Summary

A proposal to:

- Increase the supply and borrow caps for wstETH on the Linea instance

- Increase the supply and borrow caps for USDT on the Linea instance

- Increase the supply caps for WBTC on the Linea instance

- Increase the supply cap for PT-USDe-27NOV2025 on the Ethereum Core instance

- Increase the supply cap for FBTC on the Ethereum Core instance

- Increase the supply cap for ezETH on the Arbitrum instance

- Increase the supply cap for rsETH on the Arbitrum instance

- Increase the supply cap for wrsETH on the Base instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

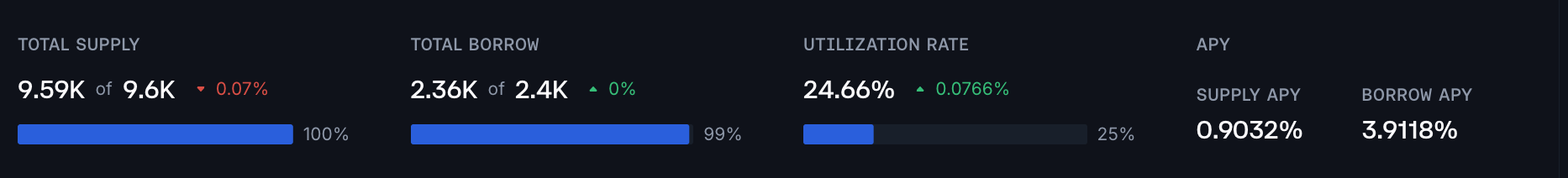

wstETH (Linea)

wstETH on Linea has reached its supply and borrow caps on September 13th, following significant inflows in the prior week. Given that both supply and borrows have been filled, the asset is experiencing strong overall demand.

Supply Distribution

The supply of wstETH is moderately concentrated, with the top 9 users accounting for 70% of the supply. The health factors among the supplies are tightly clustered in the 1.02-1.10 range, typical for leveraged staking strategies where users supply yield-bearing collateral and borrow the underlying to leverage the spread between underlying yield and borrowing costs.

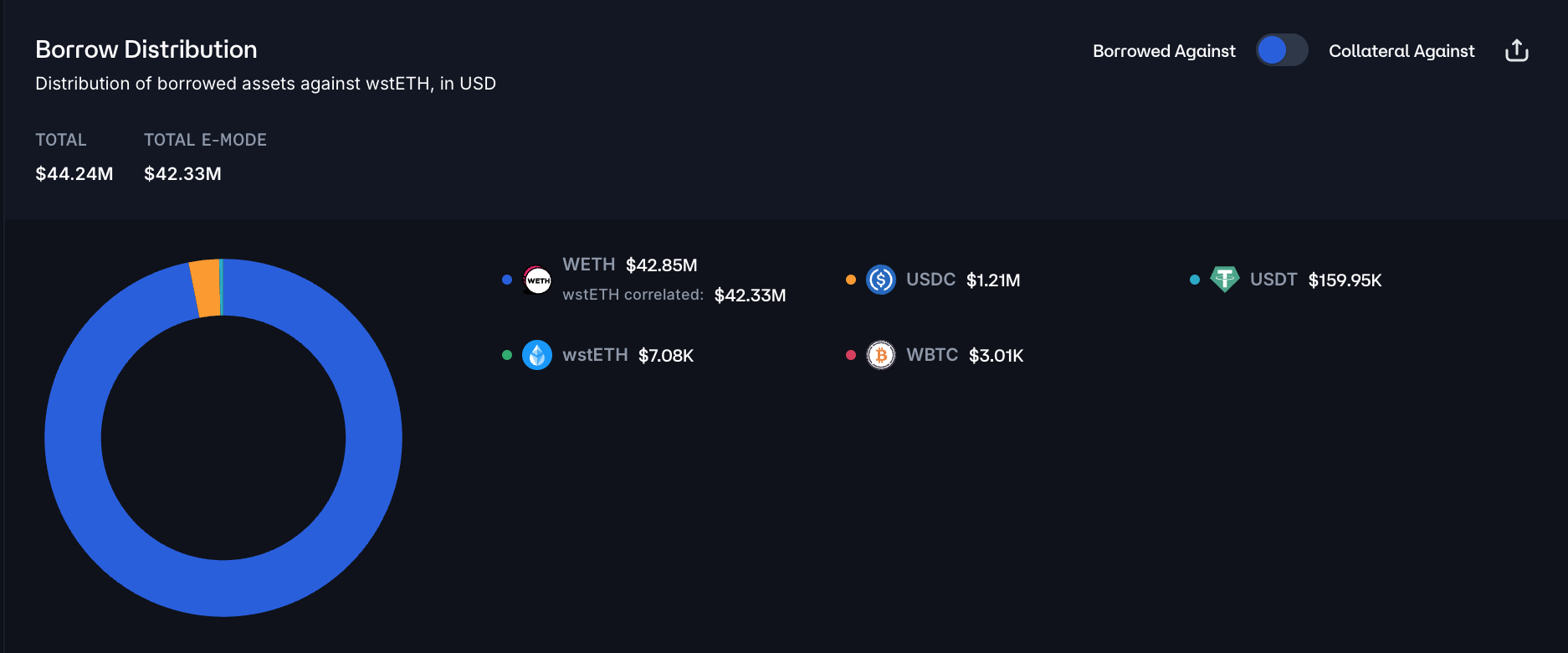

wstETH is used primarily as collateral, with WETH being the most borrowed asset. This is facilitated by the wstETH correlated E-mode, which allows for high capital efficiency. Given the market depth and high correlation between the debt and collateral, the risk of liquidations is minimal.

Borrow Distribution

The borrow distribution exhibits similar concentration levels, as the top 8 wallets have a cumulative share of over 75%. Additionally, users are collateralizing wstETH debt with WETH, with the health factors in a wide 1.10 - 1.20 range, with a minor share of outliers.

wstETH borrowing is primarily facilitated by WETH collateral, limiting the liquidation risk as the assets are highly correlated.

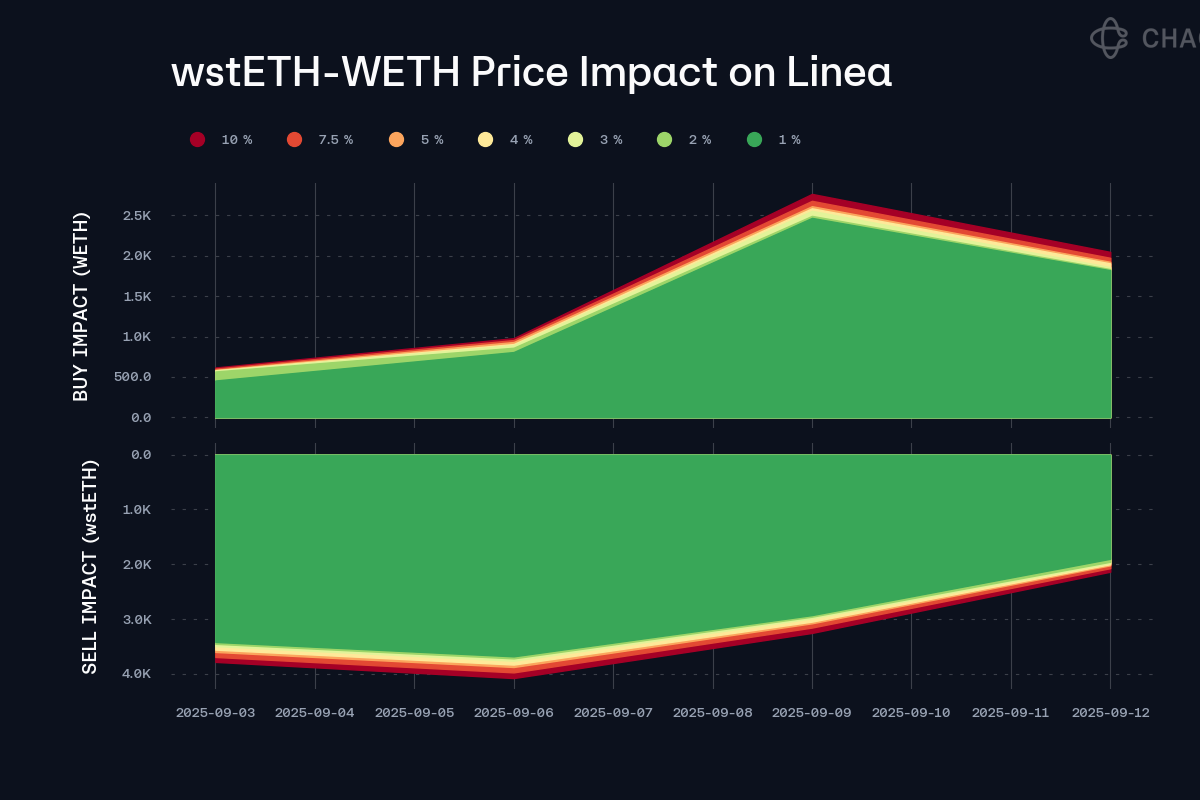

Liquidity

Currently, wstETH on-chain liquidity on Linea is sufficient to execute a 2,000 wstETH swap with only 1% slippage, supporting an increase in both supply and borrow caps.

Recommendation

Given the sufficient on-chain liquidity, safe user behavior, low liquidation risk, and persistent market demand, we recommend doubling the supply and borrow caps of wstETH on the Linea instance.

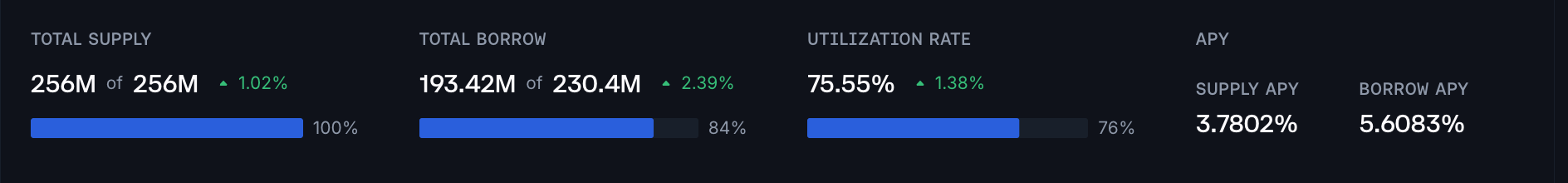

USDT (Linea)

USDT has reached its supply and borrow caps, following an increase of 70 and 50 million tokens in supply and borrows over the last five days, which indicates persistent demand for the asset on the Linea instance.

Supply Distribution

The supply of USDT shows moderate concentration, as the top 11 users account for less than 50% of the total. Based on the distribution of health factors, users can be binned into two distinct categories: a significant proportion of the users are borrowing USDC, collateralized by USDT, likely to increase incentive exposure; the other cluster of users has either no or minor borrow positions, predominantly in WETH.

As mentioned, USDT is used primarily to collateralize USDC borrowing with a 90% dominance, implying low liquidation risk due to the high correlation of these pegged assets. Additionally, USDT collateral facilitates a substantial amount of WETH debt, which currently doesn’t pose significant risk due to safe health factors.

Borrow Distribution

The borrow distribution exhibits slightly higher concentration levels, as the top 12 wallets have a cumulative share of approximately 60%. As with the supply side, the majority of debt is collateralized by other stablecoins, posing limited risk due to the high correlation of debt and collateral assets.

USDT borrowing is primarily collateralized by USDC, representing 70% of all posted collateral. Additionally, WETH accounts for a minor share of the collateral, supporting 25% of the total debt.

Liquidity

At the moment, USDT DEX liquidity on Linea has depth sufficient to limit slippage on a $10 million swap to 1.5%, supporting an increase in supply and borrow caps.

Recommendation

Considering the substantial on-chain liquidity, conservative user behavior, high correlation between collateral and debt assets on both supply and borrow sides of USDT, and persistent market demand, we recommend doubling the supply and borrow caps for USDT on Linea.

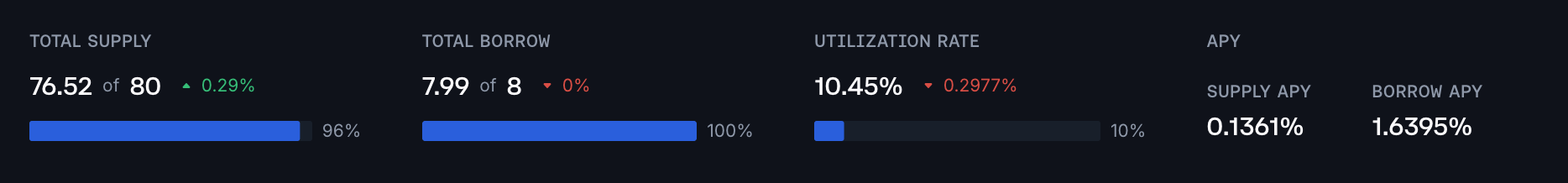

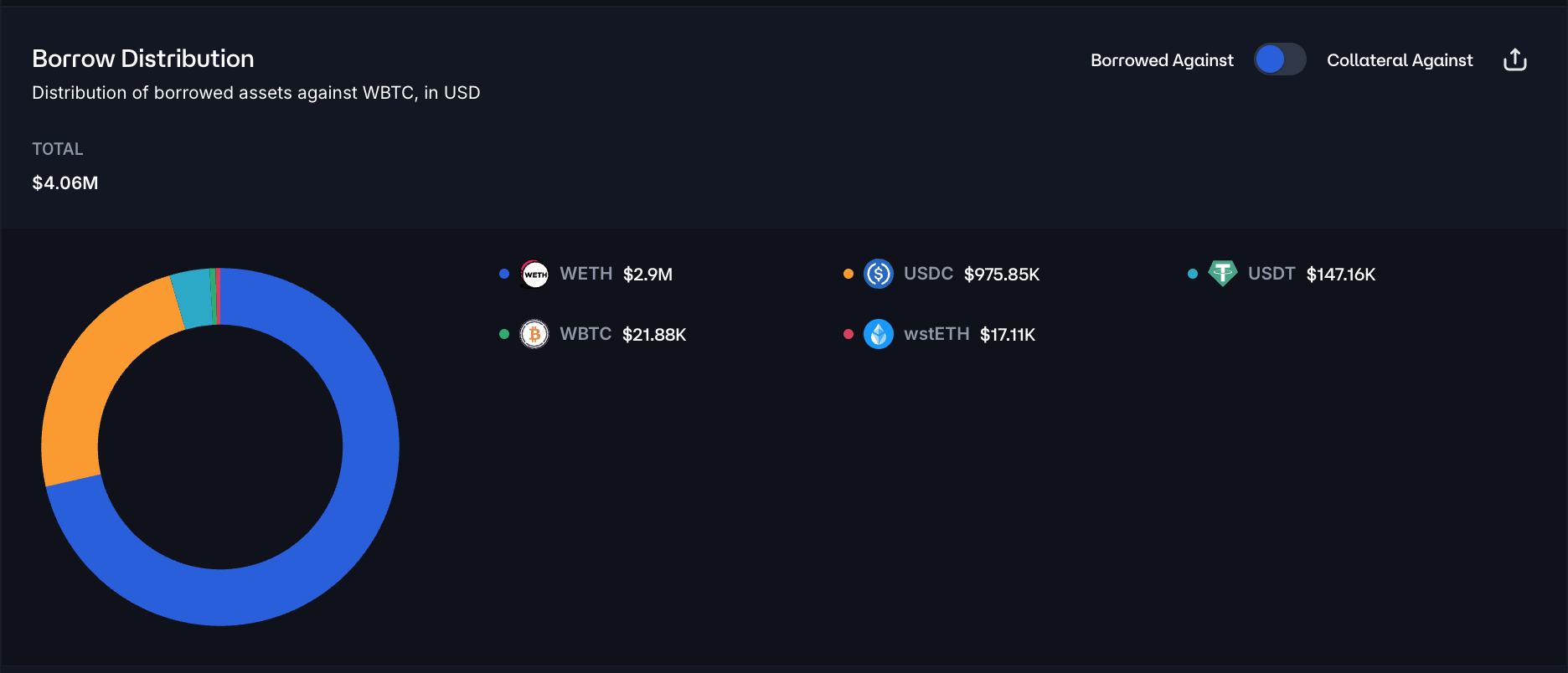

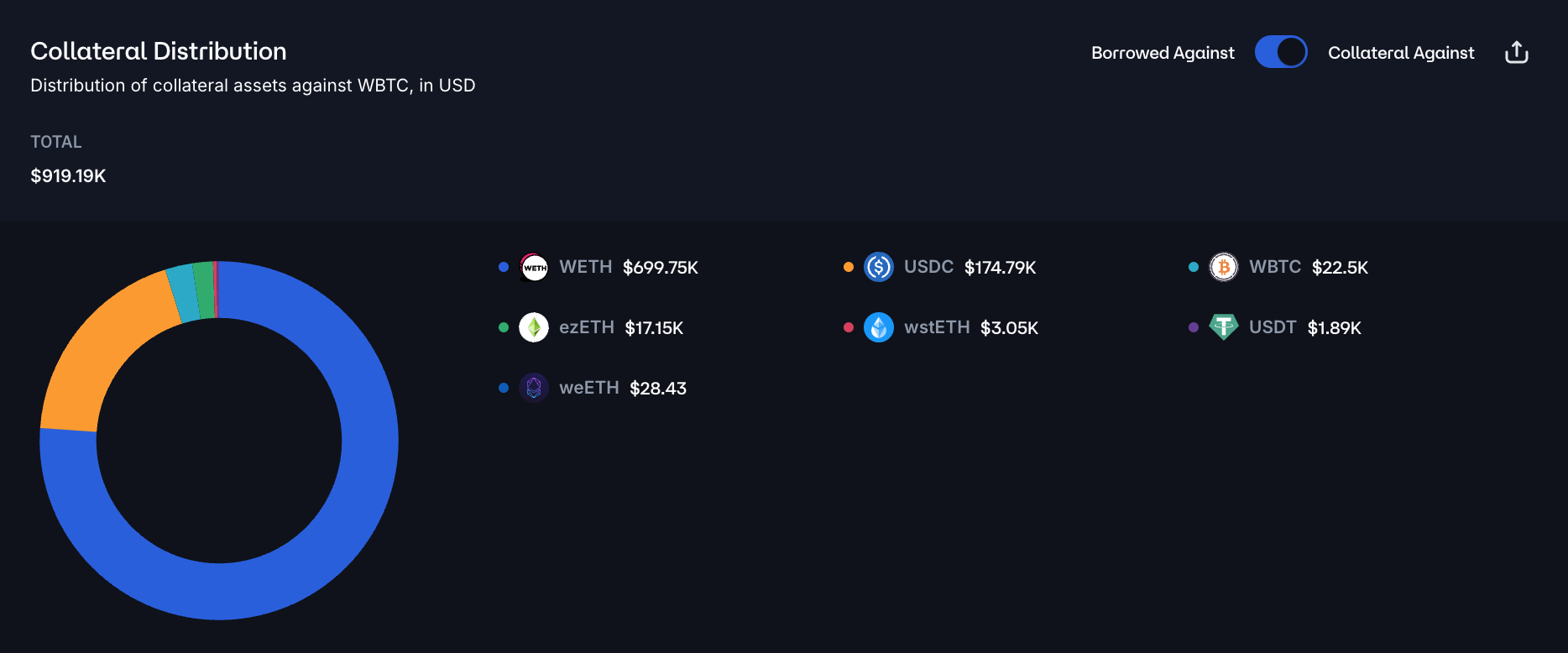

WBTC (Linea)

WBTC has reached its supply and borrow caps at 80 and 8 tokens, following an inflow of 40 WBTC since September 12th.

Supply Distribution

The supply of WBTC is highly concentrated, with the top 4 users accounting for approximately 70% of the total. The top suppliers have health factors in the 1.13 - 2.62 range, borrowing a mix of volatile and USD-pegged assets.

Over 75% of WBTC-backed debt is allocated to WETH, with an additional 24% in USDC. Given the high health factors and relatively small market size, the positions currently pose no immediate risk to the protocol.

Borrow Distribution

The borrow distribution exhibits substantially higher concentration levels, as the top user represents approximately 37% of the total WBTC debt.

WBTC is primarily collateralized by WETH and USDC, representing over 95% of all posted collateral. While liquidation risk does exist for this market, the probability of bad debt for the protocol is minimal, as the absolute size of the market is only 8 WBTC.

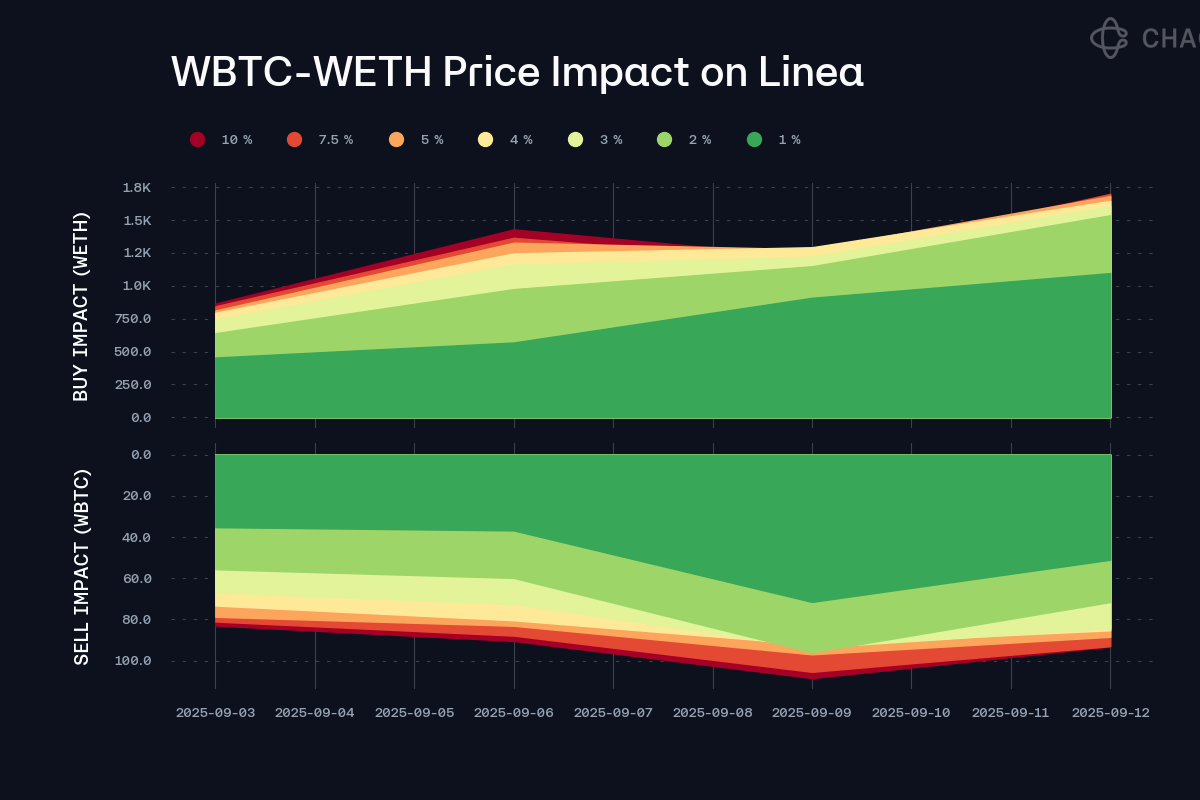

Liquidity

Currently, WBTC DEX liquidity is comparable to the whole WBTC lending market, supporting a substantial increase in supply and borrow caps.

Recommendation

Given the relatively low market size, ample liquidity, and overall low risk, we recommend doubling the supply and borrow caps for WBTC on Linea.

PT-USDe-27NOV2025 (Ethereum Core)

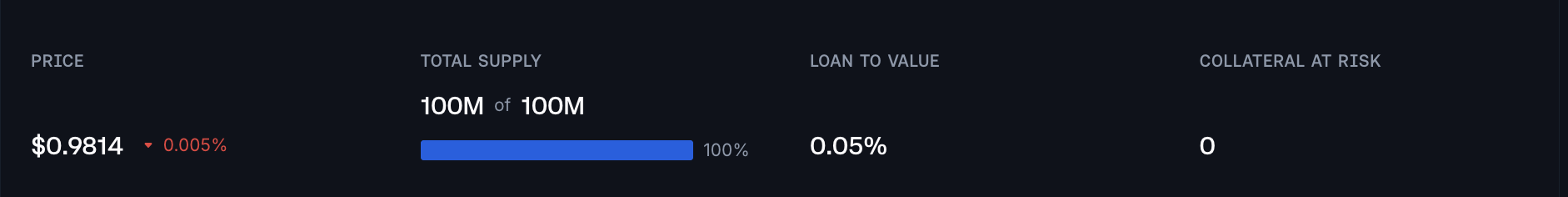

PT-USDe-27NOV2025 has reached its supply cap at 100 million tokens, following the recent cap increase on September 10th.

Supply Distribution

The supply of PT-USDe-27NOV2025 is concentrated, with the top 4 users accounting for 80% of the total. The distribution of health factors is typical for this type of collateral. Due to the nature of the looping strategy at hand, the users are keeping low health factors to maximize the leverage and increase net earnings from the rate spreads. Given the high correlation between the PT’s price and the debt asset prices, the liquidation risk is effectively minimized.

Most of the debt collateralized by the PT-USDe-27NOV2025 is in USDe and USDT, facilitated by the USDe and Stablecoins E-mode. Given the high correlation of the debt and collateral, alongside the expected convergence of the PT to USDe and high asset maturity, the liquidation and bad debt risks are minimal.

Market and Liquidity

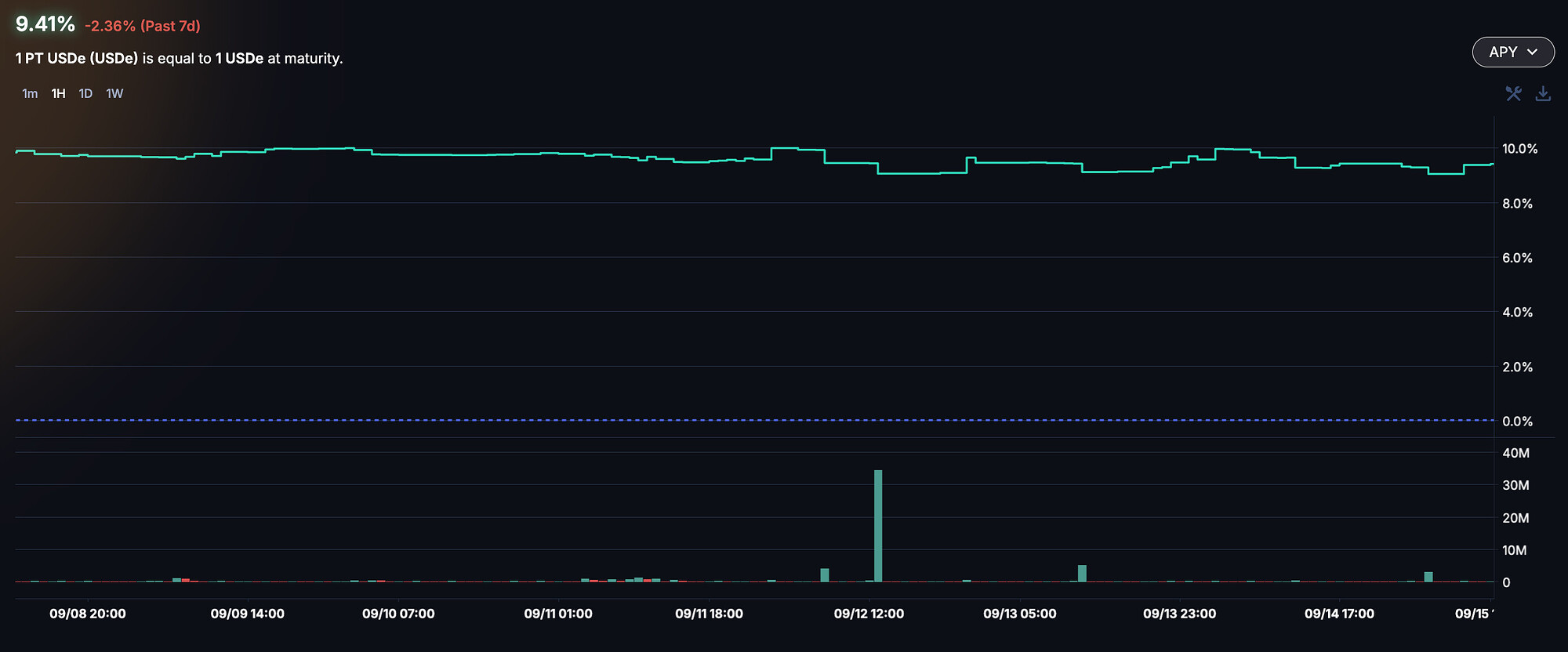

PT-USDe-27NOV2025 has exhibited minimal implied rate volatility, as the market has consistently priced in a 9.5-10% implied yield.

At the time of writing, Pendle’s AMM liquidity is sufficient to facilitate a 5 million principal token swap at 2% slippage.

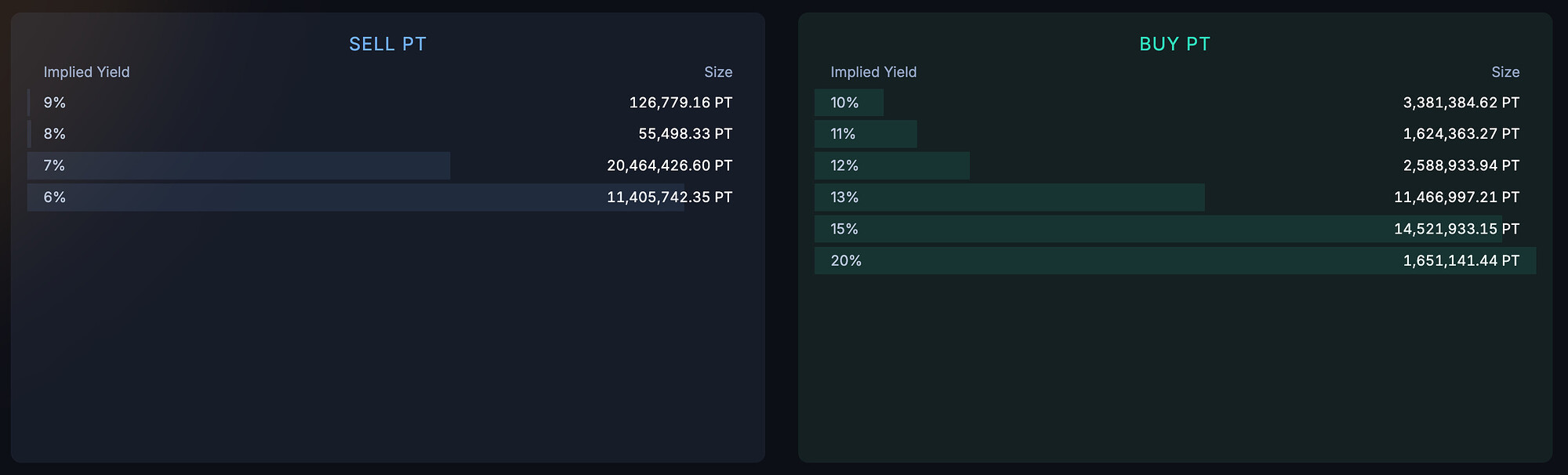

Additionally, Pendle’s orderbook exhibits significant depth, with over 30 million of liquidity at or above 6% implied yield.

Recommendation

Given the asset’s low risk, safe user behavior, and close maturity of other listed PTs, we recommend doubling the supply cap of PT-USDe-27NOV2025 to facilitate additional market growth.

FBTC (Ethereum Core)

FBTC has reached its supply cap at 900 tokens. While borrowable, the asset has been steadily growing only on the supply side, indicating high demand for using it as collateral.

Supply Distribution

The supply of FBTC is highly concentrated, with the top supplier accounting for over 85% of the total. Additionally, the supplier has significant USDT borrow positions while preserving a safe health factor of 1.92, presenting minimal liquidation risk.

FBTC is used primarily to collateralize stablecoin debt, with USDT and USDC being dominant assets, representing 95% of the total debt. Given the safe health factors and comparatively low volatility of the collateral asset, the market is not considered risky.

Liquidity

According to DEX aggregator data, slippage on a 100 FBTC sell order is limited to 2.5%, supporting an increase of the supply cap.

Recommendation

Considering the relatively low risk of liquidations, which stems from high collateral factors on the top positions, substantial on-chain liquidity, and safe user behavior, we recommend doubling the supply cap of FBTC on the Ethereum Core instance.

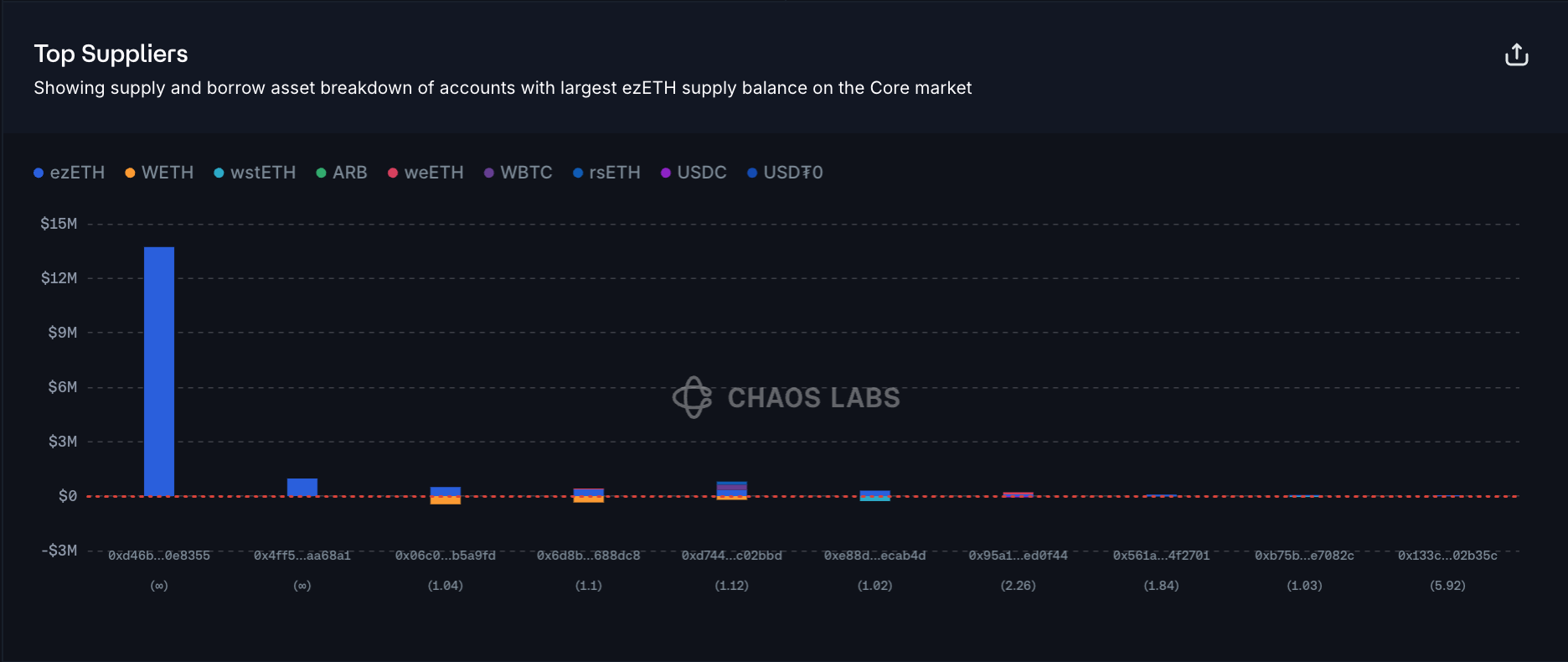

ezETH (Arbitrum)

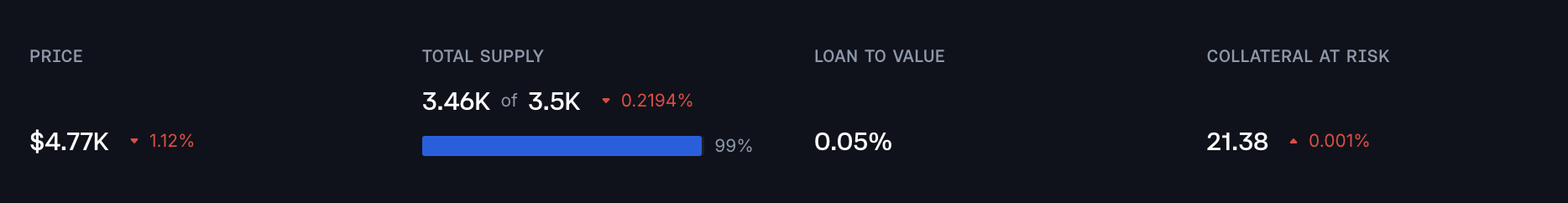

ezETH has reached its supply cap on the Arbitrum instance at 3,500 tokens, following an inflow of 1,500 ezETH over the past 4 days.

Supply Distribution

The supply of ezETH is highly concentrated, with the top supplier accounting for over 88% of the total. Additionally, the supplier has no active debt, and while such behavior does not reveal any instant utility, the wallet might be positioned for substantial WETH borrowing in the near future. Other users are participating in the leveraged restaking strategy, borrowing WETH and supplying its LRT—ezETH. Typical for such markets, the distribution of health factors is centered in the 1.02-1.10 range, posing minimal liquidation risk as the debt and collateral assets are highly correlated.

As mentioned, ezETH is utilized as collateral for WETH and wstETH, facilitated by corresponding E-Modes. Given the high correlation of ezETH with both WETH and wstETH, the liquidation risk is minimal.

Liquidity

At the moment, ezETH liquidity on Arbitrum is sufficient to facilitate a sell order of over 250 ezETH at 1% slippage, supporting a supply cap increase.

Recommendation

We recommend doubling the ezETH supply cap on the Arbitrum instance due to low liquidation risk, safe user behavior, and persistent market demand.

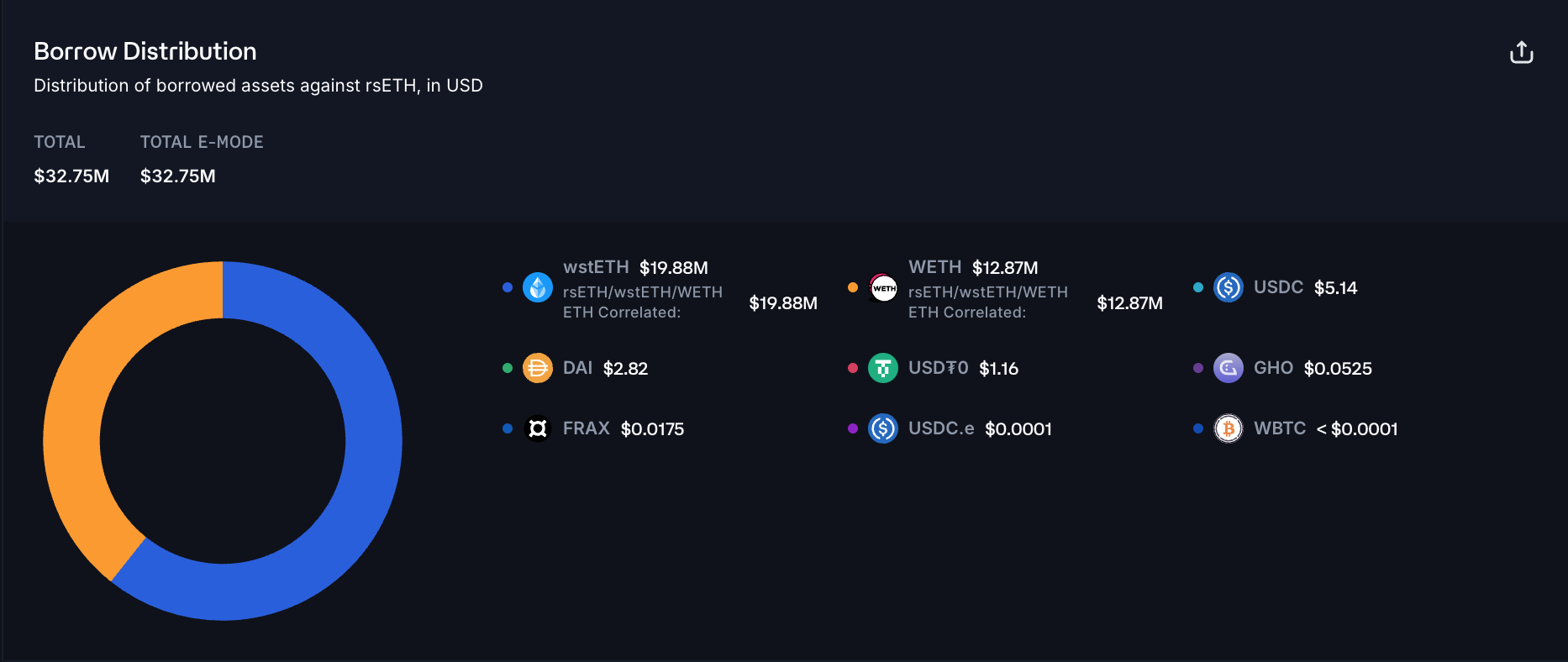

rsETH (Arbitrum)

rsETH has reached 98% of its supply cap on the Arbitrum instance at 7,760 tokens, following an inflow of 3,000 rsETH since September 5th.

Supply Distribution

The supply distribution of rsETH shows high concentration, with the top user accounting for over 60% and the top 3 suppliers representing over 98% of the total. Users’ health factors cluster in the 1.03-1.05 range as they maximize leverage to amplify net revenue in the leveraged restaking loop.

rsETH is used to collateralize wstETH and WETH debt, facilitated by the rsETH/wstETH/WETH ETH Correlated E-Mode. Given the high price correlation of the assets, the liquidation risk is minimal.

Liquidity

The depth of rsETH’s on-chain liquidity on Arbitrum is substantial. At the moment, a sell order of 100 rsETH would be limited to 2% slippage.

Recommendation

Given the rapid increase in the rsETH supply, which indicates persistent demand, safe user behavior, and ample on-chain liquidity, we recommend increasing the rsETH supply cap to increase WETH borrowing demand and facilitate additional protocol revenue.

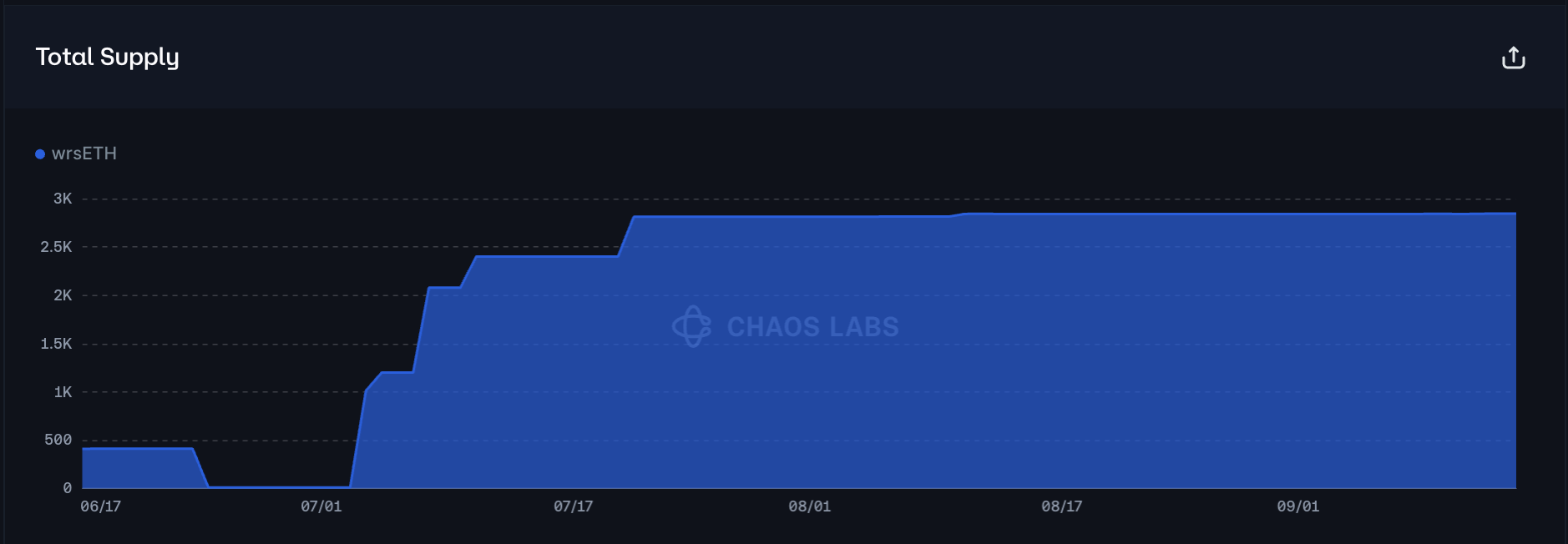

wrsETH (Base)

wrsETH has reached 87% of its supply cap on the Base instance at 2,840 tokens.

Supply Distribution

The supply distribution of wrsETH is highly concentrated, as the top user accounts for over 97% of the total. As can be observed, the user is supplying wrsETH and borrowing wstETH to leverage the spread between the restaking yield and borrow rate of wstETH. The health factor is 1.06, which is typical for such strategies, as the user is optimizing leverage for maximum returns. While the health factor is low and supply concentration is high, the position does not pose any immediate liquidation risk due to the high correlation of wrsETH and wstETH.

wstETH is used to collateralize wstETH borrowing, facilitated by the rsETH/wstETH E-Mode, which provides highly capital-efficient risk parameters.

Liquidity

wrsETH has seen a substantial increase in liquidity depth on Base. At present, it is sufficient to limit the slippage to 1% on a 200 wrsETH sell order.

Recommendation

Considering the market’s limited exposure to price volatility, safe user behavior, and ample liquidity, we recommend raising the supply cap of wrsETH by 3,250 tokens.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Linea | wstETH | 9,600 | 19,200 | 2,400 | 4,800 |

| Linea | USDT | 256,000,000 | 512,000,000 | 230,400,000 | 460,800,000 |

| Linea | WBTC | 80 | 160 | 8 | - |

| Ethereum Core | PT-USDe-27NOV2025 | 100,000,000 | 200,000,000 | - | - |

| Ethereum Core | FBTC | 900 | 1,800 | 100 | - |

| Arbitrum | ezETH | 3,500 | 7,000 | - | - |

| Arbitrum | rsETH | 7,920 | 15,840 | - | - |

| Base | wrsETH | 3,250 | 6,500 | - | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.