Summary

A proposal to:

- Increase the supply cap of weETH on the Plasma instance

- Increase the supply and borrow caps of USDe on the Ethereum Core instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

Our recent research paper, “Stress Testing Ethena: A Quantitative Look at Protocol Stability,” examines how rapidly growing deposits of Ethena’s USDe, sUSDe and especially Pendle Principal Tokens are reshaping Aave’s collateral pool and funding dynamics. It maps out both on‑chain liquidity hazards (e.g., thin PT markets, leveraged looping, rehypothecation) and backing‑side tail risks (exchange or custodian failure, collateral de‑peg, prolonged negative funding) via scenario modeling and Monte‑Carlo simulations, while proving that Aave’s current risk‑oracle floors, eMode parameterization and liquidation controls would absorb most plausible shocks. The proposed cap increases reflect and incorporate the insights from this paper.

Finally, our most recent paper, “Aave’s Growing Exposure to Ethena: Risk Implications Throughout the Growth and Contraction Cycles of USDe ,” shows that contraction and stabilization dynamics within the Aave-Ethena ecosystem are closely linked. When sUSDe yields decline, leveraged positions unwind, freeing up significant stablecoin liquidity in Aave through repayments. Simultaneously, PT/USDe borrowers shift their debt into other stablecoins, generating upward price pressure on USDe precisely when redemption demand rises. Crucially, stablecoin repayments from leverage unwinders typically outweigh PT debt migration into stablecoins, creating a natural liquidity buffer. Our analysis indicates this dynamic effectively stabilizes Aave markets, comfortably absorbing potential stress even during Ethena’s withdrawal of backing assets. Overall, the current market structure supports increased exposure, provided backing deployment into Aave remains prudently managed. The proposed cap increases reflect and incorporate the insights from the aforementioned papers.

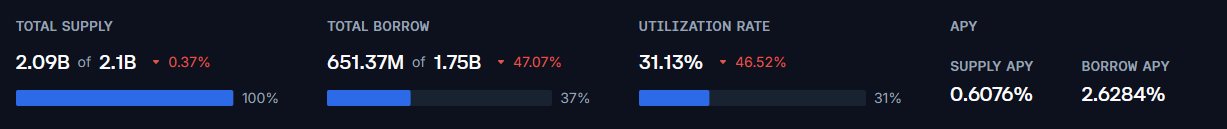

USDe (Ethereum Core)

Following the expiry of Ethena’s September PTs, the USDe vault observed a sharp growth in supply and a sharp drop in demand. This is due to the lower PT yield on the newly listed November PTs, disincentivizing usage within the looping strategy. As such, roughly 1B of USDe debt has been repaid, and 350M of USDe was deposited. This resulted in a drop in utilization of the vault, reaching a borrow APY of only 2.6% compared to its UOptimal of 7.5%. The asset’s Supply cap has also been reached with a utilization of 31%.

Supply Distribution

While the top supplier of USDe represents a significant portion of the market, all of the top suppliers mantain highly correlated debt, which minimizes liquidation risk. A significant portion of the top wallets appears to be adopting the Liquid Leverage strategy, which requires the supply of 50% USDe and 50% sUSDe in order to earn additional incentives.

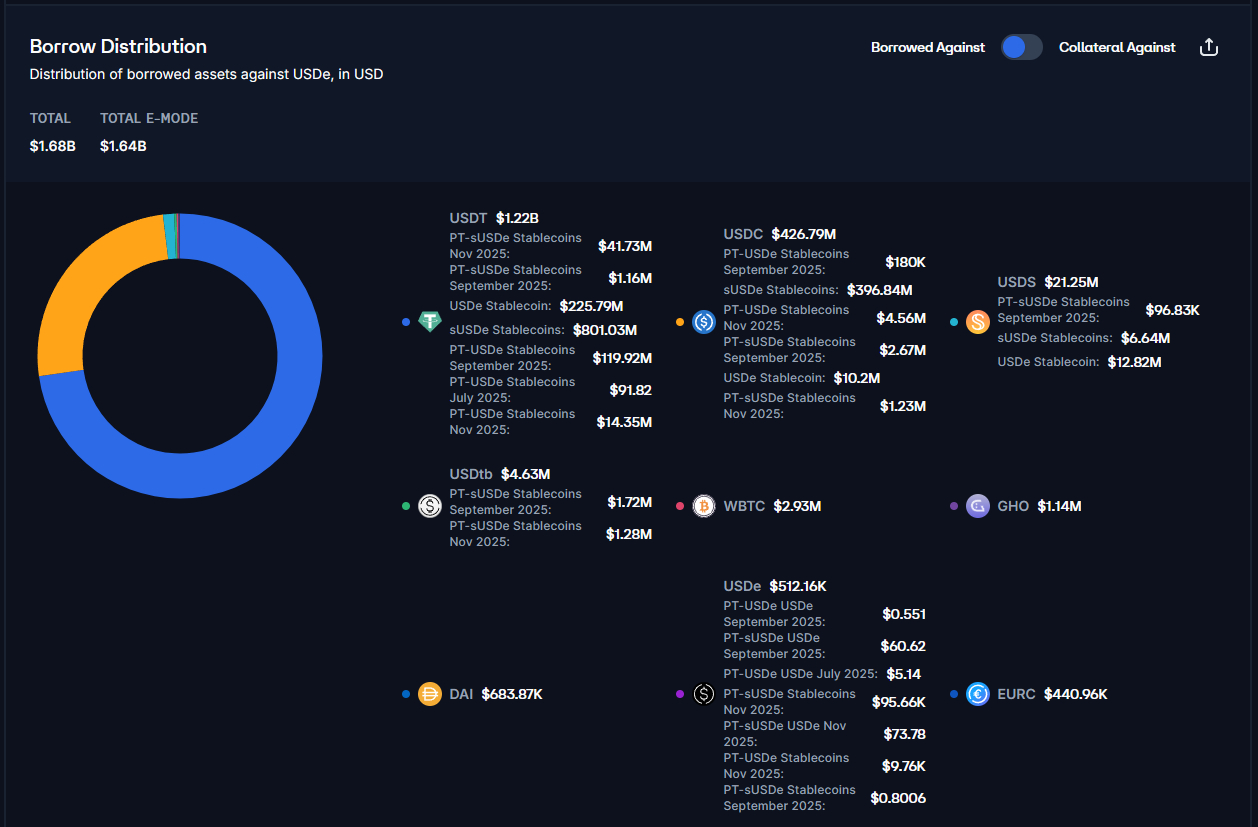

While the distribution of debt assets against USDe is heavily skewed torward USDT, with it representing over 72% of the debt, a significant portion, 25%, is also represented by USDC.

These assets maintain a high correlation with USDe, hence minimizing liquidation risk.

Recommendation

Given USDe’s quick growth, continued growth expectations thanks to the unwind of September’s PT tokens, and the safe usage behaviour within highly correlated E-Modes, Chaos Labs recommends increasing the Supply and Borrow caps of USDe.

weETH (Plasma)

Shortly after the launch of the Plasma mainnet, the weETH Aave market received a single deposit that filled the initial supply cap

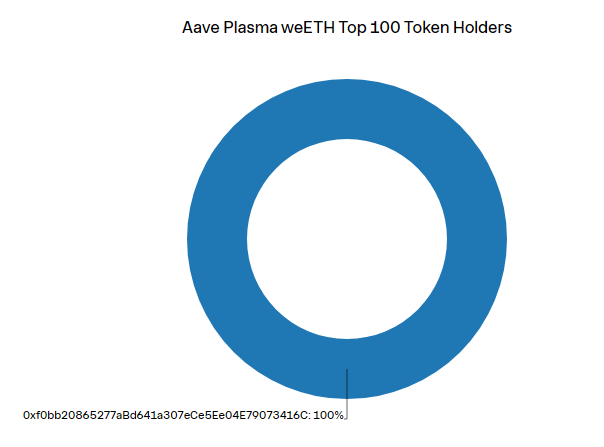

Supply Distribution

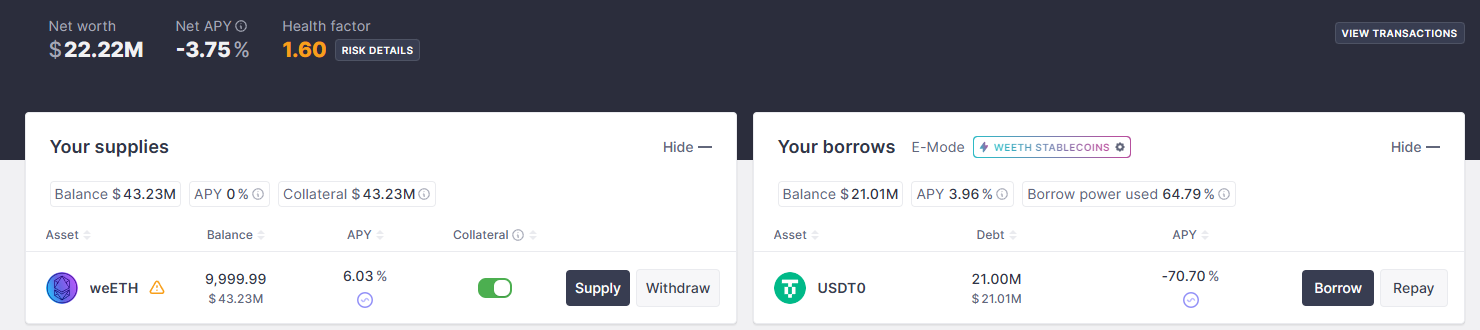

The supply of weETH on Aave is highly concentrated, with a single wallet representing the entirety of the market. The same address is currently borrowing 21M USDT against its weETH collateral, maintaining a safe health score of 1.6.

Liquidity

WeETH liquidity on Plasma is concentrated within a weETH/waPlaWETH Balancer pool; the total TVL of the pool is currently $4M, with its current asset split being 50/50. waPlaWETH represents the Aave deposited version of weETH into Aave on the Plasma instance. This translates into available buy liquidity of $2M.

Recommendation

Given weETH’s primary user safe positioning and available DEX liquidity on the market, we are supportive of increasing the supply cap of weETH on Aave Plasma Instance.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Supply Cap |

|---|---|---|---|---|---|

| Ethereum Core | USDe | 2,100,000,000 | 2,700,000,000 | 1,750,000,000 | 2,500,000,000 |

| Plasma | weETH | 10,000 | 20,000 | - | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.