Summary

A proposal to:

- Increase supply and borrow caps for USDT on the Ethereum Core instance.

- Increase supply and borrow caps for EURC on the Ethereum Core instance.

- Increase Slope 1 for USDe on the Ethereum Core instance.

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

USDT (Ethereum Core)

USDT has reached 97% of its 7.3B supply cap, largely due to a $2B inflow over the last 10 days.

Supply Distribution

USDT’s supply is highly concentrated, with the top supplier accounting for over 28% of the total, additionally, the top 4 wallets have a cumulative share exceeding 55%. The vast majority of suppliers are not borrowing any assets, which minimizes liquidation risks.

Borrow Distribution

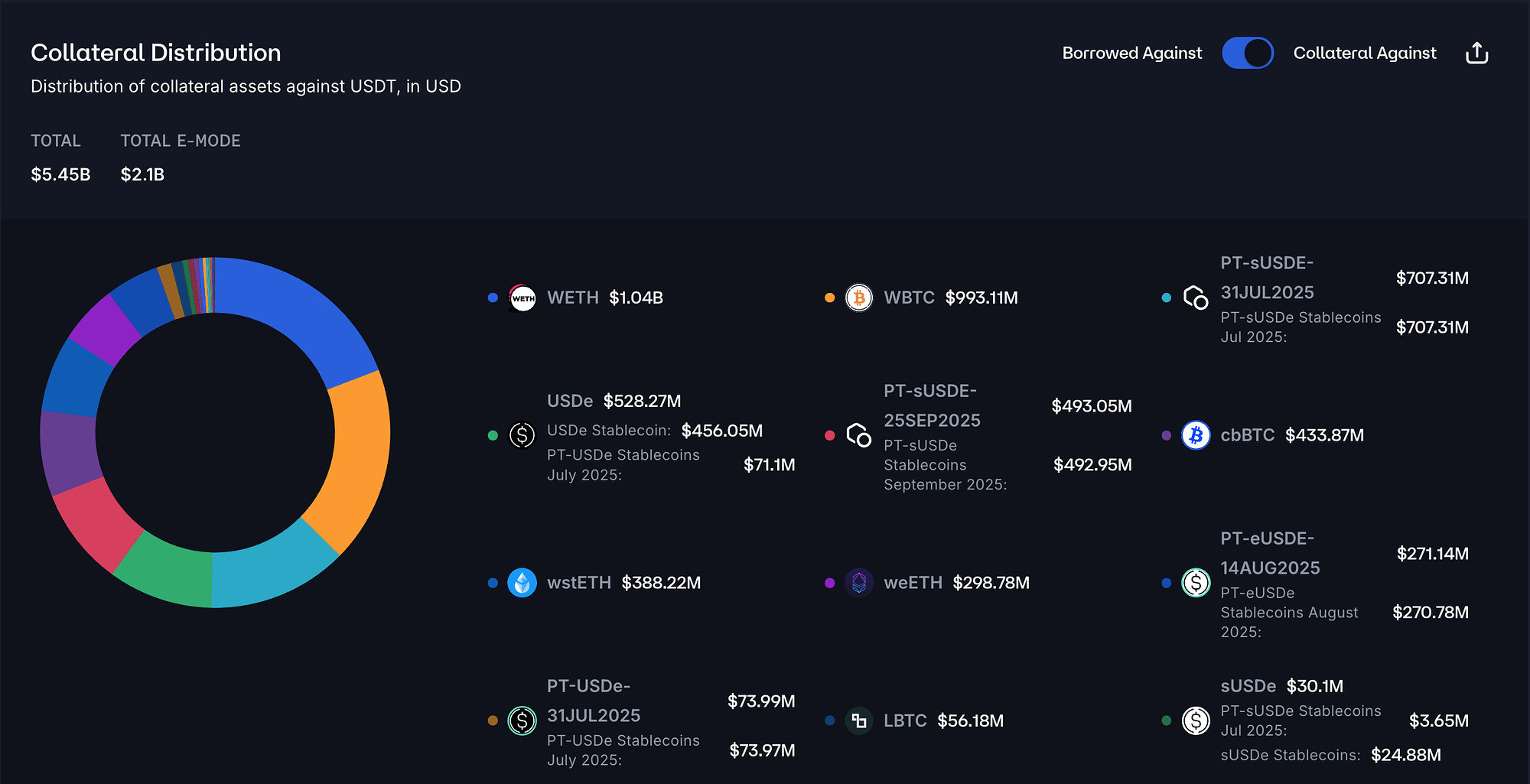

USDT’s borrow distribution is much less concentrated than its supply, with the top wallet accounting for only 7% of the total and the top 45 borrowers representing ~50%. Generally, USDT borrowers fall into two groups: those using volatile assets as collateral (WETH, WBTC, etc) and those using PT-sUSDE or PT-eUSDE tokens. The first group on average shows much higher health factors, presenting limited liquidation risk. The second group has health factors between 1.02-1.17, but due to the tight correlation between these PTs and USDT, liquidation risk is effectively minimized.

Collateral for USDT borrowing falls into two main categories: volatile assets (WETH, WBTC, wstETH, etc.) and USDe-correlated assets (PT-sUSDE, USDe, PT-eUSDE, etc.). Volatile assets represent 55% of the market while USDe-correlated assets account for 36%, significantly reducing liquidation risks.

Recommendation

Based on our analysis of user behavior, consistent liquidity, and increasing demand, we recommend increasing the supply cap by 1.2B to 8.5B and the borrow cap by 0.95B to 8B.

EURC (Ethereum Core)

EURC has reached 99% of its 7M supply cap, gaining additional 2M supply since 25th of July. The borrowing levels increased accordingly with current utilization at 90%.

Supply Distribution

EURC’s supply is moderately concentrated, with the top 9 wallets having a cumulative share under 50%. As most of the suppliers do not have any borrow positions, the liquidation risk is reduced significantly.

Borrow Distribution

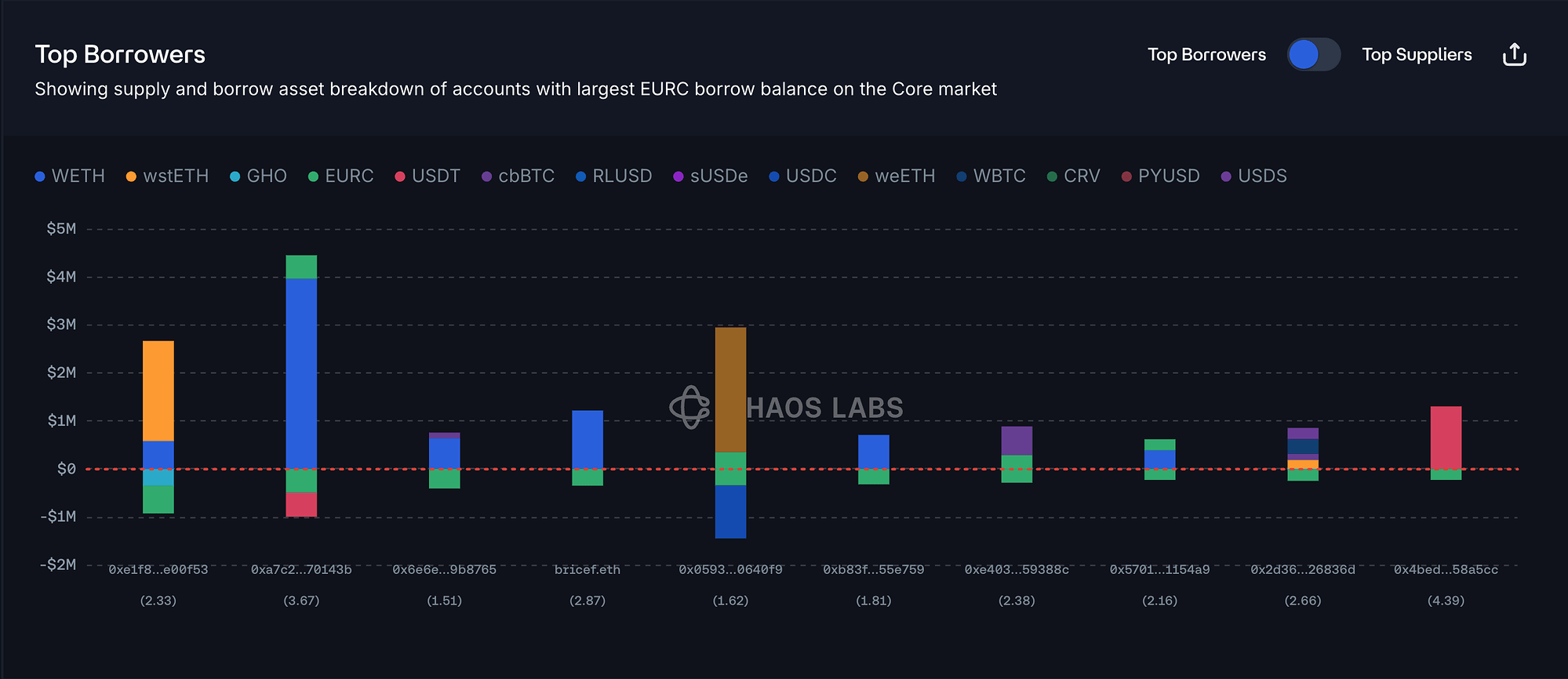

Concentration of EURC’s borrowers is also moderate with the top borrower having an 8% share of the total and the top 9 borrowers representing less than 50%. Additionally, the health factors among the top borrowers are in the safe range from 1.51 to 4.39, further limiting risk of liquidations.

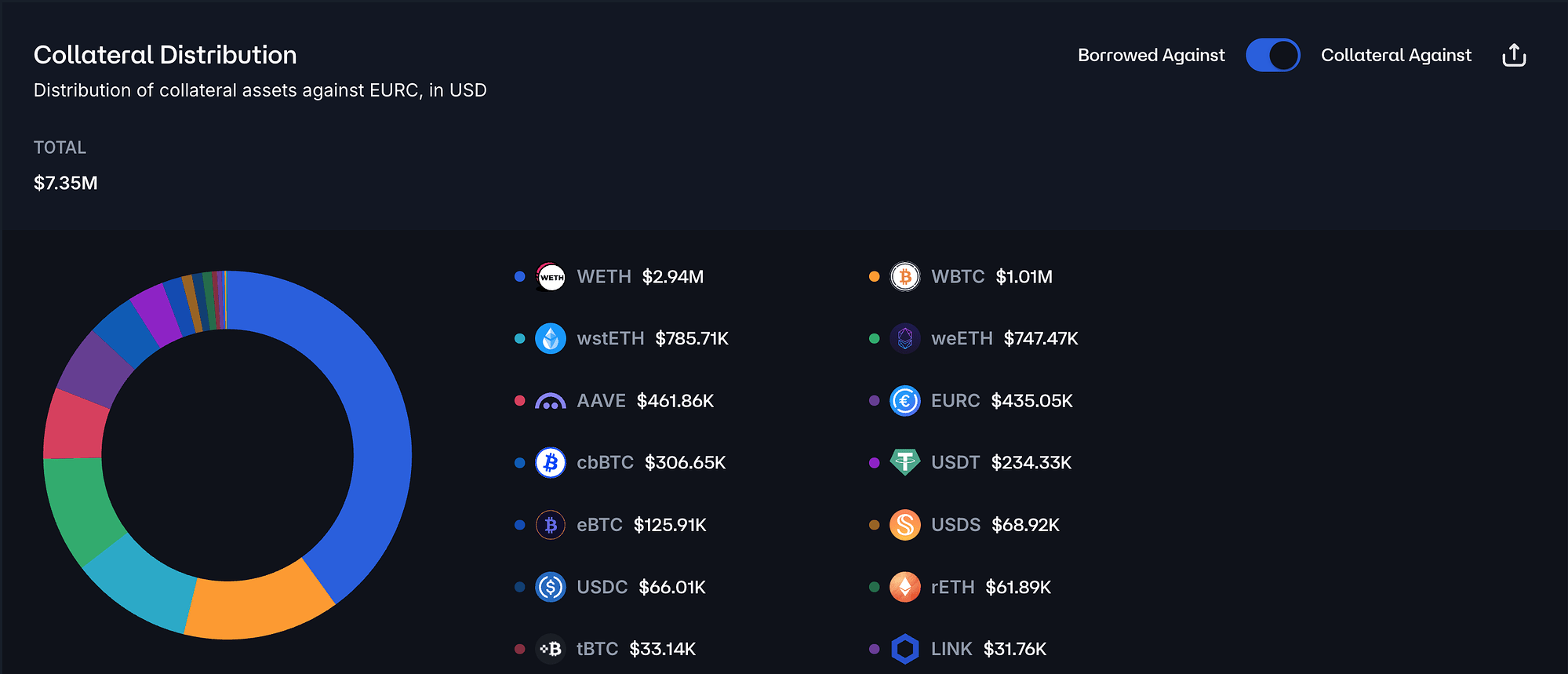

EURC collateral is predominantly comprised of volatile assets, with WETH and WBTC accounting for 53% of the total. However, the high health factors maintained by these positions significantly reduce liquidation risks.

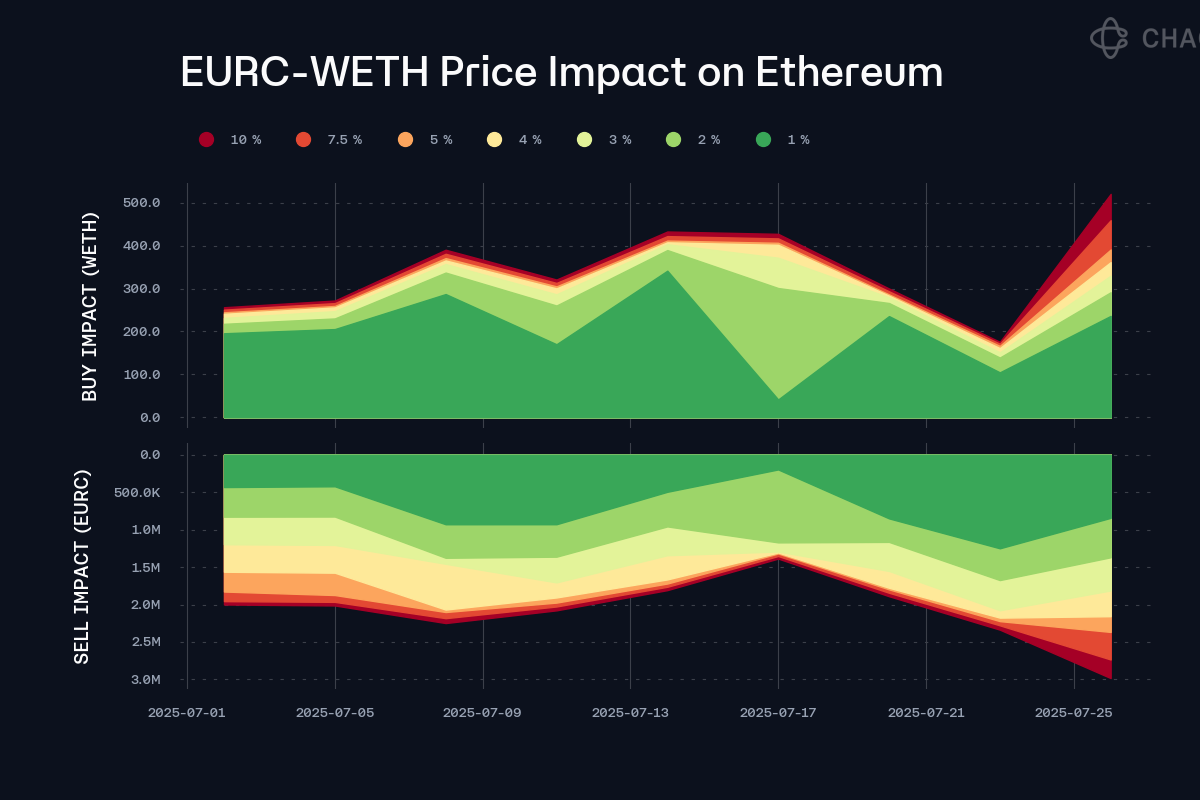

Liquidity

EURC’s liquidity profile has remained stable throughout the past month. Currently, the market depth is sufficient to limit slippage to 4% on a 2M swap. Supporting an increase in supply and borrow caps.

Recommendation

Based on the current market conditions, user behavior, and available liquidity, we recommend increasing the supply cap by 5M to 13M and the borrow cap by 5.5M to 12M.

USDe (Ethereum Core)

Building on our previous recommendation, this proposal advocates for a 0.5% increase to USDe’s Slope 1 on the Ethereum Core instance. The motivation stems from significantly improved capital efficiency enabled by the USDe E-Mode and increased Borrow Rate volatility in recent weeks.

Summary

Given the persistent and elastic demand for USDe borrowing - facilitated by USDe E-Mode and PT USDe-based looping strategies - utilization has climbed above UOptimal (80%) repeatedly over the past weeks. Recently, average effective borrow rates peaked at approximately 8%, well above the expected range under the current interest rate model.

Sustained utilization above UOptimal signals strong demand and drives additional risk, as participants show little willingness to unwind or reduce leverage. Under the current model, borrowers have limited incentive to moderate usage until substantially higher rates are triggered - leading to increased rate volatility.

Slope 1 Adjustment

To mitigate this volatility, we propose increasing Slope 1 by 0.5%, bringing it to 6.5%. This change will steepen the IR curve before UOptimal, encouraging more stable borrowing behavior as utilization approaches the kink. Additionally, it is expected to reduce market rate fluctuations and improve protocol revenue by pricing in the elevated risk more effectively.

Recommendation

Given the persistent demand for USDe borrowing, elevated borrow rate volatility, and the low sensitivity of demand to interest rate changes, we recommend increasing Slope 1 from 6.00% to 6.50%.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Core | USDT | 7,300,000,000 | 8,500,000,000 | 7,000,000,000 | 8,000,000,000 |

| Ethereum Core | EURC | 7,000,000 | 13,000,000 | 6,500,000 | 12,000,000 |

| Parameter | Current Slope 1 | Recommended Slope 1 |

|---|---|---|

| USDe | 6.00% | 6.50% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0