Summary

A proposal to:

- Decrease the Slope 1 of USDe on the Ethereum Core instance

- Increase the Supply Cap of weETH on the Plasma instance

- Increase the Supply Cap of ezETH on the Base instance

- Increase the Borrow Cap of WETH on the Plasma instance

All adjustments are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

USDe (Ethereum Core)

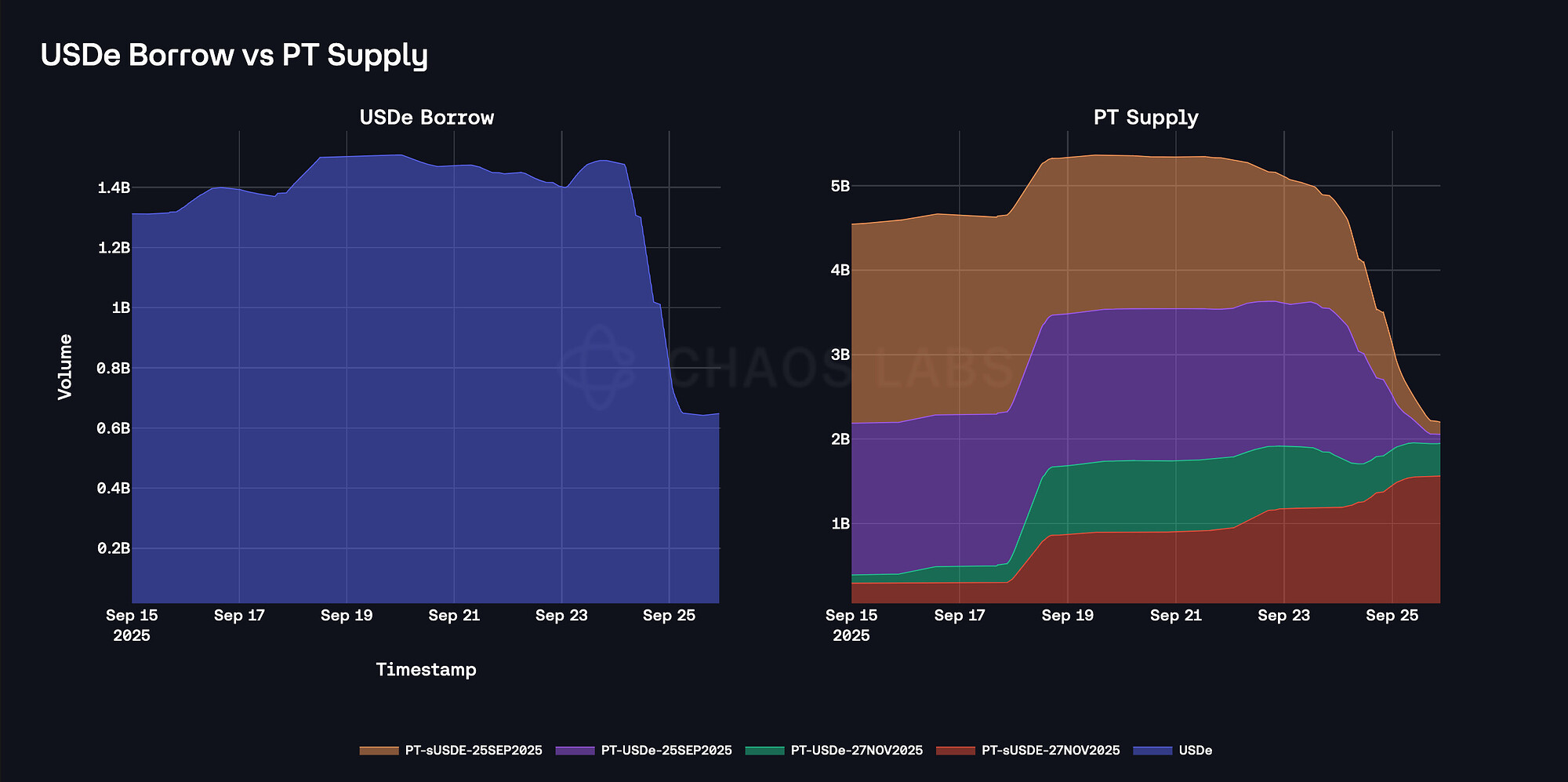

USDe borrowing on Ethereum Core has declined by over $800 million since September 25, primarily following the maturity of the September PT-sUSDe and PT-USDe tokens.

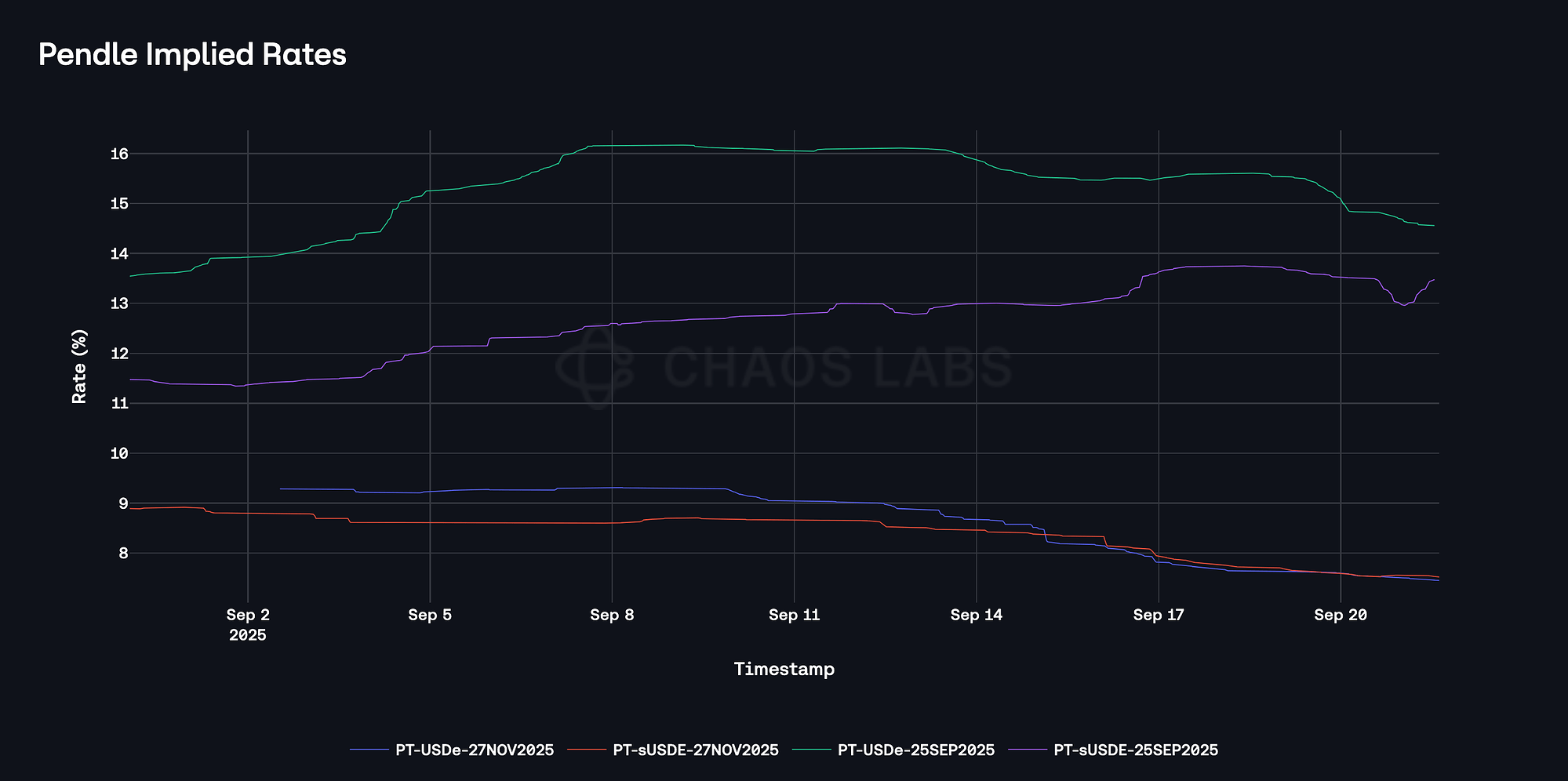

Ordinarily, such borrowers would aim to roll into new PT-based looping strategies to earn the spread between the implied PT APY and stablecoin borrow costs. However, implied yields for the November-expiry principal tokens have been materially lower; the drop in PT-USDe implied rates is on the order of 6.5 percentage points.

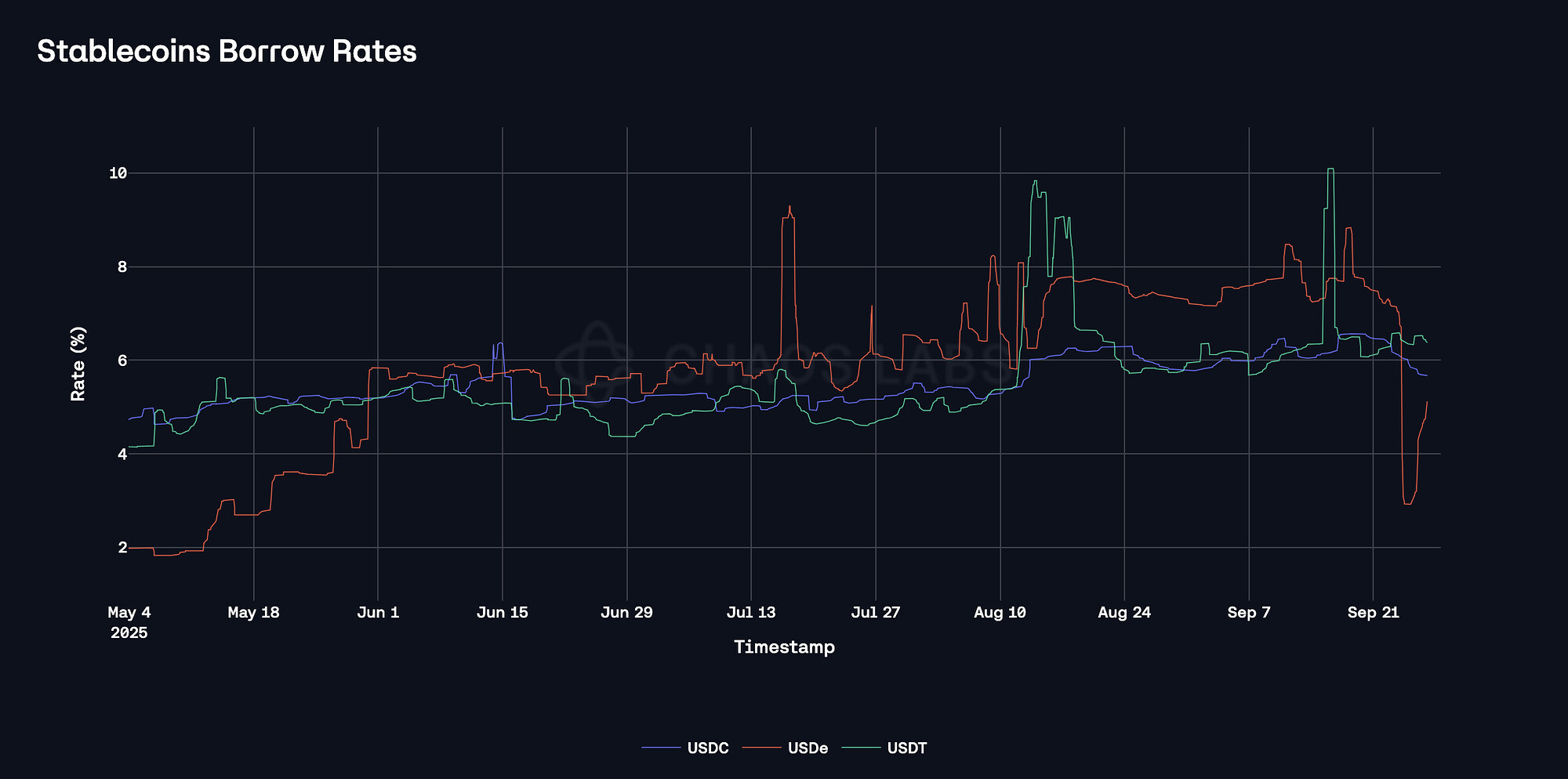

The ~50% decline in Pendle-implied rates has substantially eroded the viability of looping strategies, particularly given prevailing stablecoin borrowing costs in the 6–8% range. In prior market conditions, when Pendle yields were elevated, such strategies could generate net annualized returns of 30–50% despite elevated interest rates.

The introduction of a dedicated PT <> USDe E-Mode additionally reinforced aggregate borrowing demand for USDe, enabling borrowing against USDe-denominated PT collateral with greater capital efficiency. This structural feature helped solidify USDe’s historically higher borrowing rates relative to USDT and USDC. At present, however, given the remaining time to maturity, the Liquidation Threshold delta, and thus the incremental efficiency gain of the USDe E-Mode, is only marginal compared with the broader stablecoin E-Mode; more research on this topic can be found here.

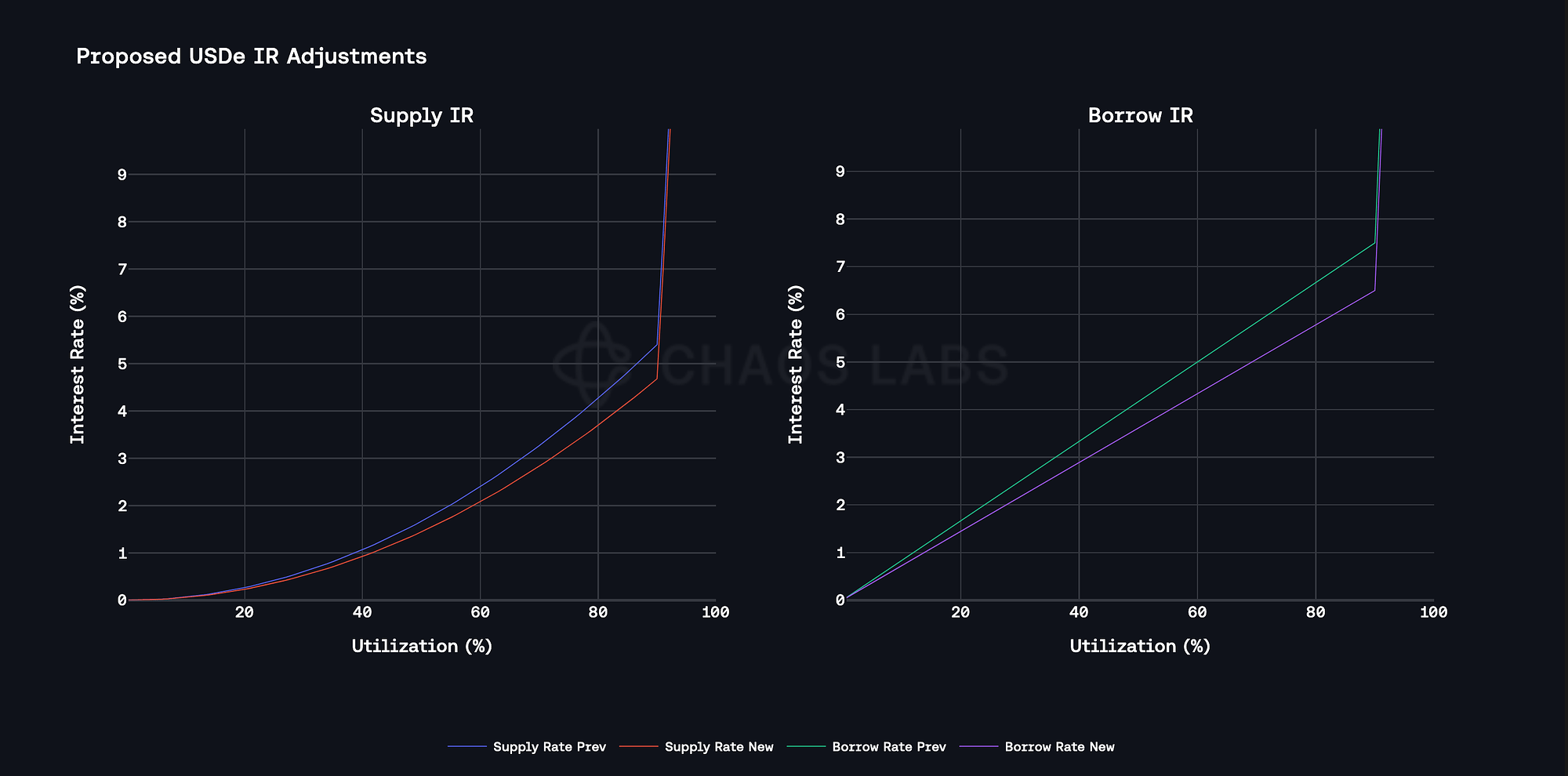

Coupled with the opportunity cost associated with PT collateralization as opposed to the extreme demand expressed for liquid leverage on the Plasma instance, which has grown to $2B in just a few days, the effective demand response implies that the alteration of interest rates on the USDe market is deemed optimal. Thus, we recommend decreasing USDe’s Slope 1 to 6.75% on Ethereum Core to incentivize additional market demand.

WETH (Plasma)

WETH has reached both supply and borrow caps on the Plasma instance in response to the considerable demand characteristics expressed in such markets. At the time of writing, the supply and borrow caps are 120 and 10 thousand tokens, respectively. As the WETH supply cap is currently timelocked, this section solely focuses on the WETH borrow cap component. Such strategizing has been performed in tandem with the Plasma team, in an effort to minimize mercenary farming at the expense of the protocol.

Borrow Distribution

Borrow distribution exhibits substantially lower concentration as the top user represents less than 25% of the market. Additionally, we observe that the borrowers are collateralizing WETH debt primarily with USDT0, likely to increase their exposure to the ongoing incentives, while maintaining a sufficient buffer in an effort to minimize outstanding liquidation risk.

Liquidity

At the time of writing, WETH on-chain liquidity on Plasma is mostly allocated in a Uniswap V3 pool, which has over 2,500 WETH and 6 million USDT0.

Additionally, the Plasma protocol team has established a $300M liquidation backstop to ensure efficient execution of liquidations on the Aave Plasma instance during periods of market stress. Such an endeavor has been modeled extensively and considered within our simulations.

Recommendation

Given the persistent demand to leverage WETH on the Plasma instance, safe user behavior, and growing liquidity, we recommend increasing the borrow caps of WETH on the instance by twofold.

weETH (Plasma)

In parallel, shortly after the launch of the Plasma mainnet, the weETH Aave market received extreme relative demand in response to the considerable incentives being distributed on the USDT market.

Supply Distribution

The supply of weETH on Aave is highly concentrated, with two wallets representing the entirety of the market, currently borrowing 32M and 10.5M USDT against weETH collateral, maintaining relatively safe health scores of 1.54 and 1.56, respectively.

Liquidity

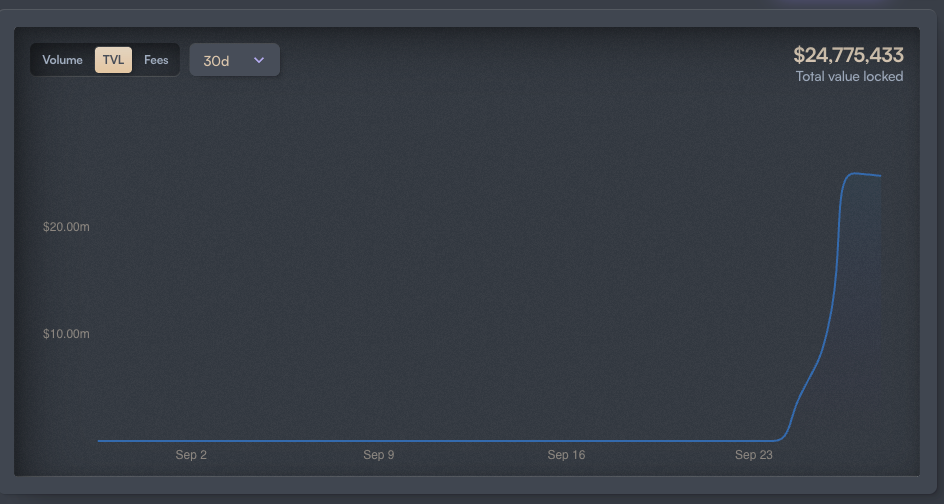

WeETH liquidity on Plasma is concentrated within a weETH/waPlaWETH Balancer pool, whose total TVL has scaled considerably over the last few days to nearly $25M. waPlaWETH represents the WETH aTokens on the Plasma instance, enabling composable and thus dual earning of protocol yields. This translates into available buy liquidity of $10M, effectively leveraging the underlying WETH liquidity in a multi-hop fashion.

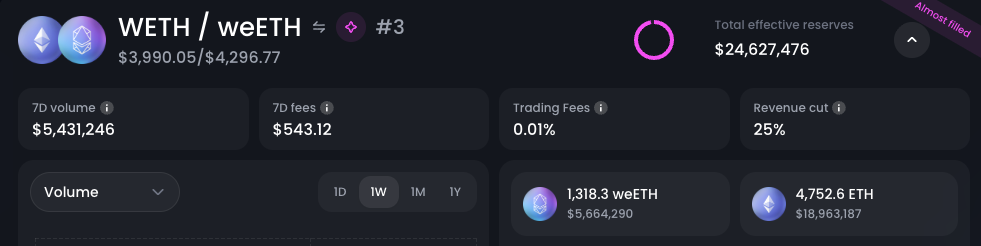

Moreover, the Fluid Protocol liquidity layer has scaled rapidly via WETH/weETH Smart Collateral, reaching total effective reserves of nearly $25M.

Recommendation

Given weETH’s primary user safe positioning and available DEX liquidity on the market, we are supportive of increasing the supply cap of weETH on Aave Plasma Instance, in parallel with a timely increase of the WETH borrow cap to facilitate optimal demand characteristics via correlated debt.

ezETH (Base)

ezETH supply on Base has increased substantially in the past 48 hours, scaling to 3,600 tokens.

Supply Distribution

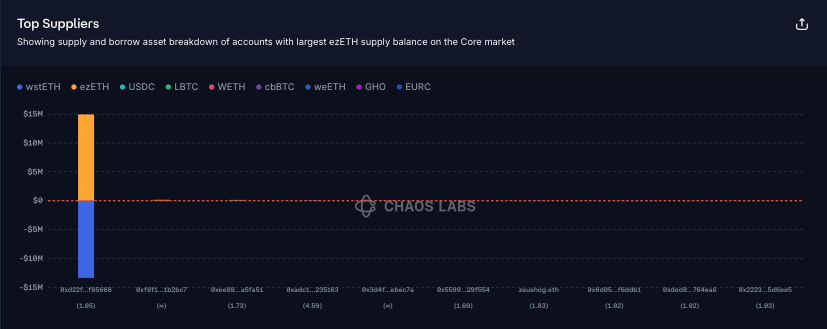

The supply distribution is highly concentrated, with the top user accounting for over 99% of the market. The users are supplying ezETH to collateralize wstETH debt, therefore leveraging restaking yield against WETH borrowing. As the debt and collateral are highly correlated, the liquidation risk is minimal.

As wstETH is the sole and dominant debt asset for ezETH collateral, the market liquidation risk is low due to the high price correlation and underlying backing characteristics between wstETH and ezETH.

Recommendation

While the market exhibits significant supply concentration, both liquidity conditions and user behavior allow for a meaningful cap increase without introducing additional protocol risk. Hence, we recommend increasing the supply cap of ezETH to drive additional demand for wstETH borrowing.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Plasma | WETH | 120,000 | - | 10,000 | 20,000 |

| Plasma | weETH | 20,000 | 40,000 | - | - |

| Base | ezETH | 3,600 | 7,200 | - | - |

USDe Slope 1 Adjustment

| Market | Asset | Current Slope 1 | Recommended Slope 1 |

|---|---|---|---|

| Ethereum Core | USDe | 7.5% | 6.75% |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.