Summary

- Increase the supply cap of PT-USDe-25SEP2025 on the Ethereum Core instance.

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

Our recent research paper, “Stress Testing Ethena: A Quantitative Look at Protocol Stability,” examines how rapidly growing deposits of Ethena’s USDe, sUSDe and especially Pendle Principal Tokens are reshaping Aave’s collateral pool and funding dynamics. It maps out both on‑chain liquidity hazards (e.g., thin PT markets, leveraged looping, rehypothecation) and backing‑side tail risks (exchange or custodian failure, collateral de‑peg, prolonged negative funding) via scenario modeling and Monte‑Carlo simulations, while proving that Aave’s current risk‑oracle floors, eMode parameterization and liquidation controls would absorb most plausible shocks. The proposed cap increases reflect and incorporate the insights from this paper.

Finally, our most recent paper, “Aave’s Growing Exposure to Ethena: Risk Implications Throughout the Growth and Contraction Cycles of USDe ,” shows that contraction and stabilization dynamics within the Aave-Ethena ecosystem are closely linked. When sUSDe yields decline, leveraged positions unwind, freeing up significant stablecoin liquidity in Aave through repayments. Simultaneously, PT/USDe borrowers shift their debt into other stablecoins, generating upward price pressure on USDe precisely when redemption demand rises. Crucially, stablecoin repayments from leverage unwinders typically outweigh PT debt migration into stablecoins, creating a natural liquidity buffer. Our analysis indicates this dynamic effectively stabilizes Aave markets, comfortably absorbing potential stress even during Ethena’s withdrawal of backing assets. Overall, the current market structure supports increased exposure, provided backing deployment into Aave remains prudently managed. The proposed cap increases reflect and incorporate the insights from the aforementioned papers.

For more insight into how the PT Risk Oracle operates, please consult the following post and its follow up. In addition, the Risk Oracles outputs can be monitored live at the following page.

PT-USDe-25SEP2025 (Ethereum Core)

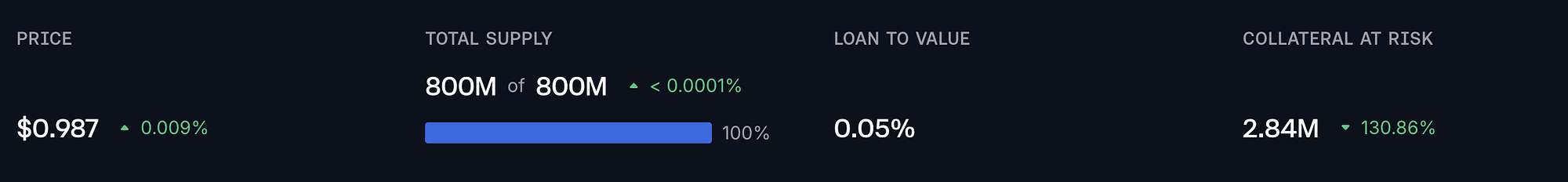

PT-USDe-25SEP2025 has reached 100% supply cap utilization.

Supply Distribution

As the supply caps have increased, the concentration of PT-USDe-25SEP2025 holdings has declined. The top five addresses now account for approximately 40% of the total supply, a level that does not pose a significant risk.

All other top suppliers are either borrowing USDe or USDT, which substantially reduces the risk of liquidations.

The largest borrowed assets against PT-USDe are USDT and USDe, with USDe being the underlying asset priced in USDT, which significantly reduces the likelihood of liquidations.

Market & Liquidity

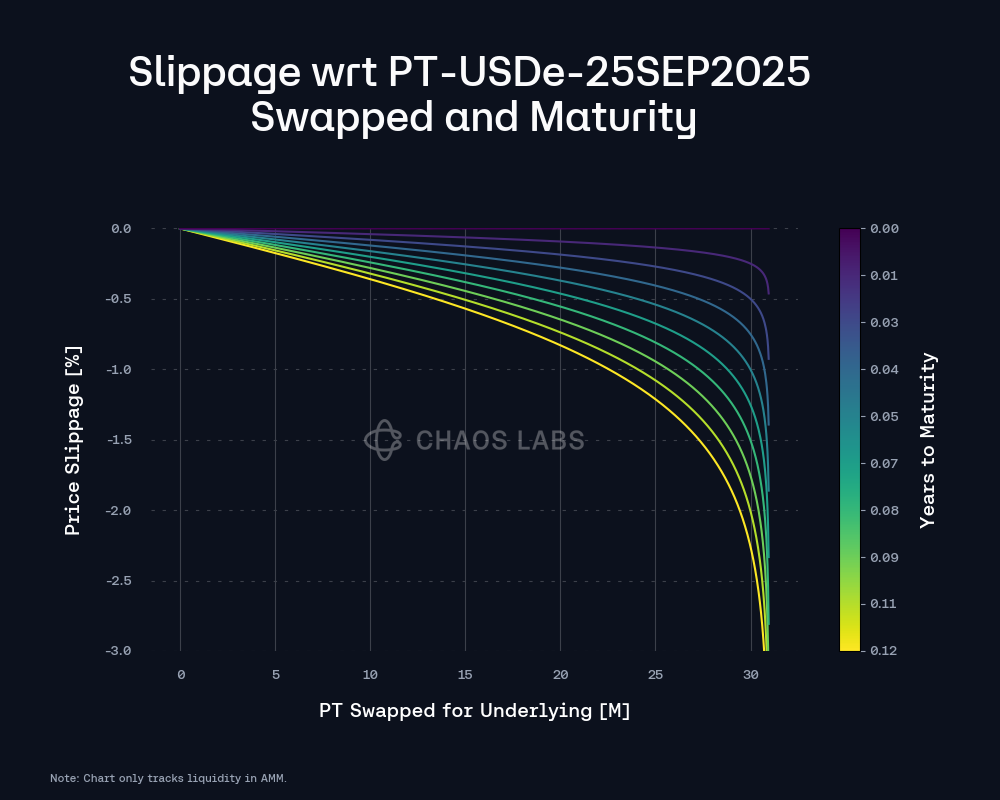

PT-USDe-25SEP2025’s Pendle AMM liquidity currently supports a swap size of 31M with slippage limited to 3%, indicating sufficient depth to handle larger positions.

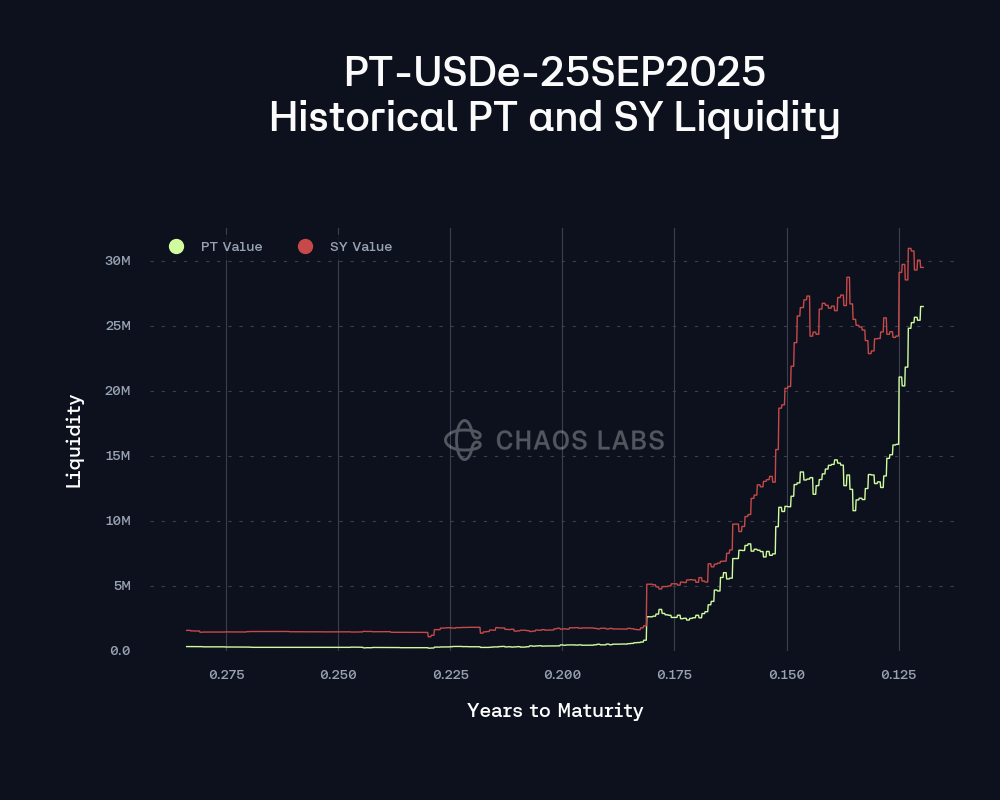

On-chain liquidity for both PT and SY sides has shown growth since our last review, with PT liquidity at approximately 26M and SY liquidity at approximately 30M.

The implied yield has increased over the past week, currently in the range of 15% to 16%, with moderate fluctuations. As maturity approaches, PT prices are increasingly anchored to their redemption value, which reduces sensitivity to short term yield changes and further supports a higher supply cap.

Recommendation

Considering user behavior, market liquidity, and strong demand, we recommend raising the supply cap to 1.4B.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Core | PT-USDe-25SEP2025 | 800,000,000 | 1,400,000,000 | - | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this research paper. Our pre-launch risk reports on Ethena, published over a year ago, represented a temporary compensated engagement, bear no implications on the current state of the protocol and can be viewed here on our website. We additionally provide proof-of-reserve attestations for the Ethena Protocol, which periodically reflect the aggregate state of the portfolio relative to the underlying USDe shares emitted.