Summary

This AIP proposes a set of risk-parameter updates to support continued growth of Ethena principal token markets on the Ethereum Core instance, while formally offboarding recently matured November-expiry markets and reducing friction for looping strategies via E-Mode adjustments. The core changes include doubling the supply caps for PT-sUSDe-5FEB2026 and PT-USDe-5FEB2026 from 120M to 240M, disabling new usage of the November 2025 principal tokens as collateral by reducing their supply caps, and adding sUSDe as a collateral asset in the PTsUSDe5FEB/Stablecoins and PTsUSDe5FEB/USDe E-Modes.

PT-sUSDe-5FEB2026 (Ethereum Core)

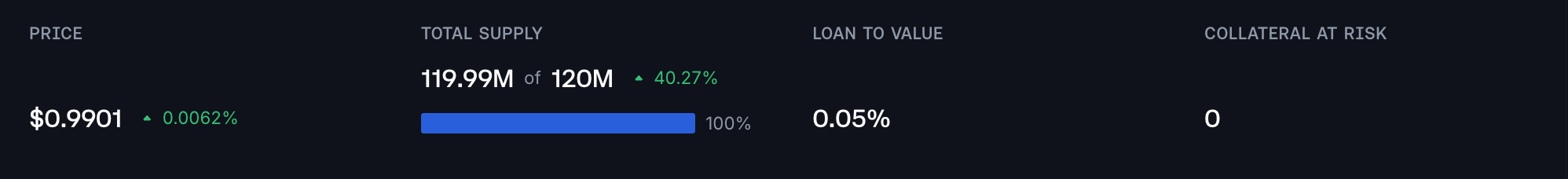

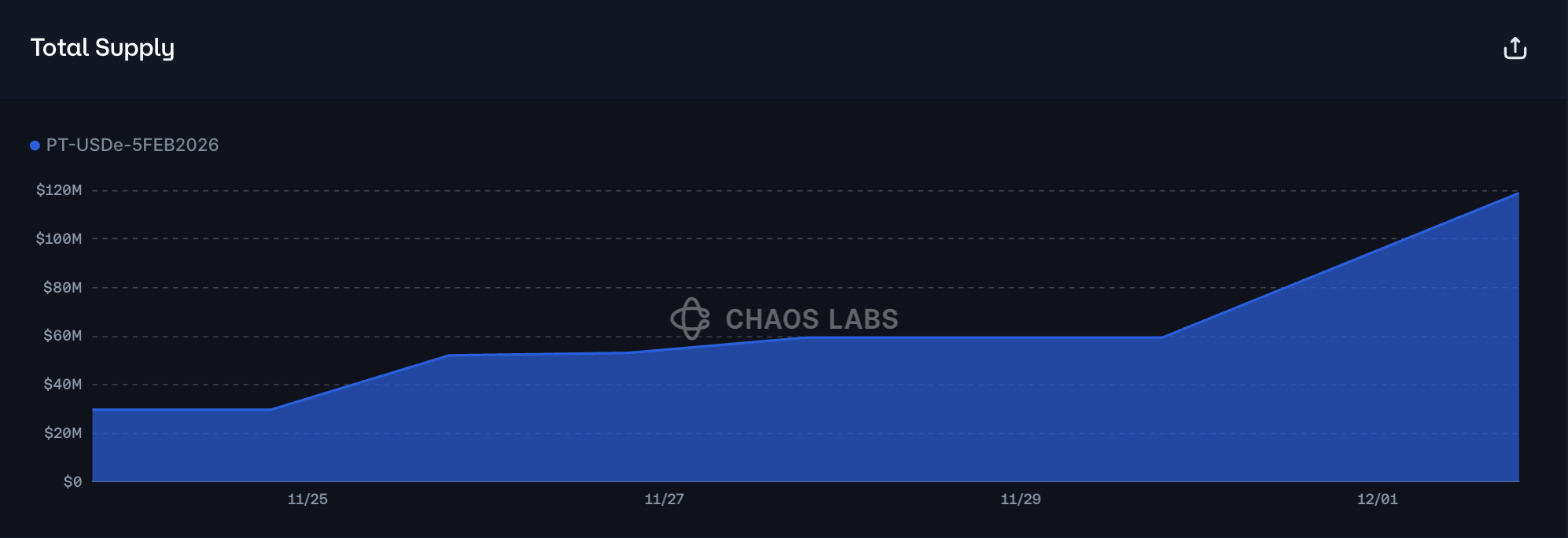

PT-sUSDe-5FEB2026 has reached its supply cap on the Ethereum Core instance following an inflow of $60 million since November 30th.

Supply Distribution

The supply of PT-sUSDe-5FEB is highly concentrated, with the top user representing over 40% of the total, while the top two users account for approximately 77.5% of the market. As can be observed in the plot below, the suppliers are using PT-sUSDe-5FEB in order to collateralize USDe and USDT debt positions. Typical for such markets, suppliers are recursively looping the yield-bearing assets against stablecoins to leverage the spread between the underlying appreciation rate of the principal token and the borrowing costs of the stablecoins. Considering the strategies employed, the health factors in the 1.03-1.20 range present minimal risk due to the high correlation of the debt and collateral assets.

As mentioned previously, the suppliers are borrowing USDe and USDT, facilitated by respective E-Modes, which provide a high level of capital efficiency, thereby allowing additional scaling of the net yields. Considering the substantial correlation of the assets, the risk of liquidations in the market is currently minimal.

As mentioned previously, the suppliers are borrowing USDe and USDT, facilitated by respective E-Modes, which provide a high level of capital efficiency, thereby allowing additional scaling of the net yields. Considering the substantial correlations of the assets, the risk of liquidations in the market is currently minimal.

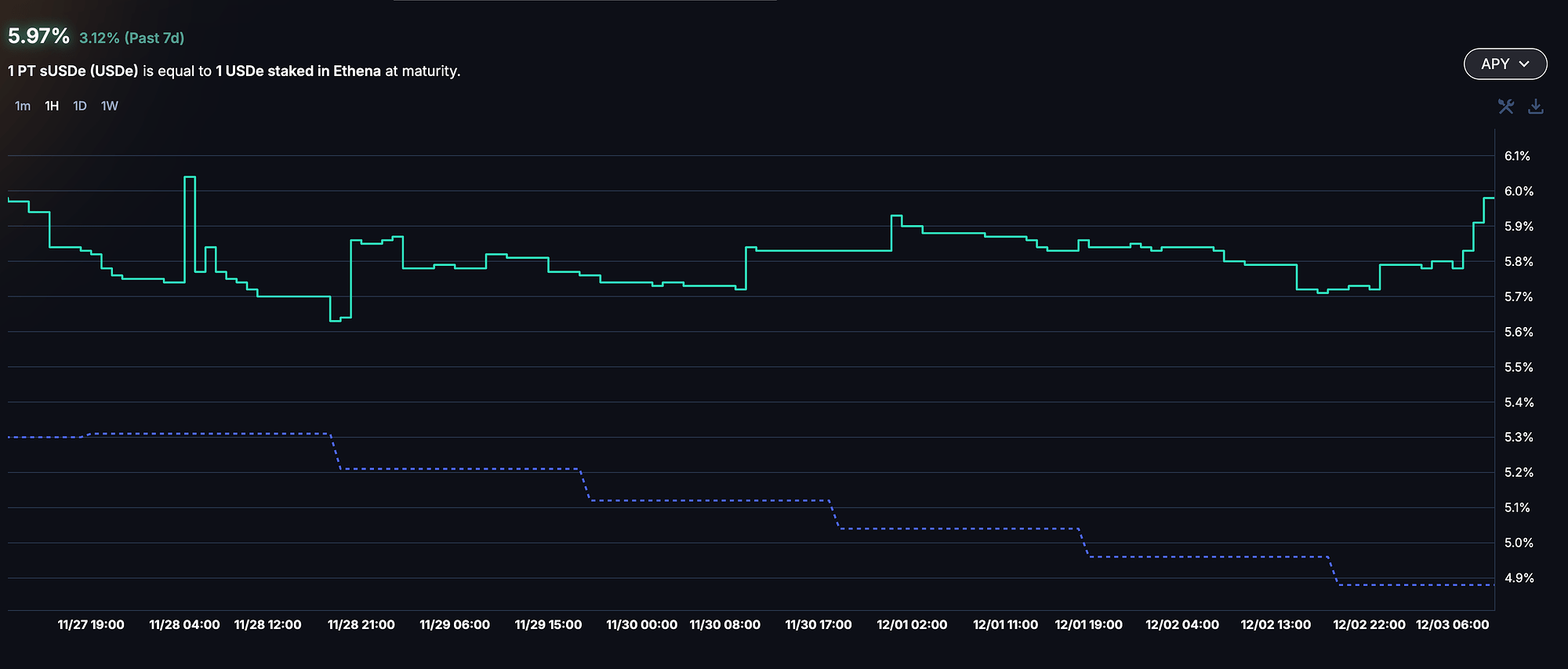

Market and Liquidity

The implied APY of the principal token has seen a substantial increase over the past two days, reaching 5.97%, which has had an adverse effect on the price of the principal token. While the impact is measurable, it is discounted by duration and is minimal. Additionally, the 50-basis-point increase in the implied rate results in higher net APYs for loopers, pushing demand to supply the principal token on Aave.

The liquidity profile of the assets with regard to the Pendle AMM has not shifted since our last review, as it can currently facilitate a swap of 20 million PT-sUSDe tokens for USDe at 1% slippage, allowing for additional expansion of the supply cap.

Recommendation

Considering the conservative user behavior, substantial on-chain liquidity, and high correlation of the borrowed and supplied assets, we recommend increasing the supply cap of the asset.

PT-USDe-5FEB2026 (Ethereum Core)

Similar to its staked counterpart, PT-USDe-5FEB2026 has also reached its supply cap on the Ethereum Core instance, resulting from an additional 60 million tokens being supplied over the last three days.

Supply Distribution

The supply of PT-USDe-5FEB2026 is heavily concentrated, with the largest supplier controlling approximately 88% of the market. As illustrated in the chart below, participants are utilizing PT-USDe-5FEB2026 as collateral to borrow USDe and USDC. As is common in these markets, users are engaging in recursive looping strategies with yield-bearing assets against stablecoins to capitalize on the difference between the underlying yield of the principal token and the borrowing costs of the stablecoin. Given the strategy being employed, the health factors, ranging from 1.14 to 1.55, are highly conservative and pose minimal risk due to the strong correlation between debt and collateral assets.

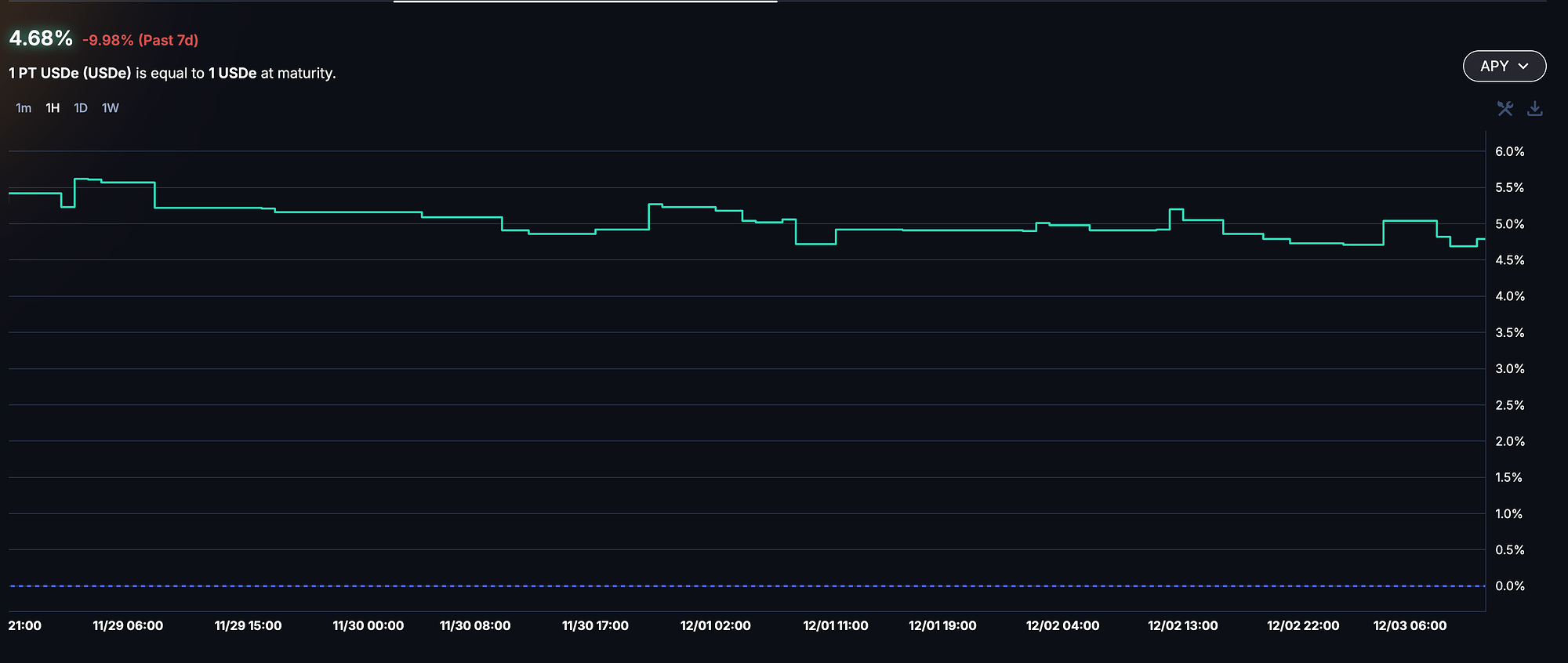

Market and Liquidity

The implied yield of PT-USDe-5FEB2026 has declined by 50 basis points over the past seven days. At the time of writing, the implied yield of the asset is 4.68%, given the borrowing cost of USDe at 3.70%. This presents limited upside, as the spread between the underlying yield of the principal token and the borrowing costs of USDe has compressed materially.

The liquidity profile of the asset has grown by 10% since our last assessment. Pendle’s AMM currently has a TVL of approximately $2.7 million, compared to $2.5 million three days ago. The estimated slippage on a 2.5 million PT-USDe swap for USDe stands at 1%, presenting a constraint on future expansion of the asset’s supply cap. While the current liquidity profile is somewhat constraining, the teams associated with liquidity provision in the market are committed to expanding the depth of Pendle’s AMM, thereby alleviating risks associated with shallow liquidity.

Recommendation

Considering the expanding demand to loop the asset, low risk of liquidations, and expected expansion in the liquidity profile of the asset, we recommend increasing the supply cap of PT-USDe-5FEB2026.

November Expiry Ethena PTs (Ethereum Core)

Given that the November expiry USDe and sUSDe principal tokens have recently matured, and the total supply currently stands at $63.75 million (representing 1.5% of the aggregate supply at the top), we recommend offboarding the assets by setting the supply caps to one. This measure will prevent any new collateral from being added and facilitate the orderly wind-down of remaining positions, simplifying risk management for these expired markets, without triggering liquidations for existing users.

PTsUSDe5FEB/Stablecoins & PTsUSDe5FEB/USDe E-Modes

We recommend adding sUSDe as an eligible collateral asset in both the PTsUSDe5FEB/Stablecoins and PTsUSDe5FEB/USDe E-Modes to reduce potential friction for sUSDe-based principal token loopers when substituting collateral. As PT-sUSDe-5FEB2025 can only be redeemed for sUSDe, enabling sUSDe within these E-Modes will allow users to migrate collateral from the principal token to sUSDe while preserving E-Mode benefits, rather than fully unwinding their positions.

To date, this substitution path has seen limited use: in September, approximately 24.27 million sUSDe of collateral, out of more than 2 billion principal tokens with September maturity, was swapped via transactions that burned PT-sUSDe and minted aEthsUSDe. While not widely adopted historically, we view this as a useful tool for advanced position management and would recommend supporting it as the markets scale. This adjustment is therefore expected to increase the stickiness of PT-sUSDe-based demand for stablecoin borrowing, reduce unnecessary deleveraging and operational overhead around redemption events, and lower potential liquidity stress when positions are adjusted at substantial market sizes.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Core | PT-sUSDe-5FEB2026 | 120,000,000 | 240,000,000 | - | - |

| Ethereum Core | PT-USDe-5FEB2026 | 120,000,000 | 240,000,000 | - | - |

| Ethereum Core | PT-sUSDe-27NOV2026 | 2,000,000,000 | 1 | - | - |

| Ethereum Core | PT-USDe-27NOV2026 | 2,400,000,000 | 1 | - | - |

PT-sUSDe Stablecoins E-mode

| Asset | PT-sUSDe-5FEB2026 | PT-sUSDe-27NOV2025 | sUSDe | USDe | USDC | USDT | USDe | USDtb |

|---|---|---|---|---|---|---|---|---|

| Collateral | Yes | Yes | Yes | Yes | No | No | No | No |

| Borrowable | No | No | No | No | Yes | Yes | Yes | Yes |

| LTV | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - | - | - | - |

| LT | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - | - | - | - |

| Liquidation Bonus | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - | - | - | - |

PT-sUSDe USDe E-mode

| Asset | PT-sUSDe-5FEB2026 | PT-sUSDe-27NOV2025 | sUSDe | USDe |

|---|---|---|---|---|

| Collateral | Yes | Yes | Yes | No |

| Borrowable | No | No | No | Yes |

| LTV | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - |

| LT | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - |

| Liquidation Bonus | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - |

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.