Summary

A proposal to:

- Increase supply and borrow caps for USDC on the Linea instance

- Increase supply and borrow caps for WETH on the Linea instance

- Increase supply and borrow caps for USDT on the Linea instance

- Increase the supply and borrow caps for wstETH on the Linea instance

- Increase the supply cap for weETH on the Linea instance

- Increase the supply cap for wrsETH on the Linea instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

Motivation

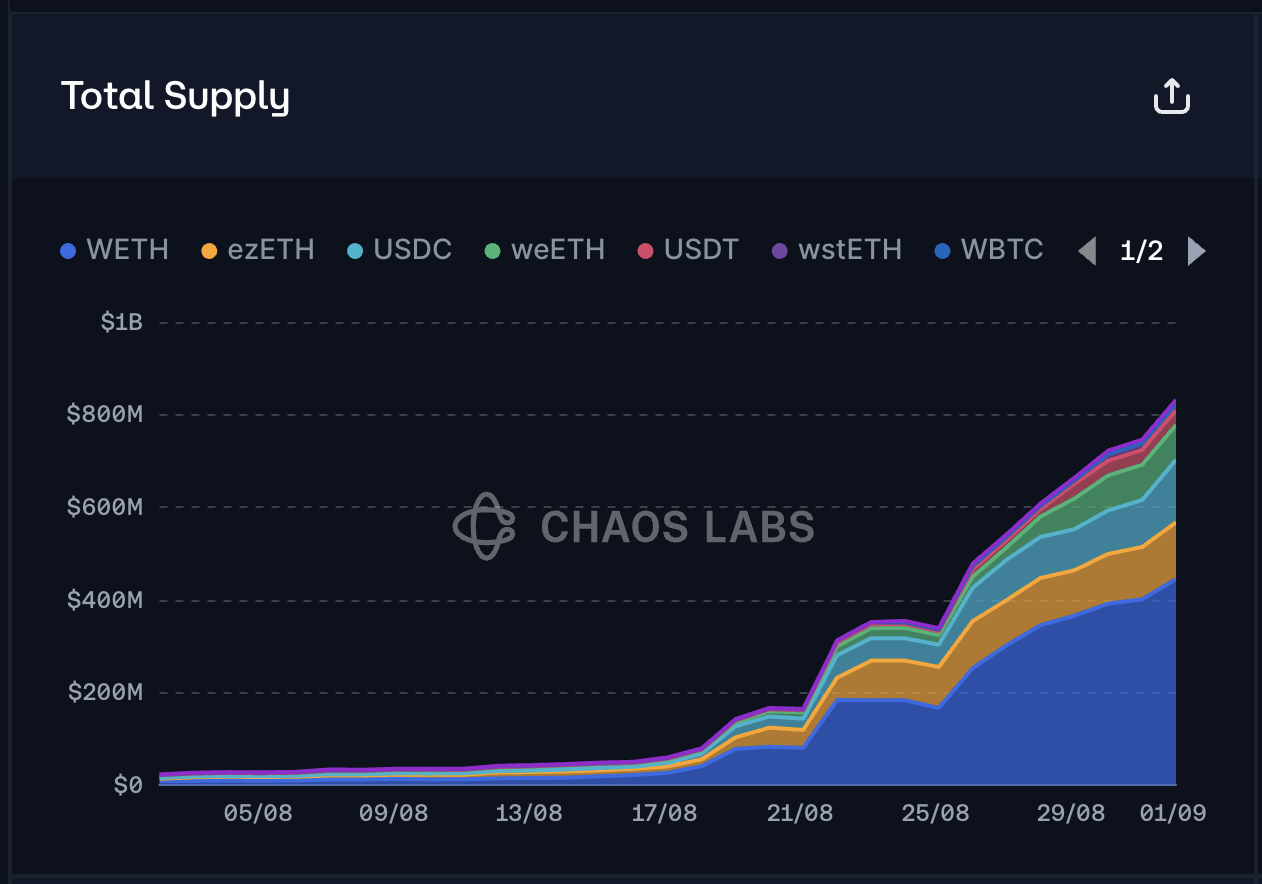

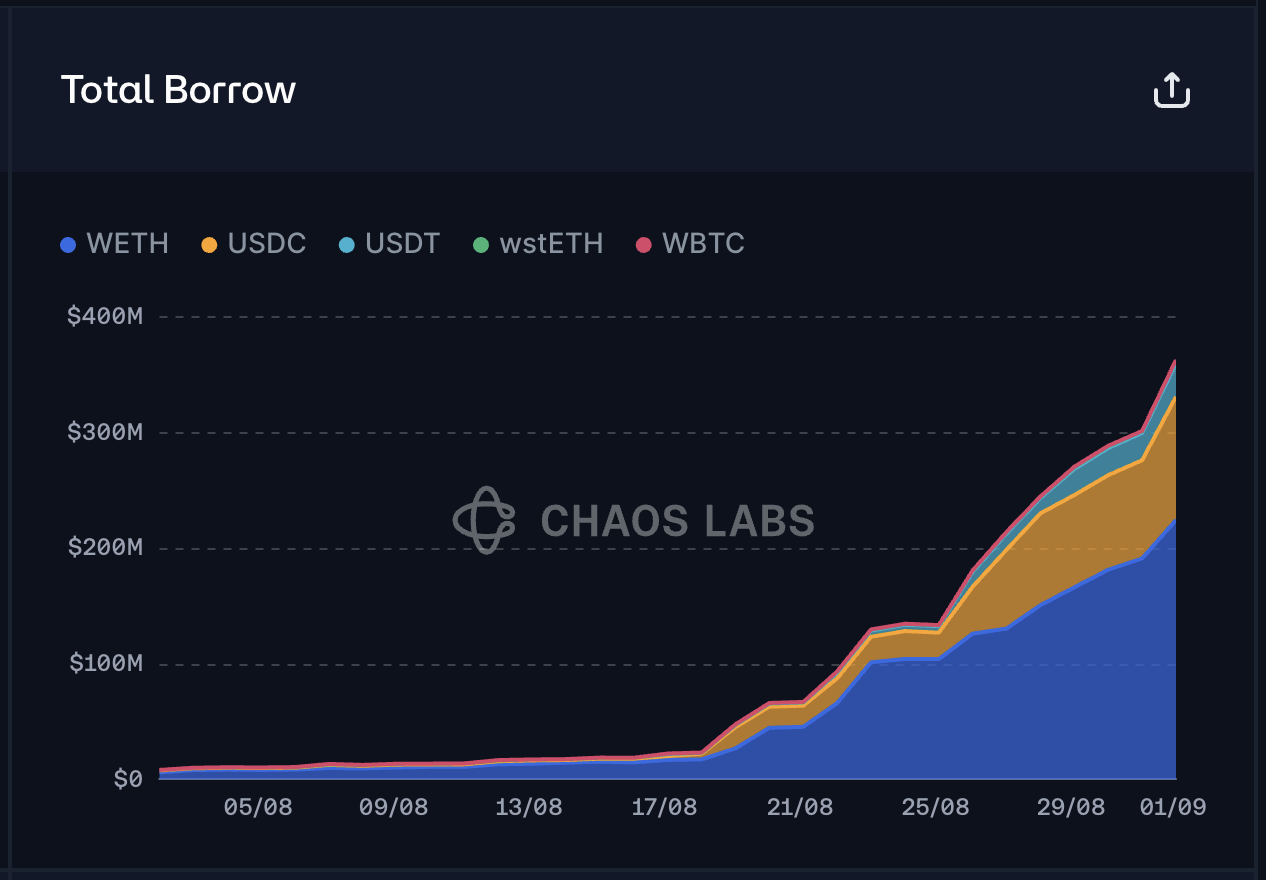

Following the recent increase of supply caps on the Linea instance, the total supply has increased an additional $240 million ****over the past 3 days reaching $830 million. The growth was driven primarily by inflows of WETH, USDC and LRTs.

As it was the case in the previous analysis, the increase in total borrows was less significant compared to supply, as the market has added roughly $100 million between WETH and USDC.

WETH

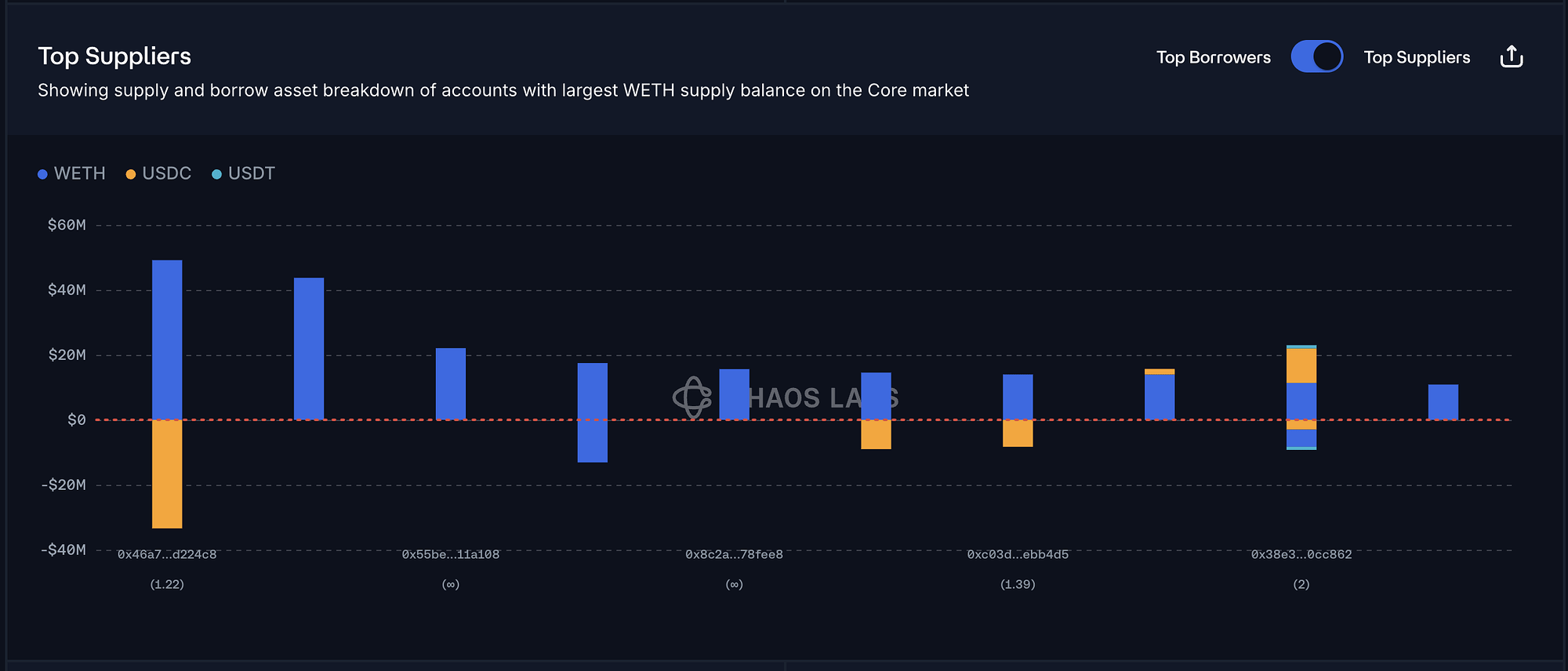

WETH has experienced substantial growth in both supply and borrow volumes. However, the majority of top suppliers currently do not maintain any borrowing positions and, consequently, do not face any liquidation risk. Additionally, the top suppliers that are currently taking USDC debt positions maintain safe health scores, limiting liquidation risk.

Stablecoins

As mentioned previously, stablecoins have increased both in supply and borrow volumes, and their use as collateral remains highly limited and limited primarily to highly correalted assets such as other stablecoins. This ensures that the market remains safe and that the risk of liquidation is minimal.

For stablecoin borrowing positions, WETH is the dominant collateral asset, representing over 80% of all posted collateral at a total of $90 million. As previously covered in the WETH section, this poses minimal risk thanks to the safe health scores and active management adopted by the positions. Additionally, the DEX liquidity is sufficient to liquidate over 1000 WETH with minimal slippage.

LSTs/LRTs

While health scores for the looping positions are in the lower range (1.02-1.1), the positions generally face minimal liquidation risk due to the high price correlation between debt and collateral. Additionally, these correlated assets have the deepest liquidity pools on Linea, ensuring a safe market in case of liquidations.

Recommendation

The Linea instance continues to see strong growth across all assets, and we expect this growth to persist. Chaos Labs will continue monitoring closely the Linea markets to ensure safe positioning of its users and prevent protocol risk.

Given this sustained demand, user behavior, and favorable liquidity conditions, we recommend increasing the supply and borrow caps for USDC, USDT, WETH, and wstETH, along with the supply cap for wrsETH and weETH, to accommodate growth while maintaining robust risk management.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Linea | USDC | 192,000,000 | 300,000,000 | 172,800,000 | 280,000,000 |

| Linea | USDT | 32,000,000 | 64,000,000 | 28,800,000 | 57,600,000 |

| Linea | WETH | 153,600 | 230,000 | 140,800 | 210,000 |

| Linea | wstETH | 2,400 | 4,800 | 600 | 1,200 |

| Linea | wrsETH | 1600 | 3,200 | - | - |

| Linea | weETH | 16,000 | 32,000 | - | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.