Overview

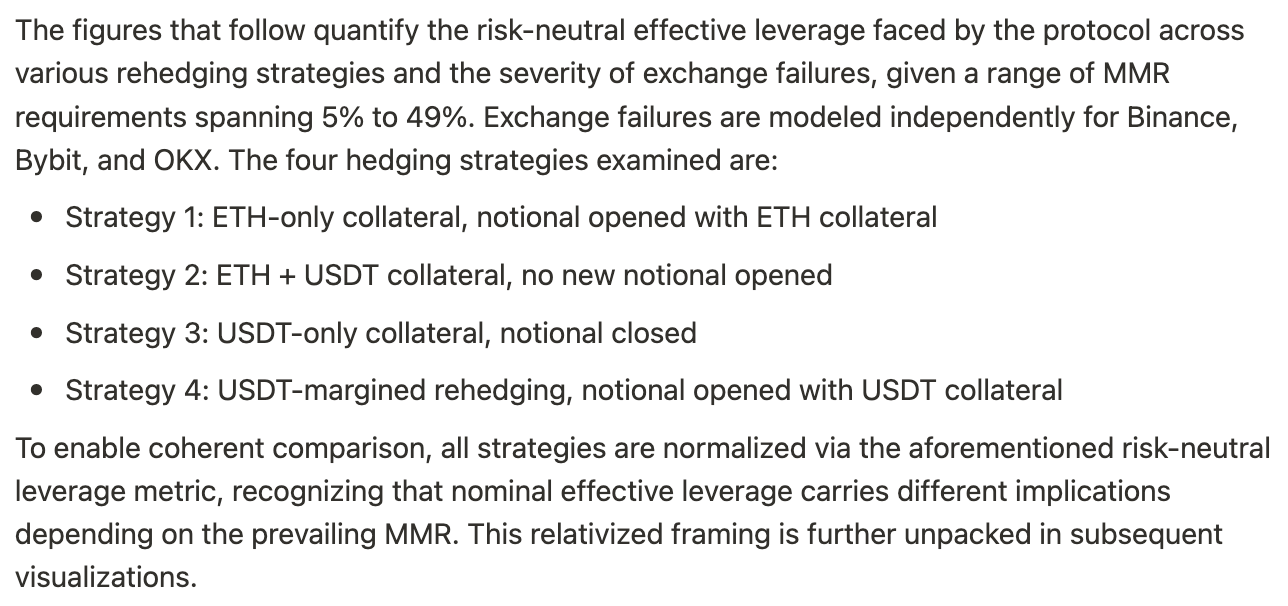

Exposure to Ethena

Aave has seen a significant increase in exposure to Ethena-related assets, specifically USDe-backed PTs, in recent months. These assets have become an increasingly prominent part of Aave’s supplied collateral base, driven primarily by users seeking to optimize returns through leveraged yield and points farming strategies.

Initially, Aave’s exposure to Ethena was primarily through sUSDe. In December 2024, sUSDe supply on Aave surged, pushing the total USDe based exposure on the platform to over $1.1 billion. At its peak, more than 20% of the total USDe supply was deposited into Aave, largely driven by sUSDe’s double digit annualized yield at the time.

As yields declined in early 2025, USDe-backed asset exposure gradually retraced. However, this trend reversed sharply beginning in May 2025, when Aave began onboarding USD-based PTs. These PTs, which represent the fixed yield component of split USDe positions on Pendle, quickly attracted attention from users looking to leverage them for farming strategies.

The result was a sharp influx of capital into Aave. Within a matter of weeks, PTs became the dominant USDe-backed collateral type on the platform. As of the latest data, the combined supply of USDe-backed assets on Aave totals approximately $2.55 billion, with PTs comprising the majority share. This growth pushed the share of total USDe supply deposited on Aave via PTs and other USDe-backed assets to 43.5%, highlighting the protocol’s growing exposure to Ethena and its collateral base and on-chain dynamics.

This influx of PT driven collateral has also triggered a notable second order effect on stablecoin utilization across the Aave Core instance. Beginning in early May, coinciding with the onboarding of USDe backed PTs, utilization rates for major stablecoins such as USDT and USDC rose significantly, from the 60–70% range to above 80–90%. The impact was even more pronounced for less utilized stablecoins like USDs and USDe, which experienced sharp utilization spikes.

Risks

A. On-Chain Risks Impacting Aave

While Aave’s exposure to Ethena-based assets has grown rapidly, this growth brings with it specific on-chain risks unique to how these assets function within the protocol. These risks stem from the structural characteristics of PTs, user behavior involving leverage and rehypothecation, and liquidity concentration. The following subsections outline the key on-chain risks facing Aave and the mechanisms in place to mitigate them.

1. PT Liquidity Risk

Risk

One of the concerns surrounding PTs is their limited and highly concentrated liquidity, which is entirely dependent on Pendle’s AMM infrastructure. Unlike more liquid stablecoin assets, PTs cannot be redeemed on demand, they are inherently locked until maturity and tradable only through Pendle’s secondary market. As PTs gained traction on Aave as collateral, their total supply increased, driven by leveraged loop strategies. This raises a systemic concern: in the event of a sudden repricing of the underlying yield (e.g. a sharp increase in implied APY), the available liquidity in Pendle may be insufficient to support rapid deleveraging or mass liquidations.

Pendle’s AMM is based on a custom design tailored for fixed-yield assets, where liquidity is concentrated within a defined yield range. The pool mechanics allow trading within a specific implied yield corridor. Once market yields move outside of this supported range, either through drastic demand shifts or sharp underlying rate repricing, the AMM becomes inactive. At this point, trading must migrate to Pendle’s external order book, which is often illiquid or sparsely populated, especially for less widely held assets.

This exact dynamic played out in the USD0++ market, where the implied yield temporarily spiked above the AMM’s supported range. As a result, the PT traded at its minimum price on the AMM, with no viable pathway for efficient execution or exit via the pool. This exposed the limitations of the AMM in handling extreme market conditions and left users reliant on thin order book liquidity, exacerbating slippage and impairing the viability of timely liquidations.

This phenomena underpins the need for strict risk oracle protections and risk parameters to ensure the protocol remains insulated from dislocations in Pendle’s fixed yield markets.

Mitigation via Risk Oracle

To address this structural liquidity concern, Aave employs a dedicated risk oracle system for PT assets, as covered in detail in our PT Risk Oracle research post here. A critical safety feature of this system is the minimum price threshold embedded in the oracle logic, along with a “killswitch” mechanism.

The minimum price threshold used by the risk oracle is derived directly from the structure of the Pendle AMM. Specifically, every Pendle market is initialized with a fixed liquidity yield range, which determines the maximum and minimum implied APYs that the AMM can support. This range is immutable and sets the boundaries for how the PT price can trade within the AMM.

Based on this structure, Chaos Labs derives the MAX_DISCOUNT_RATE_PER_YEAR, which represents the maximum allowable discount rate (i.e., the highest implied yield) that a PT can reach within the Pendle AMM. For a detailed explanation of how this parameter is derived, please refer to Chaos Labs’ analysis of the pricing algorithm here. The minimum price of a PT is then computed using this rate and the remaining time to maturity of the PT. This ensures that the minimum valuation used by the risk oracle is aligned with the lowest theoretical price at which the PT can be traded in the Pendle AMM under normal conditions.

Moreover, the risk parameters of a given PT are defined via a mathematical inequality that ensures the underlying reserve remains immune to the accrual of protocol-level bad debt under all realizations of PT-induced price volatility. This guarantee is established by explicitly bounding adverse price dislocations through deterministic state transitions of the AMM and incorporating variance metrics computed from the minimum achievable PT price. This implies that, in instances where the underlying anchor asset of the PT aligns with the debt asset, bad debt cannot explicitly accrue via collateral depreciation, such as USDe collateralization via USDe-denominated PTs. The full derivation and formalism of this constraint framework are presented in the accompanying paper.

If the PT market price falls below this floor, the risk oracle sets the LTV ratio to zero, effectively freezing the market. This prevents any new borrowing activity and halts further debt issuance against PT collateral at distressed pricing levels.

This design serves several protective functions:

- It prevents bad debt accrual by ensuring no new debt is issued against overpriced positions.

- It halts arbitrage opportunities that could exploit differences between market and oracle prices.

- It protects the protocol from unbounded interest rate spikes, which would otherwise occur if users continued borrowing while the collateral pricing no longer reflects market conditions.

In scenarios where the PT’s price drops below the oracle minimum due to market stress and remains there, the market may remain frozen until maturity. At that point, the PTs naturally resolve into underlying assets, allowing any remaining positions to be liquidated or unwound safely. This configuration ensures that Aave is insulated from the liquidity and price dislocation risks inherent to Pendle’s fixed-term structure, while still enabling users to benefit from yield-bearing PTs in normal market conditions.

Impact

In the event of a sudden repricing caused by sharp movements in implied yield, Aave is protected by the risk oracle’s safeguards.

As long as the repricing is isolated to changes in implied yield, without any underlying loss in the backing of underlying asset (i.e USDe), Aave remains protected and does not accrue bad debt. The oracle freeze prevents overvaluation based borrow activity.

However, if the repricing event is tied to a broader failure or impairment of USDe’s backing, the protocol could still face downstream credit risk. In such a scenario, the PT markets would freeze as the oracle sets the LTV to zero. Users would attempt to unwind their leveraged USDe and PT positions, triggering exit pressure across markets.

Since USDe and PTs are priced relative to USDT, the impairment in backing would not be immediately reflected in price feeds. Aave would likely wait to assess the magnitude of the loss before updating the oracle. During this delay, the price of USDe could decline, with the system able to tolerate losses up to the threshold defined by 1/(1 + LB) relative to the LTV of the lowest health score position, before incurring bad debt.

If the price drop exceeds this threshold, Aave may set the liquidation bonus to zero to internalize liquidations and reduce the risk of cascading insolvencies before repricing the asset. Collateral would then be unwound in stages: USDe may be sold on secondary markets as liquidity recovers, while PTs would need to be held to maturity before redemption. Ideally, Aave would avoid fire sales by becoming a whitelisted redeemer in the Ethena ecosystem, allowing for more orderly and direct unwinding of exposure.

These backing-related risks, such as exchange failure, custodian failure, or negative funding imbalances, are addressed in detail in the subsequent section on Backing-Related Risks Impacting USDe and Aave.

2. USDe Liquidity Risks

USDe Supply Concentration Risk

A significant portion of the USDe supplied to Aave is concentrated among a small number of participants. As of the latest data:

- Abraxas Capital controls approximately 36% of all USDe deposits on Aave

- FBG Capital controls approximately 25%

Together, these two entities account for over 61% of the USDe supply base on Aave. It is important to note that this concentration has declined from a peak of 93% in mid-May, the current level of concentration still poses a risk to market stability.

USDe Rehypothecation Risk

What compounds this risk is that many of these large suppliers are highly leveraged, participating in looping strategies that involve supplying USDe, borrowing USDT (or other stables), purchasing more USDe, and repeating the cycle. This rehypothecation loop amplifies Ethena point farming rewards but also amplifies the risk profile of the USDe market.

USDe Liquidity Risk

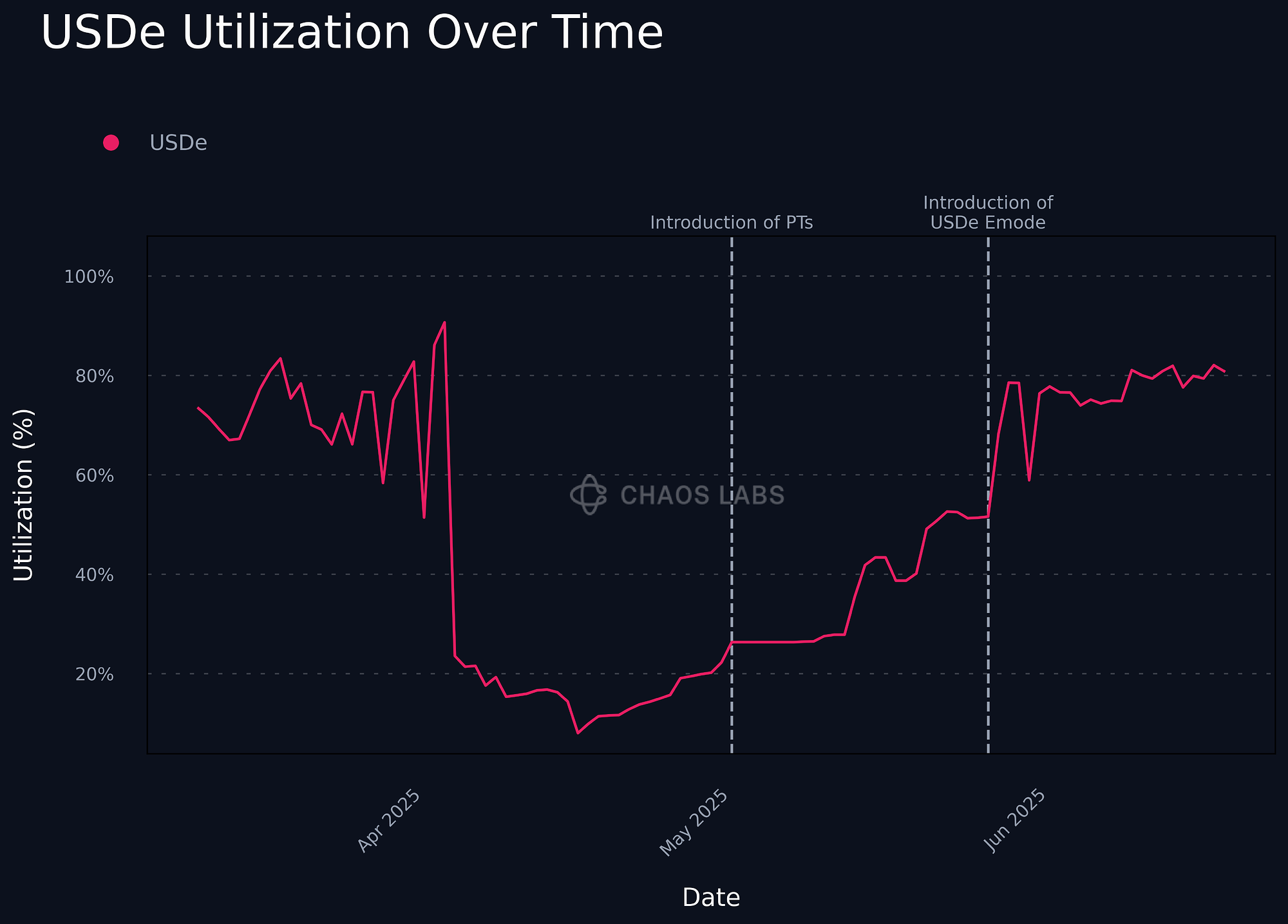

Borrowing activity for USDe has accelerated in recent months. The chart below illustrates the historical growth in USDe borrow amounts, highlighting a marked increase following the introduction of USDe eMode for PT collateral in late May. This configuration made USDe a preferred debt asset for PT loopers due to favorable risk parameters tied to correlated collateral exposure. As a result, total USDe borrowing has reached approximately $370 million, with around $220 million (60%) directly linked to leveraged PT farming strategies.

This surge in borrowing has had a direct impact on USDe’s utilization rate. As shown in the chart below, utilization climbed from approximately 50% before May to levels consistently around 80%. This tightening of borrow side liquidity underscores the growing reliance on USDe as a core component of leveraged strategies.

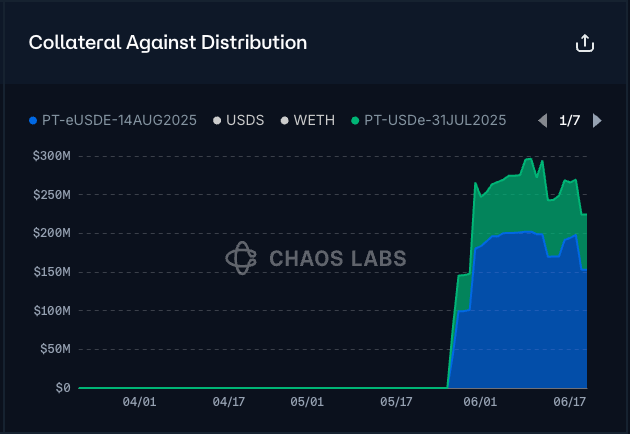

This $220 million in borrowings is distributed primarily across two PTs:

- ~$152 million USDe borrowed against PT-eUSDe-14Aug

- ~$71 million USDe borrowed against PT-USDe-31Jul

The corresponding on-chain liquidity in Pendle pools is highly uneven. While PT-eUSDe-14Aug has roughly $115 million in liquidity, PT-USDe-31Jul only has around $4.15 million. This creates an imbalance in exit liquidity during times of stress.

Impact

In the event that either of these large USDe suppliers begins to unwind their positions, whether due to a strategy change, internal capital constraints, or market conditions, it would trigger a contraction in USDe supply on Aave. This would drive utilization sharply higher, increasing borrow rates, and make leveraged PT positions unprofitable. PT-eUSDe-14Aug loopers may have enough liquidity to unwind without major disruption, but PT-USDe-31Jul loopers would likely be unable to exit due to insufficient on-chain liquidity. This rush to unwind leveraged PT positions, particularly those with inadequate on-chain liquidity, would push the PT price toward its oracle floor, trigger a risk oracle freeze, and likely result in negative yields. These stuck leveraged positions would not only be unable to repay their USDe debt, but would also prevent USDe suppliers from withdrawing, creating further stress on Aave’s liquidity layer.

It is important to highlight that the covered risk in this section is not a fundamental impairment of USDe’s backing but rather a localized shift, such as a large USDe supplier reallocating capital or changing strategy. In such a case, elevated supply APYs and rising PT yields would likely attract new liquidity. It is reasonable to expect that market participants would respond to the changing incentives, leading to new USDe deposits into Aave or fresh demand for PT tokens, thereby helping to restore balance.

In this more probable scenario, Aave may experience temporary stress, but the market would gradually find a new equilibrium as users respond to the updated yield landscape. Until that equilibrium is reached, protocol mitigation measures help contain systemic risk and maintain stability.

Mitigation Measures

Aave manages these risks primarily through conservative risk parameter settings. USDe’s optimal utilization rate is calibrated at 80%, which is lower than that of major stablecoins like USDC or USDT. This more cautious configuration provides additional headroom before borrowing rates begin to rise steeply, allowing the system more time to react to changes in market conditions or stress events triggered by concentrated withdrawals or deleveraging.

To prevent bad debt accrual in the event of sudden USDe outflows, Aave also relies on its dedicated PT risk oracle. As described in the previous risk section, this oracle includes a minimum price threshold that, when breached, freezes the market and halts further borrowing against distressed PT collateral. This mechanism ensures that borrowers cannot take on new debt against overvalued collateral during periods of price dislocation.

Additionally, Aave offers a Debt Swap feature that allows users to convert their debt from one asset to another. In the context of USDe liquidity stress, users holding USDe-denominated debt may choose to swap it for another stablecoin such as USDC or USDT to avoid high borrow rates. However, there are current limitations related to E-mode configurations:

- USDe is not yet available as a debt asset in PT stablecoin E-modes.

- Currently, all PT/USDe positions operate in the USDe E-mode as it is the only available option. Once USDe is added to the stablecoin E-mode, users can technically migrate by partially unwinding a small portion of their position to meet the required LTV threshold. However, most positions are still expected to remain in the USDe E-mode due to its superior capital efficiency.

For users in the PT stablecoin E-mode, the Debt Swap feature works efficiently using flash loans and on-chain liquidity, enabling smooth transitions between stablecoin debt assets. But for users operating in the USDe E-mode, executing a debt swap requires first reducing their LTV ratio below the threshold of the destination E-mode (i.e. PT stablecoin E-mode), then switching E-modes and performing the swap. This additional step introduces some friction but still offers a viable escape path during market stress events.

Looking ahead, USDe is expected to be integrated into PT stablecoin E-modes, which would enhance the usability of the Debt Swap feature for all PT/USDe users and reduce barriers to shifting away from USDe debt in volatile scenarios.

B. Backing-Related Risks Impacting USDe and Aave

Before examining the individual risks associated with USDe’s backing, it is important to understand how the composition of USDe’s collateral base has evolved in response to shifting market dynamics. Ethena’s backing model is adaptive, adjusting its collateral mix based on prevailing market conditions, particularly funding rates in the perpetual futures markets.

During periods of elevated funding rates, Ethena relied more heavily on delta-neutral strategies, where short perpetual positions served as a hedge against spot crypto holdings secured through off-exchange custody service providers.

However, as funding rates across major venues began to decline in Q1 2025, the protocol gradually increased its reliance on stablecoins to maintain USDe’s backing. At one point, the stablecoin backing reached as high as 76.3% around mid-May. Since then, it has gradually decreased and is now hovering around 50%, still significantly higher compared to levels observed prior to 2025.

In addition to the shift in composition toward stablecoins, the custody model for these assets also matters when evaluating risk exposure. The chart below shows how Ethena’s stablecoin reserves are distributed across custody types:

- Over 95% of the stablecoin collateral, representing nearly 50% of the total backing, is held outside the scope of centralized exchanges and off-exchange settlement providers.

- The remaining portion is delegated to exchanges via off-exchange custodians, primarily to support delta-neutral strategy operations involving linear perpetual contracts. Since linear contracts are settled in USDT, Ethena maintains a small stablecoin buffer on exchanges to meet periodic settlement obligations tied to unrealized PnL.

The composition of these stablecoins held in on-chain custody as part of USDe’s backing has undergone notable changes since early 2025. The chart below illustrates the historical distribution of stablecoin types that are backing USDe, representing assets held outside the jurisdiction of centralized exchanges and off-exchange settlement providers.

When Ethena began increasing its stablecoin exposure in February 2025, sUSDS dominated the collateral mix for a while, making up over 80% of the onchain stablecoin backing during late Q1. Over time, this allocation shifted as Ethena diversified the stablecoin base. The dominance of sUSDS declined and was gradually replaced by USDtb and USDC.

As of the most recent data:

- USDtb constitutes approximately 50% of the onchain stablecoin backing

- USDC accounts for about 35%, the majority held in Coinbase wallets to earn yield

USDtb was added as a supported asset to Ethena’s mint and redeem contracts before it was introduced into the collateral portfolio, allowing it to be used directly for the minting and redemption of USDe. While USDtb has relatively limited on-chain liquidity (around $20 million), its redemption operates through an RFQ system that enables select whitelisted addresses to redeem it for USDC on-chain. This mechanism provides a secondary pathway for liquidity access despite the limited public liquidity.

This shift toward a more stablecoin heavy collateral composition introduces a different risk profile compared to the earlier market structure, where the primary exposure was to exchange and custodians. The following subsections explore the key risks associated with this evolving collateral base and its potential implications for Aave, which now holds a substantial portion of USDe and USDe-linked assets on its balance sheet.

1. Exchange Failure Risk

Risk

Ethena’s delta neutral strategy depends on perpetuals positions executed on centralized exchanges to hedge the directional exposure of its crypto asset backing. This creates an operational reliance on exchange infrastructure, introducing a distinct form of risk known as exchange failure risk. In the event of a sudden exchange outage or collapse, Ethena’s ability to maintain effective hedging may be temporarily disrupted, placing pressure on both the integrity of its risk management and the stability of its collateral base.

To minimize this exposure, Ethena does not custody backing assets on centralized exchanges. Instead, it utilizes off-exchange settlement providers such as Copper and Ceffu, which allow the protocol to maintain margin accounts and execute trades without directly placing collateral on the exchange. This model significantly reduces solvency risk. Should an exchange become unresponsive, the main challenge is the potential inaccessibility of unrealized positive PnL that remains unsettled. While this PnL remains legally Ethena’s, it may not be immediately withdrawable or re-delegated. Recovery would depend on custodial settlement procedures or, in adverse cases, bankruptcy resolution processes.

Importantly, these off-exchange custodians have the ability to nullify positions on failed venues after a predefined number of missed settlement rounds. Nullification treats the open derivative contracts as closed at their last reconciled state, releasing the associated collateral for redeployment on other venues to restore delta neutrality.

Ethena faces a critical decision in the event of an exchange failure: it can either wait for the custodian to formally nullify the positions and then re-establish hedges using the released collateral, or it can act preemptively by increasing leverage on other exchanges. The latter option involves using unallocated stablecoins or converting spot crypto assets to stablecoins as margin to initiate offsetting short positions elsewhere. This allows Ethena to maintain hedging coverage, but introduces temporary leverage risk.

In either case, there is a window of vulnerability between the initial failure and the re-establishment of full delta neutrality. The financial impact during this window depends on the direction and magnitude of price movements, as well as the timeliness and accuracy of custodial nullification.

Mitigation Measures

Ethena and Aave employ several safeguards to mitigate the risks associated with exchange failure:

-

No Custody on Exchanges

Ethena does not hold any backing assets directly on centralized exchanges. Instead, it uses off-exchange settlement providers such as Copper and Ceffu. These providers handle the delegation of margin to exchanges to open and maintain perpetual futures positions while keeping the underlying collateral off-platform.

-

Position Rolling to Gradually Realize PnL

To reduce prolonged exposure to exchanges and realize PnL over time, Ethena passively rolls its open positions across venues. This approach helps realize PnL periodically but does not eliminate counterparty exposure at each settlement interval.

-

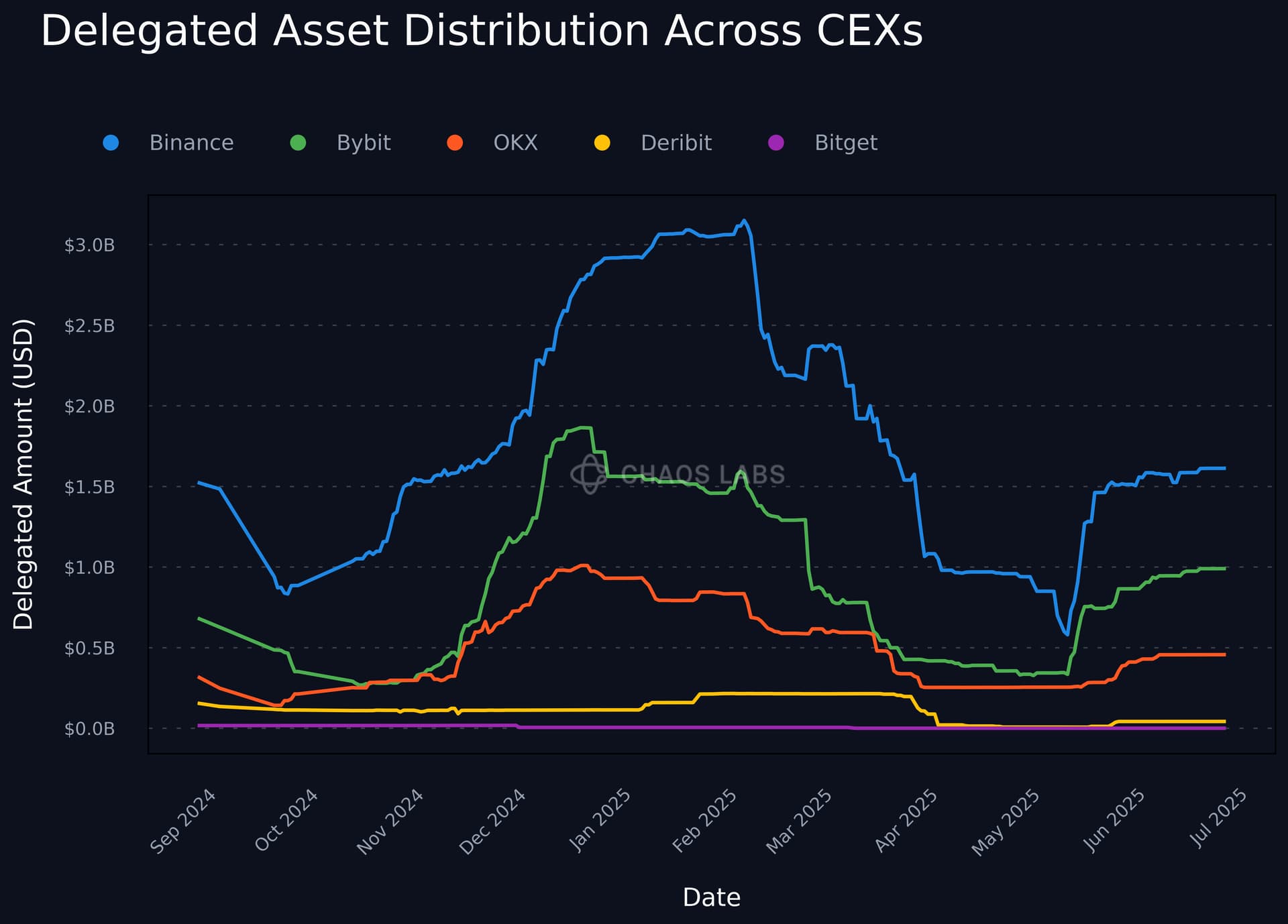

Exchange Diversification

Ethena diversifies its hedging activity across multiple exchanges to avoid concentration risk. Historical data indicates that the majority of delegated exposure is allocated as follows: Binance: 50 - 65%, Bybit: 15 - 30%, OKX: 10 - 15%.

Bitget and Deribit have been used occasionally, but recent delegations to these venues have become negligible. Ethena’s core hedging operations are concentrated among the three major exchanges: Binance, Bybit, and OKX.

- Position Nullification by Custodians

In the event of exchange failure, Ethena’s off-exchange settlement providers can nullify open positions after a set number of missed settlement rounds: two in the case of Copper.

Nullification allows the protocol to treat these positions as closed at their last reconciled state, removing exposure to further losses and enabling the immediate redeployment of collateral to re-establish delta neutrality on another exchange. This mechanism is critical to limiting realized loss and shortening the unhedged window during exchange disruption events.

-

Aave Internalizing Liquidations

In the event of collateral impairment, Aave can internalize liquidations by setting the liquidation bonus to zero for USDe-based positions, such as USDe/stablecoin and PT-USDe/stablecoin pairs, prior to updating oracle prices. This approach creates a buffer that enables the system to absorb additional price declines without accruing bad debt. The buffer is especially valuable when the price of USDe falls to a level where the LTV of the highest risk position begins to exceed the bad debt threshold defined by

1/(1+LB). -

Direct Redemption Access via Whitelabel Integration

Aave can explore becoming a whitelisted USDe redeemer within the Ethena ecosystem. This would allow Aave to redeem USDe directly for backing assets instead of selling on secondary markets, reducing slippage and price impact during stressed conditions. Such an integration would enhance Aave’s resilience and improve exit pathways in scenarios where on-chain liquidity is impaired.

Impact

While the nullification mechanism helps preserve the integrity of the backing, it introduces a temporary window during which Ethena’s ability to access unrealized PnL is constrained. If prices move unfavorably during this delay, the unrealized profit on affected positions may become temporarily inaccessible until the custodian either settles balances with the exchange or initiates recovery through legal proceedings.

The actual impact, therefore, depends on two key factors:

- Price direction and volatility during the settlement delay

- Timing of the custodian’s nullification decision

This dynamic creates an inherent trade-off between acting early to hedge and waiting for confirmation from the custodian. The earlier Ethena acts, the more it reduces exposure duration, but it also takes on additional leverage, introducing potential liquidation risk if prices move unfavorably before the original positions are nullified.

To better understand the real-world implications of an exchange failure, we evaluate several hypothetical scenarios that explore how Ethena’s hedging posture and custodian response timing interact with price volatility. These scenarios illustrate the range of potential outcomes based on different assumptions, such as whether Ethena waits for custodial nullification or preemptively re-establishes hedges, and whether market prices rise or fall during the exposure window. Each scenario quantifies how these variables could affect USDe’s collateral backing and what downstream impact that might have on Aave’s exposure.

Scenario 1: Ethena Waits for Custodian to Nullify Positions (Price Decreases)

Scenario Description:

In this scenario, a centralized exchange suffers a critical failure, rendering it unresponsive and halting normal settlement operations. Ethena, which has open short perpetual positions on the affected venue, does not immediately take action to re-hedge elsewhere. Instead, it waits for its off-exchange settlement provider (e.g., Copper or Ceffu) to officially classify the venue as failed and nullify the affected positions.

The nullification process is triggered only after a predefined number of missed settlement rounds, typically two rounds for Copper. During this window, Ethena’s open notional on the failed exchange becomes unhedged while the spot crypto assets remain held by its off-exchange settlement provider. As a result, the protocol is exposed to directional price movements in the underlying assets.

Any adverse price movement that occurs during this settlement delay may result in unrealized PnL that becomes temporarily inaccessible. While this PnL remains legally Ethena’s, it may not be immediately withdrawable or re-deployable. The custodian will first attempt to settle the balances with the exchange; if unsuccessful, recovery would depend on the outcomes of bankruptcy proceedings. Once the custodian formally nullifies the positions, the underlying collateral is released and Ethena can reallocate it to functioning venues to re-establish delta neutrality. Until then, the inability to access unrealized profits may create a temporary shortfall in backing.

This scenario represents the most conservative posture: Ethena does not intervene early and instead relies on its custodians’ formal processes. The total impact on USDe’s backing depends on two variables: (1) the size of collateral delegated to the failed exchange and (2) the magnitude of the price decline during the delay window.

Impact on USDe Backing:

Ethena maintains a $61 million reserve fund designed to absorb collateral losses arising from events such as exchange failures. This reserve functions as a first-loss buffer, shielding USDe’s backing from minor to moderate market dislocations. If the loss incurred during a custodian nullification window remains within this threshold, the backing of USDe remains fully intact and Aave’s exposure is not impacted.

However, in cases of sustained price declines during the exposure window, Ethena may face temporary inaccessibility of positive PnL held on the failed exchange. If this unrecoverable portion exceeds the reserve capacity, it could result in a shortfall in accessible backing. Once the $61 million threshold is surpassed, the deficit begins to erode the effective collateral backing of USDe. The degree of this impact depends on both the percentage of collateral delegated to the failed exchange and the magnitude of the price drop during the nullification delay.

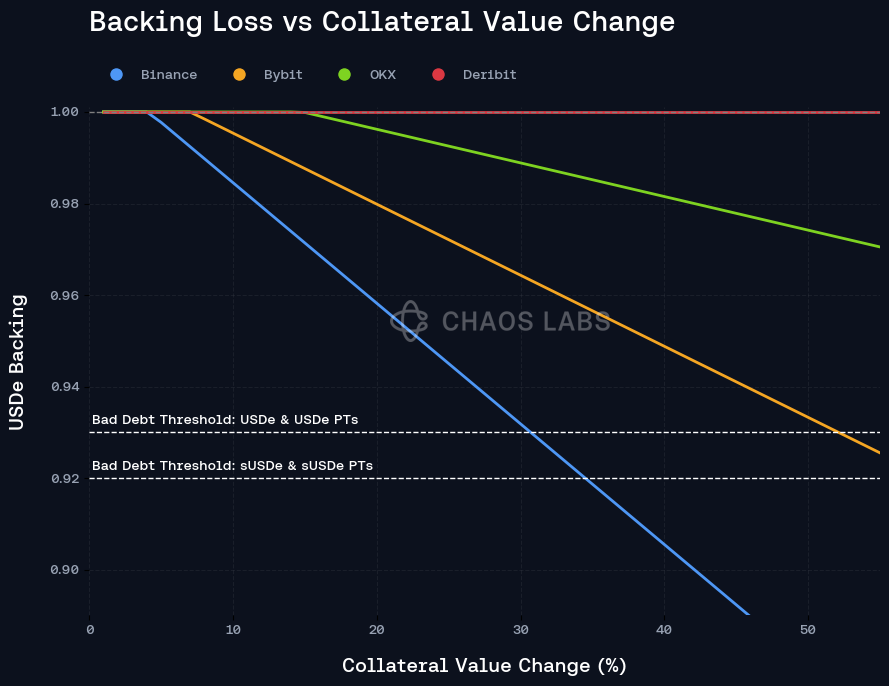

The chart below illustrates the deterioration of USDe’s effective collateralization as a function of price decline for each major exchange. The x-axis shows ETH/BTC price drop percentages, while the y-axis represents the resulting USDe backing.

To quantify these effects, the following table presents the expected loss in USDe backing under different price drops, along with the threshold price decline needed to fully deplete the reserve fund, and begin accruing bad debt on Aave if liquidations are internalized:

| Exchange | Backing Loss @ 5% Price Drop | Backing Loss @ 10% Price Drop | Backing Loss @ 15% Price Drop | Price Drop to Exceed Reserve Fund | Price Drop to Incur Bad Debt |

|---|---|---|---|---|---|

| Binance | 0.23% | 1.6% | 2.97% | 5% | 31% |

| Bybit | 0% | 0.48% | 1.28% | 8% | 53% |

| OKX | 0% | 0% | 0.011% | 15% | N/A |

Implications for Aave:

In the event of a major exchange failure, the most immediate impact is often observed in secondary market pricing. USDe’s price is likely to react swiftly and disproportionately, reflecting fear and volatility before any actual losses to its backing materialize. During this early phase, it is critical for Aave to closely monitor the situation and assess the magnitude of the impairment. While PTs would automatically be frozen by the PT risk oracle if their prices fall below the minimum floor, Aave should proactively freeze USDe markets until the extent of the backing loss is verified to prevent users from borrowing against potentially overvalued collateral. This could be achieved via the introduction of a dedicated USDe risk oracle that triggers a freeze when backing impairment is detected.

Given that the pricing of USDe and PT assets is based on the USDT oracle, transient secondary market volatility does not immediately affect the protocol’s collateral valuations. This oracle lag acts as a natural buffer, reducing the risk of premature liquidations driven by temporary price dislocations rather than actual solvency concerns. This also buys Aave some time to measure the impact of the failure on USDe’s backing and determine the appropriate next steps.

However, the unfolding stress would still trigger behavioral effects. USDe/stablecoin loopers would likely rush to unwind their positions, selling USDe on secondary markets in anticipation of further declines. Similarly, PT holders may attempt to exit their leveraged strategies. Both cohorts would face liquidity constraints; USDe and PTs have limited on-chain liquidity, and these exit attempts would likely exceed what the market can absorb in a short time frame. As a result, many positions could become trapped, unable to deleverage, while also pressuring utilization rates of USDe on Aave.

Once Aave has a clearer understanding of the backing impairment, for example following a custodian’s nullification of open positions, the protocol can proceed with oracle repricing of USDe assets. At this stage, Aave must evaluate the effective LTV ratios across positions to determine whether repricing will trigger bad debt.

If the price of USDe declines such that the effective LTVs of the weakest positions exceed the threshold defined by 1/(1+LB), Aave would accrue bad debt. With the current configuration, this point is reached if USDe’s backing declines by more than approximately 4%. This would be the case, for example if Binance were to fail and ETH/BTC dropped more than 20%, resulting in a backing impairment of around 4%.

To mitigate the formation of bad debt in such a case, Aave could choose to internalize liquidations by setting liquidation bonuses to zero. This mechanism gives the protocol additional breathing room: instead of bad debt accruing at a 4% loss threshold, the system could tolerate a backing loss of approximately 7% before entering bad debt territory. In the Binance failure scenario, this means that ETH/BTC prices would need to decline more than 31% before Aave begins accruing bad debt. This extra buffer could be critical in managing liquidation flows and preserving solvency under extreme market conditions.

To illustrate the relationship between collateral value declines and bad debt accrual across different exchanges, the chart below plots bad debt accumulation on Aave as a function of ETH/BTC price drops, under the assumption of exchange failure. Each line represents one exchange (Binance, Bybit, OKX) and shows the corresponding scale of bad debt as prices fall.

Following repricing and internalized liquidations, Aave would begin receiving collateral in the form of liquidated assets, primarily PT tokens, USDe, and sUSDe. For PT tokens, which are non-redeemable until maturity, the protocol can simply hold them and wait for their natural resolution. This approach avoids immediate forced sales and allows the PTs to mature into the underlying USDe without incurring slippage or liquidity risk.

For USDe and sUSDe, selling USDe into secondary markets is feasible if liquidity has recovered and a new equilibrium price has been established, but such sales would still carry meaningful slippage and price impact.

A more efficient and less disruptive approach would be for Aave to become a whitelisted participant in Ethena’s mint and redeem contracts. As a whitelabeled redeemer, Aave could bypass the secondary market entirely and redeem USDe directly for its underlying stablecoin collateral. This mechanism would not only reduce market stress but also maximize recovery value for the protocol by avoiding execution in thin or volatile markets.

Probability of Price Decreasing Enough to Trigger Bad Debt

To quantify Aave’s risk exposure in the event of a centralized exchange failure, we assess the likelihood that ETH prices decline enough during the unhedged window to cause USDe’s backing to deteriorate beyond the 7% threshold. Crossing this threshold would result in Aave accruing bad debt, even after internalizing liquidations.

To estimate these probabilities, we rely on Monte Carlo simulations of ETH price paths, calibrated using historical volatility and return distributions. These simulations model tens of thousands of potential price trajectories to capture extreme but plausible tail outcomes.

We use each exchange’s nullification window — the expected period between failure and when the custodian formally nullifies positions — to measure exposure duration. For each venue, we determine the required ETH price drop that would push Ethena’s backing loss above the 7% threshold and then compute the corresponding probability from the Monte Carlo distribution.

The table below summarizes these results:

| Exchange | Nullification Window | Required Price Drop to Trigger Bad Debt | Price Drop Over Nullification Window (p99) | Probability ETH Drops Enough to Trigger $1 in Bad Debt |

|---|---|---|---|---|

| Binance | 48 hours | 31% | 17.04% | <0.1% |

| Bybit | 4 hours | 53% | 4.16% | <0.01% |

| OKX | 8 hours | N/A | 6.52% | N/A |

As the data indicates, even under conservative assumptions calibrated to historical volatility, the likelihood of ETH declining enough to trigger bad debt during the nullification window remains extremely low across all venues.

Scenario 2: Ethena Waits for Custodian to Nullify Positions (Price Increases)

Scenario Description:

In this scenario, a centralized exchange experiences a failure, rendering it unresponsive and halting normal settlement operations. Ethena, which has short perpetual positions on the failed venue, does not take immediate action but instead waits for the off-exchange custodian (e.g. Copper or Ceffu) to nullify the open positions. During the delay period between the failure and nullification, prices of the underlying crypto assets increase.

Impact on USDe Backing:

There is no loss of backing in this case. Since Ethena is unhedged during a price increase, it stands to benefit financially from the appreciation of its spot crypto collateral. The unrealized PnL, which remains unsettled during the delay window, ultimately accrues to Ethena when positions are nullified, resulting in a net positive effect on USDe’s backing. While secondary market prices for USDe may experience short-term volatility during the event, the protocol’s underlying solvency and collateralization remain intact or even improve.

Implications for Aave:

There are no negative implications for Aave. Backing remains fully intact or improves, and risk of bad debt is nonexistent. While secondary market volatility may cause short-term fluctuations in USDe pricing, Aave’s pricing mechanism, which relies on a USDT-based oracle, insulates the protocol from this noise. Given that exchange failures typically coincide with downward market moves, this scenario is considered low probability. However, even if it occurs, neither Ethena nor Aave is expected to experience adverse effects.

Scenario 3: Ethena Hedging Early Before Custodian Confirmation (Price Decreases)

Impact on USDe Backing:

In this scenario, where Ethena preemptively re-establishes hedges using available stablecoins or spot-converted margin before custodial nullification is confirmed, it can materially reduce the realized loss incurred during a window of unhedged directional exposure. This strategy effectively restores delta neutrality shortly after failure is detected, limiting the extent of directional risk if ETH or BTC prices fall.

If re-hedging is completed swiftly and efficiently, the backing loss can be contained well below the reserve fund threshold. Even if prices decline during the execution window, early action ensures that losses accrue only over a short interval, preserving the integrity of USDe’s backing. Unlike the approach in Scenario 1, where Ethena absorbs full unrealized losses during the nullification delay, this proactive approach allows the protocol to cap downside risk and prevent deep erosion of collateral. If Ethena is wrong and the custodian is right, meaning the exchange did not actually fail, then the newly opened hedges can be unwound, and the system can revert back to its original state with minimal disruption.

Implications for Aave:

From Aave’s perspective, this proactive hedging strategy by Ethena reduces tail risk associated with exchange failure. By closing the unhedged exposure window early, the probability that USDe’s backing deteriorates beyond Aave’s bad debt threshold is significantly diminished.

Moreover, proactive hedging improves protocol optics during market stress. The ability to maintain delta neutrality and preserve backing despite exchange failure reinforces confidence in USDe’s resilience, reducing the chances of secondary market depegs or liquidity-driven panic unwinds that could propagate to Aave.

That said, Aave must remain vigilant in monitoring real-time backing metrics during such events. However, compared to the passive strategy in Scenario 1, this approach provides Aave with greater margin for safety and reaction time.

In summary, Ethena’s decision to hedge early under exchange failure materially reduces Aave’s exposure to directional volatility and credit impairment and should be considered as a mitigation pathway in the absence of timely custodial resolution.

Scenario 4: Ethena Hedging Early Before Custodian Confirmation (Price Increases)

Scenario Description:

In this scenario, a centralized exchange suffers a failure, prompting Ethena to take proactive steps before the custodian formally nullifies the affected positions. Anticipating potential losses due to unhedged directional exposure, Ethena re-establishes delta neutrality by deploying available stablecoins or spot converted ETH/BTC as margin to open new short positions on operational exchanges.

This approach effectively restores hedge coverage, but it introduces temporary leverage. Until the custodian nullifies the original short positions on the failed exchange and releases the associated collateral, Ethena operates with elevated leverage across surviving venues. During this window, Ethena faces increased liquidation risk if prices move unfavorably.

In the rare event that ETH or BTC prices rise sharply during this period, the added leverage could bring Ethena closer to liquidation thresholds, particularly if MMRs are high and the amount of stablecoin margin available is limited. This scenario therefore represents a downside tail event: Ethena acts early, expecting a price decline, but instead faces a sharp rally while operating with elevated leverage.

Impact on USDe Backing:

The primary risk to USDe’s backing in this scenario stems from liquidation of the short positions before the custodian releases the original margin. If ETH or BTC prices increase significantly, Ethena’s re-hedged positions could trigger liquidation on certain venues, depending on the leverage profile and collateral mix.

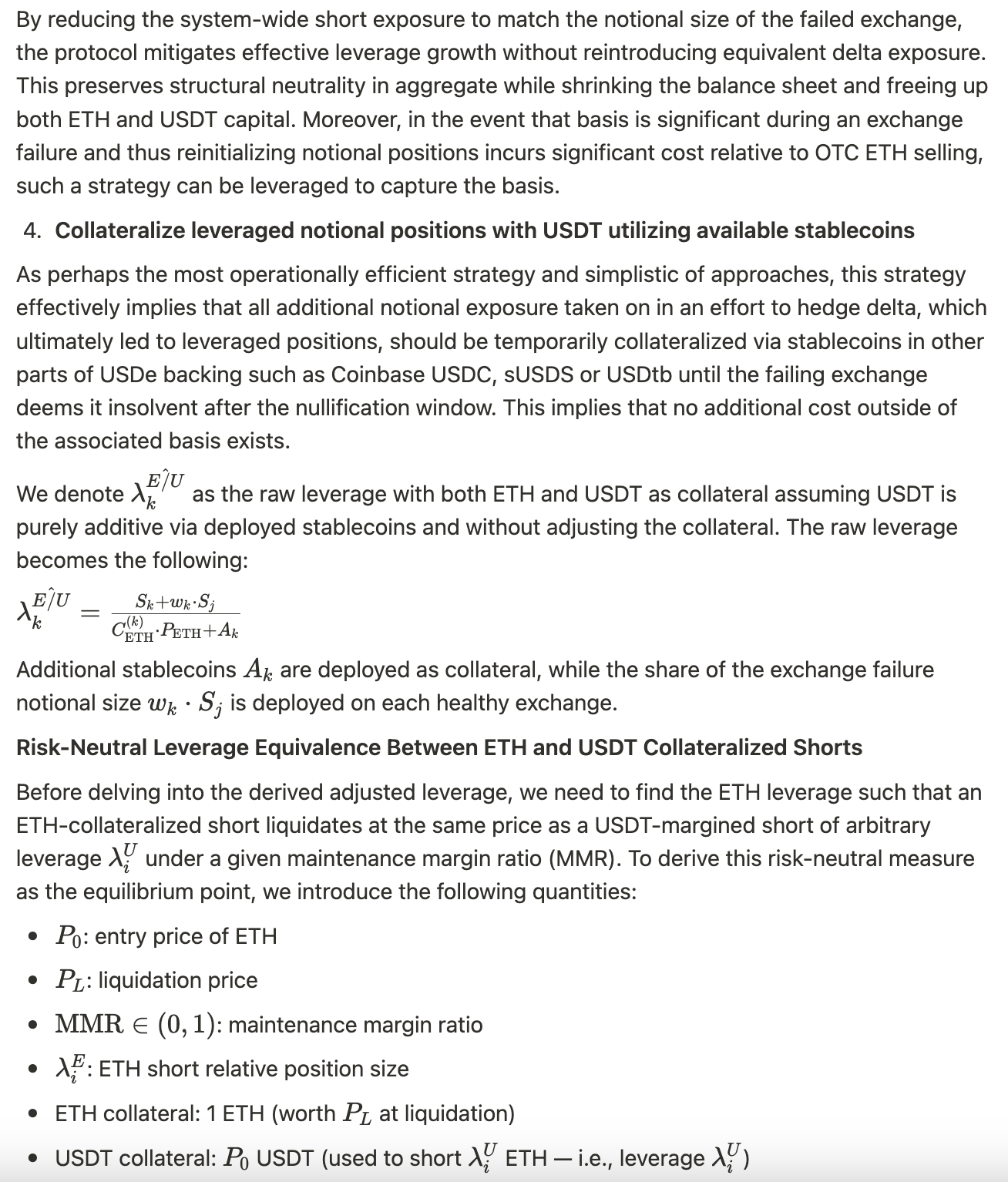

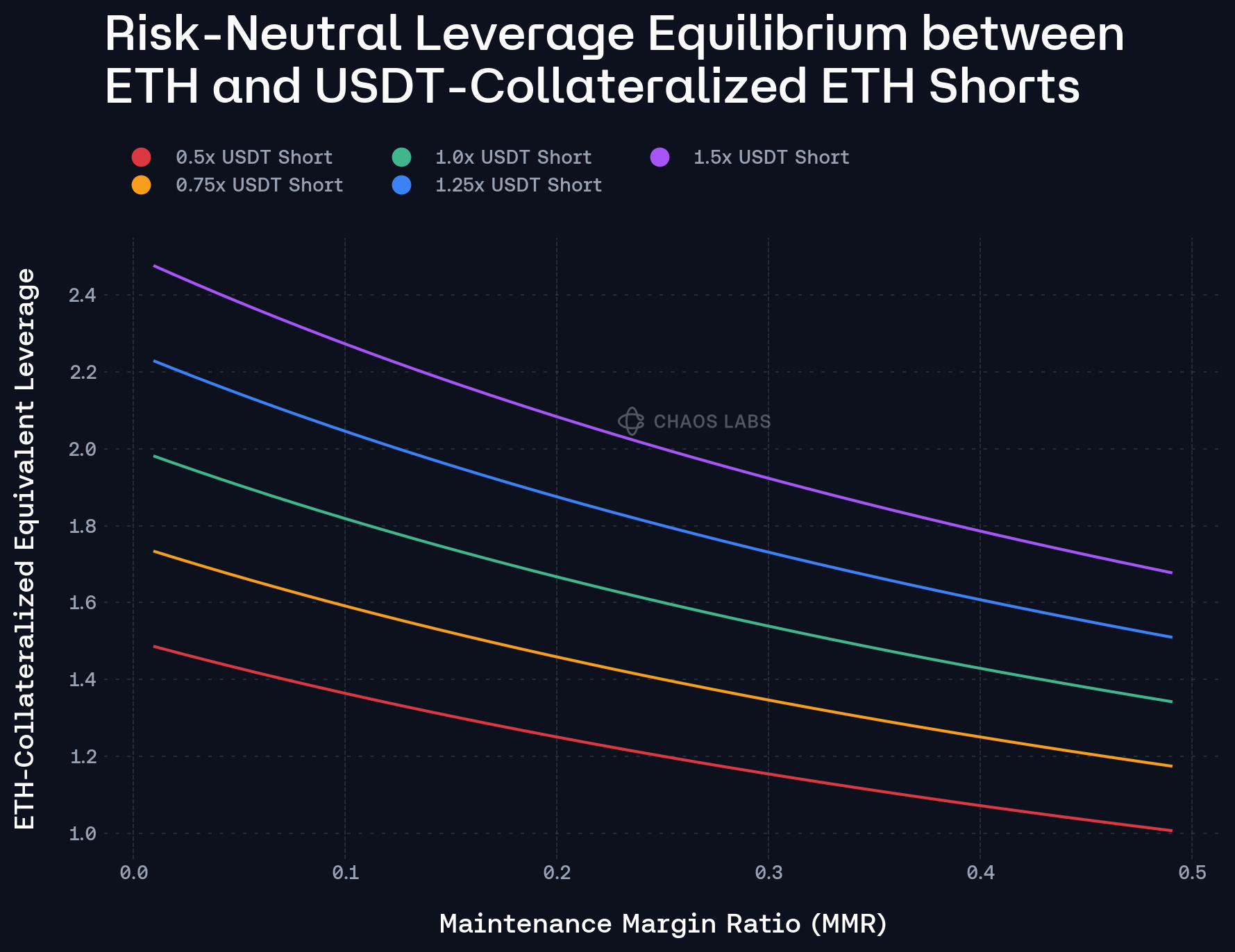

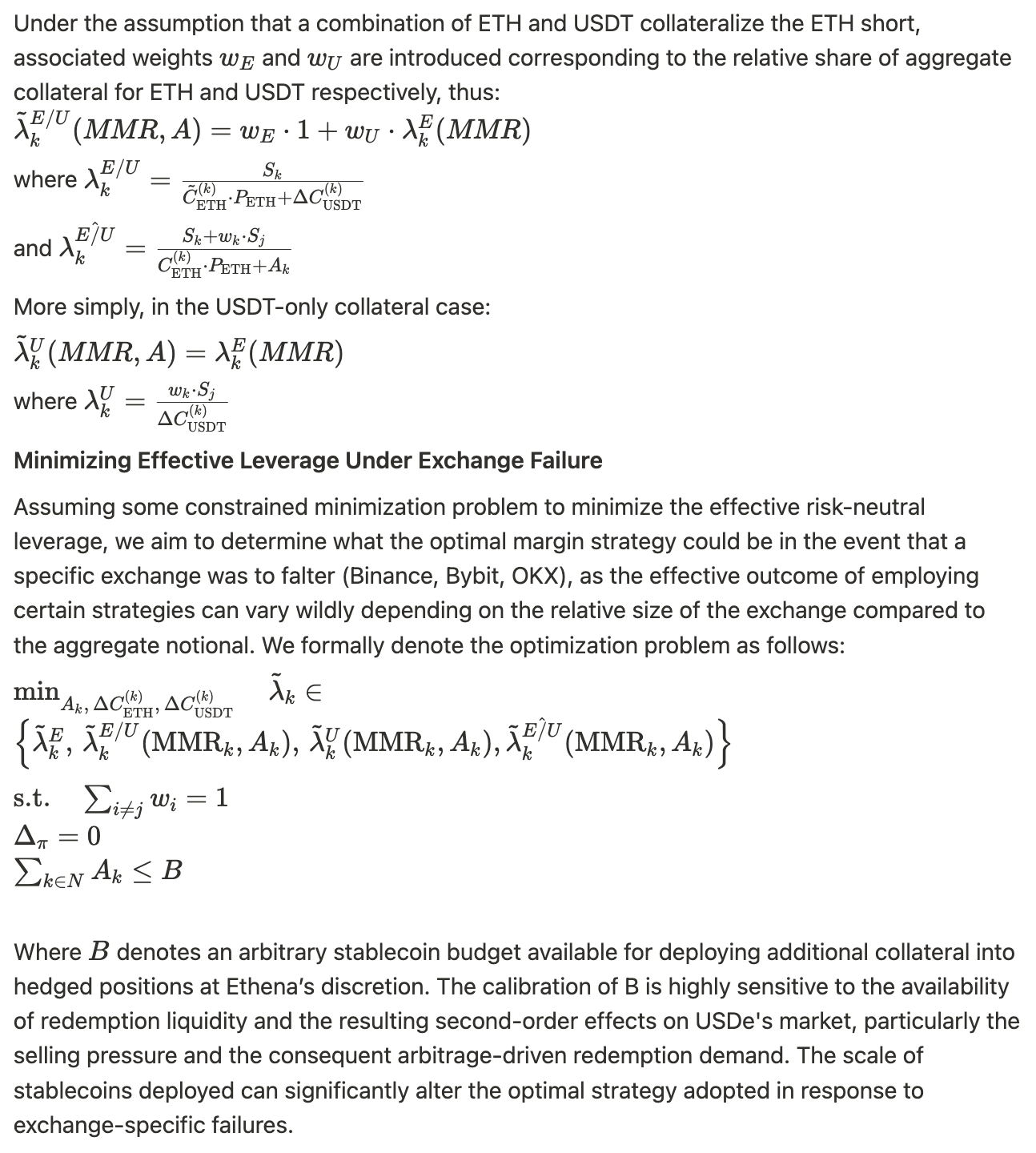

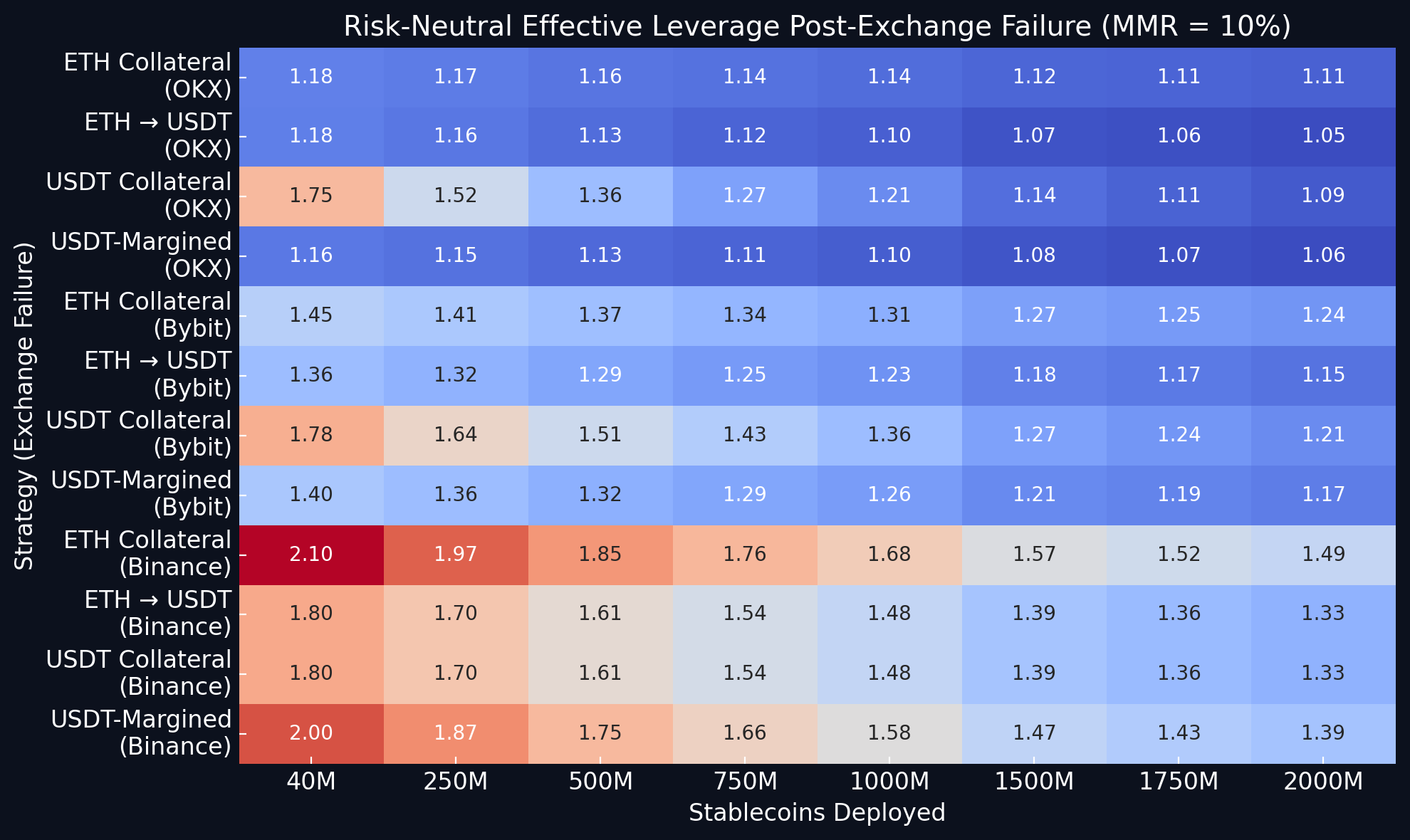

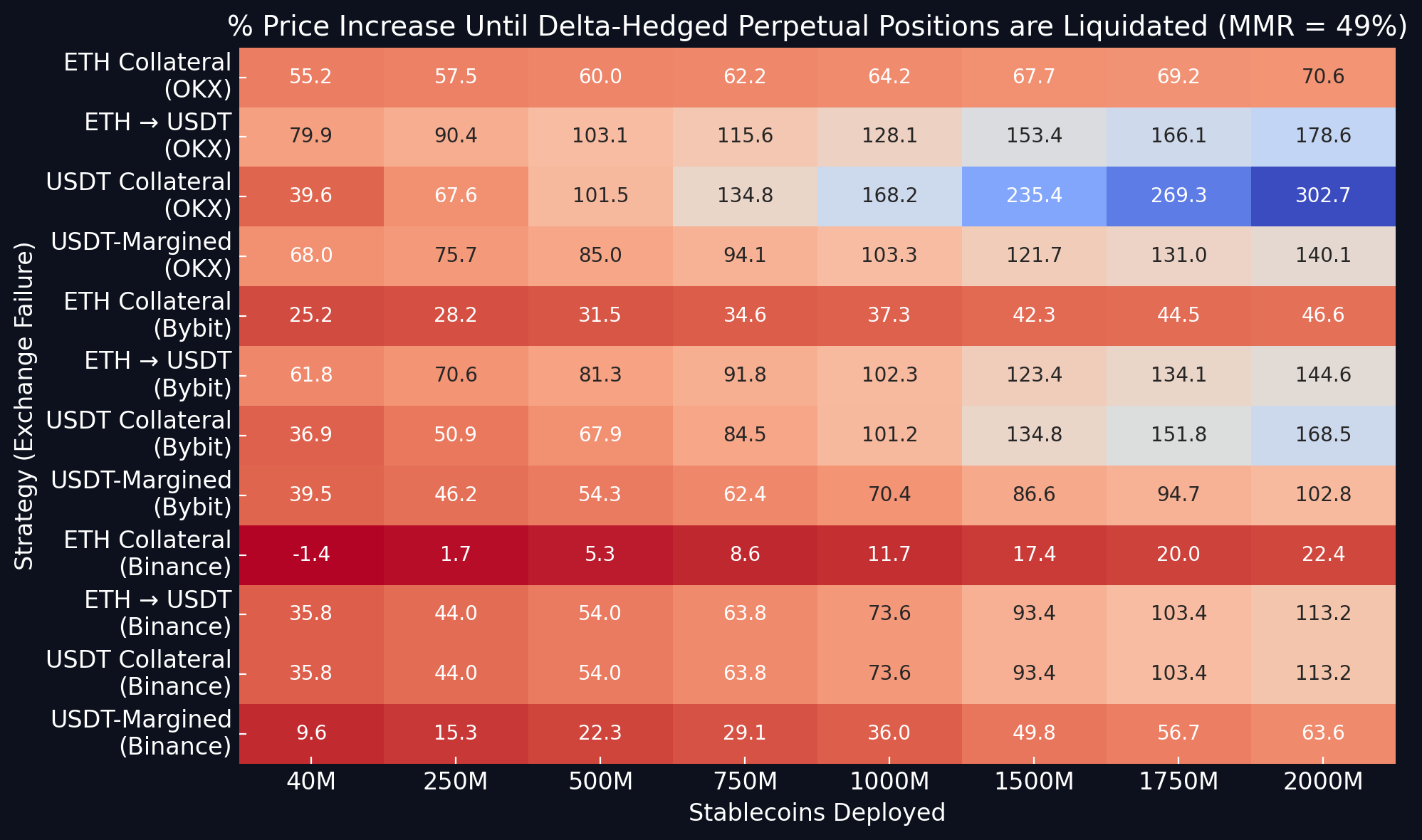

We have provided a detailed mathematical framework in the *Rehedging Strategies* section to evaluate the most optimal strategy under varying constraints, including MMR and available stablecoin budget to deploy. The framework solves for the capital allocation that minimizes effective leverage and reduces market impact given these constraints and outlines four hedging approaches: ETH-only collateral, ETH + USDT collateral (Strategy-2), USDT-only collateral and USDT-Margining of additonal notional.

Across all modeled rehedging strategies, the liquidation thresholds, measured as the required percentage price increase in ETH, are exceptionally high under realistic maintenance margin assumptions (5–10%). Even under stress scenarios involving concentrated exchange failures, triggering liquidation would necessitate extreme and sustained upside volatility in ETH. For instance, price increases well above 150–300% are required across most configurations (perhaps slightly less in the event of a Binance failure), far exceeding historical norms within the narrow windows where failure-induced rehedging would be actively managed.

In this context, the operational simplicity of USDT-margined rehedging (i.e., Strategy 4) becomes highly attractive. Although this method may not always yield the mathematically optimal liquidation threshold, the differences compared to ETH → USDT (Strategy 2) or hybrid collateral structures are marginal in practical terms, especially given the improbability of such drastic price moves occurring during a period of exchange dysfunction.

Moreover, in a scenario where ETH is rapidly appreciating (the only condition under which liquidation would even be conceivable), shorting basis becomes more favorable, further reinforcing the attractiveness and operational viability of initiating fresh USDT-margined shorts in such conditions.

Notably, Ethena’s use of margin-tier-aware sub-accounting ensures effective MMRs remain anchored around 5–10%, even under large notional loads. This reinforces the finding that liquidation is not a proximate risk under any strategy, and suggests that operational efficiency, speed of deployment, and liquidity access should take precedence over small differences in margin mechanics.

Implications for Aave:

While the probability of this scenario is low, since sharp price increases are not typically associated with exchange failures, it nonetheless presents a unique risk profile for Ethena and, by extension, Aave.

If liquidations were to occur during this window, the effective collateralization of USDe could be impacted. However, our modeling shows that even under extreme conditions, the probability of such a loss materializing is very low with properly sized capital deployment and balanced hedging strategies outlined before.

Nonetheless, it reinforces the importance of robust capital allocation frameworks and monitoring systems to assess risk under fast-moving conditions. The optimization model provided in the *Rehedging Strategies* section offers a valuable tool to inform such decisions dynamically, depending on real-time constraints and market conditions.

2. Custodian Failure Risk

Ethena relies on off-exchange settlement providers, primarily Ceffu and Copper, to custody the majority of its crypto asset backing. These providers enable Ethena to maintain delta-neutral hedges without holding collateral directly on centralized exchanges. Assets remain in custodian-managed wallets, and derivative positions are mirrored via virtual balances on exchange accounts, with daily or more frequent settlement cycles. This design significantly limits exposure to exchange insolvency.

As of recent data, approximately 55% of USDe’s backing is held via off-exchange settlement providers, a notable decrease from previous levels above 90%. This reduction is due to an increase in stablecoin collateral held outside of these custodians. The chart below illustrates the historical shift in backing across custody types.

As a result, the impact of custodian failure has materially declined. Stablecoin collateral now accounts for approximately 45% of the backing, stored independently of these providers, further insulating the protocol from centralized custody risk.

3. Collateral Asset Depeg Risk

Risk

Ethena’s backing includes LSTs such as wBETH, stETH, and mETH, which carry an inherent risk of slashing and other various penalties due to their exposure to Ethereum’s consensus layer. If validators associated with these assets are penalized, for example, due to a client bug, the backing value of USDe could be affected.

As detailed in our previous analysis on Ethereum staking penalties, one of the most severe risks stems from a Consensus Layer Majority Client Bug that causes a finality halt and triggers the inactivity leak. Given the current validator client distribution, such an incident could lead to meaningful slashing.

Ethena currently holds approximately $250 million in LSTs, mostly in wBETH.

Over time, the total share of LSTs in USDe’s backing has declined from around 12% to approximately 4 to 5%, largely due to an increase in unallocated stablecoins in the backing mix.

Impact

In a scenario where the majority consensus layer client suffers from a bug and 30% of LST operators are running the faulty client, the slashing impact would reflect the conditions modeled in our Ethereum slashing risk analysis. Under such circumstances, where finality is blocked, and the inactivity leak is triggered, we estimate a loss of approximately 6.77% on the affected LST assets, mostly due to the inactivity leak.

Given that LSTs currently represent 4.5% of USDe’s total collateral backing, this would result in a net collateral loss of roughly 0.304% of the entire backing.

Ethena’s reserve fund stands at $60 million, which serves as a buffer for adverse events. The loss modeled in this scenario would represent just ~27% of the reserve fund, suggesting that the protocol is well-positioned to absorb the shock. The overall impact on USDe’s peg and solvency would, therefore, be negligible.

4. Negative Funding Risk

Risk

Ethena’s delta-neutral strategy involves holding spot crypto assets (such as BTC or ETH) while taking short positions in perpetual futures contracts to hedge directional exposure. This structure relies on funding payments between long and short positions in the perpetual market, which are determined by the difference between the perp price and the spot price.

When funding rates are positive, in other words, when there is a higher demand for leveraged long positions than shorts, longs pay funding to shorts. In this case, Ethena earns yield on its hedge, contributing positively to sUSDe’s yield. However, when funding rates turn negative, short positions incur funding costs.

Sustained periods of negative funding can erode the profitability of the delta-neutral strategy and place stress on the protocol’s backing.

Mitigation Measures

Ethena employs two key mitigation strategies for funding risk:

- Collateral Rebalancing: The protocol can unwind delta-neutral positions and reallocate to stablecoin-backed collateral, thereby reducing its exposure to negative funding.

- Reserve Fund: Ethena maintains a $60 million reserve fund specifically earmarked for adverse funding environments. This buffer can absorb negative funding shocks during transition periods when rebalancing occurs or when market conditions delay the shift to stablecoin-heavy backing.

Impact

Ethena has demonstrated high agility in responding to shifts in funding conditions. As seen in the *Stablecoin Share in USDe Backing vs Funding Rates* chart, the inverse relationship between stablecoin share and funding rates is pronounced. When funding rates decline, Ethena closes delta-neutral positions and reallocates its collateral mix toward stablecoins, thereby reducing open interest exposure to the perpetual markets.

During the unwinding of delta neutral positions in negative funding environments, Ethena may also capture basis profit, arising when the perpetual price is below the spot price due to elevated short side pressure. Closing the short at a discount (buying back the perp at a lower price) while selling the spot at a higher price can generate additional profit, helping to offset part of the funding cost incurred during the holding period.

This adaptive rebalancing mechanism limits the impact of negative funding periods. In scenarios where funding rates remain negative for an extended period, the shift toward a stablecoin heavy collateral structure helps minimize systemic risk. Additionally, prolonged negative funding tends to contract USDe supply, which in turn reduces Ethena’s open interest footprint in perp markets. This self-correcting dynamic can relieve pressure on funding rates, a reflexivity that becomes more influential as Ethena’s share of open interest grows (currently at around 5–6%).

Conclusion

The primary risk to Aave from its growing exposure to USDe-backed assets stems from potential backing loss scenarios. While Ethena’s design incorporates multiple layers of protection, such as reserve fund, adaptive rebalancing of collateral base and off-exchange settlement, the risk of collateral impairment, particularly in the event of centralized exchange or custodian failure, remains the most material threat to USDe’s solvency. Aave’s increasing reliance on USDe and USDe-linked PTs means that any impairment to USDe’s backing could directly impact the protocol’s ability to recover value through liquidations.

On the on-chain side, the emergence of PTs as a dominant collateral type has led to increased sensitivity to Pendle AMM dynamics, stablecoin utilization pressures, and rehypothecation-driven leveraged loops. Aave’s risk oracle system and eMode configurations are effective in mitigating many of these risks, particularly by freezing markets during pricing dislocations and allowing structured deleveraging. However, concentrated supplier behavior and uneven liquidity profiles across PT markets remain areas of concern that warrant ongoing parameter tuning and stress testing.

On the backing side, Ethena’s hedging and collateral management mechanisms are generally robust, especially under common market conditions. Scenario modeling indicates that the probability of bad debt accruing to Aave remains extremely low, even under conservative assumptions. Importantly, the use of off-exchange custodians significantly reduces the risk of full collateral loss from centralized exchange failure. However, during rare and extreme tail events, such as an exchange failure coinciding with adverse price movements, Ethena’s ability to act decisively and re-establish hedges becomes critical.

In the event of exchange failure, the decision to hedge early is shown to reduce the likelihood of backing erosion, particularly when prices decline. Conversely, in the unlikely case that prices rise rapidly following early action, the protocol may face elevated liquidation risk if leverage is not carefully managed. Our mathematical modeling of rehedging strategies demonstrates that mixed collateral strategies (particularly Strategy-2) offer a resilient balance between capital efficiency and liquidation protection, especially under stress scenarios involving major venues like Binance.

Overall, Aave is well-positioned to manage the current level of USDe and PT exposure through a combination of conservative risk parameters, real-time oracle systems, and mitigation features such as internalized liquidations and debt swaps. Nonetheless, ongoing coordination with Ethena around redemption access, and real-time backing transparency will remain important to maintaining systemic stability as these asset classes mature.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this research paper. Our pre-launch risk reports on Ethena, published over a year ago, represented a temporary compensated engagement, bear no implications on the current state of the protocol and can be viewed here on our website. We additionally provide proof-of-reserve attestations for the Ethena Protocol, which periodically reflect the aggregate state of the portfolio relative to the underlying USDe shares emitted. This research paper was not created in collaboration with Ethena; however, we are grateful for the team’s thorough review.