Summary

Chaos Labs recommends reducing the Slope2 parameter of USDT on Aave V3 Ethereum Core from 35% to 22.5%. The objective is to mitigate the extreme volatility in borrowing rates observed following significant supplier withdrawals and prevent disruptive rate spikes that impair borrower positions, particularly in rate-sensitive strategies.

Motivation

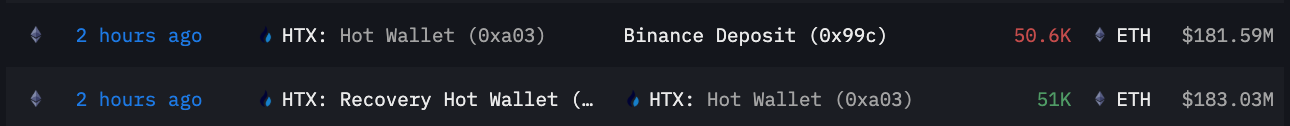

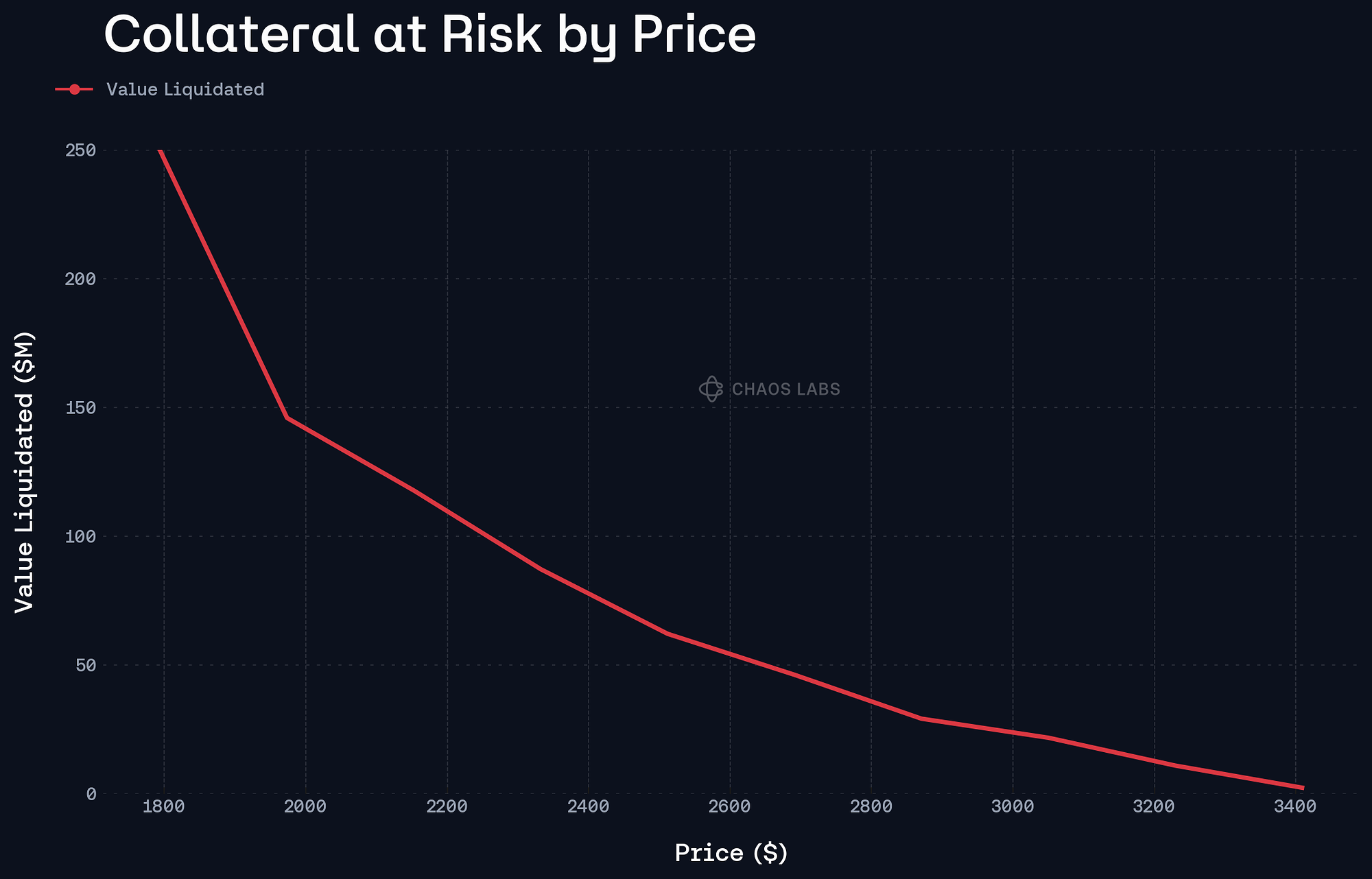

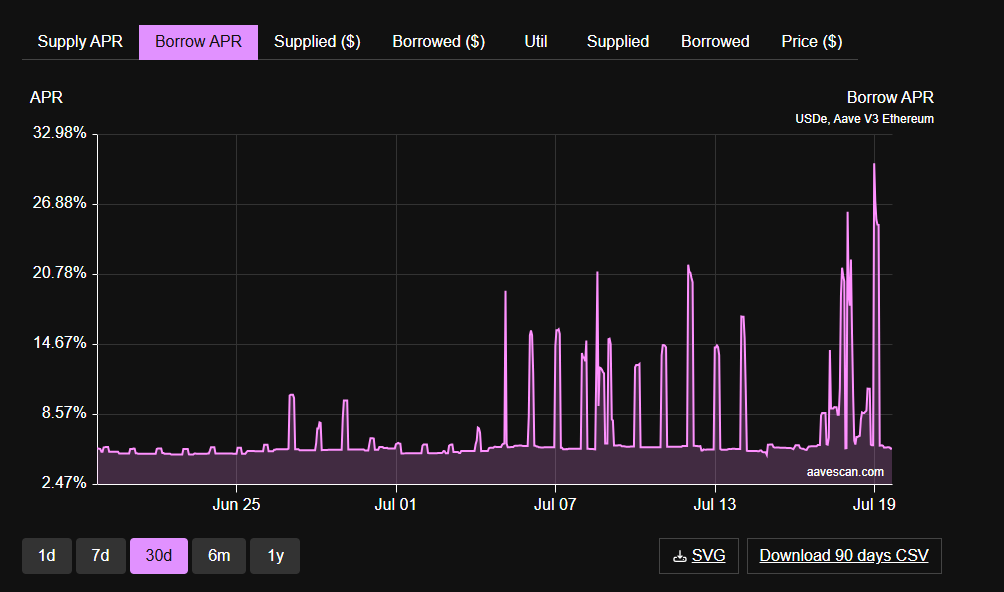

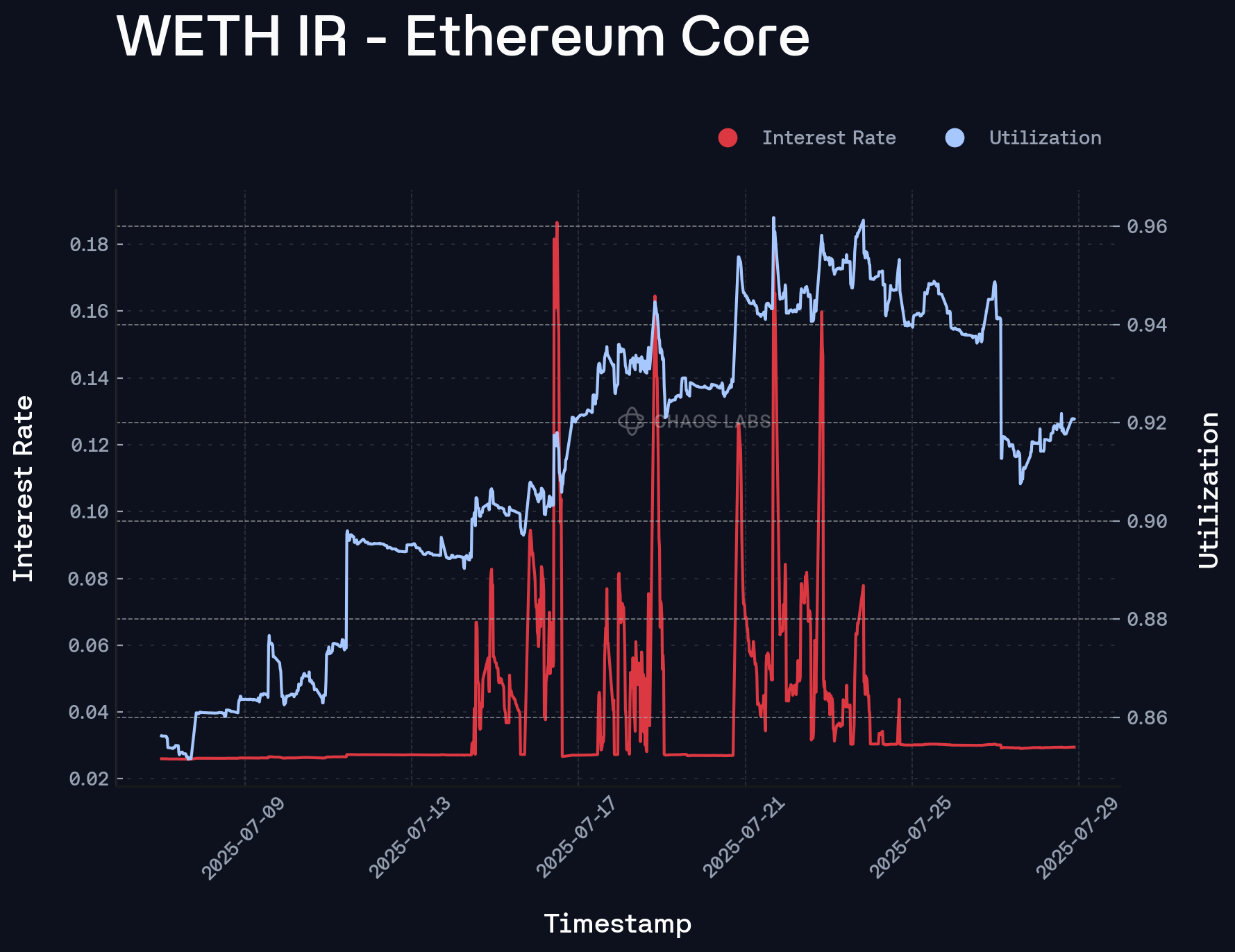

The recent activity by Huobi, the largest USDT supplier on Aave, resulted in a withdrawal of approximately 400 million USDT. This action abruptly pushed the market utilization to 100%, triggering the jump in variable borrow rates to above UOptimal and spiking borrowing costs to around 40%. This volatility directly impacts borrowers and strategies sensitive to rate changes, especially those involving Ethena PTs, which represent a significant portion of collateral currently backing USDT borrow positions.

Moreover, Huobi continues to hold a significant USDT balance on Aave, with approximately 1.19 billion USDT still deposited and available for potential withdrawal, previously representing 40% of the total aUSDT supply.

On-chain activity indicates a recurring pattern of weekly withdrawals and redeposits by Huobi, though the exact amounts vary significantly with respect to liquidity availability. In previous instances, Huobi has withdrawn up to 1 billion USDT in a single transaction. This time-deterministic withdrawal behavior contributes to causing interest rate volatility and reinforces the need for a less aggressive Slope2 parameter to accommodate such fluctuations without compromising borrower stability.

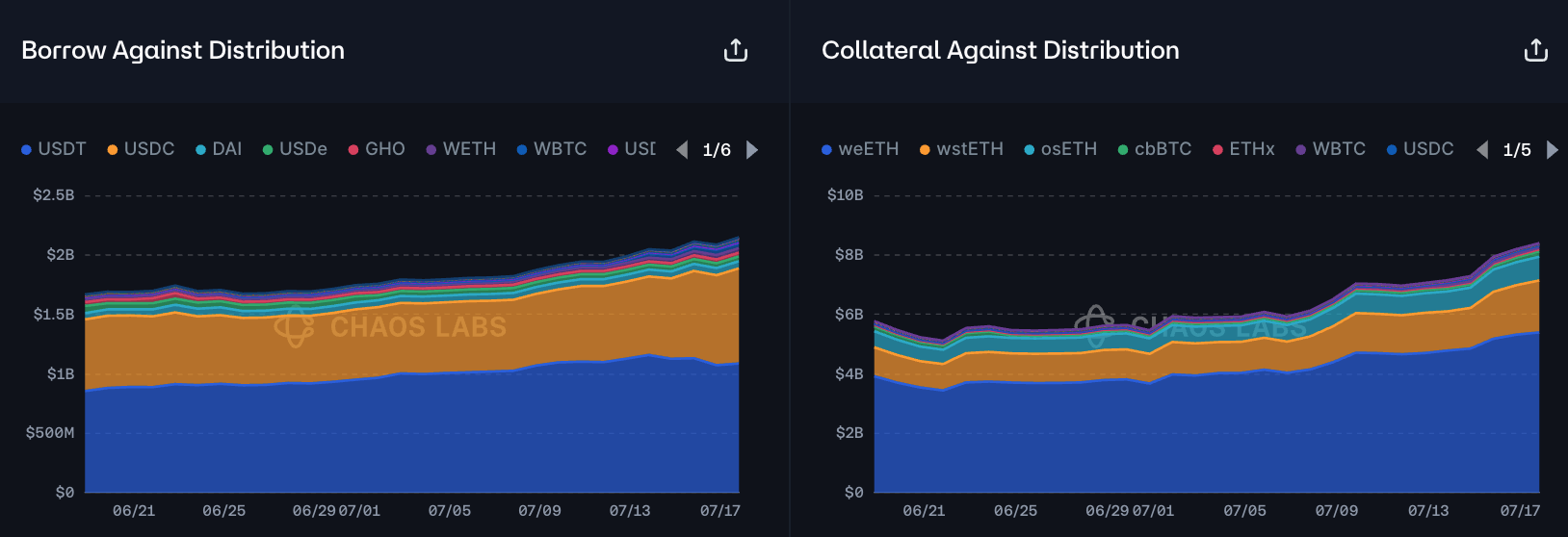

With USDT borrowing demand recently surging due to increased appetite for leverage, relative liquidity has thus remained more constrained amid elevated market utilization levels.

In previous instances of Huobi aUSDT withdrawals, such as on 05/16, led to significant temporary outflows of $500M in collateralized USDT debt due to significant utilization and thus interest rate spikes.

While it is unclear precisely what the observed strategy exogenously correlates to, this Huobi address persistently performs USDT redemptions whenever the price of USDT falls below $1, before redepositing USDT into Aave within a few days after.

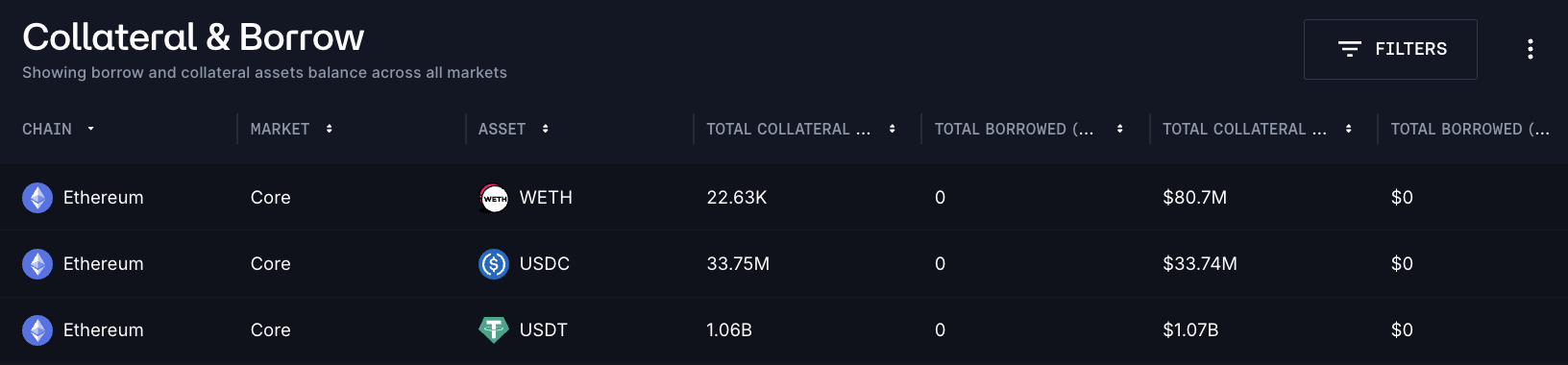

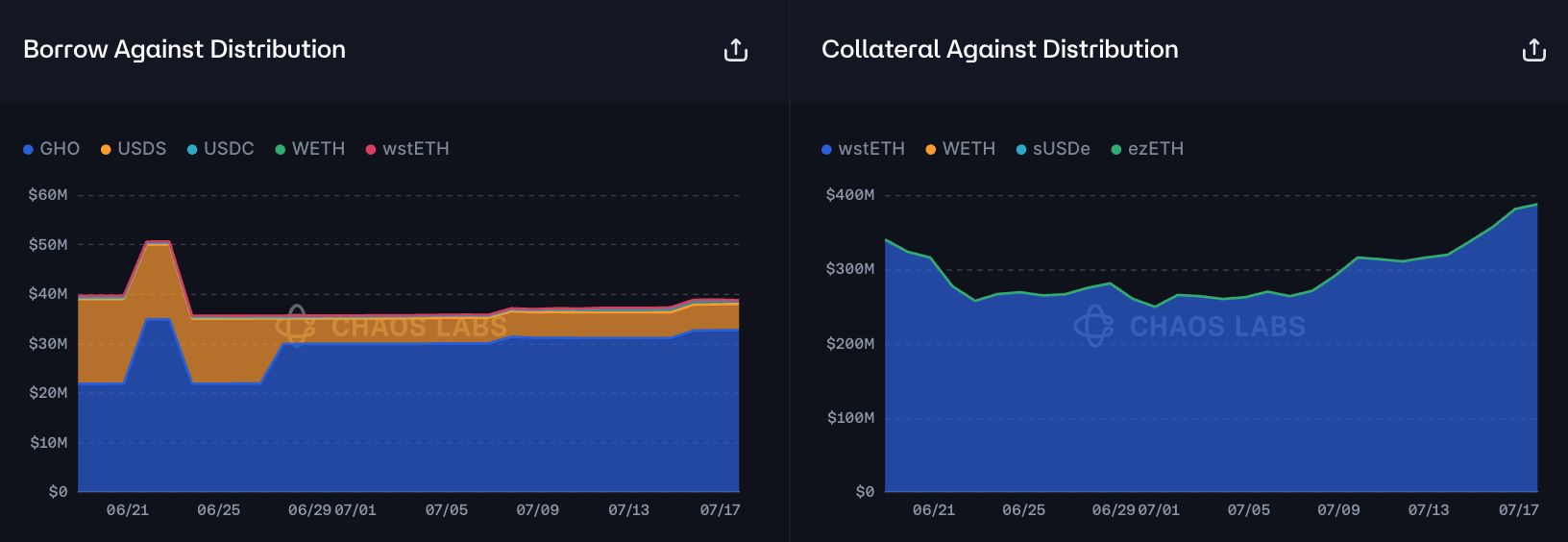

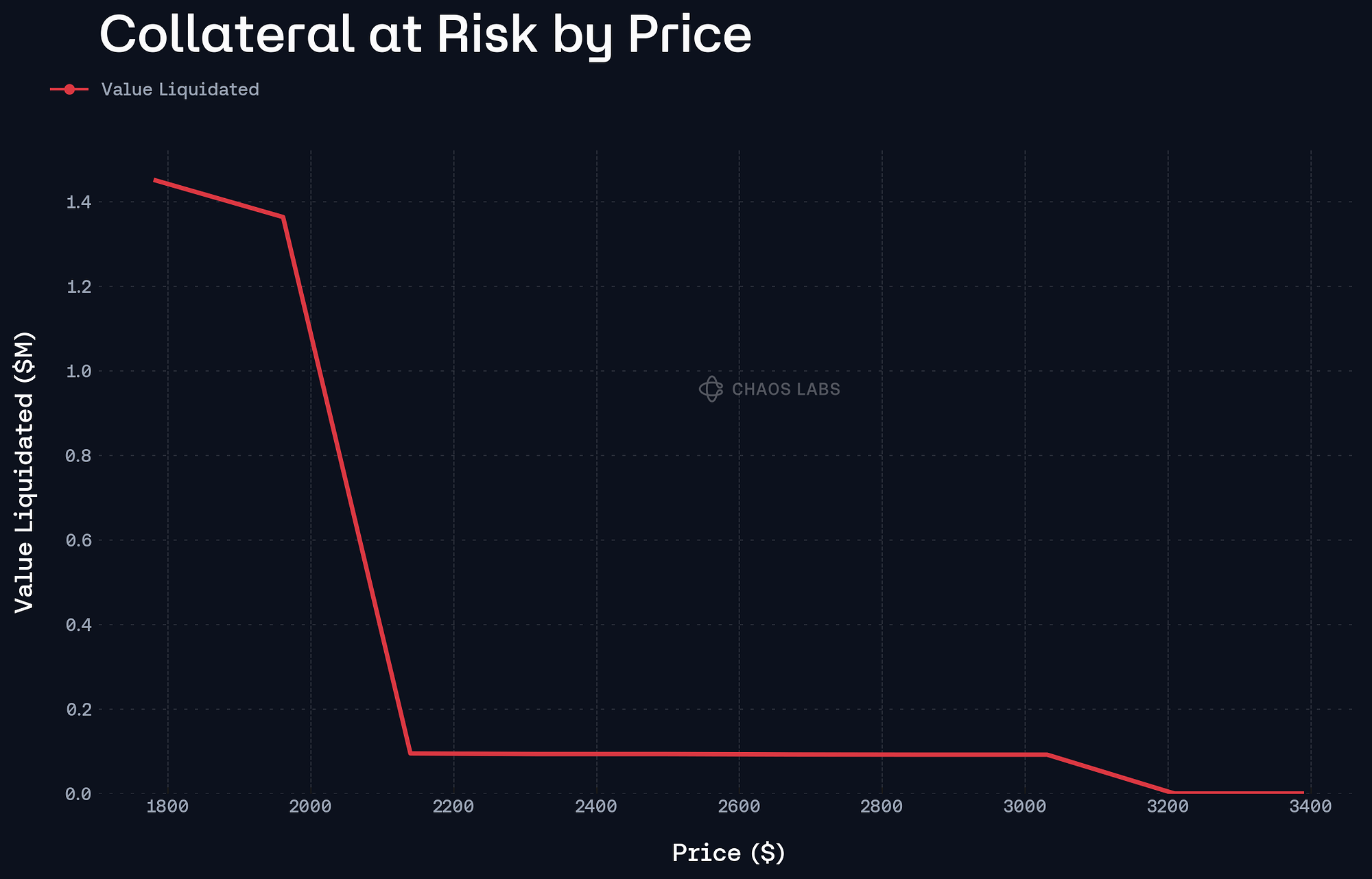

USDT’s limited role as a collateral asset on Aave (with only ~$30M borrowed against it) means that high utilization poses minimal risk to the protocol in the context of hypothetical collateralized aToken debt liquidations. However, the knock-on effects of high borrowing rates, particularly for users relying on rate predictability, reduce Aave’s competitiveness as a borrowing venue for USDT and potentially drive away activity.

Specification

| Asset | Market | Current Slope 2 | Recommended Slope 2 |

|---|---|---|---|

| USDT | Ethereum Core | 35% | 22.5% |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0