Summary:

A proposal to:

-

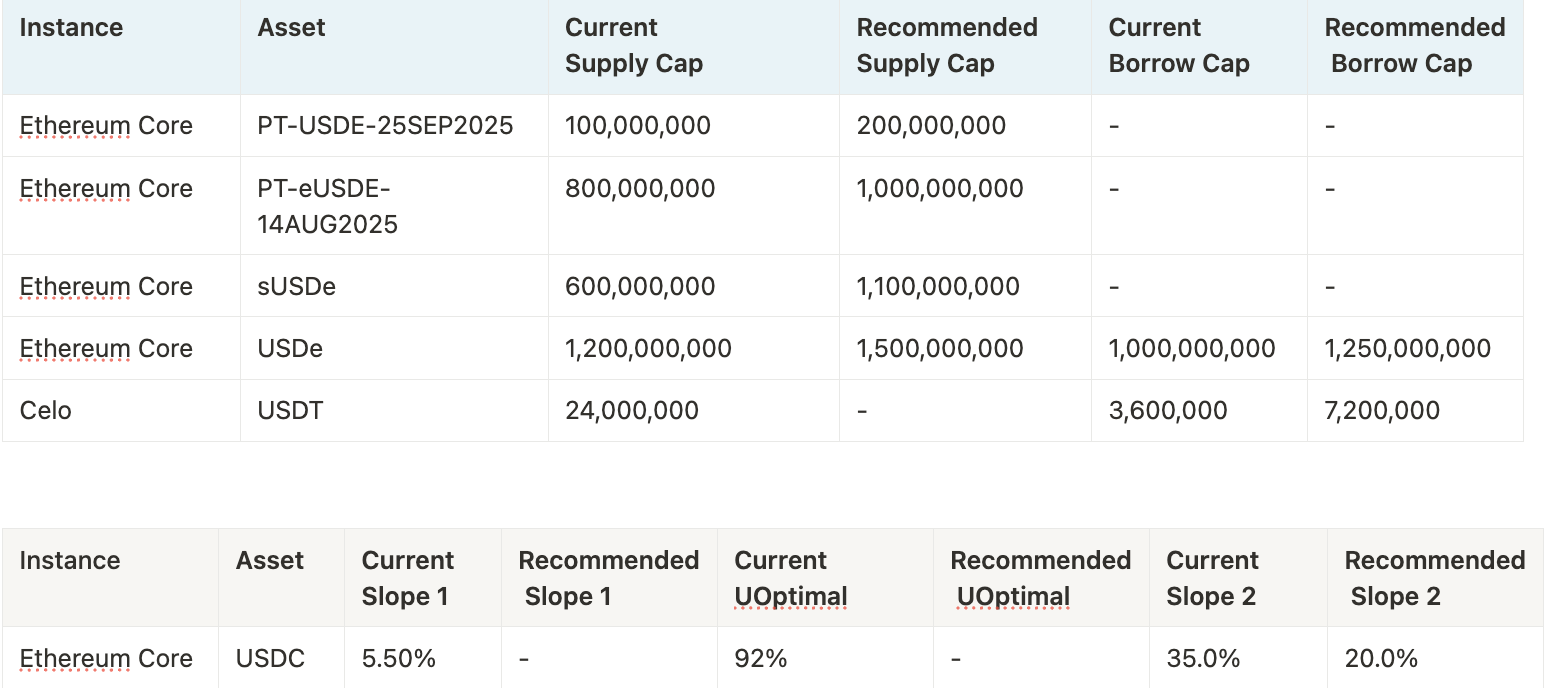

Increase supply cap for PT-USDe-25SEP2025 on the Ethereum Core instance.

-

Increase supply and borrow cap for USDe on the Ethereum Core instance.

-

Increase supply cap for sUSDe on the Ethereum Core instance.

-

Increase supply cap for eUSDe-14AUG2025 on the Ethereum Core instance.

-

Adjust Slope 2 for USDC on the Ethereum Core instance.

-

Adjust borrow cap for USDT on the Celo instance.

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

Our recent research paper, “Stress Testing Ethena: A Quantitative Look at Protocol Stability,” examines how rapidly growing deposits of Ethena’s USDe, sUSDe and especially Pendle Principal Tokens are reshaping Aave’s collateral pool and funding dynamics. It maps out both on‑chain liquidity hazards (e.g., thin PT markets, leveraged looping, rehypothecation) and backing‑side tail risks (exchange or custodian failure, collateral de‑peg, prolonged negative funding) via scenario modelling and Monte‑Carlo simulations, while proving that Aave’s current risk‑oracle floors, eMode parameterization and liquidation controls would absorb most plausible shocks.

Finally, our most recent paper, “Aave’s Growing Exposure to Ethena: Risk Implications Throughout the Growth and Contraction Cycles of USDe ,” shows that contraction and stabilization dynamics within the Aave-Ethena ecosystem are closely linked. When sUSDe yields decline, leveraged positions unwind, freeing up significant stablecoin liquidity in Aave through repayments. Simultaneously, PT/USDe borrowers shift their debt into other stablecoins, generating upward price pressure on USDe precisely when redemption demand rises. Crucially, stablecoin repayments from leverage unwinders typically outweigh PT debt migration into stablecoins, creating a natural liquidity buffer. Our analysis indicates this dynamic effectively stabilizes Aave markets, comfortably absorbing potential stress even during Ethena’s withdrawal of backing assets. Overall, the current market structure supports increased exposure, provided backing deployment into Aave remains prudently managed. The proposed cap increases reflect and incorporate the insights from the aforementioned papers.

For more insight into how the PT Risk Oracle operates, please consult the following post and its follow-up. In addition, the Risk Oracles outputs can be monitored live at the following page.

PT-USDe-25SEP2025 (Ethereum Core instance)

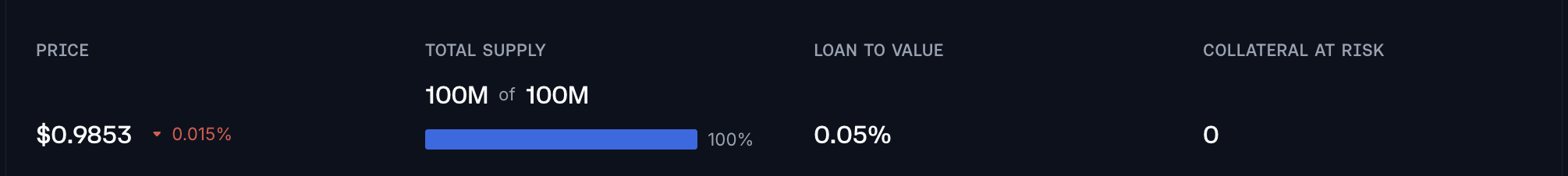

PT-USDe-25SEP2025 has reached its supply cap at 100M following a recent 50M inflow in the recent 2 days.

Supply Distribution

PT-USDe-25SEP2025’s supply is moderately concentrated with the top 1 supplier holding over 20% of the total and the top 4 accounting for over 75%. The health factors of the wallets are mostly in the 1.02 - 1.1 range, while one wallet has no borrowing positions we can expect him to add some stablecoin borrowing due to the nature of the observed strategy.

While most of the wallets have low health factors the risk is being minimized by high correlation of the debt and collateral assets.

The majority of assets borrowed against PT-USDe-25SEP2025 are in USDe and USDT. The risk of liquidation with this position composition is effectively minimized due to the inherent nature of PT to converge to the

underlying asset (USDe) at maturity.Liquidity

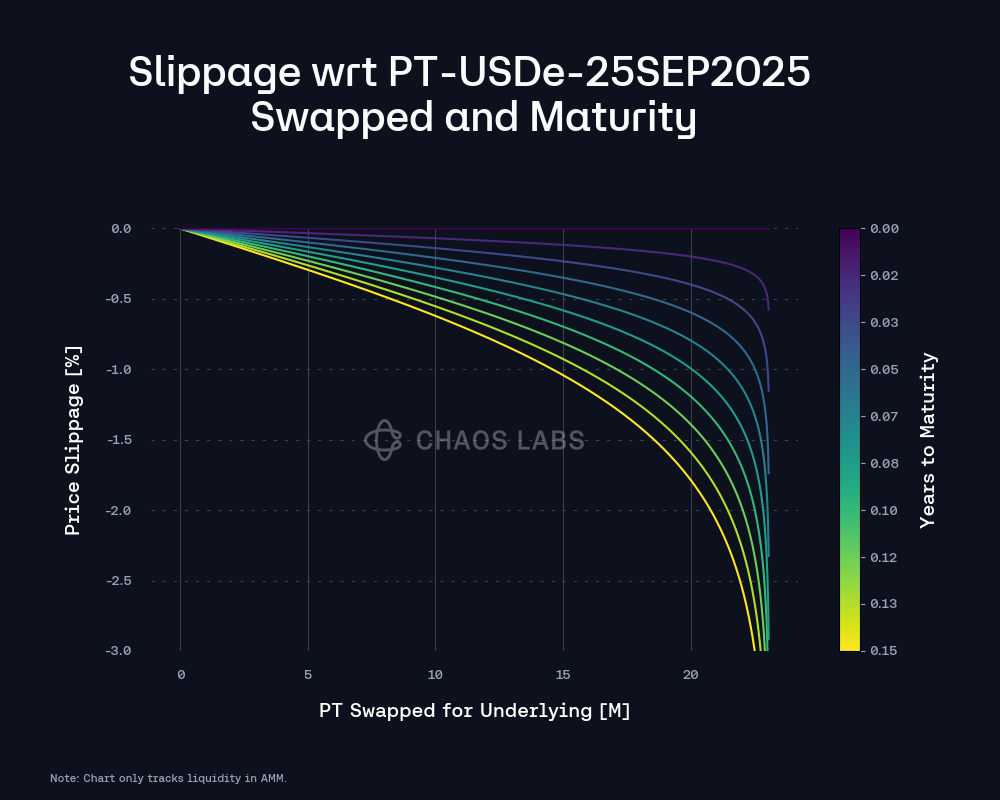

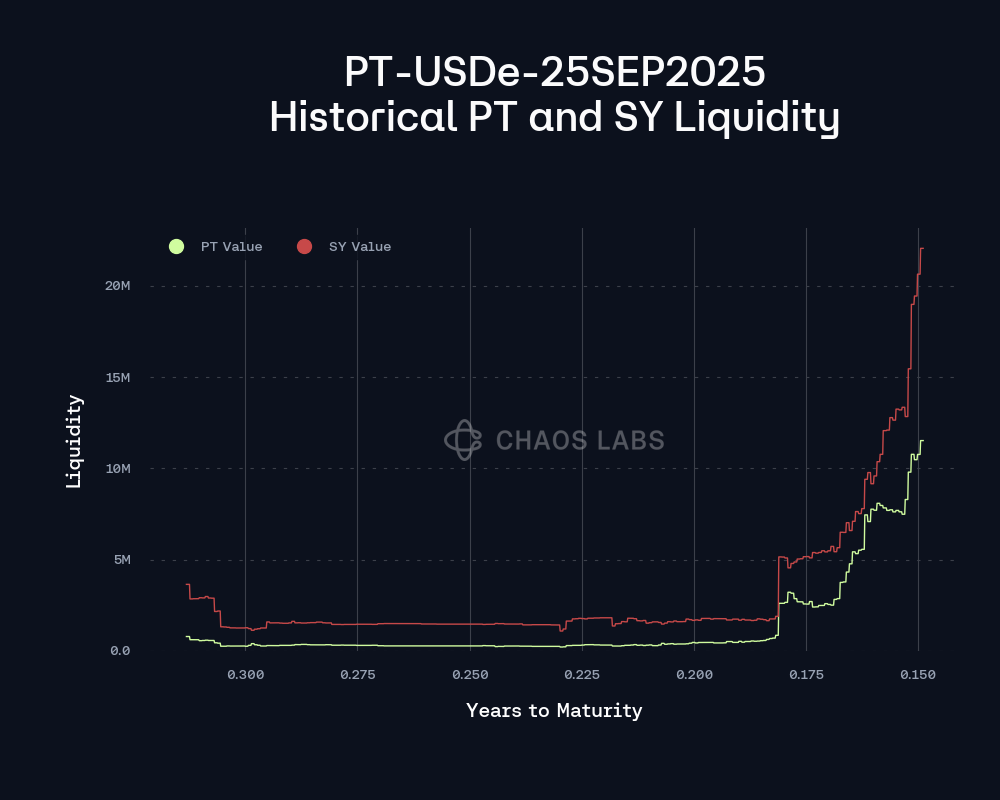

At the moment Pendle’s AMM can support a swap of 23M with slippage limited to 2%.

Additionally, the liquidity has increased for both the PT and SY, recently reaching respective highs of 25M and 11M.

The implied yield has mostly been stable with a slight 1.5% decline over the past 2 days. While fluctuation in the implied yield directly affect the prices of PTs their magnitude is largely reduced due to short to medium duration (55 days).

Recommendation

Given user-behavior and strong demand, we recommend increasing the supply cap by 200M.

sUSDe (Ethereum Core instance)

The supply cap for sUSDe has been reached at 600M, following the recent inflow of 500M sUSDe. This sharp increase in supply can be attributed to the Liquid Leverage incentive program where users supply USDe and sUSDe and loop them with other stablecoins to maximize yield.

Supply Distribution

The supply distribution is moderately concentrated, with the top 9 suppliers holding less than 50% of the total. Users’ health scores generally range from 1.03 to 1.15, but liquidation risk remains minimal due to the tight correlation between collateral and debt prices.

Stablecoins dominate the borrow distribution, with USDT and USDC accounting for over 97% of borrows. As previously mentioned, since borrowing is concentrated in stablecoins, liquidation risks remain minimal.

Recommendation:

Based on current market conditions, user behavior, and strong demand, we recommend increasing the supply cap for sUSDe by 500M.

USDe (Ethereum Core instance)

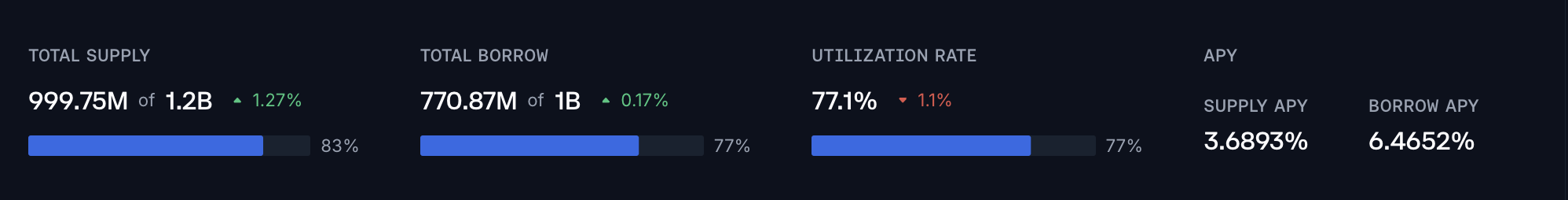

In the recent month USDe supply on the Core instance has grown from 450M to 1,000M initially fueled by the demand created by PT USDe-based looping strategy and recently by the introduction of Liquid Leverage.

Supply Distribution

USDe’s supply shows moderate concentration, with the top wallet holding over 15% and the top 11 accounts comprising ~69% of the total. Most suppliers have opened borrow positions against their collateral, with health scores primarily ranging from 1.02 to 1.15. Since the borrowed asset is USDT, liquidation risk remains low due to the correlation between debt and collateral.

USDT dominates borrowing against USDe at 92%. Since both are stablecoins, liquidation risk in this market remains minimal.

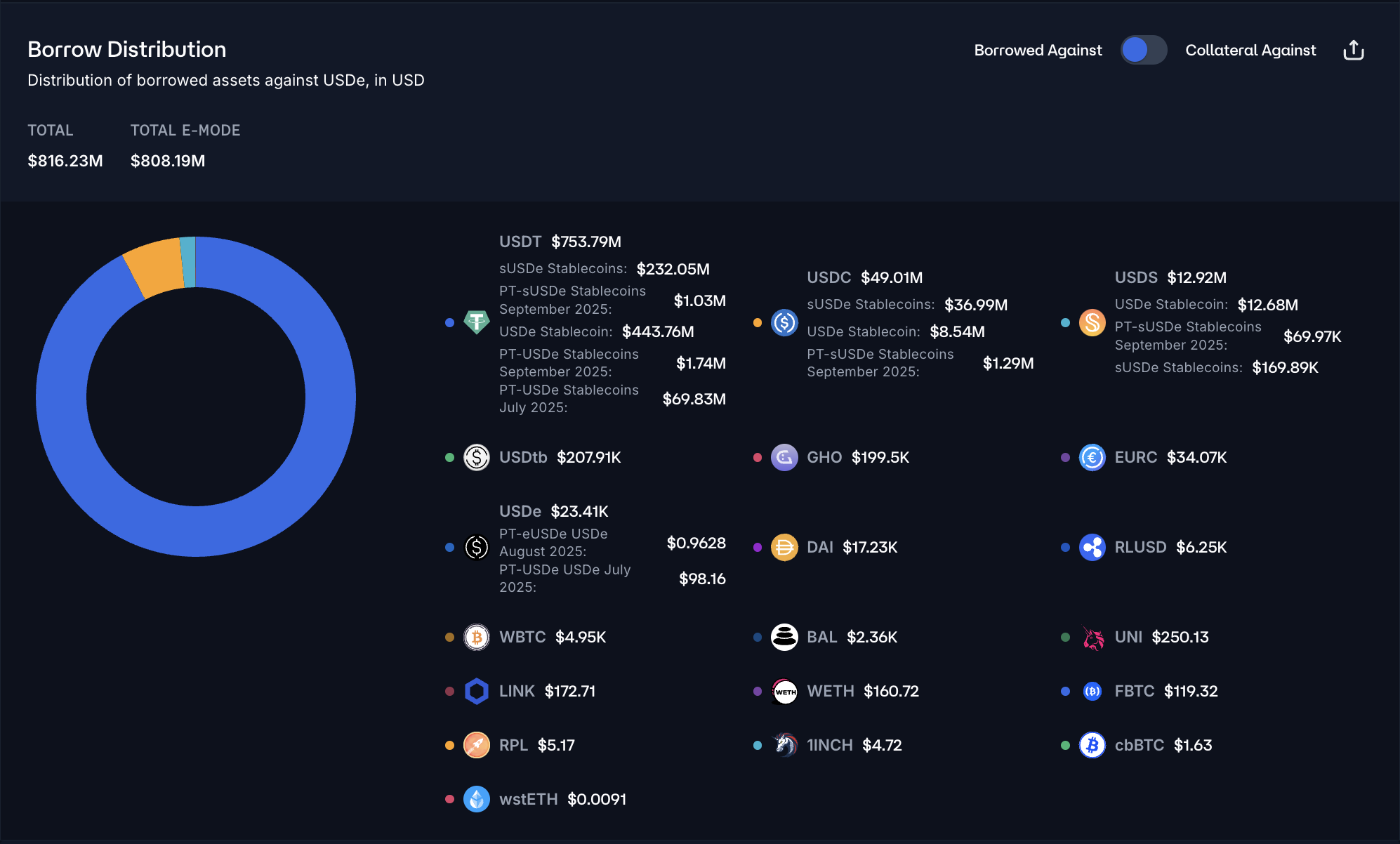

Borrow Distribution

Borrow distribution is significantly less concentrated compared to supply, with the top borrower accounting for 8% of the total and the top 24 users having a combined share of 70%. Additionally, health factors for borrow positions show a much wider distribution, with approximately 33% of wallets in the 1.02-1.25 range and 67% at 1.25 or above.

Users predominantly borrow USDe using USDe, sUSDe, and eUSDe-based PTs as collateral, which represents over 70% of all posted collateral. Since these collateral assets are highly correlated with the debt asset, the risk of significant liquidations is minimal.

Recommendation:

Given the limited risk and strong demand for both supplying and borrowing USDe, fueled by the PT looping and Liquid Leverage strategies, we recommend increasing the supply and borrow caps by 300M and 250M respectively.

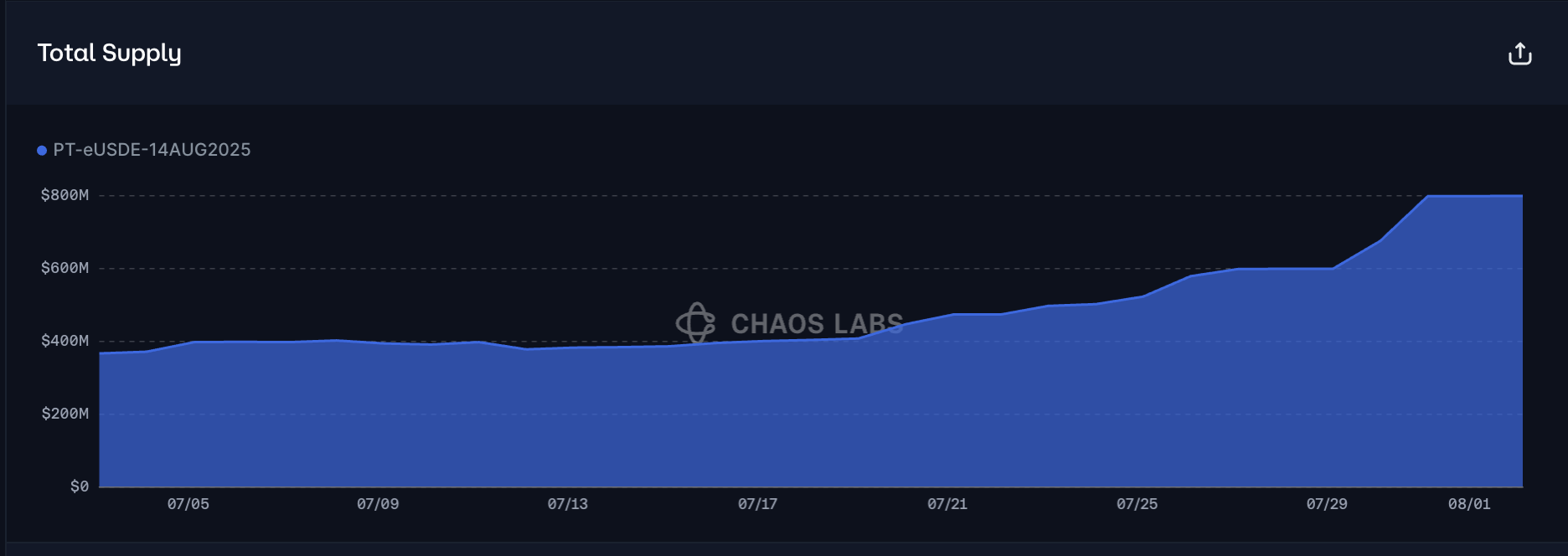

PT-eUSDE-14AUG2025 (Ethereum Core)

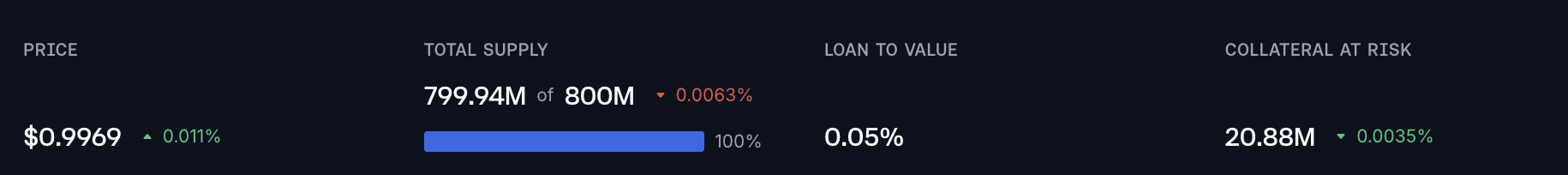

PT-eUSDE-14AUG2025 has reached its recently raised supply cap at 800M.

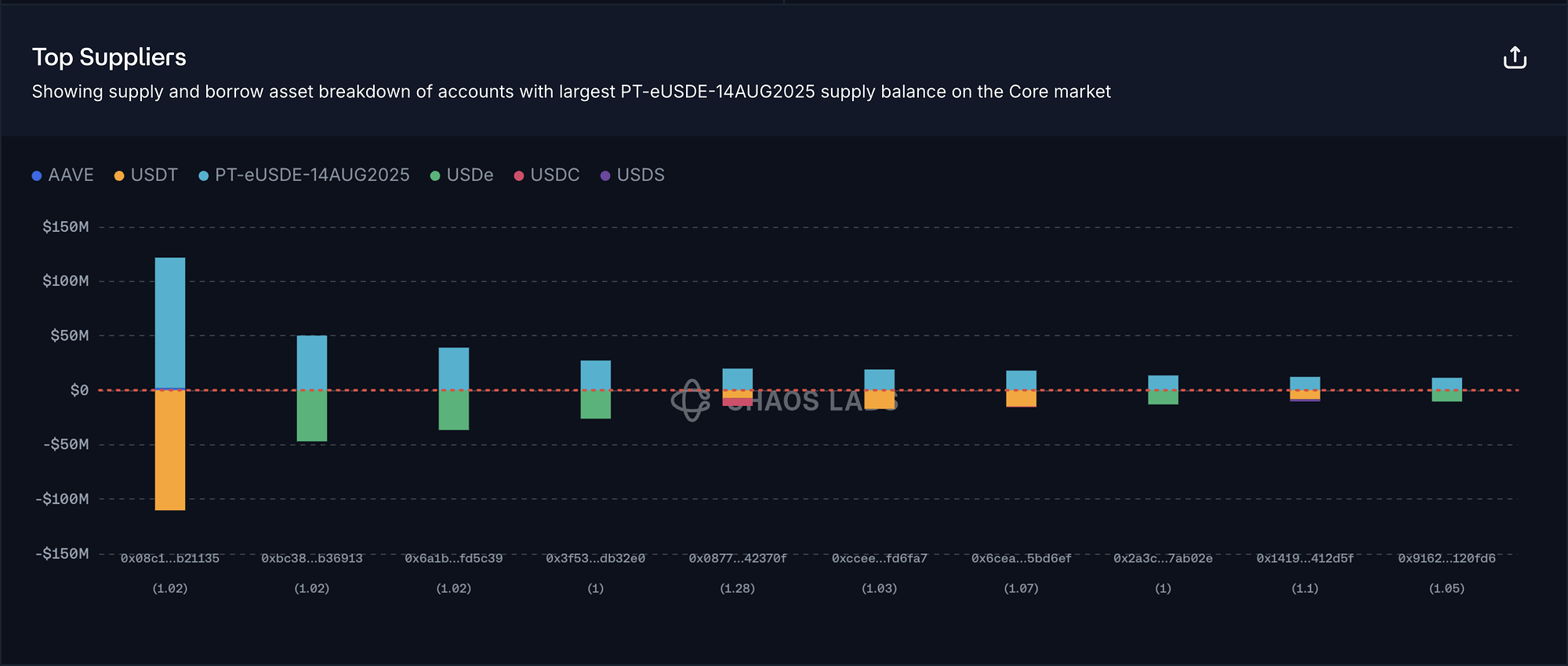

Supply Distribution

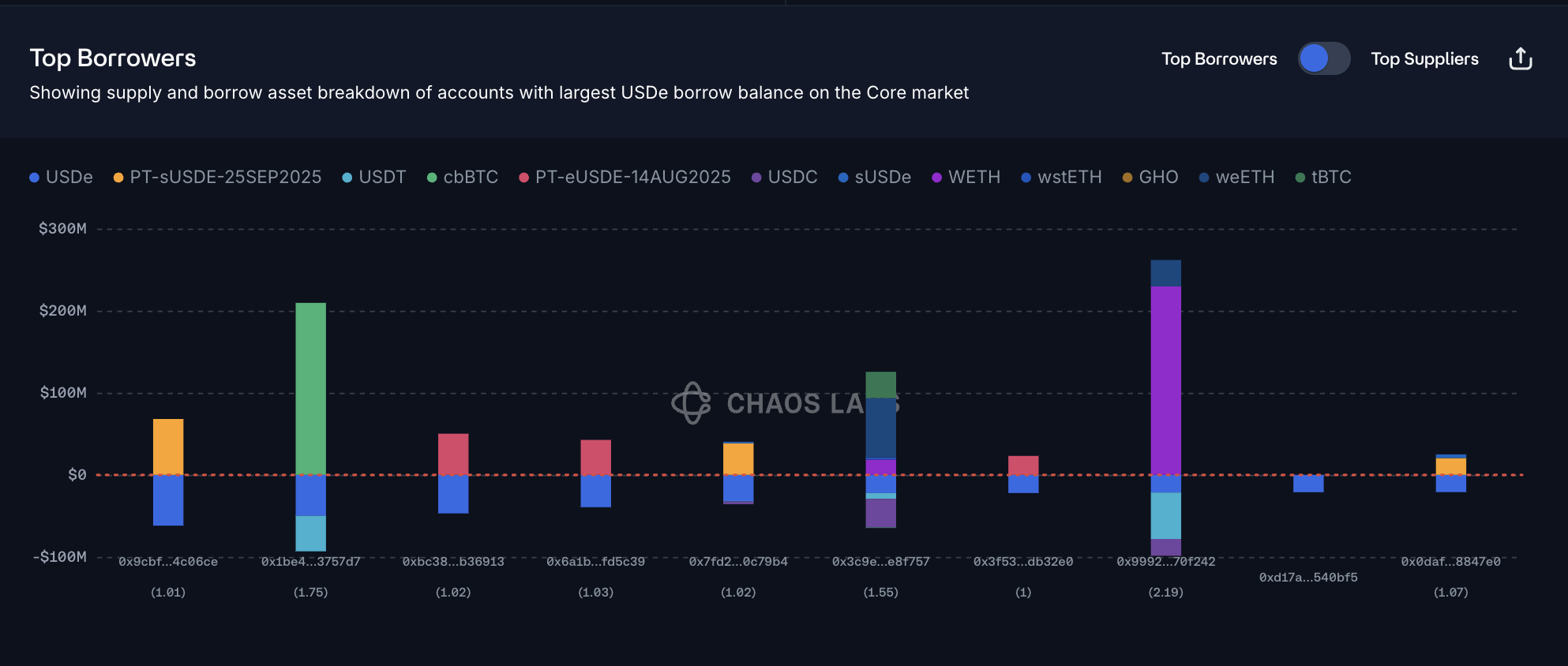

PT-eUSDE-14AUG2025’s supply is highly concentrated, with the top supplier representing 20% of the total and the top 12 suppliers accounting for 60%. Health scores cluster around 1.02, as loopers are incentivized to maximize their leverage. Most top suppliers borrow either USDT or USDE, which significantly reduces liquidation risk due to the high correlation between collateral and debt.

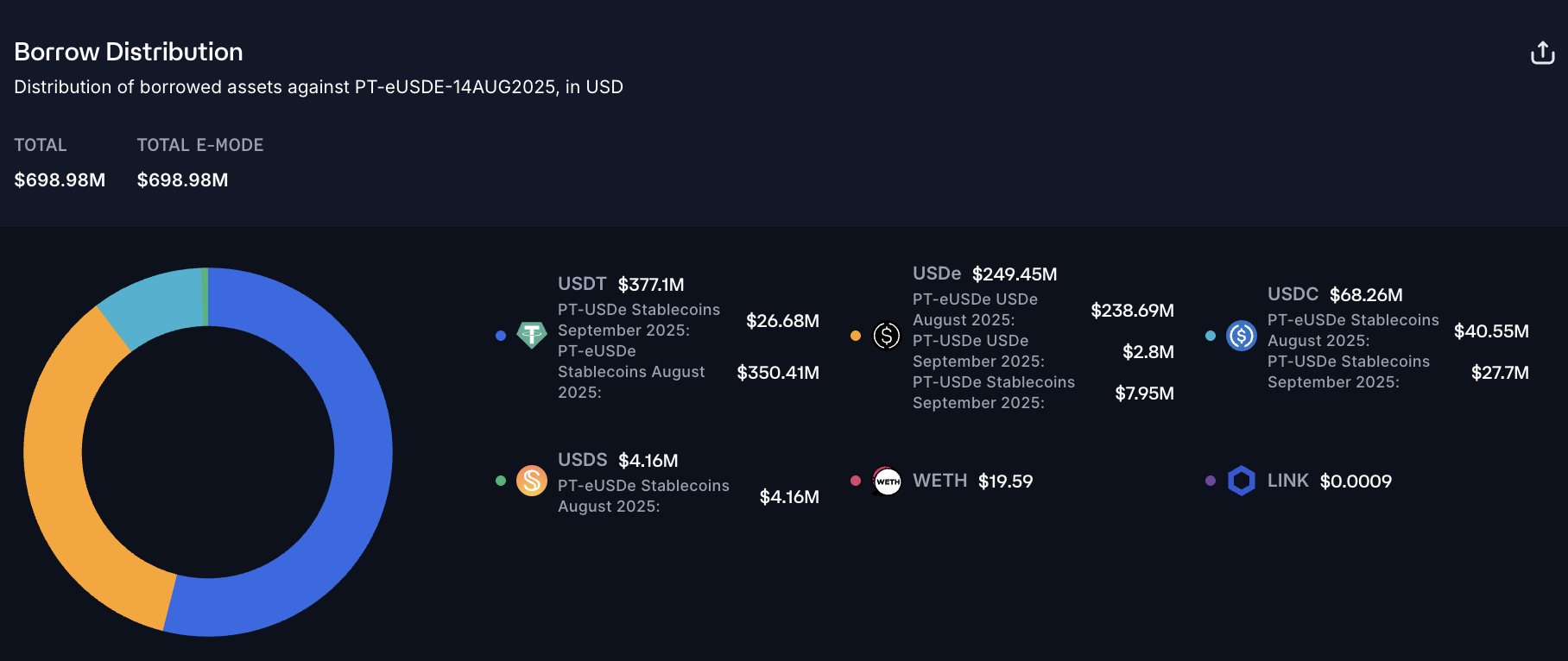

PT-eUSDE-14AUG2025 is predominantly used to borrow USDT/USDC and USDe, facilitated by the Stablecoin and USDe E-modes. Given that the underlying of the PT’s is USDe, risk of liquidation is minimal.

Liquidity

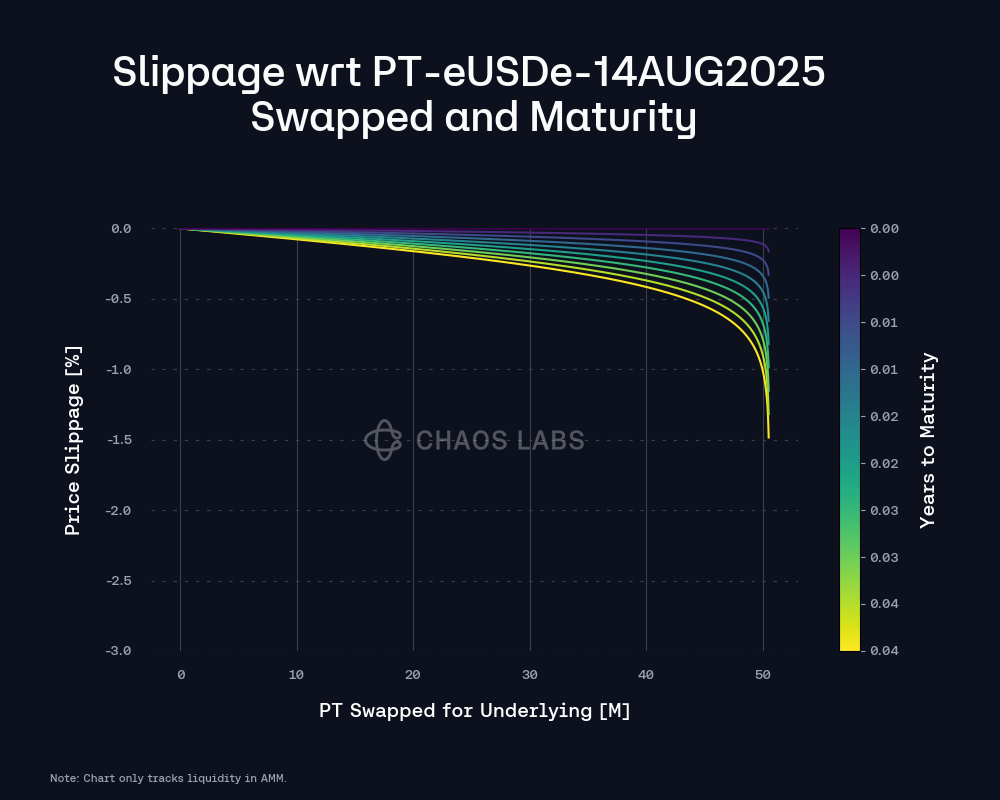

As the principal token approaches maturity, AMM liquidity on Pendle is increasing. Currently, it can facilitate a sell order of 50M with a conservative 2.5% slippage.

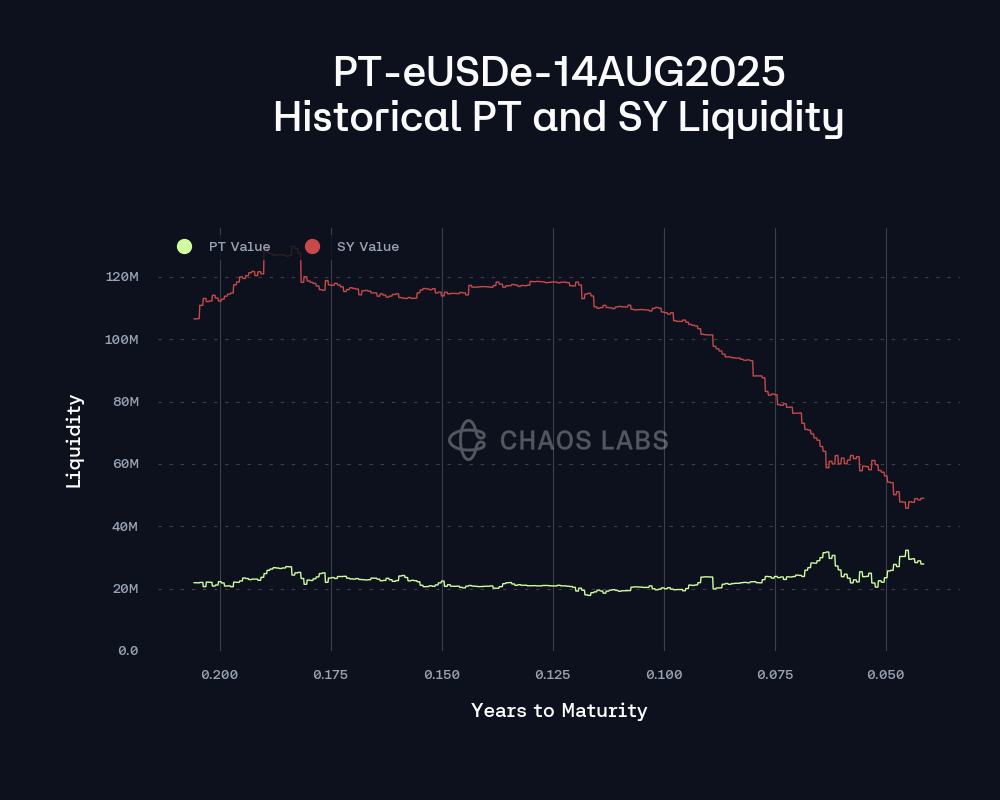

As the opportunity cost associated with providing liquidity into PT-eUSDe-14AUG2025’s pool has grown due to elevated yield stemming from external yield-bearing assets, on-chain liquidity has remained stable at the 20-25M level, while SY’s liquidity has declined. This change is a combination of withdraws from the Liquidity pool and the increase of PT yield, which drives a higher share of the pool to be represented by PT tokens.

Overall, the market has experienced some volatility as the implied yield oscillates in the 11.5% - 14% range. Although these yield fluctuations impact the PT’s price, the effect diminishes proportionally as maturity approaches, becoming minimal at just 11 days remaining. Consequently, the incremental duration risk of the asset is limited, suggesting that under adverse market conditions, the probability and magnitude of price declines are significantly reduced as maturity nears.

Recommendation:

Considering user behavior, strong demand, and minimized risk associated with low duration, we recommend raising the supply cap by 200M.

USDC (Ethereum Core instance)

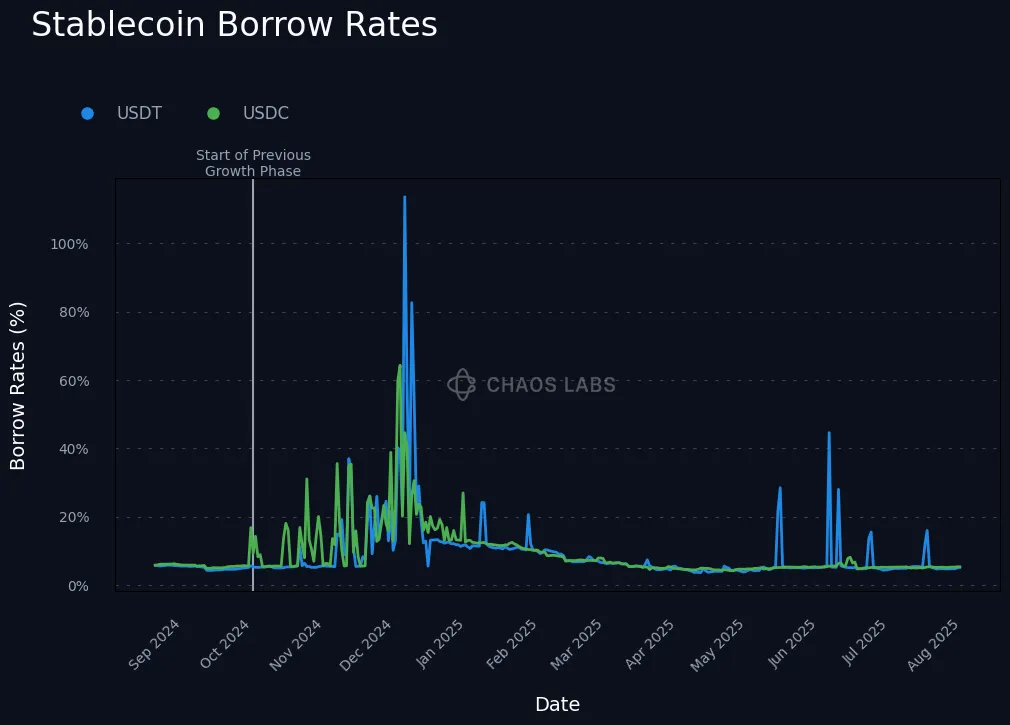

Given the previous cap increases, we estimate that USDC is going to see increased demand over the next couple of days, as users are going to borrow USDC to partake in either Liquid Leverage incentives or USDe-based PT looping. During previous sUSDe yield spikes, the rates for USDC have exhibited high volatility as utilization spiked, stemming from rate-agnostic yield farmers aiming to gather as much liquidity as possible, at the cost of short term unprofitability.

To avoid spiking rate volatility, we propose reducing Slope 2 by 20%. This adjustment will flatten the interest rate curve after the kink, lowering the sensitivity of interest rates to additional demand.

USDT (Celo instance)

USDT’s borrow cap utilization currently stands at 61%, while its supply cap utilization is at 38%. Although the borrow cap is not yet nearing full capacity, the recent increase in borrowing activity over the past two weeks, combined with the expected surge in demand from upcoming incentive programs, suggests it may be worth evaluating whether we should proactively raise the borrow cap.

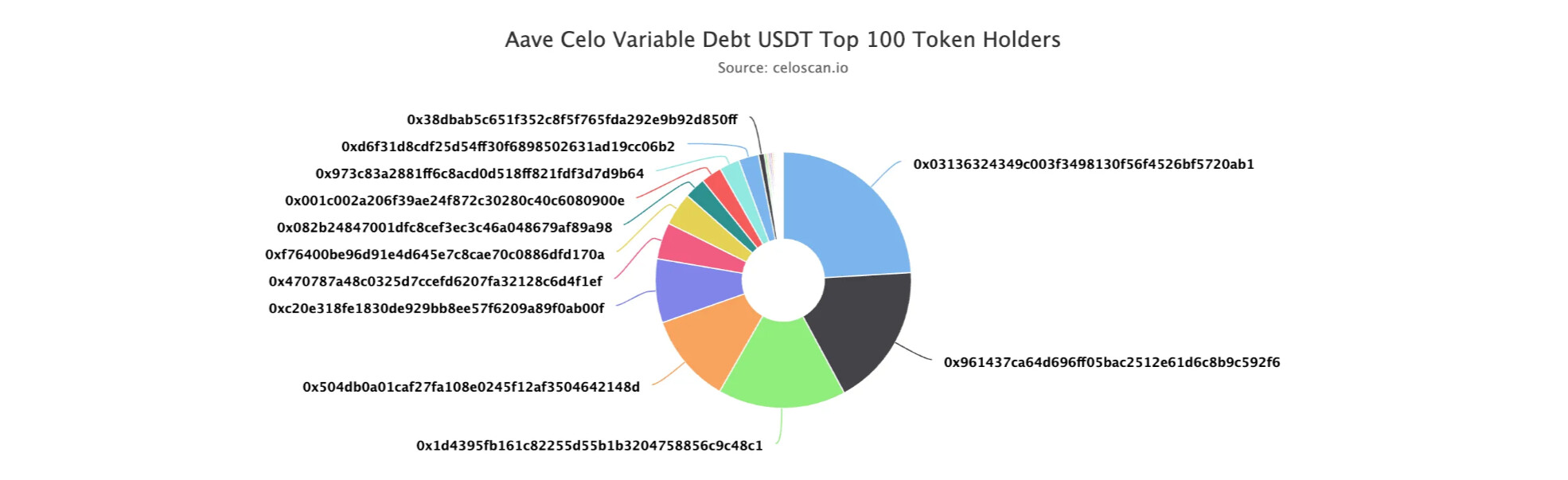

Borrow Distribution

The distribution of USDT borrowing is slightly concentrated, with the top borrower accounting for 24% of the total. However, since this user currently maintains a health score of 1.21, we do not view this as a significant risk.

The remaining top borrowers also present limited liquidation risk. The second-largest borrower has collateralized USDT itself, while the third-largest borrower maintains a health score of 1.1. These factors significantly reduce the likelihood of liquidation.

Liquidity

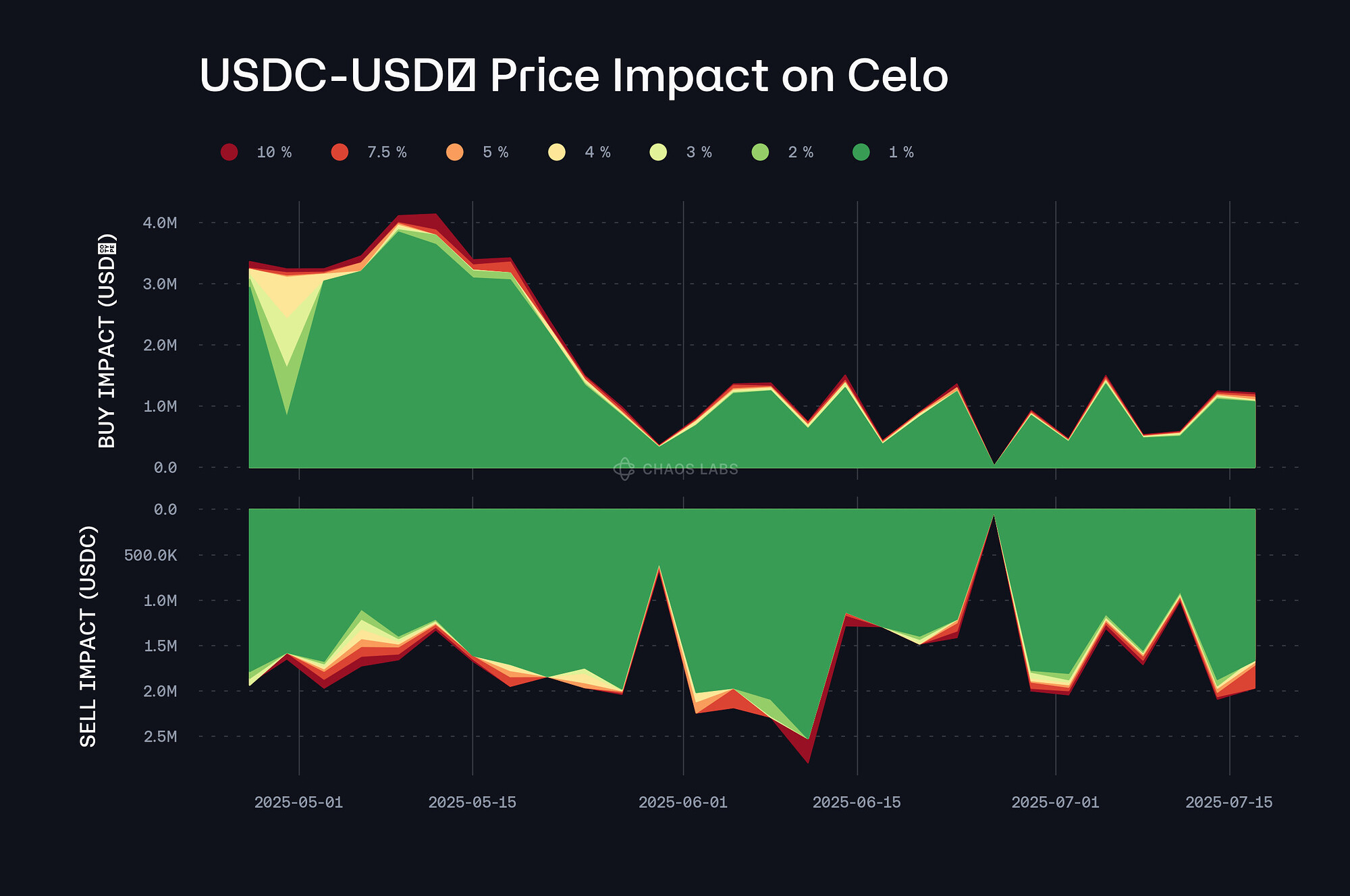

Currently, selling 1M USDT for USDC would incur less than 1% price slippage, indicating sufficient liquidity to support a borrow cap increase.

Recommendation

Given the user-behavior and on-chain liquidity, we recommend increasing USDT’s borrow cap.

Specification

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this research paper. Our pre-launch risk reports on Ethena, published over a year ago, represented a temporary compensated engagement, bear no implications on the current state of the protocol and can be viewed here on our website. We additionally provide proof-of-reserve attestations for the Ethena Protocol, which periodically reflect the aggregate state of the portfolio relative to the underlying USDe shares emitted.