Summary

A proposal to:

-

Increase supply cap for tETH on the Ethereum Prime instance.

-

Increase supply cap for PT-sUSDe-25SEP2025 on the Ethereum Core instance.

-

Increase supply cap for PT-USDe-14AUG2025 on the Ethereum Core instance.

-

Increase supply cap for PT-USDe-25SEP2025 on the Ethereum Core instance.

-

Increase supply cap and borrow cap for USDe on the Ethereum Core instance.

-

Increase supply cap for sUSDe on the Ethereum Core instance.

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

Our most recent research paper, “Stress Testing Ethena: A Quantitative Look at Protocol Stability,” examines how rapidly growing deposits of Ethena’s USDe, sUSDe and especially Pendle Principal Tokens are reshaping Aave’s collateral pool and funding dynamics. It maps out both on‑chain liquidity hazards (e.g., thin PT markets, leveraged looping, rehypothecation) and backing‑side tail risks (exchange or custodian failure, collateral de‑peg, prolonged negative funding) via scenario modelling and Monte‑Carlo simulations, while proving that Aave’s current risk‑oracle floors, eMode parameterization and liquidation controls would absorb most plausible shocks. The proposed cap increases reflect and incorporate the insights from this paper.

For more insight into how the PT Risk Oracle operates, please consult the following post and its follow-up. In addition, the Risk Oracles outputs can be monitored live at the following page.

tETH (Ethereum Prime)

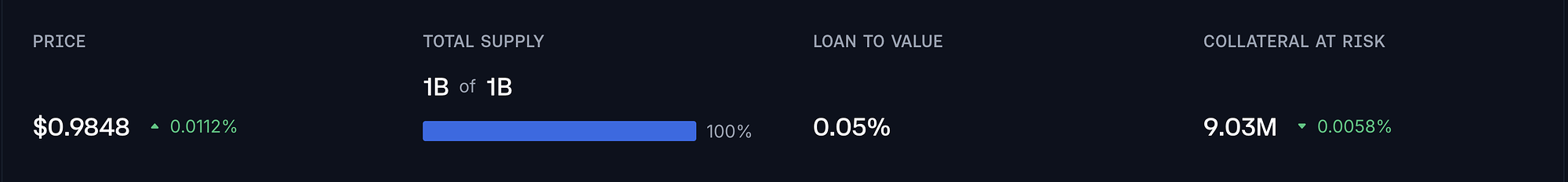

tETH supply has reached 97% of its supply cap, following an influx of 18K tETH this month.

Supply Distribution

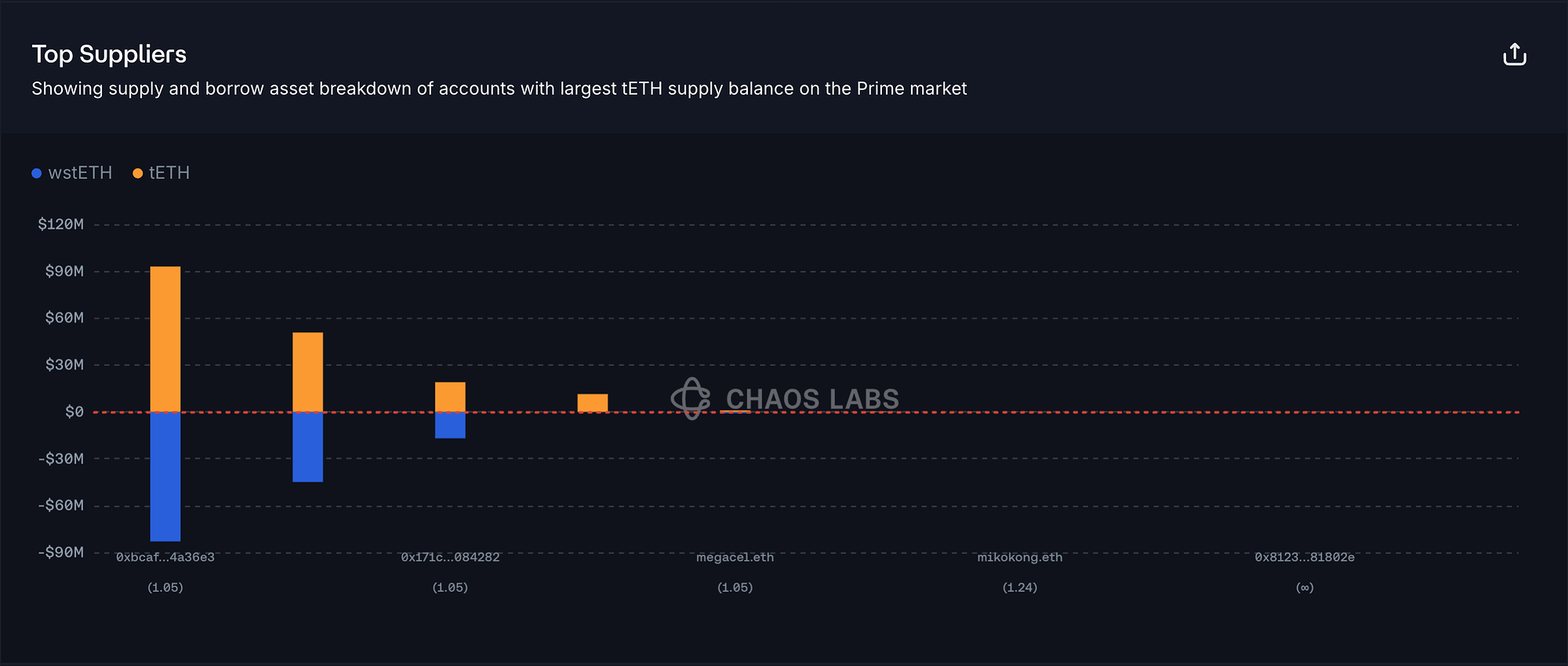

The supply is highly concentrated, with the top 2 suppliers controlling 82% of the total and the top 4 suppliers accounting for a cumulative share of 95%. Users’ health factors have a high concentration, falling in the range from 1.05 to 1.06. Nevertheless, the asset borrowed against tETH is wstETH and given the high correlation between debt and collateral asset prices, the risk of liquidations is reduced significantly.

The only asset borrowed against tETH is wstETH, facilitated by the tETH/wtETH E-mode, providing a capital-efficient way to loop tETH with wstETH.

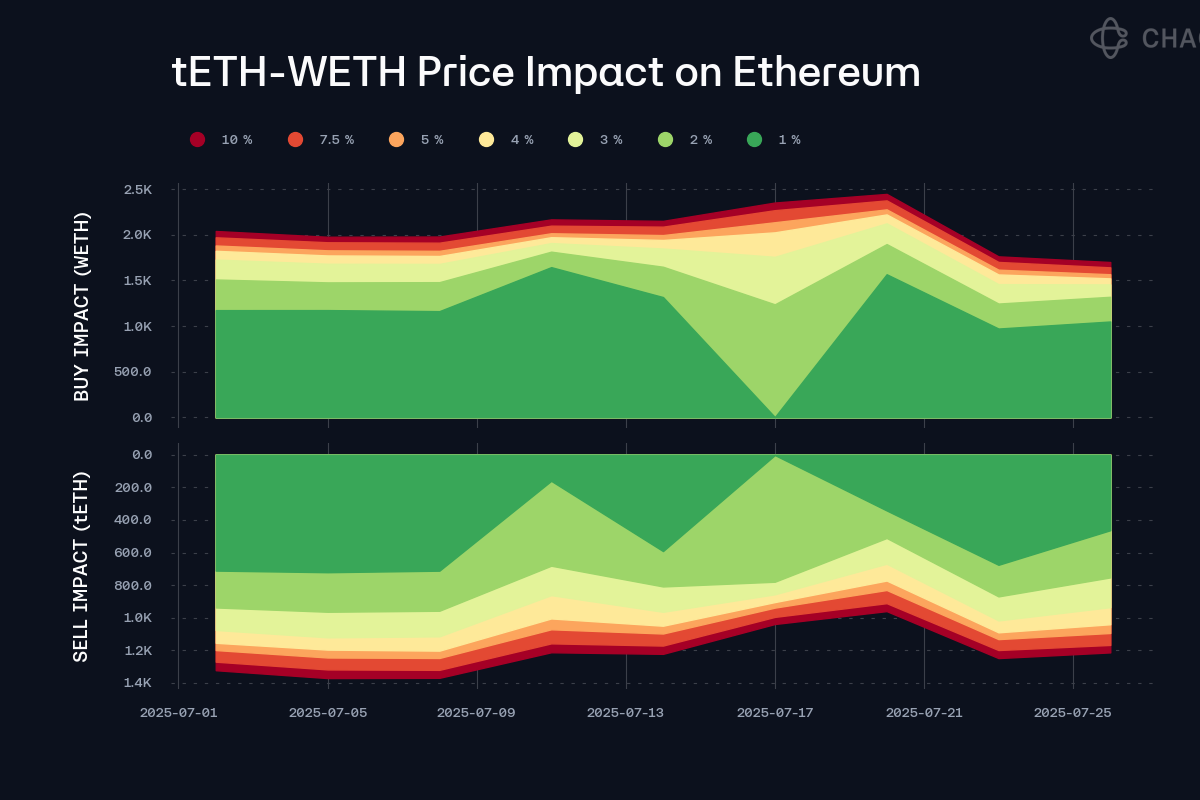

Liquidity

Currently, a sell order of 1,000 tETH would result in a 2% price impact. Additionally, the tETH Vault contract offers Fast Redemption, enabling users to redeem tETH directly for wstETH at a 2% fee.

WETH IR-related Risks

tETH is an LST that aims to capture the spread between ETH borrow rates and POS rewards. This is achieved by borrowing ETH on lending markets like Aave using wstETH deposited by users, then staking the borrowed ETH. The protocol continues this recursive looping strategy until it reaches the desired LTV and risk parameters.

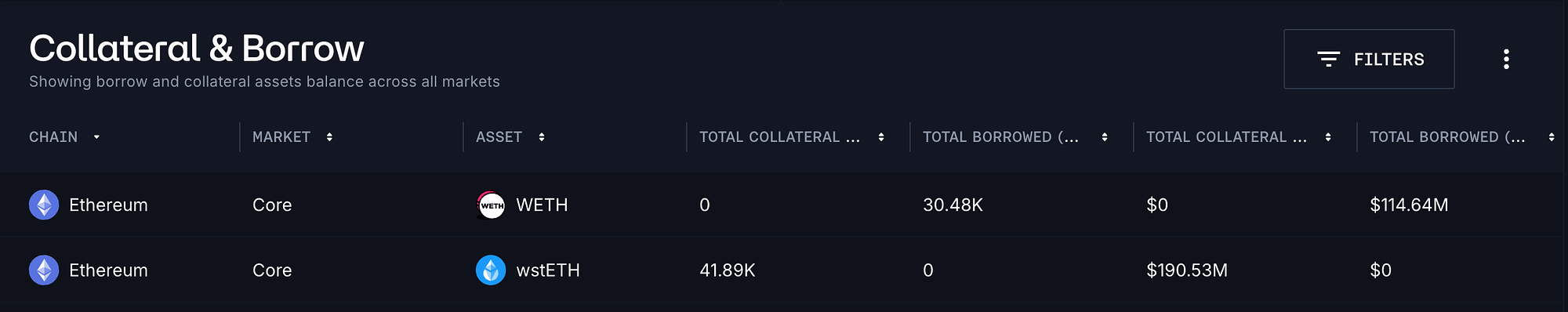

At the moment, Treehouse has over $190M wstETH as collateral and $115M WETH as debt.

Following recent WETH withdrawals, borrow utilization has reached 93.5%. As a result, the interest rate is now 2.99% while Lido’s yield stands at 2.60%. This creates a negative yield of -0.40% on Treehouse’s ETH strategy, reducing tETH’s returns and in some cases causing losses. In order to mitigate this risk Treehouse monitors the utilization and, according to the docs, will deleverage if net yield stays negative for 2+ days, reducing the risk of losses.

Raising the cap will likely drive fresh WETH borrowing as new tETH is minted and, consequently, new WETH is to be borrowed. However, if utilization stays near today’s 93% Treehouse’s risk policy will halt new loops and begin deleveraging once net yield is negative for two consecutive days. At the moment Treehouse’s Strategy wallet has neither increased nor decreased their borrowings as can be seen in the latest transactions dating to July 11th.

Recommendation

Considering user behavior, stable liquidity, and strong demand, we recommend raising tETH’s supply cap by 20K to 60K.

PT-sUSDE-25SEP2025 (Ethereum Core)

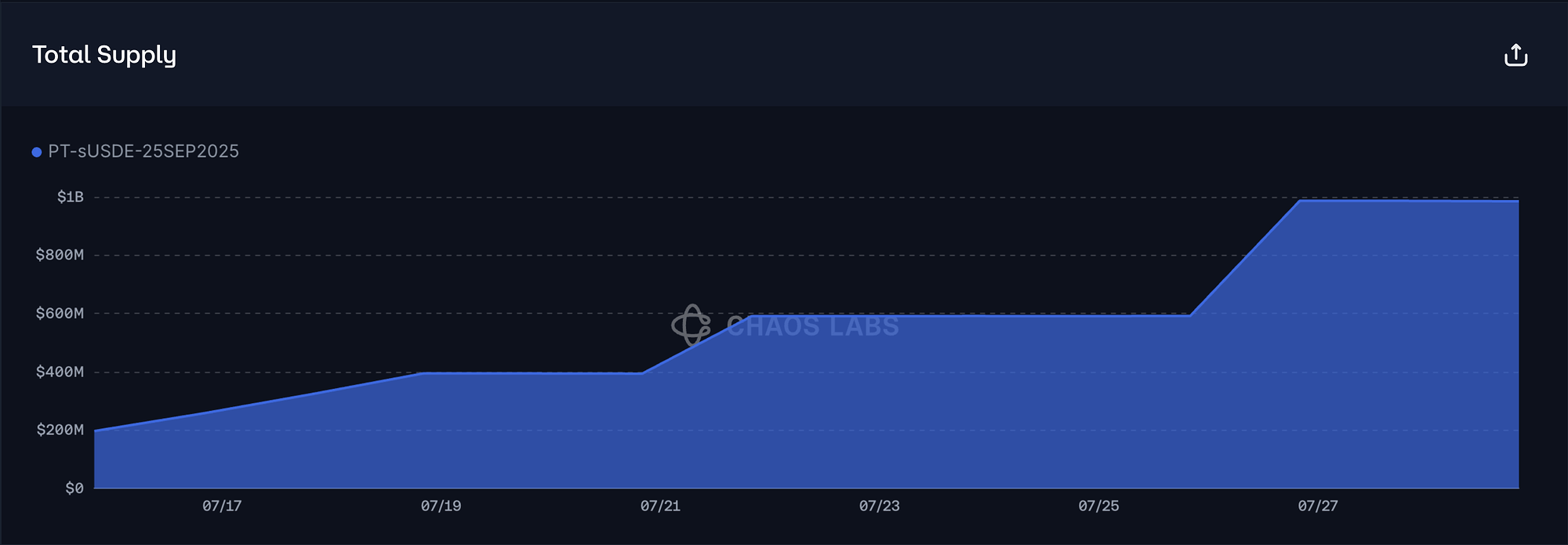

PT-sUSDe-25SEP2025 has reached 100% of its supply cap utilization, shortly after the previous supply cap increase of 400M, indicating persistent demand.

Supply Distribution

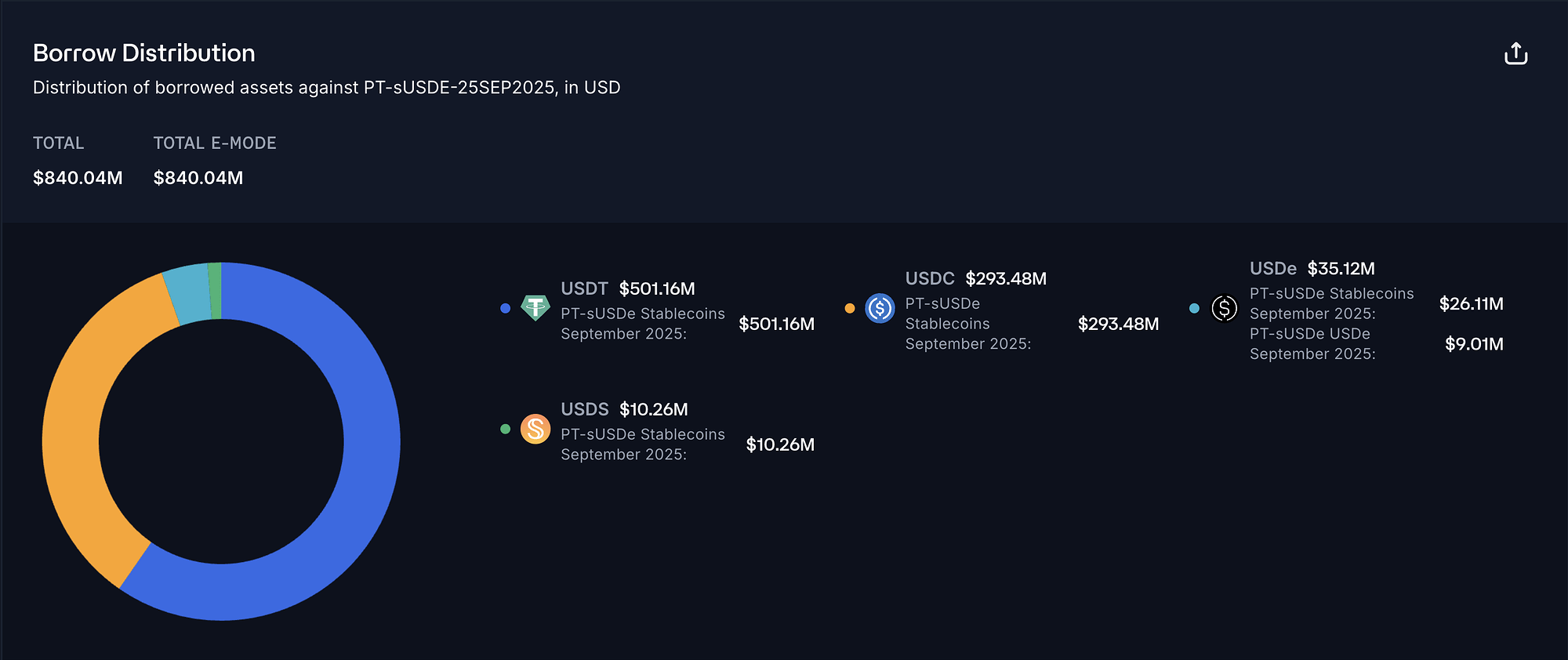

PT-sUSDE-25SEP2025’s supply is moderately concentrated, with the top supplier holding approximately 9% of the total market and the top 11 suppliers accounting for over 55% cumulatively. Health factors of the top suppliers are highly concentrated around 1.03, primarily because loopers are incentivized to maximize leverage. However, users are using PT-sUSDE to borrow stablecoins (USDT, USDC), which significantly reduces liquidation risk since the prices of collateral and debt assets are tightly correlated.

PT-sUSDE is predominantly used to borrow stablecoins, with USDT and USDC accounting for 95% of borrowing activity, facilitated by the Stablecoins E-Mode.

Liquidity

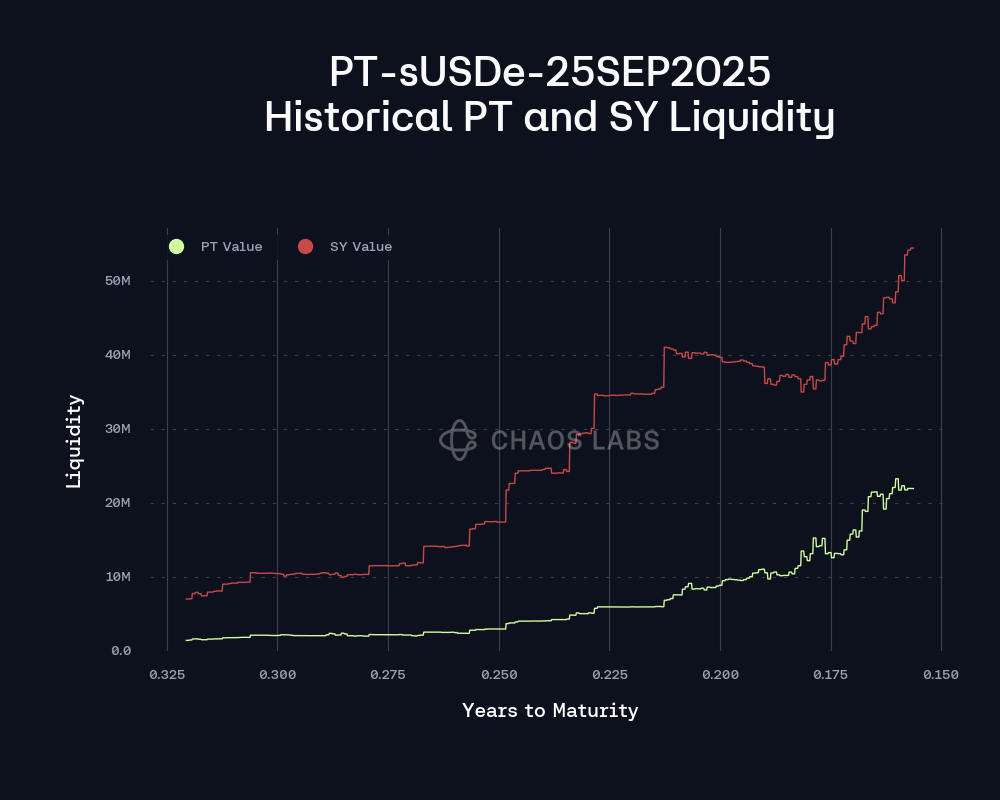

Currently, Pendle’s AMM liquidity for PT-sUSDE-25SEP2025 supports a 55M swap with slippage limited to 3%

Additionally, the on-chain liquidity has been growing at a consistent pace, currently reaching 25M for PT-sUSDE-25SEP-2025 and 55M for its SY-token. The increase in liquidity is largely driven by the substantial yield, in part caused by the yield of the underlying asset. The observed increase in liquidity on the September expiration matches a migration pattern of liquidity from the previous expiry.

Moreover, there is additionally 60M of liquidity in Pendle’s orderbook before 14% implied yield.

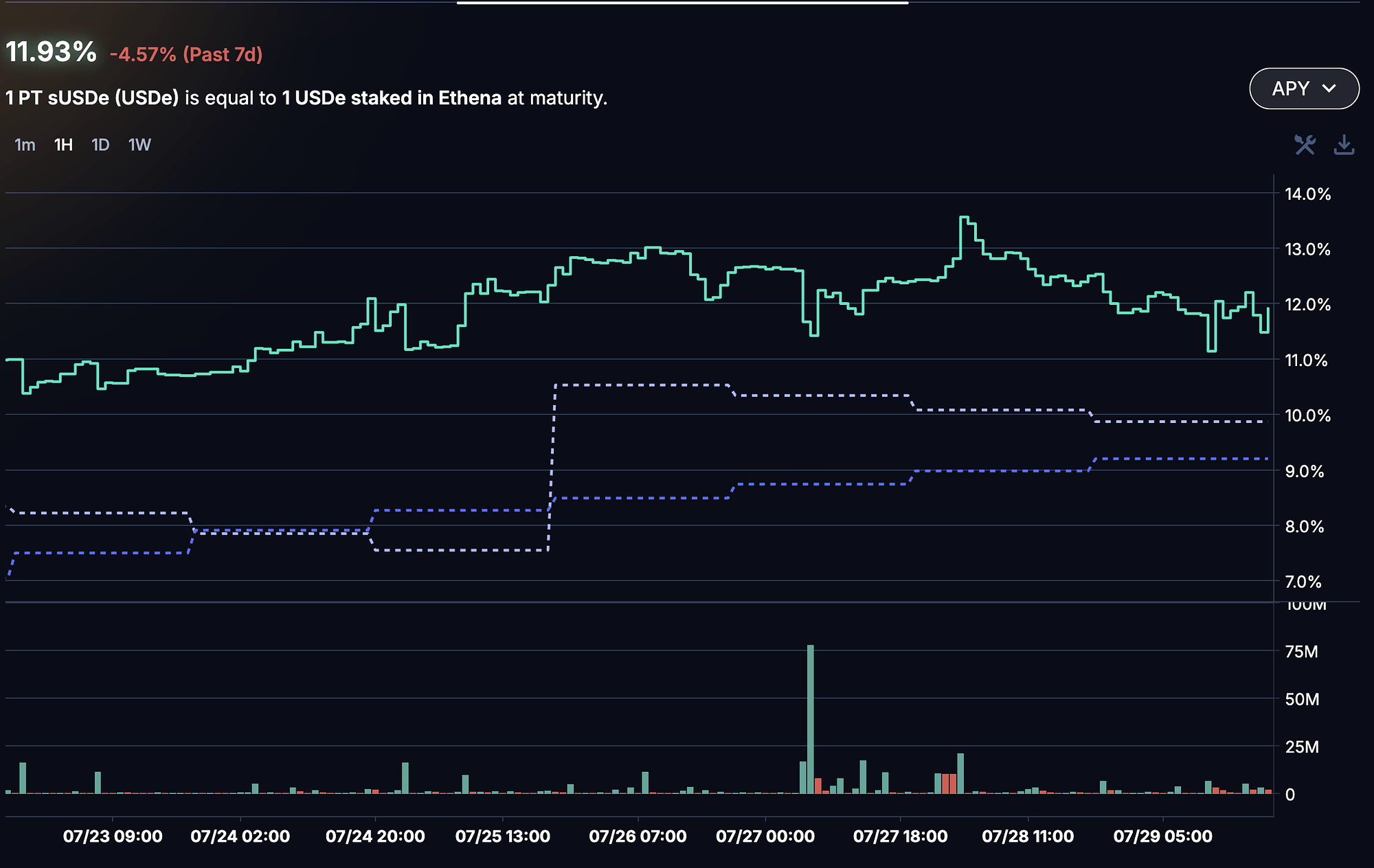

The implied yield has been moderately volatile this week, initially rising to 13.5% before stabilizing at 12%. While yield fluctuations impact the price of principal tokens, their effect diminishes with shorter duration.

Recommendation

Given user-behavior and the demand to roll over from other PTs maturing on the 31st of July, we recommend increasing the supply cap by 1B.

PT-eUSDE-14AUG2025 (Ethereum Core)

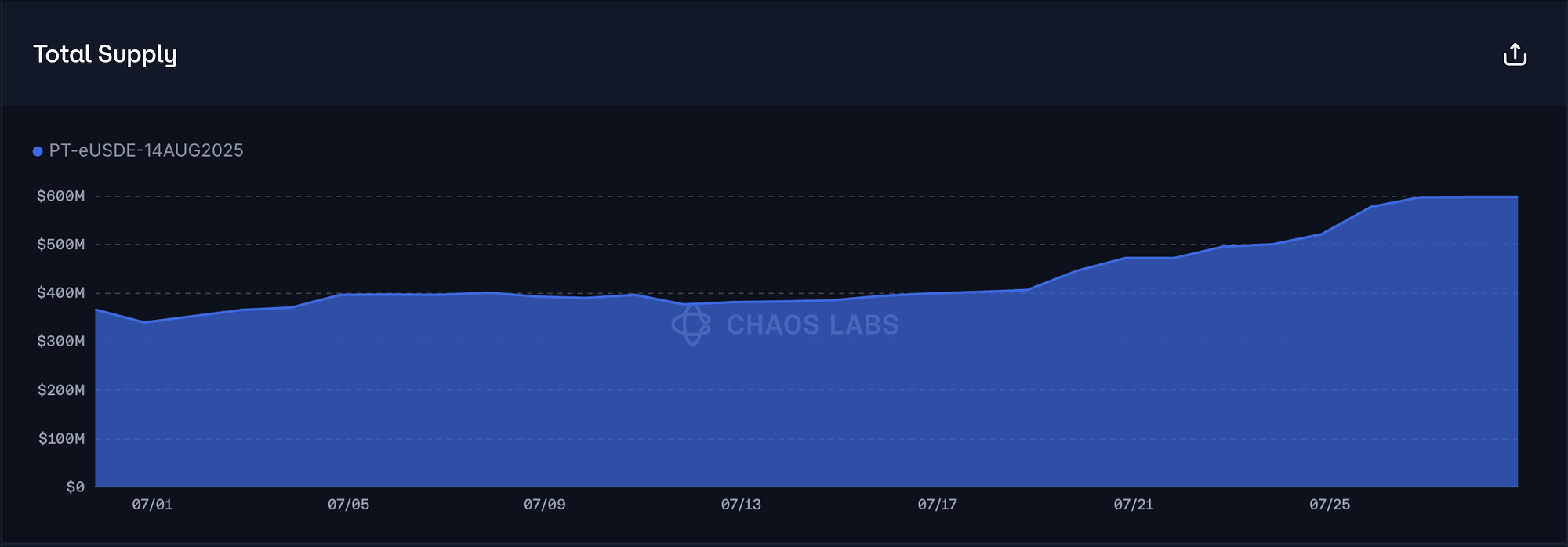

PT-eUSDE-14AUG2025 has reached its recently raised supply cap at 600M.

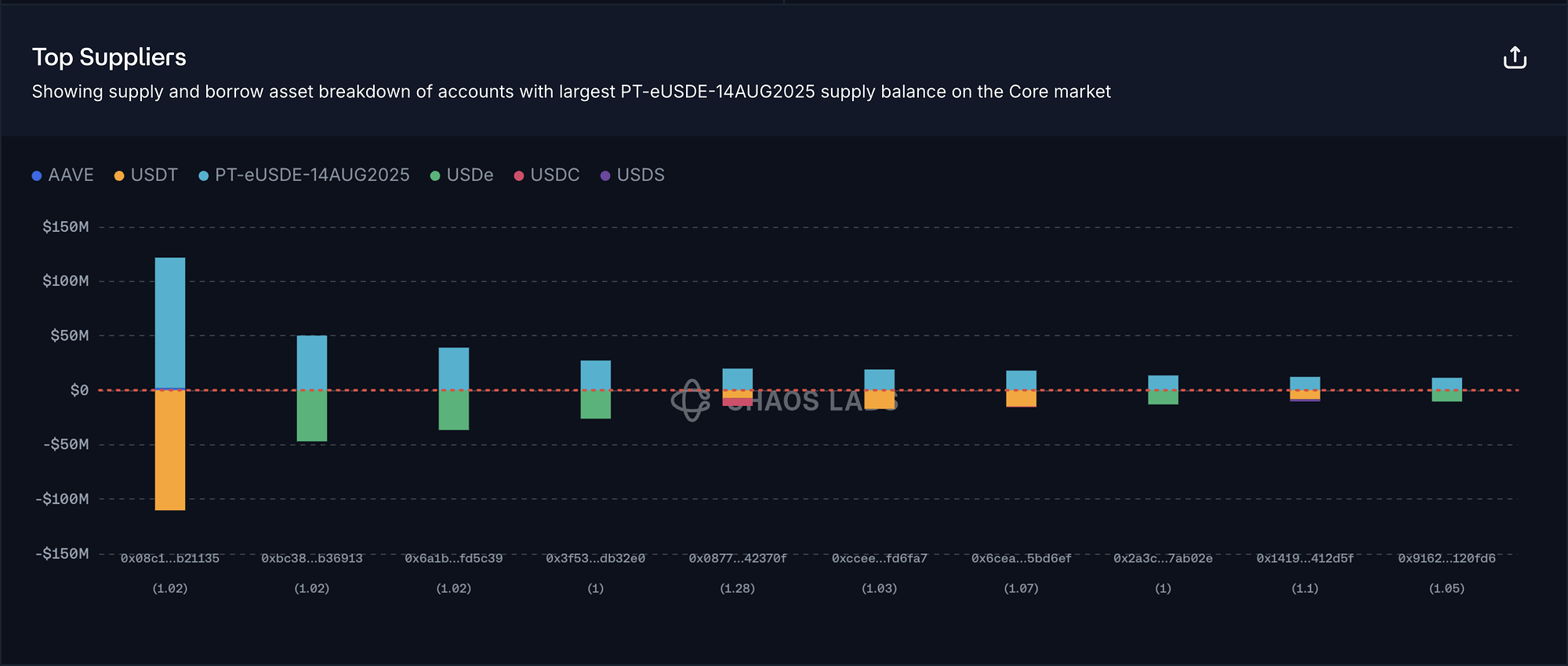

Supply Distribution

PT-eUSDE-14AUG2025’s supply is highly concentrated, with the top supplier representing 20% of the total and the top 12 suppliers accounting for 60%. Health scores cluster around 1.02, as loopers are incentivized to maximize their leverage. Most top suppliers borrow either USDT or USDE, which significantly reduces liquidation risk due to the high correlation between collateral and debt.

PT-eUSDE-14AUG2025 is predominantly used to borrow USDT/USDC and USDE, facilitated by the Stablecoin and USDe E-modes. Given that the underlying of the PT’s is USDE risk of liquidation is minimal.

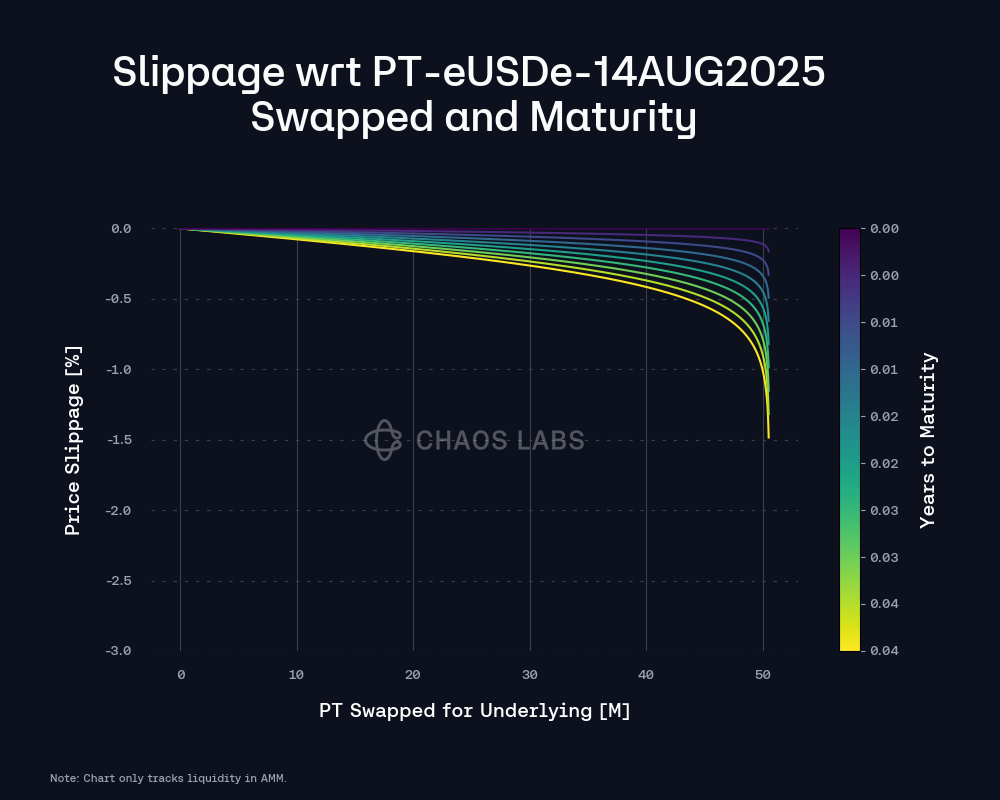

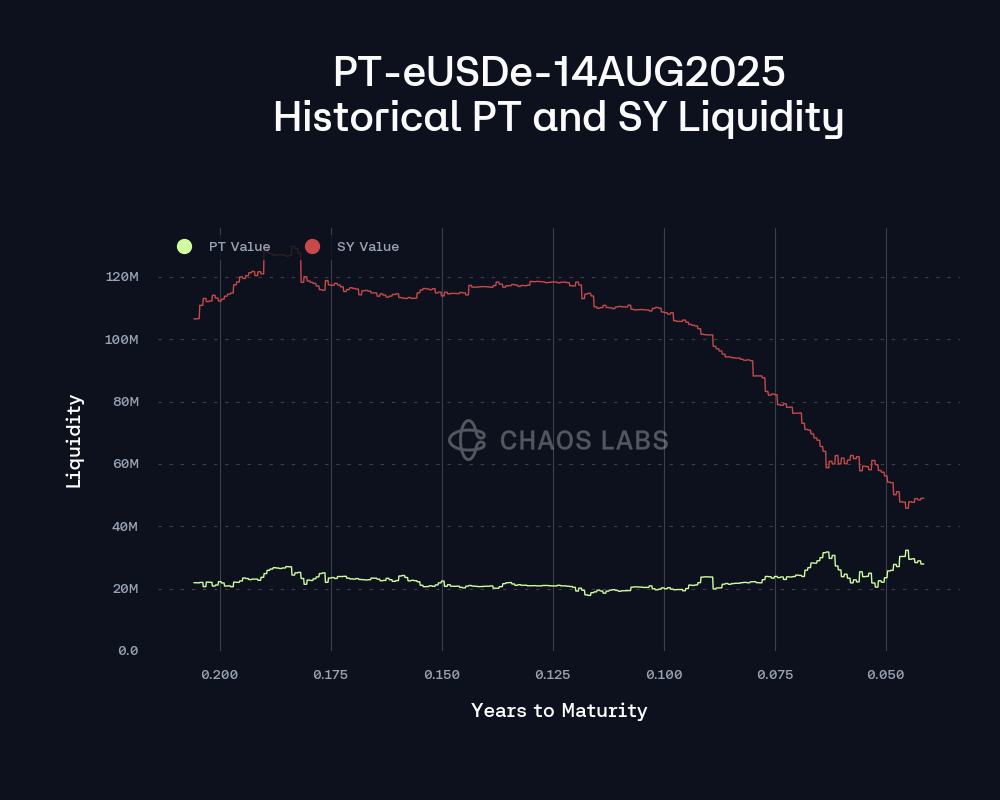

Liquidity

As the principal token approaches maturity, AMM liquidity on Pendle is increasing. Currently, it can facilitate a sell order of 50M with a conservative 2.5% slippage.

As the opportunity cost associated with providing liquidity into PT-eUSDe-14AUG2025’s pool has grown due to elevated yield stemming from external yield-bearing assets, on-chain liquidity has remained stable at the 20-25M level, while SY’s liquidity has declined. This change is a combination of withdraws from the Liquidity pool and the increase of PT yield, which drives a higher share of the pool to be represented by PT tokens.

There is additionally more than 14M worth of PT buy orders at or below 13% implied yield.

Overall, the market has experienced some volatility as the implied yield oscillates in the 11.5% - 14% range. While this affects the PT’s price, the actual magnitude is reduced proportionally with duration and is effectively minimized at 15 days to maturity. In this sense, the additional incremental duration risk associated with such an asset implies that under adverse market conditions

Recommendation:

Considering user behavior, strong demand, and minimized risk associated with low duration, we recommend raising the supply cap by 200M.

USDe (Ethereum Core)

USDe has reached its supply cap of 960M, with an inflow of 270M in the last 24 hours.

Supply Distribution

USDe’s supply is highly concentrated, with the top 2 wallets holding over 44% of the total supply. Health factors cluster around an average of 1.06. Since both debt and collateral are stablecoins, liquidation risk is minimized.

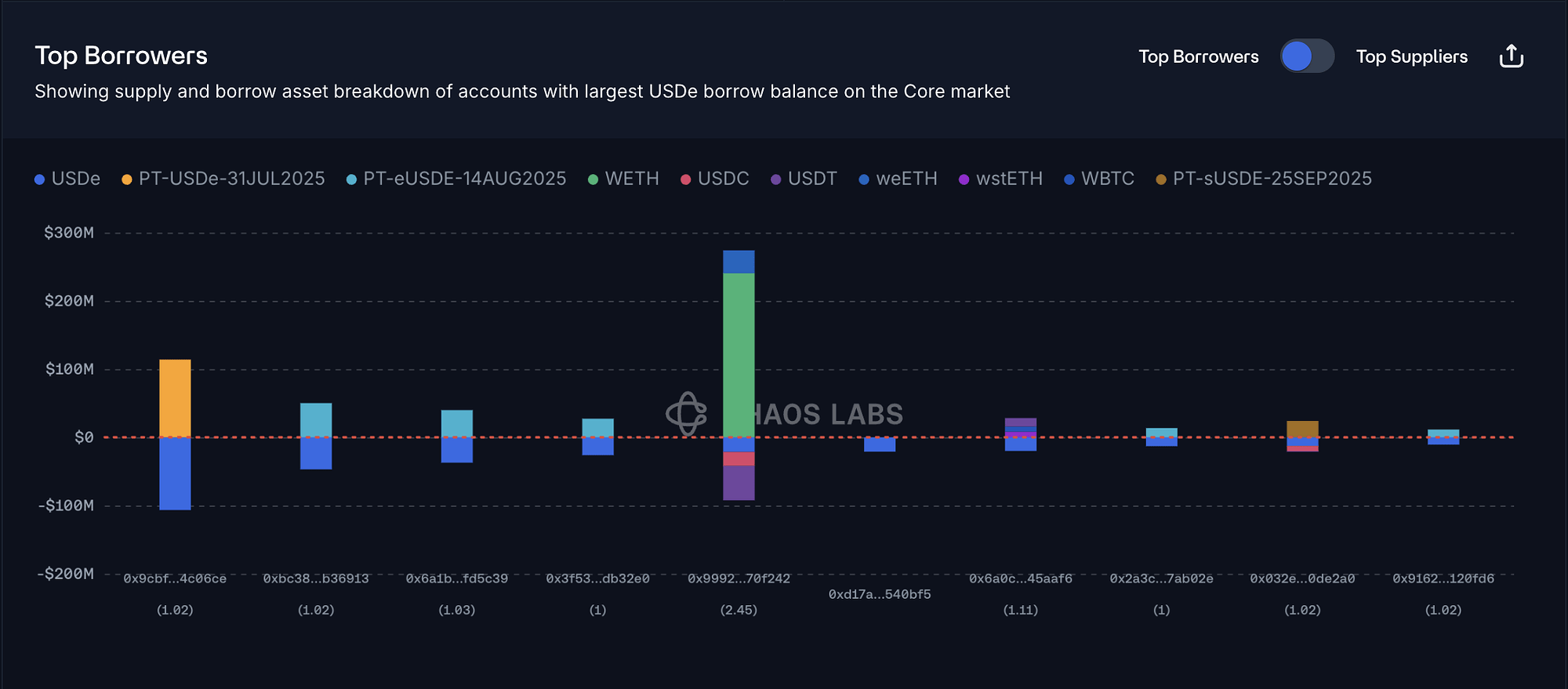

Borrow Distribution

USDe’s borrow distribution is less concentrated compared to supply, with the top 9 users having a cumulative share under 60%. Most top borrowers use USDe-based PT tokens to collateralize their USDe positions. While health factors are tightly concentrated around 1.02, liquidation risks are minimal as USDe-based PTs converge to the underlying asset with maturity.

Additionally, the majority of the debt is collateralized by eUSDE, USDe, and sUSDE PTs with an 80% total share, facilitated by their respective E-modes.

Recommendation

Given the strong demand for looping USDe-based PTs and the recent introduction of Liquid Leverage, we recommend increasing the supply cap to 1,2B USDe and the borrow cap to 1B.

sUSDe (Ethereum Core)

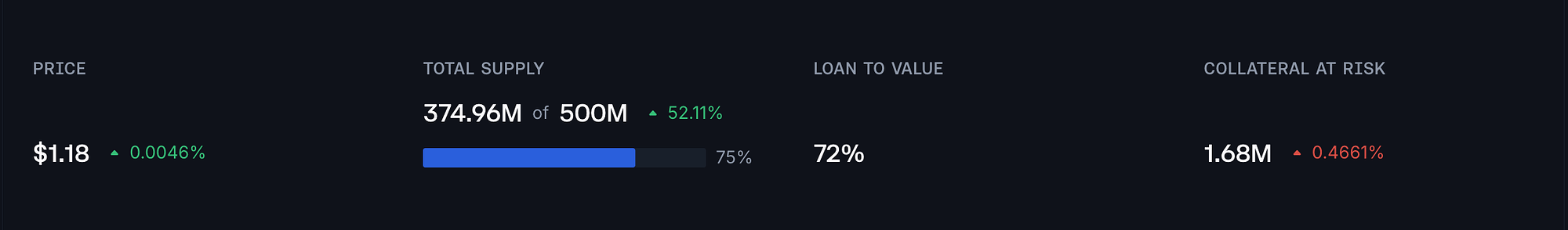

sUSDe has reached 75% of its supply cap following a recent inflow of 270M during the past 24 hours.

Supply Distribution

sUSDe’s supply distribution shows moderate concentration, with the top wallet holding over 25% and the top 7 users comprising 48% of the total supply. Many sUSDe suppliers also supply USDe, likely due to the launch of Liquid Leverage by Ethena. While top suppliers’ health factors cluster in the 1.02-1.06 range, liquidation risk remains minimal since the supplied assets (USDe and sUSDe) and borrowed assets (primarily USDC and USDT) are highly correlated.

Recommendation

Given the market conditions and a sharp increase in demand observed over the past 24 hours, following the introduction of Liquid Leverage, we recommend increasing the supply cap to 600M sUSDe.

PT-USDE-25SEP2025 (Ethereum Core)

PT-USDE-25SEP2025’s supply has been reached at 50M within 10 minutes from its listing, indicating consistently strong demand for new USDe-based PT assets.

Supply Distribution

The supply is concentrated, with the top user supplying over 45% of the total. Although health factors are tightly clustered around 1.02, liquidation risk remains minimal due to the strong correlation between debt and collateral prices.

Recommendation

Considering user behavior, market dynamics and strong demand, we recommend to increase the supply cap by 50M to reach 100M.

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Prime | tETH | 40,000 | 60,000 | - | - |

| Ethereum Core | PT-sUSDE-25SEP2025 | 1,000,000,000 | 2,000,000,000 | - | - |

| Ethereum Core | PT-eUSDE-14AUG2025 | 600,000,000 | 800,000,000 | - | - |

| Ethereum Core | USDe | 960,000,000 | 1,200,000,000 | 660,000,000 | 1,000,000,000 |

| Ethereum Core | sUSDe | 500,000,000 | 600,000,000 | - | - |

| Ethereum Core | PT-USDE-25SEP2025 | 50,000,000 | 100,000,000 | - | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0