Summary

LlamaRisk supports listing PT-sUSDe-27NOV2025 on the Aave V3 Core instance. At the time of this analysis, the asset matures in approx 100 days. The market environment, characterized by high and stable yields from sUSDe, has generated significant user demand for fixed-rate products. Onboarding this Principal Token (PT) allows users to lock in these attractive yields, which aligns with Aave’s goal of providing diverse and useful financial primitives.

Given the demonstrated demand for previous PT-sUSDe maturities and the healthy liquidity profile of this new pool, adding this asset presents a minor incremental risk to the Aave Core market while offering a significant first-mover advantage.

Assessment of PT base asset: Link

Considered PT asset maturity: PT-sUSDe-27NOV2025

Asset State

Asset Growth

The Ethena ecosystem has demonstrated aggressive growth recently, partially fueled by the large Aave adoption. The total supply of USDe has surged to nearly 11 billion, marking an increase of over 51% over the last month. Crucially, this growth is matched by user engagement, with the total supply of the yield-bearing sUSDe reaching 5.5 billion. This reflects a high and stable staking ratio of just over 50%.

Source:

LlamaRisk Ethena Risk Portal, August 15, 2025

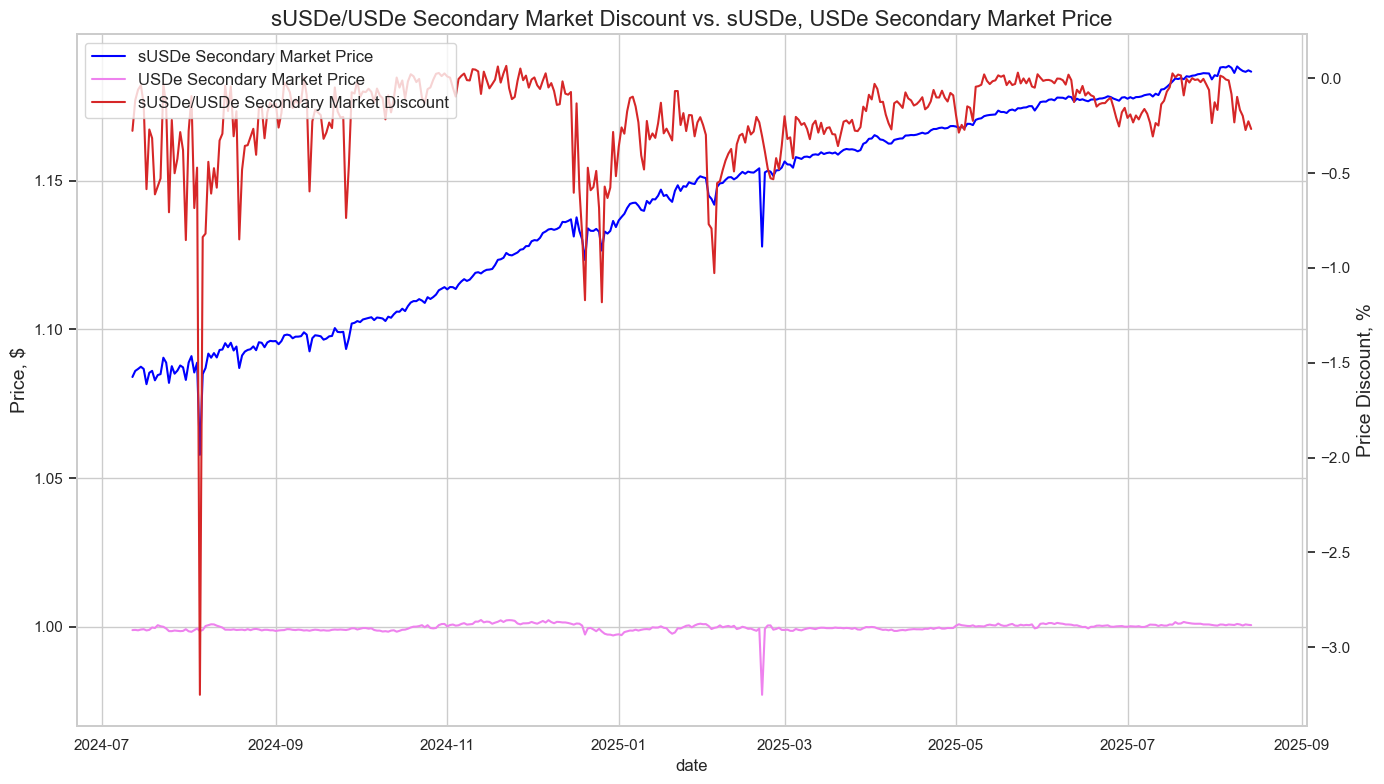

Underlying Stability

The stability of the underlying USDe peg and the overall health of the Ethena protocol are critical risk parameters. The market price of USDe remains tightly pegged, and the secondary market for sUSDe also shows signs of efficiency, with its market price closely tracking the internal exchange rate. From a protocol health perspective, Ethena maintains a solvency ratio of 100.53% and is supported by a Reserve Fund capitalized at over $61 million. While the historical price chart reveals brief periods of volatility in the sUSDe/USDe discount, these de-pegs have historically been short-lived, with arbitrage opportunities quickly restoring market balance. This demonstrated resilience is a positive indicator of the asset’s stability.

Source: LlamaRisk, August 15, 2025

Underlying Yield Source

The yield mechanism for sUSDe is derived from Ethena’s delta-neutral strategy. In this model, USDe is backed by a portfolio of stablecoins (USDT, USDC, etc.) and paired with short perpetual futures positions. This structure enables sUSDe to capture revenue from market funding rates and the yield from its underlying stablecoin collateral, which is then distributed to sUSDe holders. The yield’s sustainability is contingent on consistently positive funding rates and the robust performance of Ethena’s risk management framework. Although designed to be market-neutral, the yield can fluctuate with funding rate dynamics and the performance of the collateral assets.

Underlying Utility

The primary driver for sUSDe demand is the delta-neutral yield generated by the Ethena strategy. While some secondary speculative interest is related to potential future Ethena incentives, it is not the core source of demand. sUSDe functions as a synthetic stablecoin with an embedded yield mechanism, appealing to users who want delta-neutral market exposure combined with an additional source of yield. Multiple sUSDe PT maturities on Pendle indicate sustained user interest and utility.

Market Analysis

Total Supply

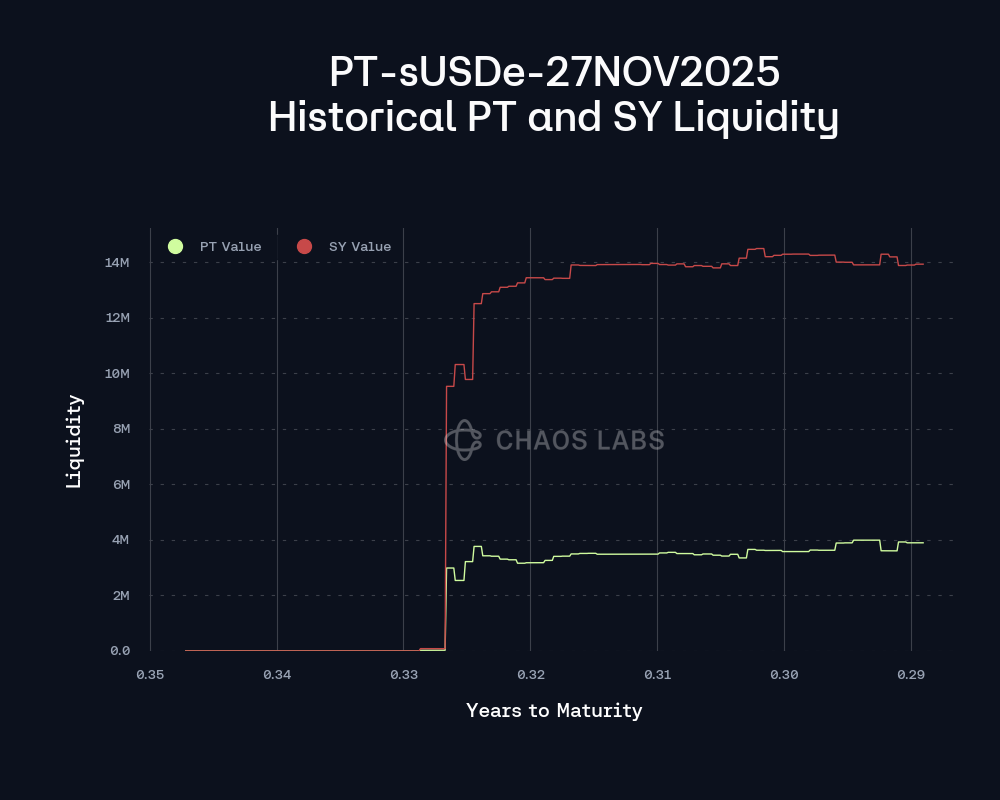

The PT-sUSDe-27NOV2025 maturity pool has demonstrated impressive growth since its launch in late July 2025. Analysis of the pool’s liquidity shows a rapid ramp-up, stabilizing at a healthy level.

Source: LlamaRisk, August 15, 2025

As of August 15, 2025, the pool’s total available liquidity (TVL) is approximately $18.0M. The total supply of the underlying SY-sUSDe has reached nearly $60.0M.

A more detailed breakdown of the pool’s composition is:

- Total Liquidity: $17.99M

- SY sUSDe: $14.43M (80.25%)

- PT sUSDe: $3.55M (19.75%)

Source:

Pendle, August 15, 2025

These liquidity levels, accumulated two weeks after the pool’s deployment, indicate strong market demand for this specific maturity and support the pool’s stability.

Market Depth

The market’s order book reflects healthy and deep liquidity. The bid-ask spread on the implied yield is approximately 0.3% (8.6% sell vs 8.9% buy), indicating an efficient market.

Source:

Pendle, August 15, 2025

The market depth is robust, particularly for shorting the yield (buying PT). The 10% depth is over 15M PT tokens on the buy side. The liquidity is expected to grow, especially as the September PT pool matures.

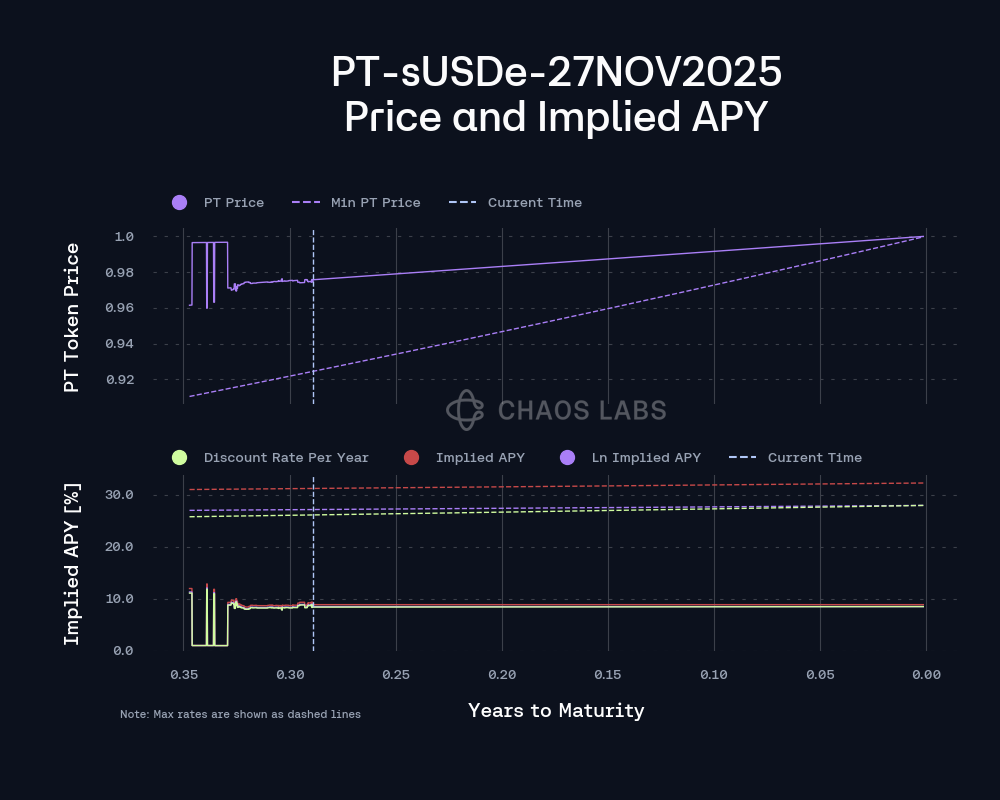

Price and Yield

The implied yields for both the PT and the associated LP positions have remained stable and attractive since the pool’s inception, reflecting the consistent high yield of the underlying sUSDe.

Source: LlamaRisk, August 15, 2025

As of this review (103 days to maturity), the implied yield for the PT is ~8.8% APY, while the maximum LP yield is ~10.0% APY. The stability of the implied PT yield suggests a consistent market expectation for future sUSDe rates, making it an attractive asset for users seeking predictable returns.

The pool has the following parameters on Pendle:

- Liquidity Yield Range: 5% - 26%

- Input Tokens: USDe, sUSDe

- Output Tokens: sUSDe

- AMM Fee: 0.12%

- Orderbook Fee: 0.16%

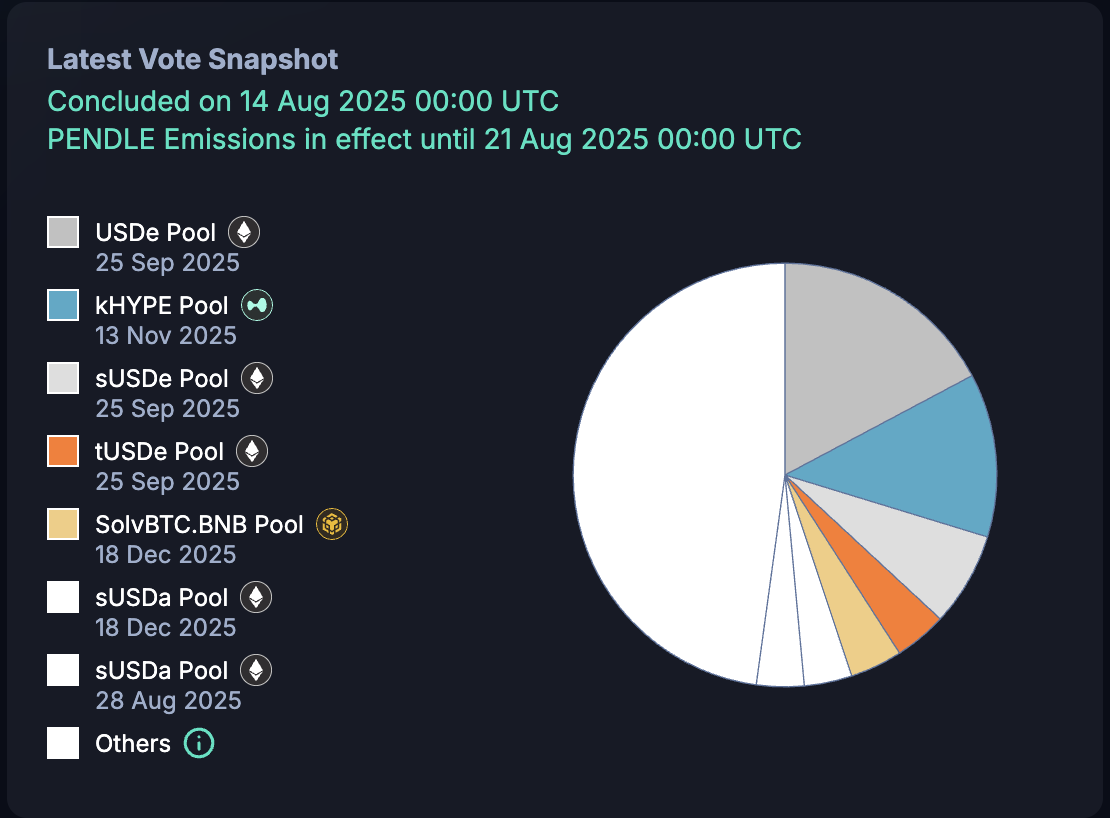

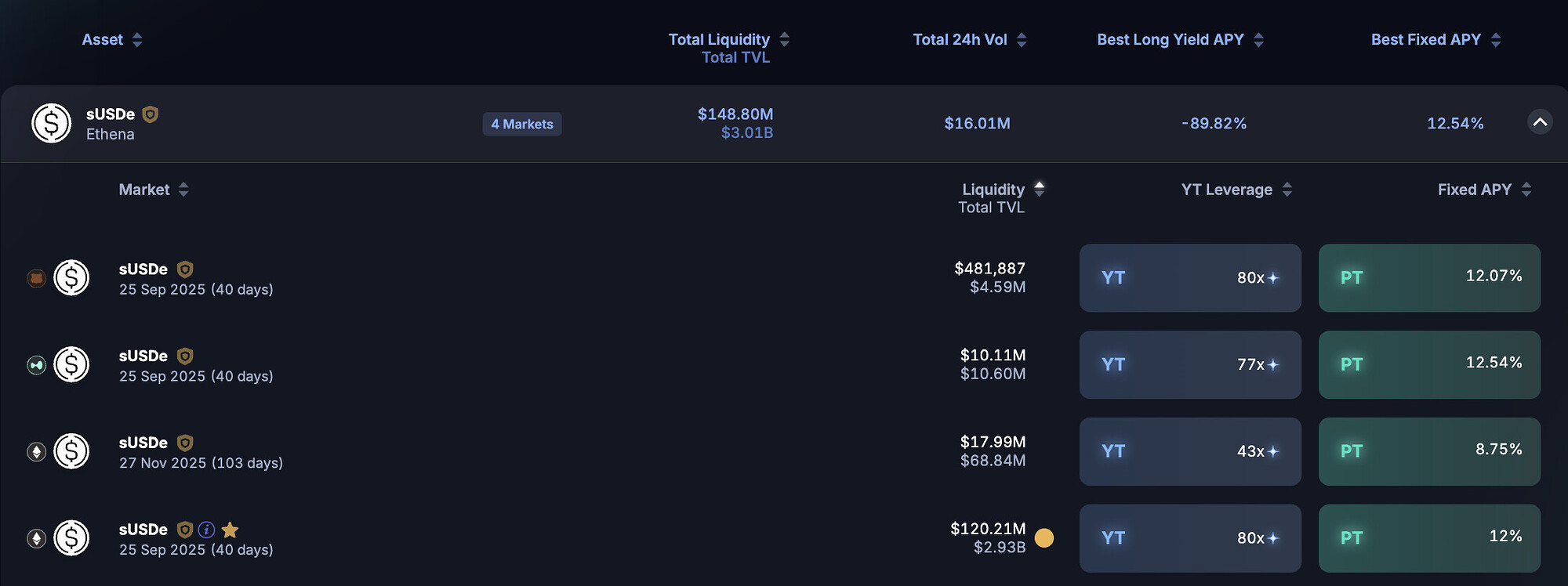

Maturities

The existence of multiple sUSDe maturities on Pendle with a total TVL of $3B, including the active September and November 2025 pools, signals strong and persistent user interest in the product. This double maturity availability ensures a more natural rollover of the PT pools, which is also relevant for Aave’s exposure. Before the November pool expires, a new maturity pool will be created, letting users migrate continuously.

Source:

Pendle, August 15, 2025

Integrated Venues

PT-sUSDe-27NOV2025 is not yet integrated into other lending venues due to the recency of the pool. This represents a significant first-mover advantage for Aave to capture the primary lending demand for this asset.

Recommendations

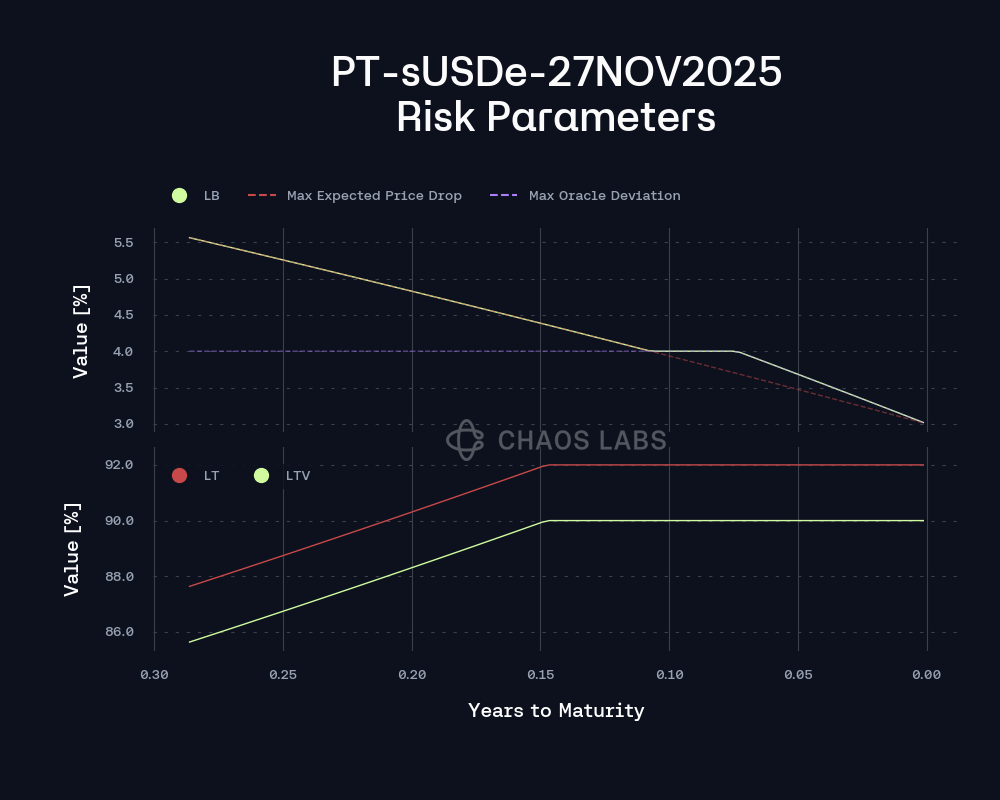

We have aligned the risk parameter recommendations for the PT-sUSDe-27NOV2025 listing with @ChaosLabs which has already been published in this thread.

Price Feed Recommendation

We recommend using the exchange rate of sUSDe/USDe with the PT linear discount rate Oracle implementation. The price of USDe will be derived from the USDT/USD feed, which is consistent with the pricing of other USDe-denominated assets within the Aave ecosystem. Furthermore, we recommend implementing a CAPO on the oracle to mitigate the risk of upward price manipulation of the underlying exchange rate.

The initial discount rate should be slightly higher than the observed market rate to create a small safety margin, especially since the pool’s maturity is longer than those previously onboarded on Aave. In addition, the maximal discount should reflect the pool’s LP range with a margin of conservativeness. The recommended parameters presented by Chaos Labs support this rationale.

Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded partly by the Aave DAO. LlamaRisk serves as Ethena’s Risk Committee member and an independent attestor of Ethena’s PoR solution. LlamaRisk did not receive compensation from the protocol(s) or their affiliated entities for this work. The information should not be construed as legal, financial, tax, or professional advice.