Overview

In alignment with our Principal Token Risk Oracle framework, outlined in detail here, we present our risk parameter recommendations for the proposed maturity and underlying assets listing on Plasma: PT-USDe-15JAN2026 and PT-sUSDe-15JAN2026. Leveraging the dynamic linear discount rate oracle implementation, we also provide our recommended values for initialDiscountRatePerYear and maxDiscountRatePerYear, derived from the extended methodology detailed here.

Assets Overview

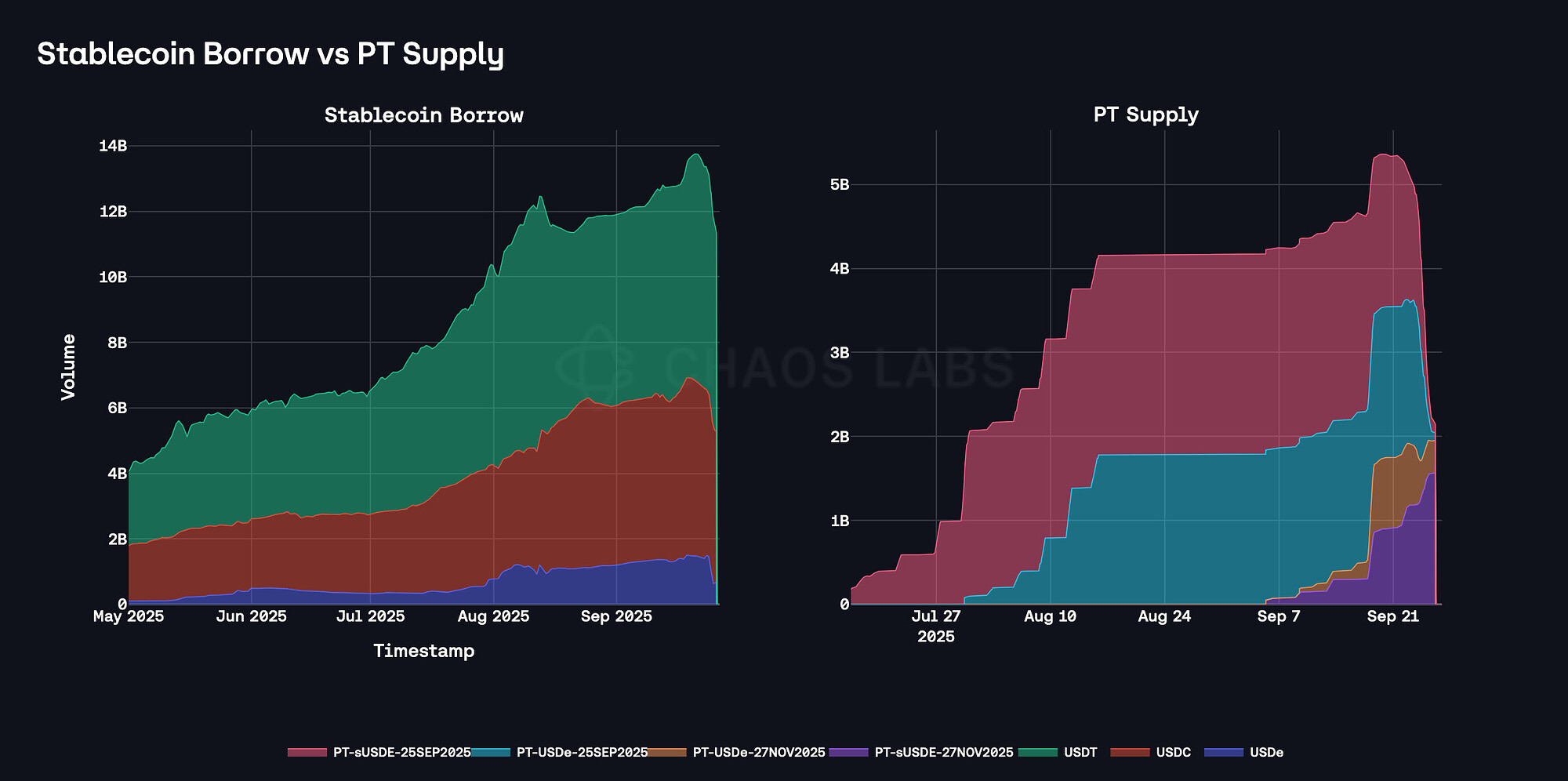

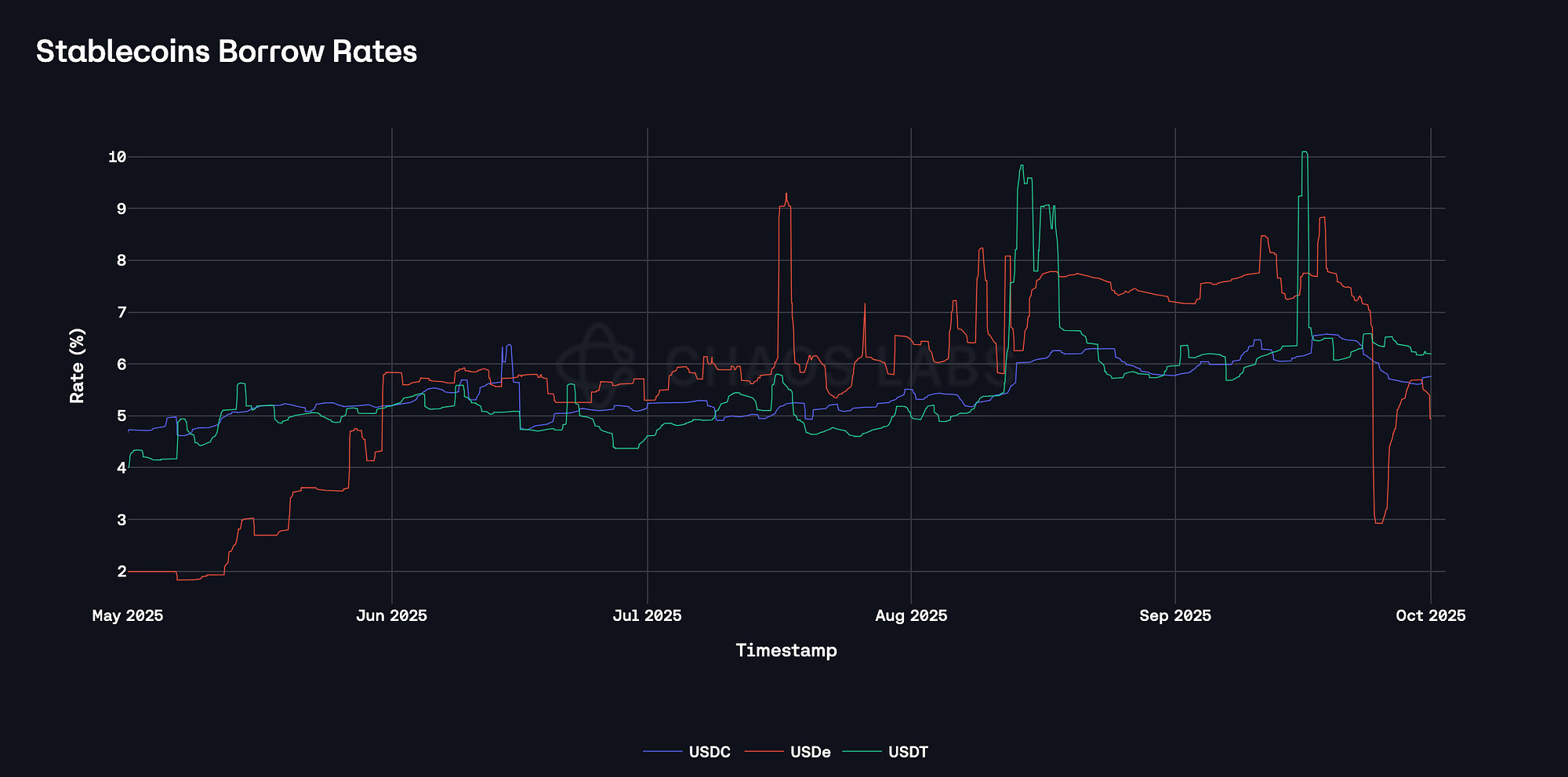

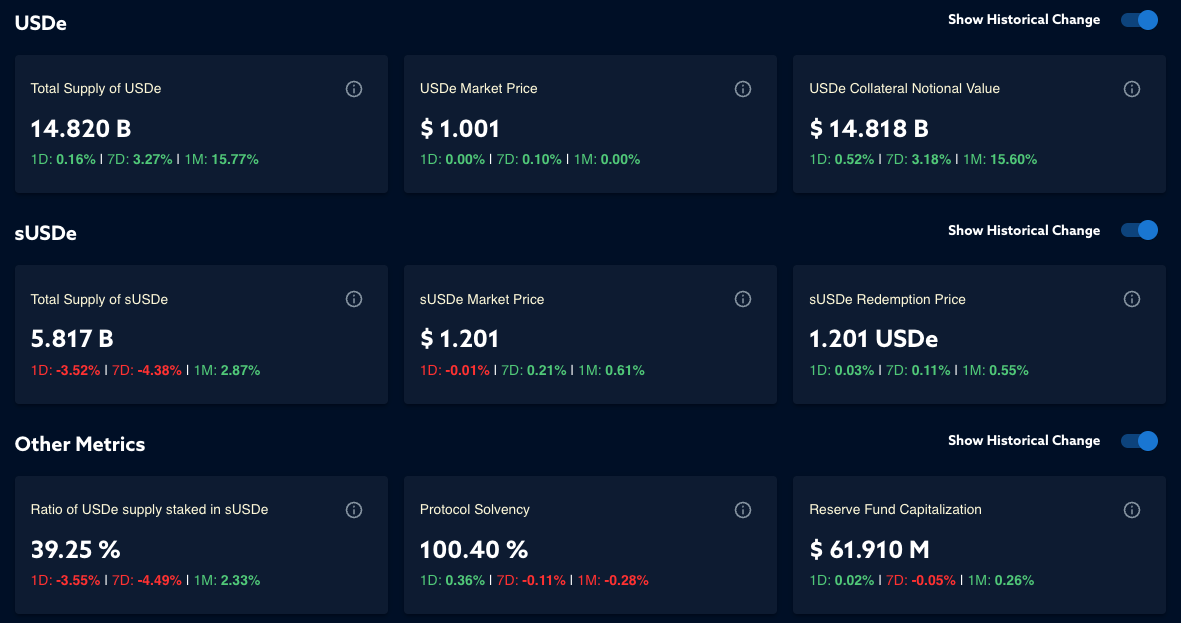

Akin to USDe- and sUSDe-based assets previously listed on Ethereum Core with respective maturities in July, August, September, and November, the January PTs represent USDe and sUSDe principal tokens, which tokenize the value of the underlying with respect to expected yield. Historically, the assets have benefited Aave as they allow for looping of stablecoins, where users leverage the spread between the locked-in implied rate of the principal tokens vs borrowing costs of stablecoins.

The high leverage, along with the substantial underlying yield of the PTs, has created significant demand for stablecoin borrowing. This has resulted in elevated borrow rates and volumes, increasing the protocol’s revenue.

Considering the impact that the listing of Ethena-based principal tokens has had on the Ethereum Core market, including substantial yields for suppliers, utility for loopers, and revenue for the DAO, we expect the listing of January principal tokens to have a similar effect on the Plasma market, adding substantial stablecoin borrowing demand to USDT and USDe.

PT-USDe-15JAN2026

Stablecoin E-Mode

Through our quantitative algorithm, we find that the integration risk of the asset decays with time to maturity. This justifies the use of progressively less conservative risk parameters over time. We outline the projected evolution of the LT, LTV, and LB, with the initial parameterization approximately as follows:

LTV: 85.4%

LT: 87.4%

LB: 4.9%

USDe E-Mode

To enhance the asset’s capital efficiency, we propose a dedicated USDe E-Mode. Since both the PT’s underlying asset and the debt asset share the same collateral base, risk parameters shouldn’t be limited by typical underlying asset considerations. Instead, parameters should be driven by Pendle AMM’s liquidity dynamics, aligning better with the PT’s pricing structure. Below, we outline the projected evolution trajectories of LT, LTV, and LB, with initial parameters approximately as follows:

LTV: 86.2%

LT: 88.2%

LB: 3.9%

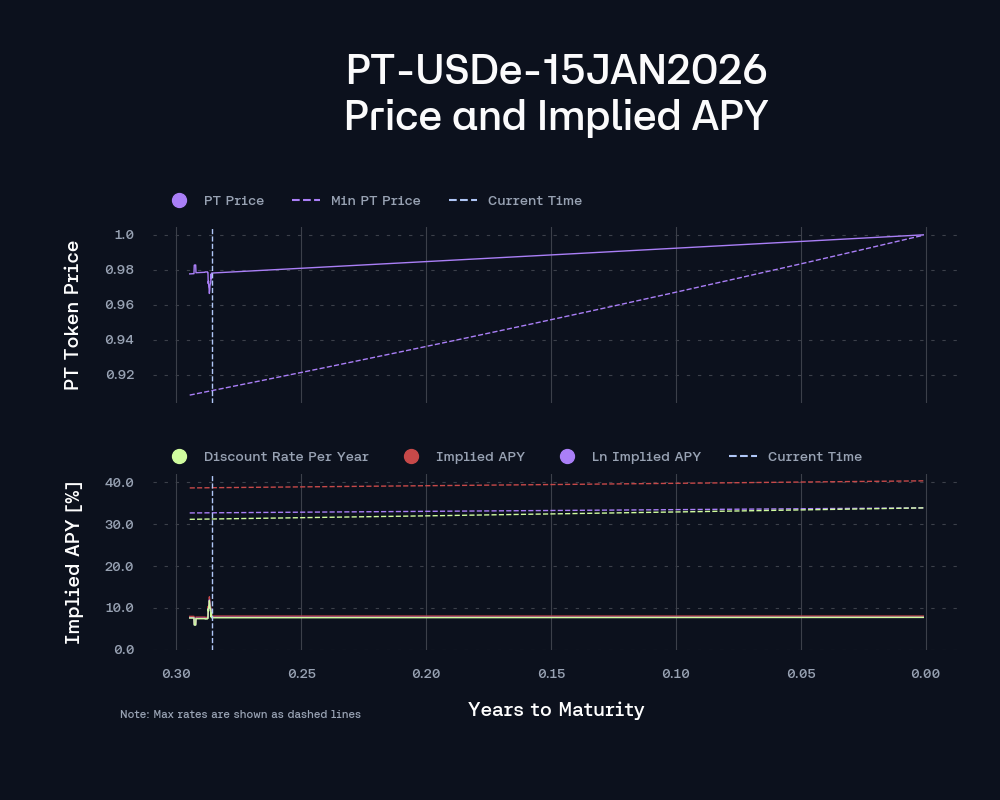

Initial Discount Rate Per Year and Maximum Discount Rate Per Year

Based on the limited historical observed data and the pricing configuration of the market, our initial recommendations for the discountRatePerYear and maxDiscountRatePerYear are as follows:

Initial discountRatePerYear: 7.96%

maxDiscountRatePerYear: 33.88%

If pricing dynamics change until its listing, such that discountRatePerYear will require a refresh, we will institute such a change accordingly upon listing.

Supply Cap

With PT-USDe-15JAN2026, liquidity depends on both the underlying USDe markets and Pendle’s PT/SY AMM pool, and current depth is sufficiently strong, especially when considering the recent deployment. The plot below represents the liquidity available under 3% slippage as the market approaches maturity. As the market matures and moves closer to expiry, the slippage associated with selling PT becomes less extreme. This trend is especially pronounced for assets with higher expected implied yield fluctuation, as they tend to have more variance in liquidity concentration. The market currently facilitates swaps of up to $14M with slippage limited to 3% or less.

The SY Liquidity in PT-USDe-15JAN2026’s AMM has reached $12M within the first 5 days of launch, indicating a substantial liquidity depth, and has remained at that level since.

PT-sUSDe-15JAN2026

Stablecoin E-Mode

As time-to-maturity shortens, modeled integration risk compresses, which supports gradually relaxing risk constraints. The expected path for LTV, LT, and LB reflects this, with the initial settings approximately:

LTV: 83.9%

LT: 85.9%

LB: 6.0%

USDe E-Mode

To maximize capital efficiency, we recommend a dedicated sUSDe E-Mode. Because the PT’s collateral base and the borrow leg are backed by the same underlying, constraints tied to generic collateral considerations are less binding. Instead, parameterization should follow Pendle AMM liquidity behavior, which better maps to PT pricing mechanics. The projected trajectories for LT, LTV, and LB are shown below, with initial parameters:

LTV: 84.5%

LT: 86.5%

LB: 5.2%

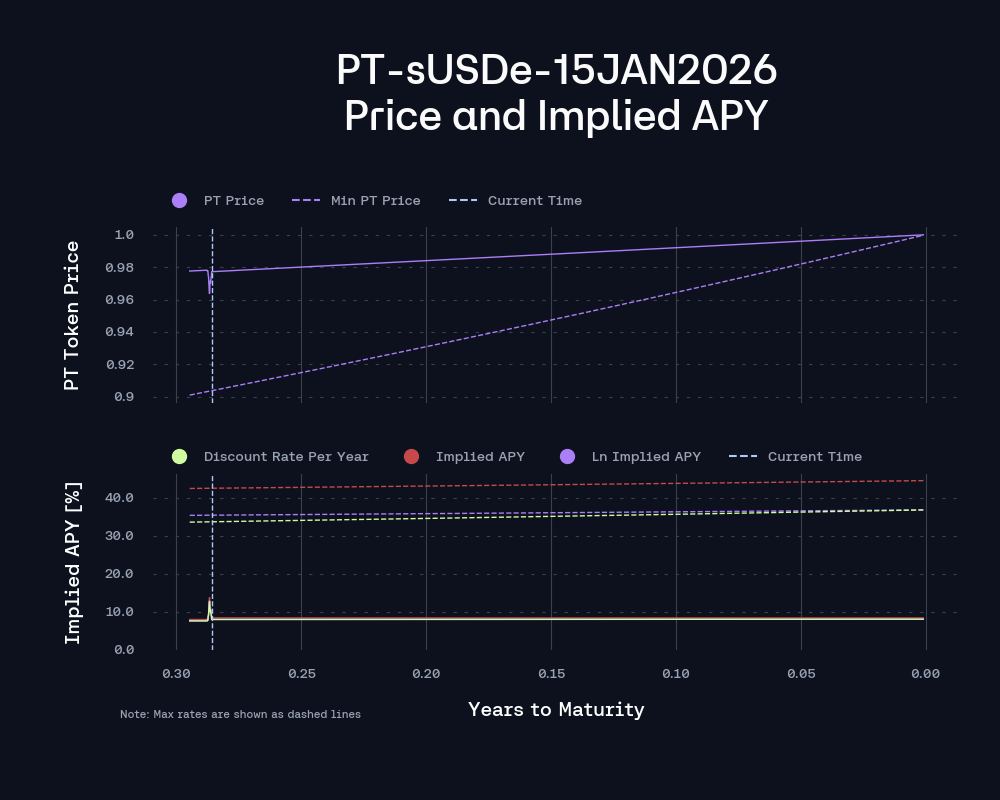

Initial Discount Rate Per Year and Maximum Discount Rate Per Year

Based on observed market behavior and the current pricing configuration, we recommend the following parameters:

Initial discountRatePerYear: 8.38%

maxDiscountRatePerYear: 36.82%

If market conditions shift prior to listing and warrant an update to discountRatePerYear, we will revise these values at listing time.

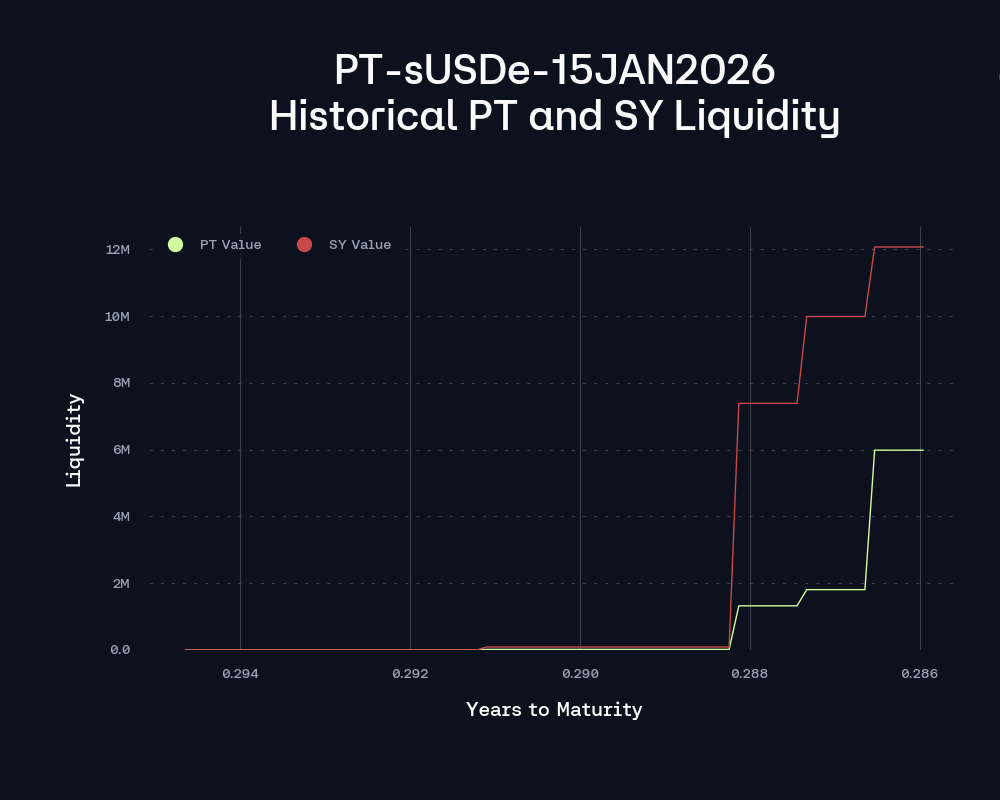

Supply Cap

Liquidity of PT-sUSDe-15JAN2026 is a function of both the underlying USDe venues and Pendle’s PT/SY AMM pool. Despite the recent deployment, depth is already substantial. The plot below represents the liquidity available under 3% slippage as the market approaches maturity. As the market matures and moves closer to expiry, the slippage associated with selling PT becomes less extreme. This trend is especially pronounced for assets with higher expected implied yield fluctuation, as they tend to have more variance in liquidity concentration. The market currently facilitates swaps of up to $14M with slippage limited to 3% or less.

The SY Liquidity of the PT-sUSDe-15JAN2026’s pool has been consistently growing and reached $12M within the first five days of the launch.

Recommendation

Considering the deep AMM liquidity and additional utility for the users that the listings will provide, we support listing both PT-sUSDe-15JAN2026 and PT-USDe-15JAN2026.

Specifications

| Parameter |

Value |

Value |

| Asset |

PT-USDe-15JAN2026 |

PT-sUSDe-15JAN2026 |

| Isolation Mode |

No |

No |

| Borrowable |

No |

No |

| Collateral Enabled |

Yes |

Yes |

| Supply Cap |

200,000,000 |

200,000,000 |

| Borrow Cap |

- |

- |

| Debt Ceiling |

- |

- |

| LTV |

0.05% |

0.05% |

| LT |

0.1% |

0.1% |

| Liquidation Penalty |

7.50% |

7.50% |

| Liquidation Protocol Fee |

10.00% |

10.00% |

| E-Mode Category |

PT-USDe/USDe, PT-USDe/Stablecoins |

PT-sUSDe/USDe, PT-sUSDe/Stablecoins |

PT-USDe/Stablecoins E-mode

| Asset |

PT-USDe-15JAN2026 |

USDT0 |

USDe |

| Collateral |

Yes |

No |

No |

| Borrowable |

No |

Yes |

Yes |

| LTV |

Subject to Risk Oracle |

- |

- |

| LT |

Subject to Risk Oracle |

- |

- |

| Liquidation Bonus |

Subject to Risk Oracle |

- |

- |

PT-USDe/USDe E-mode

| Asset |

PT-USDe-15JAN2026 |

USDe |

| Collateral |

Yes |

No |

| Borrowable |

No |

Yes |

| LTV |

Subject to Risk Oracle |

- |

| LT |

Subject to Risk Oracle |

- |

| Liquidation Bonus |

Subject to Risk Oracle |

- |

Initial E-mode Risk Oracle for PT-USDe-15JAN2026

| Parameter |

Value |

Value |

| E-Mode |

Stablecoins |

USDe |

| LTV |

85.4% |

86.2% |

| LT |

87.4% |

88.2% |

| LB |

4.9% |

3.9% |

Linear Discount Rate Oracle for PT-USDe-15JAN2026

| Parameter |

Value |

| discountRatePerYear (Initial) |

7.96% |

| maxDiscountRatePerYear |

33.88% |

PT-sUSDe/Stablecoins E-mode

| Asset |

PT-sUSDe-15JAN2026 |

USDT0 |

USDe |

| Collateral |

Yes |

No |

No |

| Borrowable |

No |

Yes |

Yes |

| LTV |

Subject to Risk Oracle |

- |

- |

| LT |

Subject to Risk Oracle |

- |

- |

| Liquidation Bonus |

Subject to Risk Oracle |

- |

- |

PT-sUSDe/USDe E-mode

| Asset |

PT-sUSDe-15JAN2026 |

USDe |

| Collateral |

Yes |

No |

| Borrowable |

No |

Yes |

| LTV |

Subject to Risk Oracle |

- |

| LT |

Subject to Risk Oracle |

- |

| Liquidation Bonus |

Subject to Risk Oracle |

- |

Initial E-mode Risk Oracle for PT-sUSDe-15JAN2026

| Parameter |

Value |

Value |

| E-Mode |

Stablecoins |

USDe |

| LTV |

83.9% |

84.5% |

| LT |

85.9% |

86.5% |

| LB |

6.0% |

5.2% |

Linear Discount Rate Oracle for PT-sUSDe-15JAN2026

| Parameter |

Value |

| discountRatePerYear (Initial) |

8.38% |

| maxDiscountRatePerYear |

36.82% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0