liquidation Scenario

When a borrowing position’s health factor drops below 1, it becomes eligible for liquidation. This allows whitelisted addresses (which must have completed KYC with RealT) to acquire 50% (when the HF is between 1 and 0.95) or 100% (when the HF is below 0.95) of the position’s collateral at a 10% discount, thus repaying the debt. As of June 27, there have been 39 liquidations, totaling $12,849.

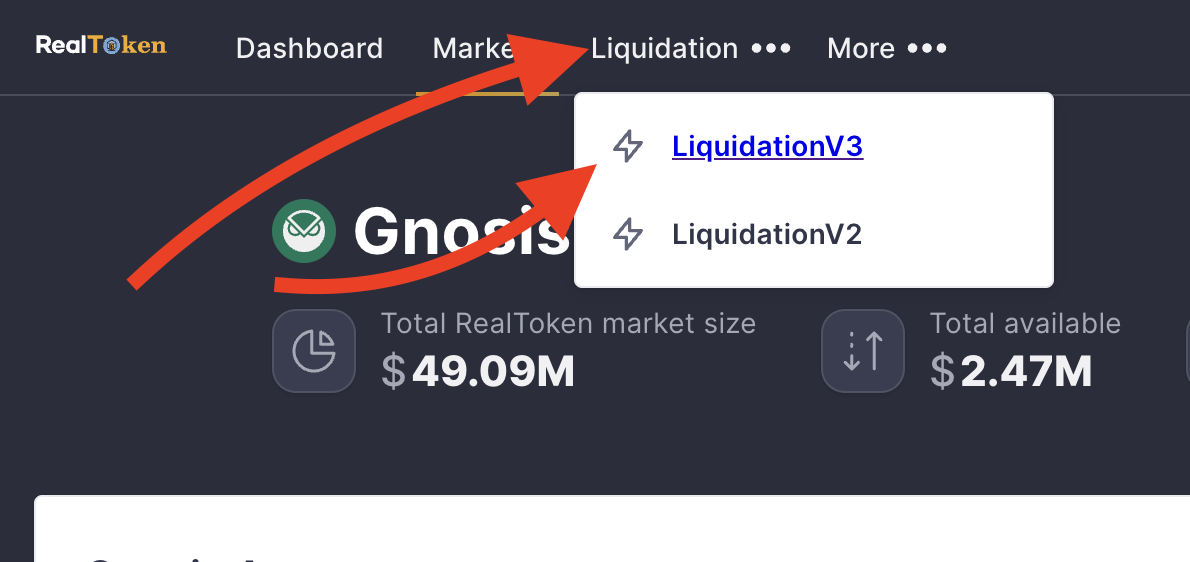

The image shows where users can see the positions available for liquidation and acquire them at a discount.

Source: RMM Liquidation-v3, July 1, 2025

Token Liquidity

Although RealT states that “investors should be prepared to hold their RealTokens indefinitely,” there are currently methods for selling them. RealT offers a buyback program, purchasing up to $2,000 weekly tokens per user.

It needs to be clarified if the $2K is per user or in total.

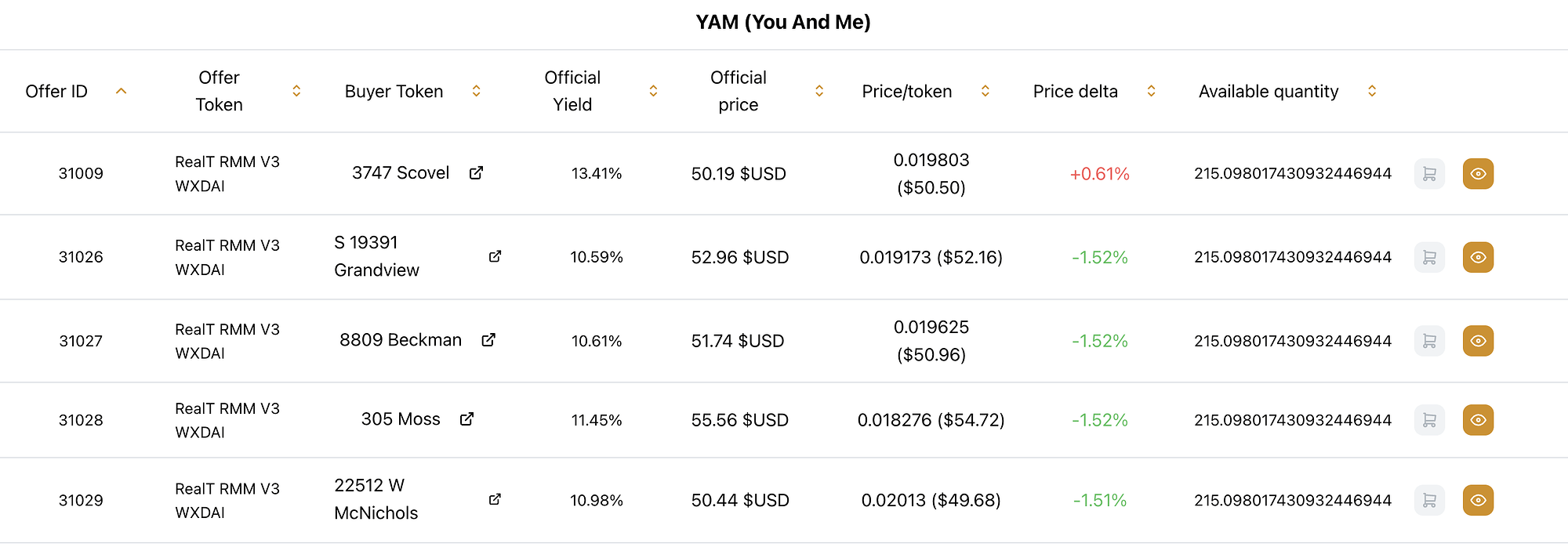

Beyond this, a secondary market called YAM (You and Me) exists, which allows users to place buy and sell orders to exit their positions.

Source: YAM (You and Me), June 27, 2025

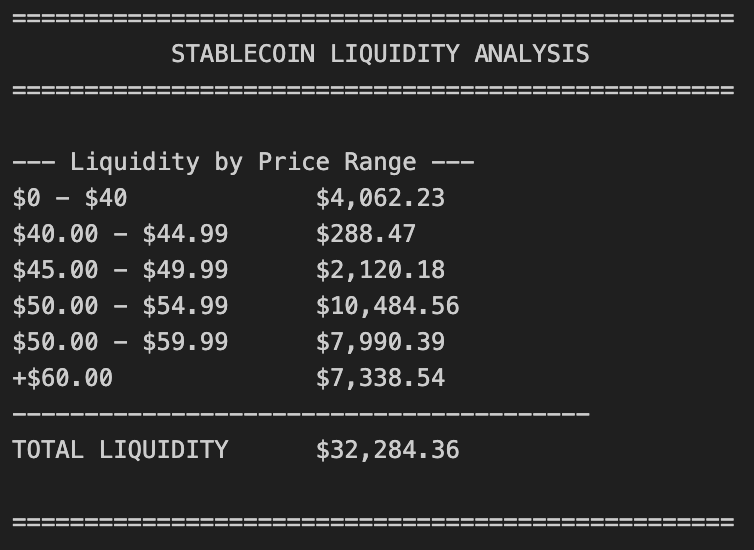

As of June 27, the total aggregated liquidity across all 724 RealTokens on YAM is $32,284. It is important to note that not all the tokens are available for use as collateral in RMM v3.

Source: LlamaRisk, June 27, 2025

1.3 Tokenomics

The total supply of armmWXDAI is not fixed; it depends on users supplying and withdrawing XDAI from RMM. Currently, 2,642 unique addresses hold armmWXDAI.

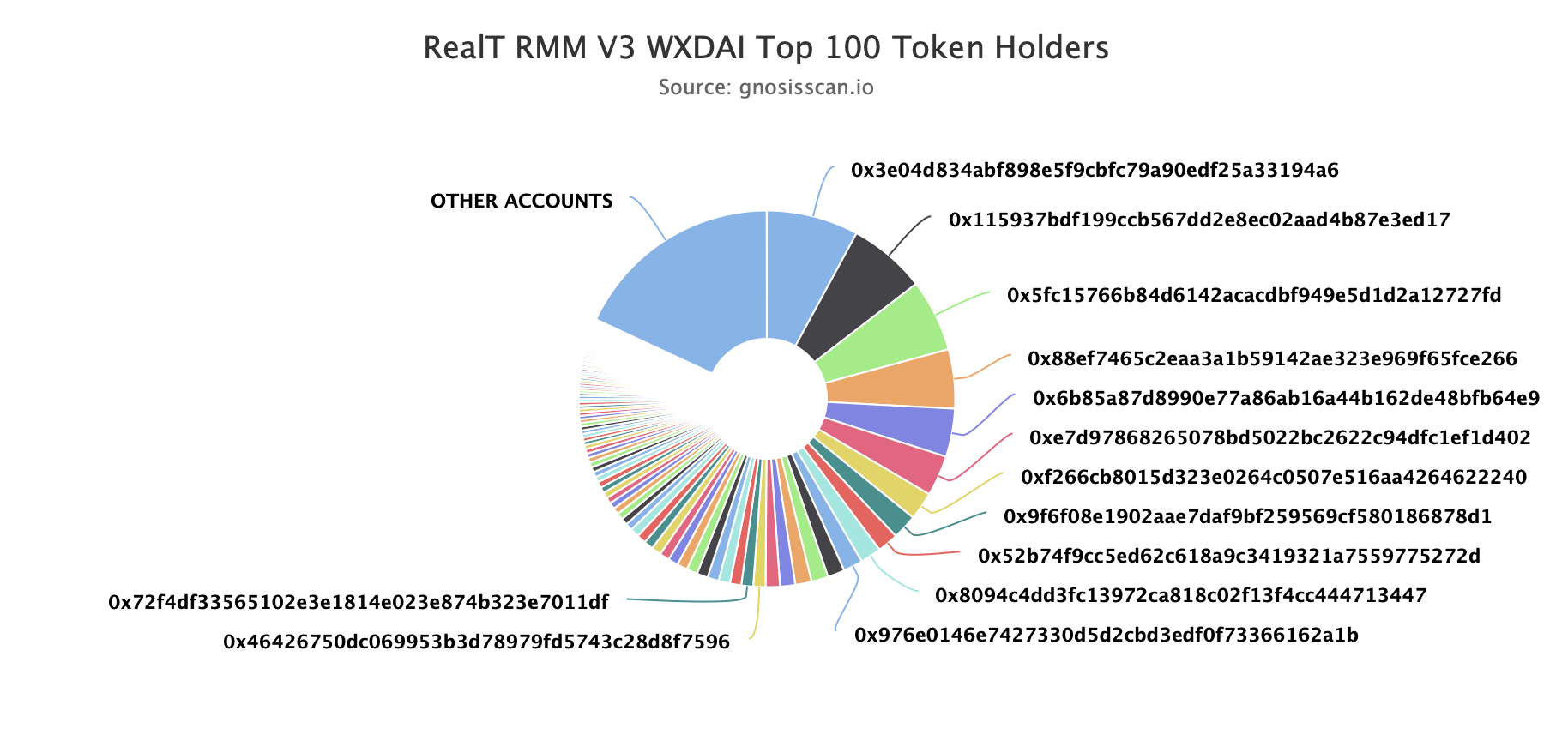

1.3.1 Token Holder Concentration

Source: armmWXDAI Top 100 Token Holders, June 27, 2025

Although the top 10 holders own 41.60% of the tokens, controlling an important share, the average holding per address is 2,450 tokens due to the high number of holders, showing that small and medium users also hold this token.

2. Market Risk

2.1 Liquidity

Liquidity for armmWXDAI is accessible only through the RMM market by withdrawing the underlying XDAI. If no bad debt is accrued on the market, every armmWXDAI is backed by one XDAI. Therefore, all armmWXDAI can be withdrawn for XDAI, though it may not be possible to redeem at any given time due to temporary liquidity constraints.

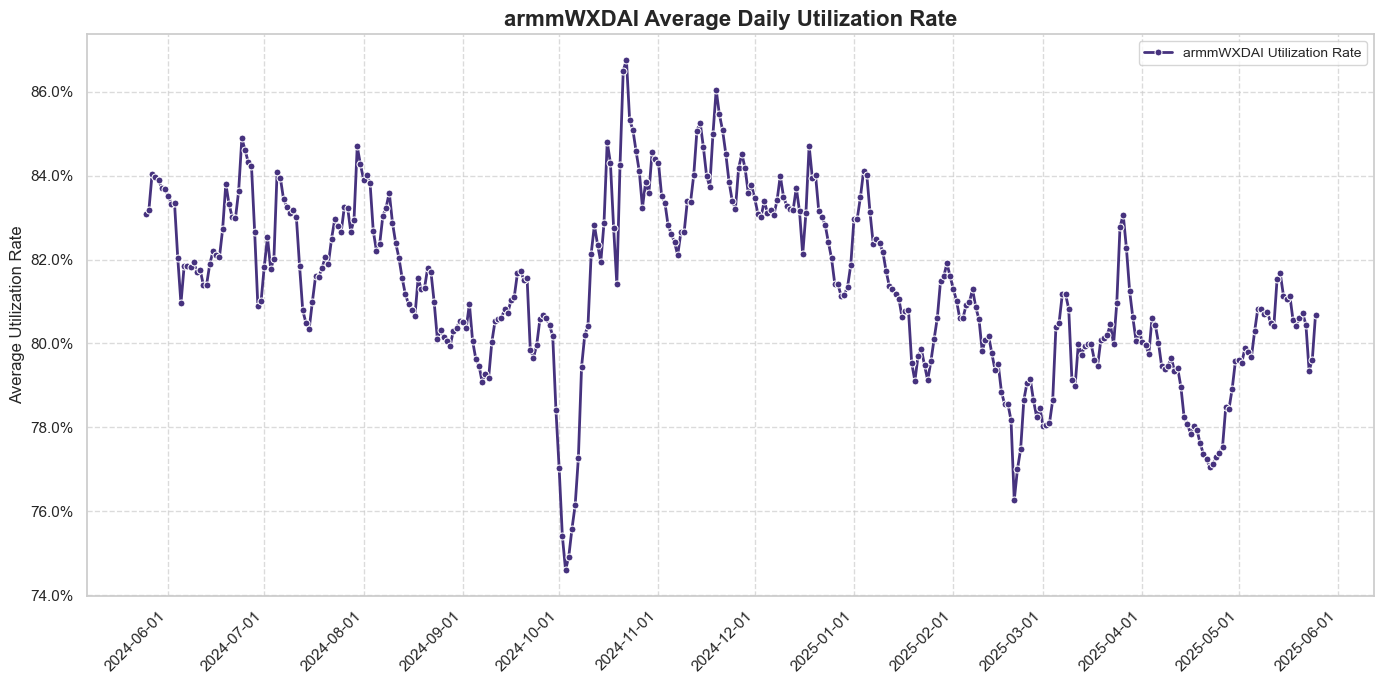

During the last year, the utilization for XDAI has been around 82%, leaving the remaining 18% for redemptions. Currently, this is equivalent to $1.164M.

Source: LlamaRisk, June 27, 2025

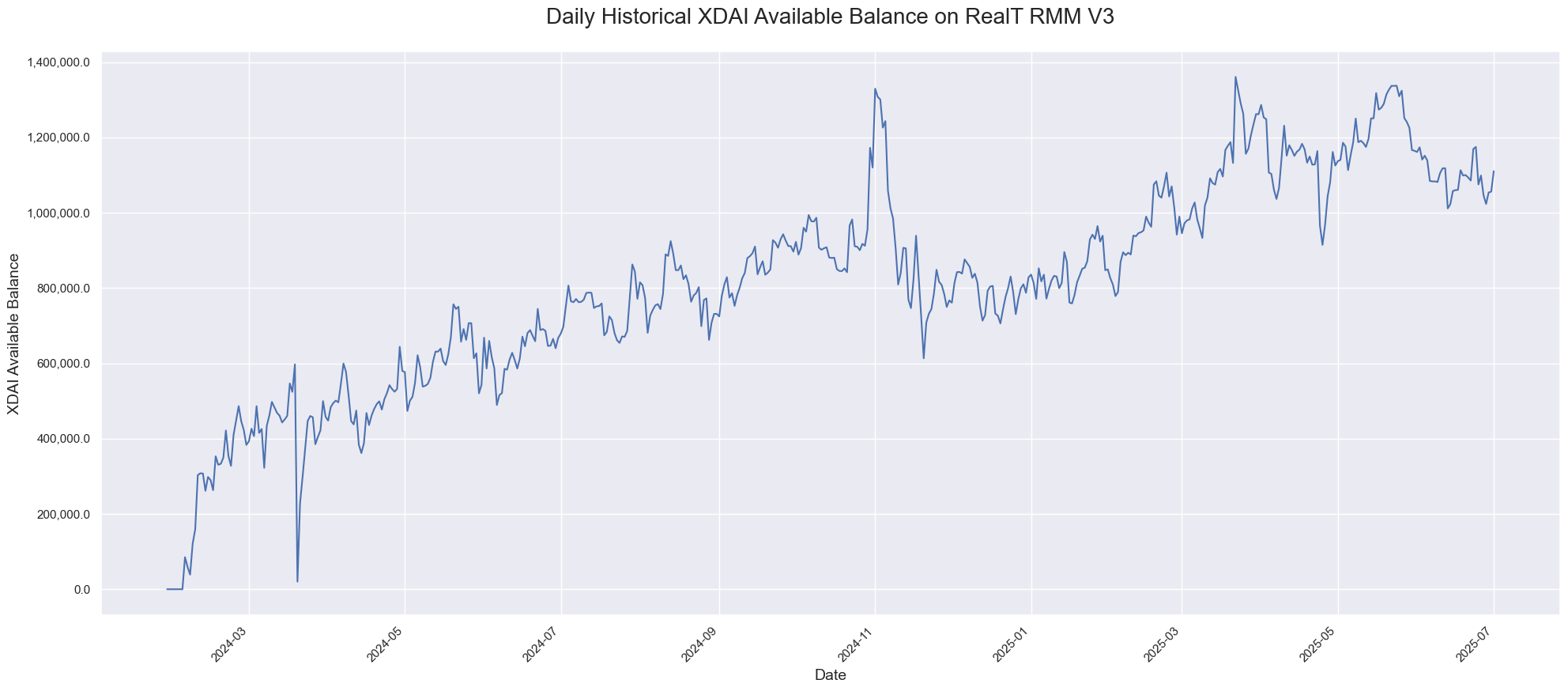

Historically, the amount available for redemptions has increased since the market deployment in February 2024, staying above $800,000 for most of the last year.

Source: LlamaRisk, July 2, 2025

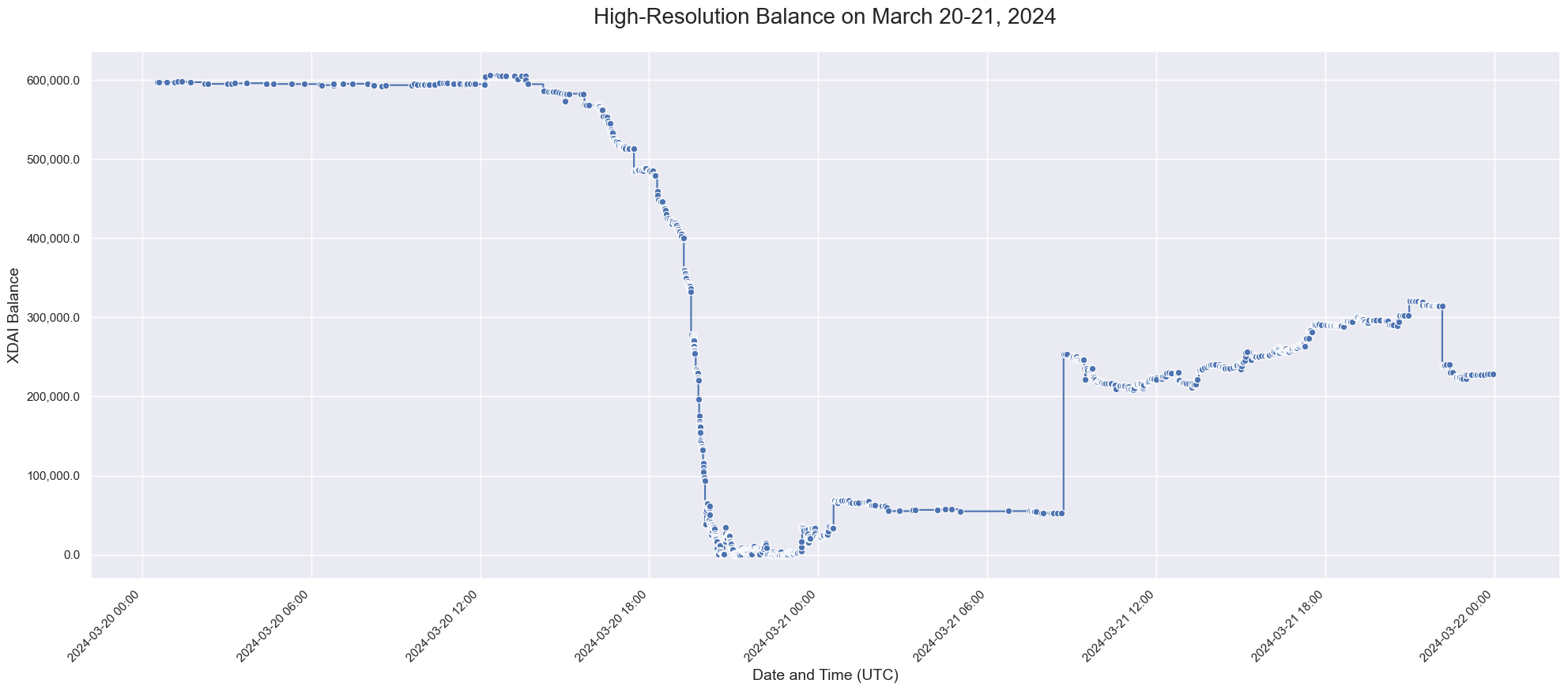

The data also shows a few days of market stress on March 20 and 21, 2024, when the available balance went to zero for a few hours after all liquidity was withdrawn from the market in less than six hours.

Source: LlamaRisk, July 2, 2025

2.1.1 Liquidity Venue Concentration

There is no secondary market liquidity; the liquidity comes from the liquidity buffer in the RMM v3.

2.1.2 DEX LP Concentration

N/A

2.2 Volatility

2.3 Exchanges

2.4 Growth

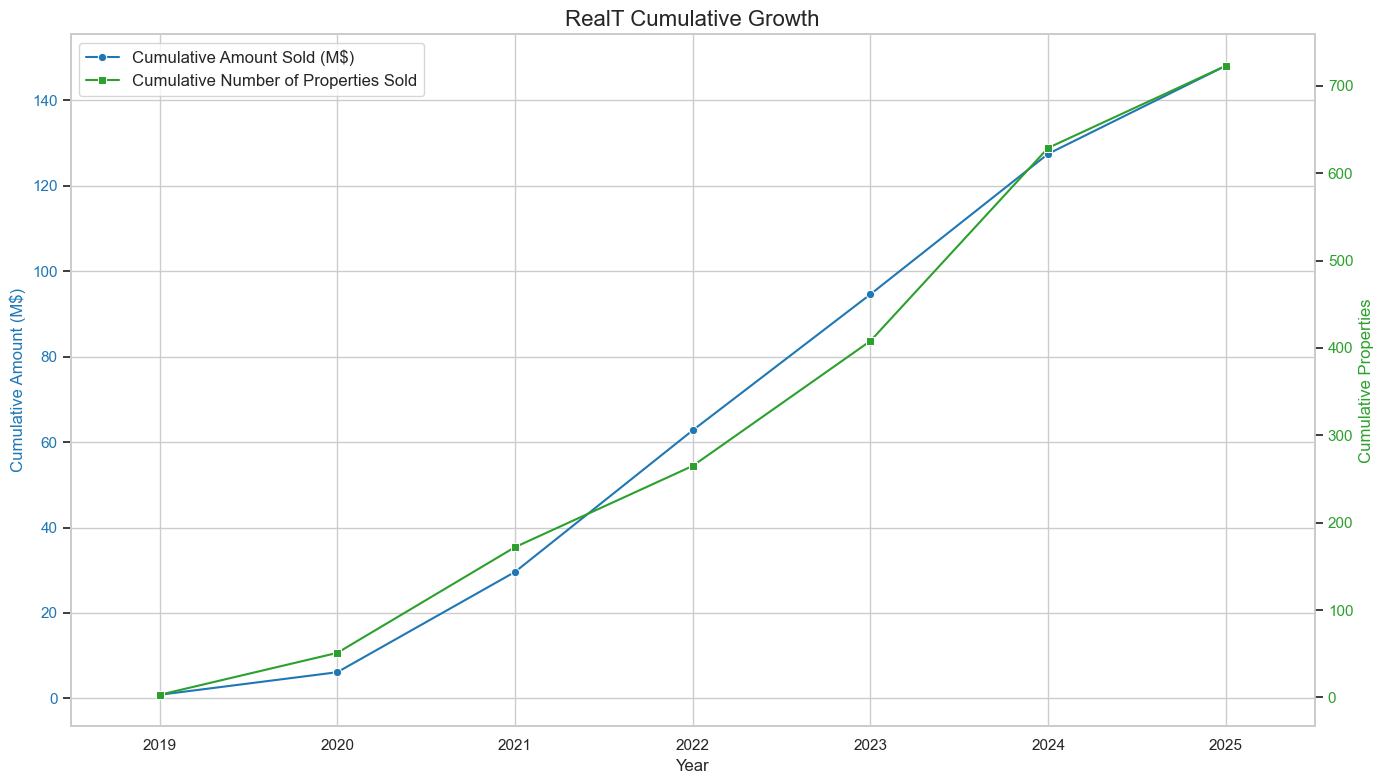

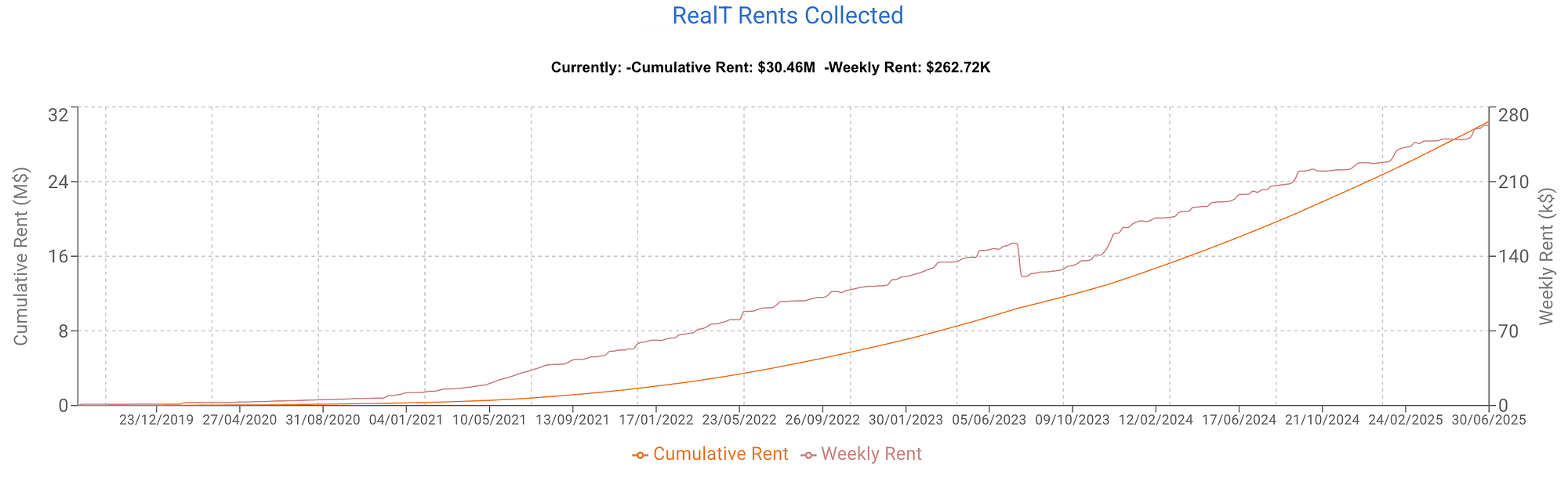

Since its launch in 2019, RealT has demonstrated significant growth, tokenizing 714 properties valued at over $140 million.

The portfolio growth directly translates into substantial real-world yield for token holders. The total rent distributed has surpassed $30.46 million, as illustrated by the rise of the cumulative rent curve. Correspondingly, the recurring weekly rental income has scaled to over $262k.

Source: LlamaRisk, June 27, 2025

Source: Pit’s BI, June 27, 2025

3. Technological Risk

3.1 Smart Contract Risk

ABDK Consulting audited the custom smart contracts developed by RealT for integration with the Aave V3 protocol. The audit, completed on February 26, 2024, did not cover Aave’s core code but focused on the new wrapper and governance contracts: RealTokenWrapper.sol, RTW.sol, ATokenRTW.sol, and RealTokenShareholderMeeting.sol.The final report identified a significant number of issues across various severity levels, highlighting the complexity of the new integration. The findings are as follows: Critical Issues: 0 Major Issues: 6 (All 6 have been fixed) Moderate Issues: 5 (3 fixed, 2 acknowledged by the team) Minor Issues: 29 (10 fixed, 19 acknowledged) Informational Issues: 100 (29 fixed, 71 acknowledged)While all major issues were resolved, the high total volume of findings (112 across Minor and Informational categories) underscores the substantial complexity and novelty of the wrapper contracts built to interact with Aave’s established protocol.

3.2 Bug Bounty Program

There is currently no active bug bounty.

3.3 Price Feed Risk

Currently, there is no price feed available for armmWXDAI because there is no source of secondary market liquidity.

If there is high trust that the market will not have any solvency issues, the easiest solution would be to use the WXDAI <=> armmWXDAI exchange rate. However, the issue with this approach is that it does not reflect the real-time situation of the lending market or the value of the collateral assets; it only reflects the interest accrued by the aToken.

3.4 Dependency Risk

The armmWXDAI (aToken) contract has several technical dependencies, primarily defined in its implementation contract, AToken.sol.

- ERC-20 Standard: The token inherits from

IncentivizedERC20.sol and ScaledBalanceTokenBase.sol, which implement the standard functions of an ERC-20 token, such as balanceOf, totalSupply, and transfer.

- EIP-712: The contract inherits from

EIP712Base.sol to support permit-based approvals (permit function) via off-chain signatures, enabling more gas-efficient and flexible transaction authorization.

- Aave V3 Architecture: The token is deeply integrated into the Aave V3 architecture, which RealT’s RMM is forked from.

- OpenZeppelin Libraries: The contract relies on Standard, audited libraries from OpenZeppelin for security and functionality:

SafeCast.sol and VersionedInitializable.sol.

4. Counterparty Risk

4.1 Governance and Regulatory Risk

The Offering Memorandum template frames the offering as a sale of common shares in a newly-formed Delaware C-corporation that will hold a single U.S. rental property, with the shares embodied exclusively as ERC-20-compatible “RealTokens.” The document uses the defined term “Issuer” for the single-purpose Delaware corporation that will own the underlying property. In the universal template, its legal name is left as the placeholder {#Issuer}, after which the document refers to that entity interchangeably as “the Company,” “RealToken,” and “RealT”. The text clarifies that the issuer is “a Delaware corporation” formed under the DGCL solely for this offering, distinct from—but administered by—the Manager.

The memorandum designates RealToken Technologies Inc.—doing business as RealToken Inc. and branded to investors as “RealT,” as the “Manager” of the issuer. It is a Delaware corporation formed on February 14, 2019, headquartered at 980 N. Federal Highway, Suite 110, Boca Raton, Florida 33432.

No underwriter or escrow is used, and there is no minimum raise; subscription proceeds go directly to the issuer as soon as accepted. Distribution is strictly offshore under Regulation S to persons that are not “U.S. persons,” with a one-year distribution-compliance period before the tokens can enter the United States or be resold to U.S. investors. Purchasers must certify non-U.S. status, make representations about local law compliance, and acknowledge that secondary sales will likewise have to occur only under Regulation S or another exemption. The memorandum expressly warns that the tokens are unregistered securities and embeds the standard restrictive legends in the code base and off-chain documentation.

Beyond the non-U.S. requirement, the memorandum imposes a suitability filter (“substantial means, no need for liquidity”) and, for Canadian residents, demands accredited-investor and permitted-client status. Tokens remain “restricted securities” for at least one year; hedging and on-chain collateralisation are barred unless they also comply with the Securities Act.

Each token carries one limited vote, an equal share of declared distributions, and a pro-rata claim on liquidation proceeds. Voting is restricted to fundamental decisions such as electing directors, approving a sale or merger, or amending the charter; day-to-day control sits with the board and the Manager. Investors have no appraisal, redemption, pre-emptive, or conversion rights, and may be subject to forced refusal of a transfer if the board believes the change would breach securities thresholds (2,000 beneficial owners, tax status, or regulatory triggers). Cash flow after operating expenses services a 10 % operating-expense reimbursement to the Manager, a 2 % annual management fee, a separate property-management fee, and—on any capital event—a 10 % promote, before the balance is distributed to shareholders.

A help-desk article that instructs holders how to “send your RealTokens back to RealT” confirms that the company accepts the tokens and pays USDC within ten business days, i.e., it is already acting as a central counterparty. Whenever RealT itself posts standing buy-orders on YAM and settles them in USDC, it may be considered “effecting transactions in securities for the account of others” and simultaneously “buying and selling securities for its account”—activities that meet the Exchange Act definitions of broker and dealer. In addition, YAM is already a multilateral matching engine that RealT controls through upgradeable smart contracts; once the issuer (or its Manager) becomes a regular counterparty on that engine, the platform may look like an alternative trading system, not merely a peer-to-peer bulletin board. Neither the Offering Memorandum nor the website discloses broker-dealer, ATS, or transfer-agent registration.

Identified Deficiencies

Our review has identified several substantive issues that warrant attention.

- Subscription proceeds are disbursed to the issuer immediately; the absence of an independent escrow arrangement, an underwriter, or a minimum-subscription threshold exposes investors to completion risk and the possibility of misapplied funds.

- The corporate governance framework affords shareholders only limited influence: the board may amend the bylaws and issue additional shares (up to the 2,000-holder limit under Exchange Act Rule 12g-1) without investor approval, creating a potential for dilution.

- The memorandum states that the corporation will issue Form 1099s, implying dividend treatment for U.S. tax purposes. However, it does not address passive foreign investment company (PFIC) or controlled foreign corporation (CFC) considerations for non-U.S. investors, nor does it analyse possible U.S. withholding on stablecoin distributions.

- While the offering has been structured for compliance with U.S. federal law, other jurisdictions—e.g., EU, UK—are likely to characterise the tokens as securities, thereby triggering licensing obligations that the issuer has not undertaken; cross-border regulatory exposure therefore rests with investors.

- Additional safeguards are required to confirm the independence of the Property Manager from the Manager, particularly regarding setting purchase prices, arranging acquisitions, and administering rental distributions; at present, the documentation contains no requirement for qualified, arm’s-length valuations in related-party transactions.

We remain available to work with RealT to obtain further documentation and to evaluate appropriate mitigation measures for the residual risks identified above.

4.2 Access Control Risk

4.2.1 Contract Modification Options

The protocol’s core contracts, including armmWXDAI, employ an upgradable proxy pattern. This allows the contract logic to be modified without requiring users to migrate their funds. Modifications are controlled through a role-based access control.

The ACLManager defines several roles, with the two most powerful being:

DEFAULT_ADMIN_ROLE: The highest-level role. This role can grant and revoke any other role in the system, giving it ultimate control over the entire permission structure.

POOL_ADMIN_ROLE: The operational administrator role. This role is responsible for executing the contract upgrades.

aToken (armmWXDAI)

The armmWXDAI contract is a transparent, upgradable proxy. Its administrative functions are managed as follows:

Contract Upgrades:

Upgrades are controlled exclusively by the contract’s admin. The on-chain admin for the armmWXDAI proxy is the PoolAddressesProvider contract. Therefore, only the PoolAddressesProvider can execute an upgradeTo call on the proxy. This is initiated by an address with the POOL_ADMIN_ROLE calling the appropriate function on the PoolConfigurator, which then instructs the PoolAddressesProvider to perform the upgrade.

Minting and Burning:

The mint and burn functions on the aToken are permissioned. They can only be called by the main Pool contract.

4.2.2 Timelock Duration and Function

Currently, there is no timelock in place.

4.2.3 Multisig Threshold / Signer Identity

The ultimate control over the POOL_ADMIN_ROLE—and therefore the ability to upgrade the armmWXDAI contract—is held by an EOA.

Admin Address: 0x5Fc96c182Bb7E0413c08e8e03e9d7EFc6cf0B099

Note: This assessment follows the LLR-Aave Framework, a comprehensive methodology for asset onboarding and parameterization in Aave V3. This framework is continuously updated and available here.

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.