Summary

LlamaRisk supports adding both USDtb and USDe to the Stablecoin E-Mode. Adding USDtb is expected to create a beneficial dynamic for Ethena-related assets on Aave, while including USDe as E-Mode collateral is necessary to facilitate a smooth transition for expiring PTs.

Key Proposal Details

Addition of USDtb to Stablecoin E-Mode

This proposal would enable Ethena to reuse a portion of the USDtb it supplies to Aave. Adding USDtb to the Stablecoin E-Mode incentivizes users to borrow USDtb to leverage their PT positions. This action would lead to the minting of new USDe, effectively returning the initially supplied USDtb to Ethena.

From Ethena’s perspective, this makes depositing on Aave more attractive. The protocol would earn the underlying yield and Aave supply yields and gain an incremental yield on the reused liquidity. This dynamic is not expected to affect the risk profile of USDe and its derivatives negatively; however, we will continue to monitor developments and actively keep the DAO informed. For Aave, wider USDtb adoption and borrow interest would help to partially alleviate USDT liquidity pressures that were lately present on the Core market.

Addition of USDe as E-Mode Collateral

We support adding USDe to the stablecoin E-Mode to ensure a seamless migration from the PTs expiring in July to those expiring in September. The need to ensure flexible migration opportunities has also been the highlight of the community in the governance forum.

The USDtb Reuse Flow

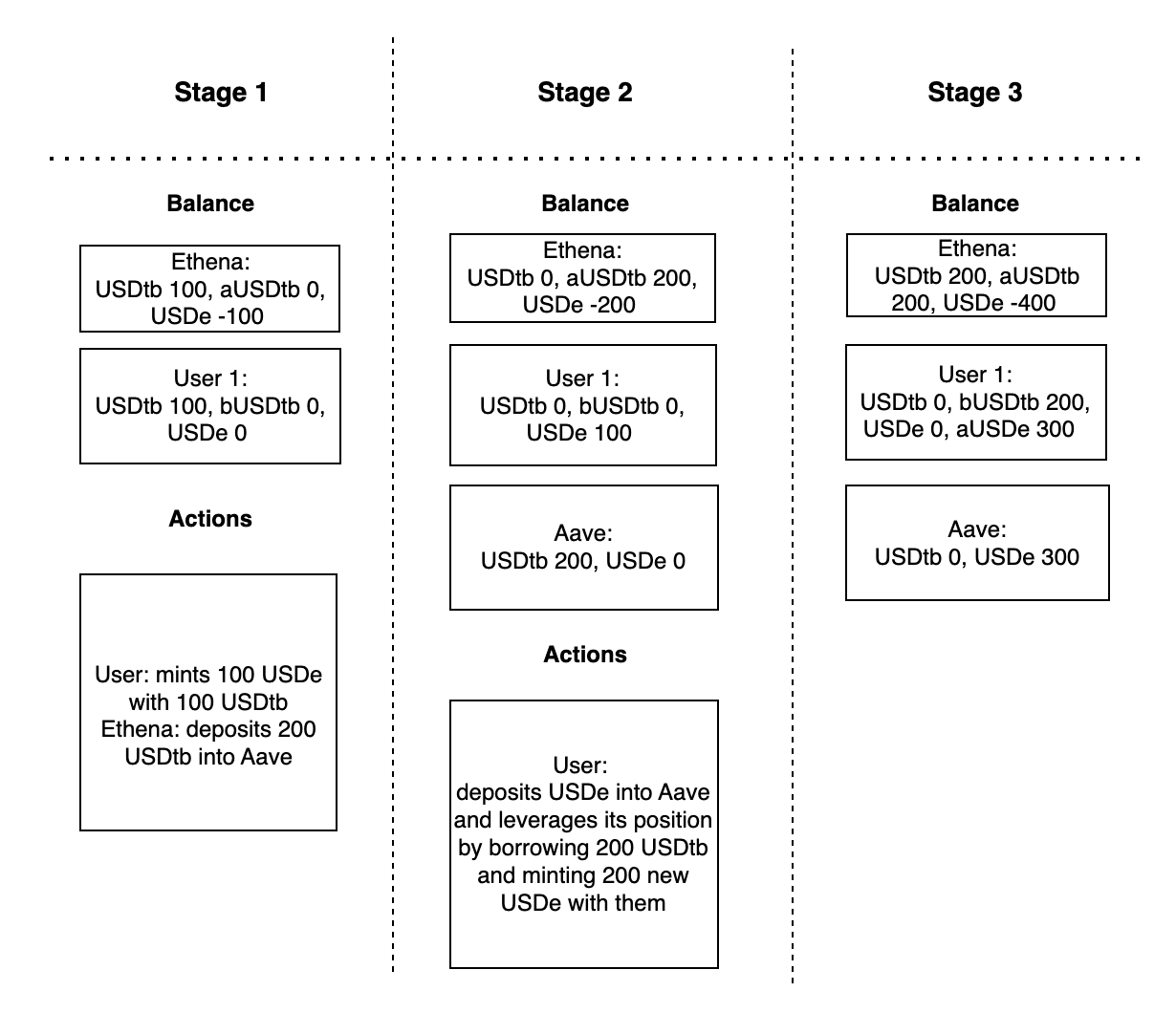

Adding USDtb to the Stablecoin E-Mode introduces a cycle where Ethena can leverage its stablecoin holdings. The process is as follows:

- Ethena deposits its USDtb into Aave.

- Users borrow this USDtb to create leveraged PT positions, which involve minting USDe (the underlying asset of the PT).

- The minting of new USDe returns the initially deposited USDtb to Ethena.

The diagram below illustrates a simplified version of this dynamic, using USDe to represent the PTs or other derivatives with USDe as their underlying asset.

If users later decide to redeem their USDe derivatives for stablecoins, they must first repay their USDtb loan. This action would provide Ethena with the necessary liquidity to process the redemptions.

This dynamic offers a significant advantage to Ethena by allowing it to leverage its USDtb holdings, potentially earning the supply yield multiple times. This cycle could continue in a hypothetical scenario with 100% utilization, where all borrowed USDtb is used for looping PTs. This would inflate the USDe supply and dilute the sUSDe yield until a market equilibrium is reached, where looping PT tokens is no longer profitable. Nonetheless, the impact of such dynamics is largely limited by the currently imposed conservative USDtb supply caps.

Related Risks

This proposal’s primary impact on Ethena would be the effect on liquidity risk, particularly concerning the ability to process withdrawals.

Should Ethena choose to hold the re-acquired USDtb in its treasury, it would directly enhance the protocol’s liquidity. This increase in accessible reserves would significantly improve Ethena’s capacity to process withdrawals, especially when contrasted with the current use of USDtb as collateral for non-USDe assets, which ties up liquidity.

Conversely, if the re-acquired USDtb is not retained as a liquid reserve but instead utilized to open new delta-neutral positions or engage in other yield-generating strategies, the impact on liquidity could be neutral or negative. In such a scenario, the funds would remain deployed rather than enhancing the immediate availability of assets for withdrawals, thus doing little to mitigate or potentially exacerbating liquidity challenges.

A consideration for Aave in this context is minimal, as the re-acquisition and subsequent use of USDtb primarily affect Ethena’s internal liquidity management and do not directly impact Aave’s protocol or its users. As mentioned above, the impact on the USDe risk profile because of such actions would be minimal.

Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk serves as Ethena’s Risk Committee member and Ethena’s PoR attestor. LlamaRisk did not receive compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.