Overview

Chaos Labs supports the listing of PT-sUSDE-27NOV2025. In alignment with our Principal Token Risk Oracle framework, outlined in detail here, we present our risk parameter recommendations for the proposed maturity and underlying asset listing: PT-sUSDE-27NOV2025. Leveraging the dynamic linear discount rate oracle implementation, we also provide our recommended values for initialDiscountRatePerYear and maxDiscountRatePerYear, derived from the extended methodology detailed here.

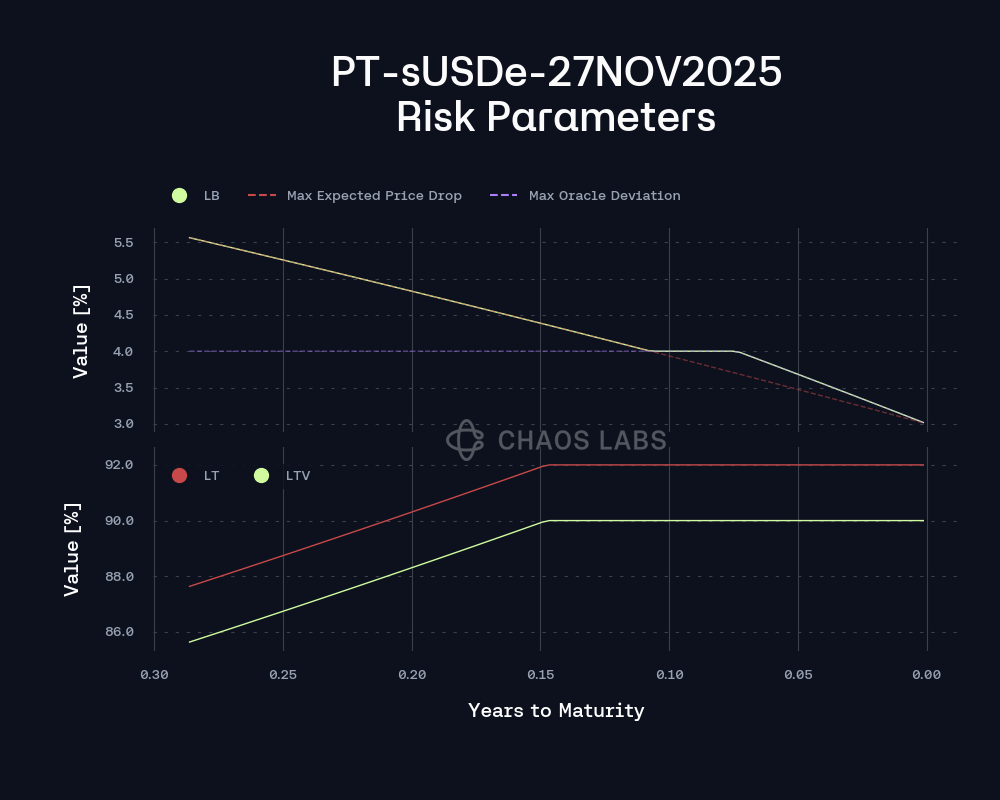

Risk Oracle Parameter Evolution

Stablecoin E-mode

Through our rigorous quantification of the algorithm, we find that the integration risk decays as the PT approaches maturity. This dynamic justifies the use of progressively less conservative risk parameters over time. Taking into account the underlying proposed configuration of USDe E-mode within Aave, we outline the projected evolution of the LT, LTV and LB, with the initial parameterization approximately as follows:

LTV: 86.1%

LT: 88.1%

LB: 5.4%

The collateral parameters will continue to become more permissive, evolving in accordance with the plot above. This set of parameters explicitly refers to E-mode, and we recommend setting non-E Mode parameters such that the asset is effectively prohibited from borrowing uncorrelated assets.

As such, the underlying configuration will be derived in accordance with a minimum liquidation bonus of 3% and a maximum liquidation threshold of 92%.

USDe E-mode

To further enhance capital efficiency, we propose the introduction of a USDe E-Mode for PT-sUSDE-27NOV2025. While the PT token’s underlying asset is sUSDe, the debt asset is USDe, and both are intrinsically linked through the Ethena protocol’s redemption and staking mechanisms. This close relationship mitigates pricing divergence risk, allowing for a more permissive risk framework than would typically be applied to uncorrelated asset pairs. As such, the parameterization should be informed primarily by Pendle AMM liquidity dynamics, rather than generic stablecoin risk considerations. We outline the projected evolution of the LT, LTV, and LB, with the initial parameterization approximately as follows:

LTV: 87.8%

LT: 89.8%

LB: 3.4%

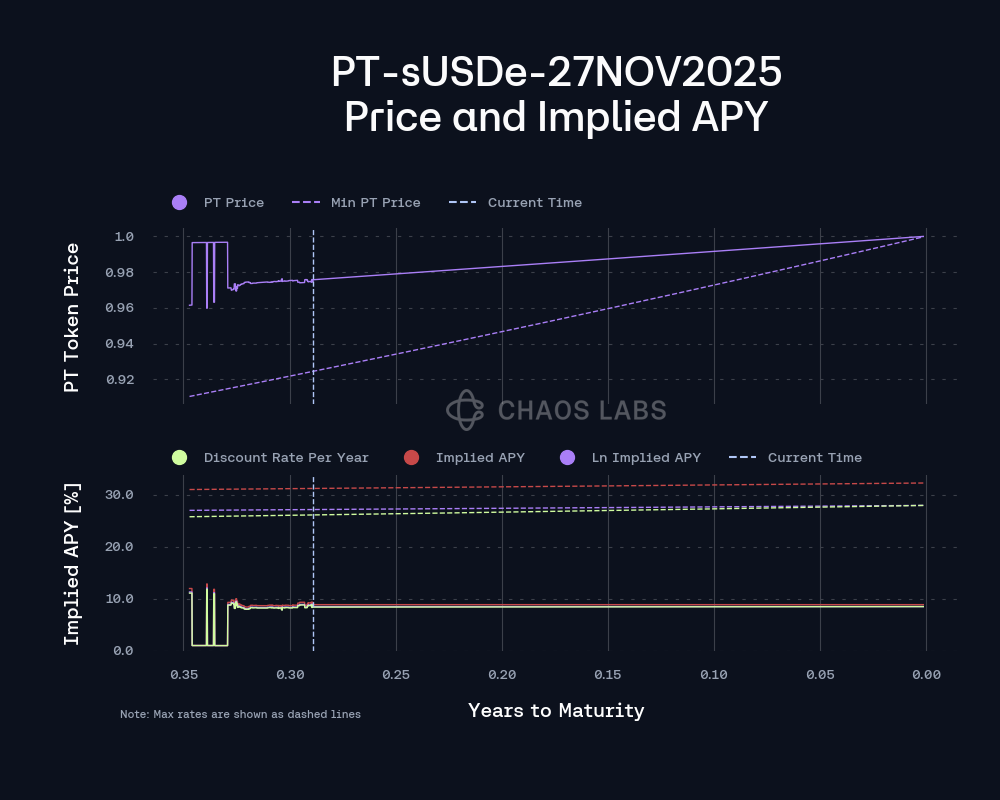

Initial Discount Rate Per Year and Maximum Discount Rate Per Year

Based on historical observed data and the pricing configuration of the market, our initial recommendations for the discountRatePerYear and maxDiscountRatePerYear are as follows:

Initial discountRatePerYear: 8.52%

maxDiscountRatePerYear: 27.9%

If pricing dynamics change until its listing, such that discountRatePerYear will require a refresh, we will institute such a change accordingly upon listing.

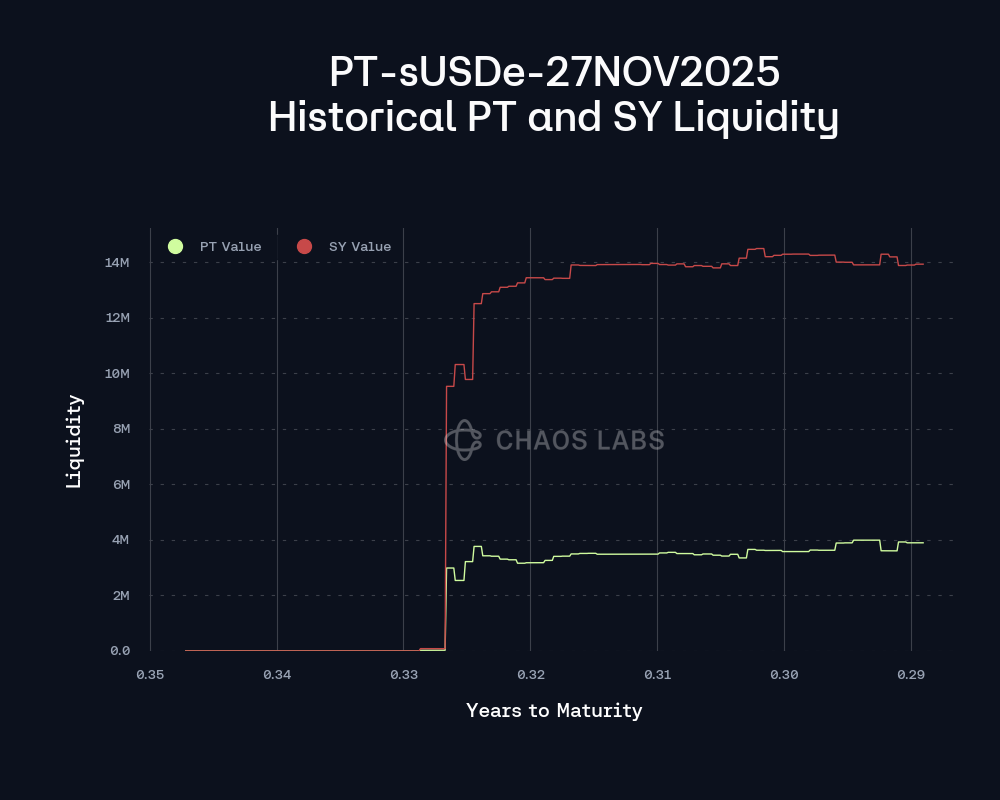

Supply Cap

With the relevant debt assets necessitating the leveraging of on-chain liquidity for both the underlying asset and Pendle AMM liquidity, PT-sUSDE-27NOV2025 employs mediocre on-chain liquidity. The plot below represents the amount of liquidity available under 3% slippage as the market approaches expiry, given the current liquidity distribution in the AMM. As the market matures and moves closer to expiry, the slippage associated with swapping PT becomes less extreme. This trend is especially pronounced for assets with lower scalarRoot values, i.e. a greater expected implied yield fluctuation, and they tend to have more variance in liquidity concentration. Supported by on-chain liquidity in the Pendle AMM, the market currently facilitates swaps of up to $11M with less than 3% slippage.

PT-sUSDE-27NOV2025 has SY liquidity in the AMM, which reached $14M within the first weeks of inception but has remained largely unchanged since then.

In order books, there are more than 10 million PT buy orders for PT-sUSDE-27NOV2025, indicating decent demand for the asset.

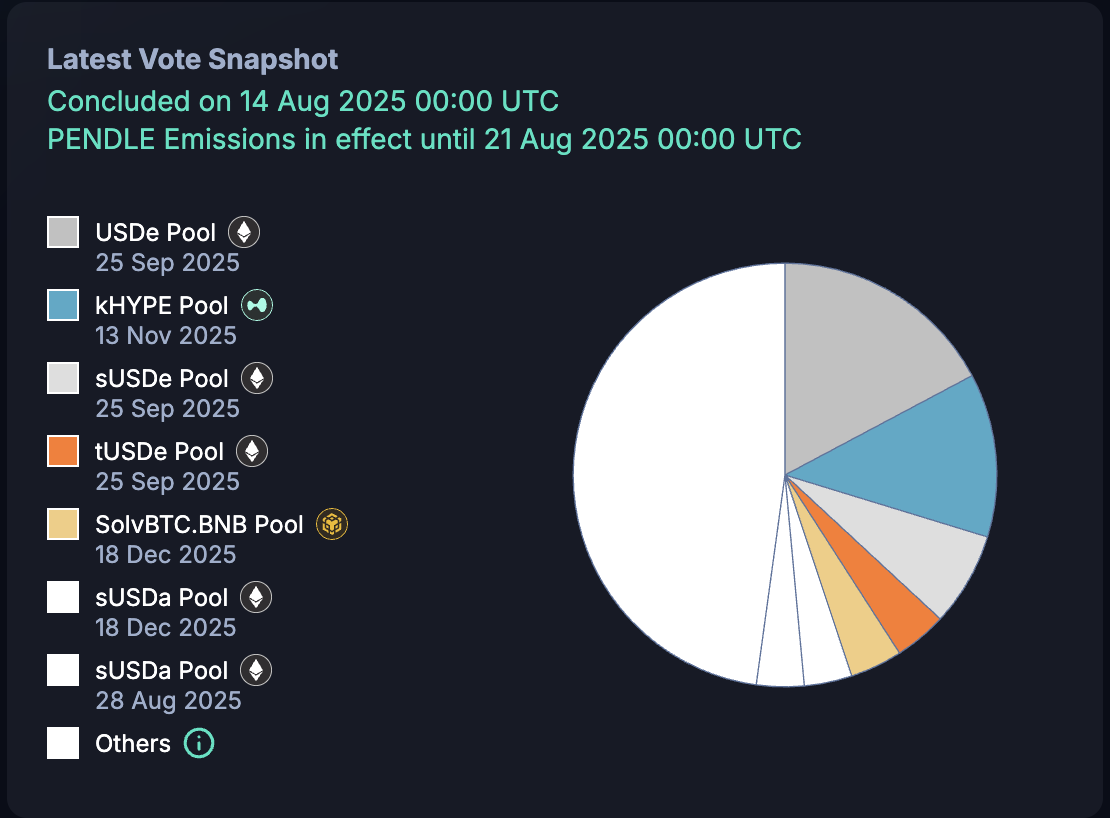

The recent vePendle voting concluded and will remain effective until 21 August. PT-sUSDE-27NOV2025 received 0.79% of the votes, resulting in an aggregated LP APY of around 8.5%, which is lower than PT-sUSDE-25SEP2025 at 9.6% and PT-USDe-25SEP2025 at 16.5%.

The underlying sUSDe yield is expected to rise, which could boost LP APYs for both PT-sUSDE-27NOV2025 and PT-sUSDE-25SEP2025. This increase could be further supported by higher points allocations to attract additional liquidity.

Currently, PT-sUSDE-27NOV2025 offers 20x Sats points, the lowest among the three, compared to 25x for PT-sUSDE-25SEP2025 and 60x for PT-USDe-25SEP2025. Adjustments to vePendle votes and point incentive structures could help drive growth in PT-sUSDE-27NOV2025 liquidity.

Migration of Existing PTs

To support a seamless migration from other PT-sUSDe assets with expiries prior to November to PT-sUSDe-27NOV2025, we recommend including PT-sUSDe-25SEP2025 and sUSDe in the newly created E-Modes.

Specification

| Parameter | Value |

|---|---|

| Asset | PT-sUSDe-27NOV2025 |

| Isolation Mode | No |

| Borrowable | No |

| Collateral Enabled | Yes |

| Supply Cap | 75,000,000 |

| Borrow Cap | - |

| Debt Ceiling | - |

| LTV | 0.05% |

| LT | 0.1% |

| Liquidation Penalty | 7.50% |

| Liquidation Protocol Fee | 10.00% |

| E-Mode Category | PT-sUSDe Stablecoins, PT-sUSDe USDe |

PT-sUSDE Stablecoins E-mode

| Asset | PT-sUSDe-27NOV2025 | PT-sUSDe-25SEP2025 | sUSDe | USDC | USDT | USDS | USDe | USDtb |

|---|---|---|---|---|---|---|---|---|

| Collateral | Yes | Yes | Yes | No | No | No | No | No |

| Borrowable | No | No | No | Yes | Yes | Yes | Yes | Yes |

| LTV | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - | - | - | - | - |

| LT | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - | - | - | - | - |

| Liquidation Bonus | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - | - | - | - | - |

PT-sUSDE USDe E-mode

| Asset | PT-sUSDe-27NOV2025 | PT-sUSDe-25SEP2025 | USDe |

|---|---|---|---|

| Collateral | Yes | Yes | No |

| Borrowable | No | No | Yes |

| LTV | Subject to Risk Oracle | Subject to Risk Oracle | - |

| LT | Subject to Risk Oracle | Subject to Risk Oracle | - |

| Liquidation Bonus | Subject to Risk Oracle | Subject to Risk Oracle | - |

Initial E-mode Risk Oracle

| Parameter | Value | Value |

|---|---|---|

| E-Mode | Stablecoins | USDe |

| LTV | 86.1% | 87.8% |

| LT | 88.1% | 89.8% |

| LB | 5.4% | 3.4% |

Linear Discount Rate Oracle

| Parameter | Value |

|---|---|

| discountRatePerYear (Initial) | 8.52% |

| maxDiscountRatePerYear | 27.9% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0