Summary:

A proposal to:

- Increase supply and borrow caps for USDC on the Linea instance

- Increase supply and borrow caps for USDT on the Linea instance

- Increase supply and borrow caps for WETH on the Linea instance

- Increase the supply cap for ezETH on the Linea instance

- Increase the supply cap for wrsETH on the Linea instance

- Increase the supply and borrow caps for wstETH on the Linea instance

- Increase LTV for ezETH on the Linea instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

Motivation

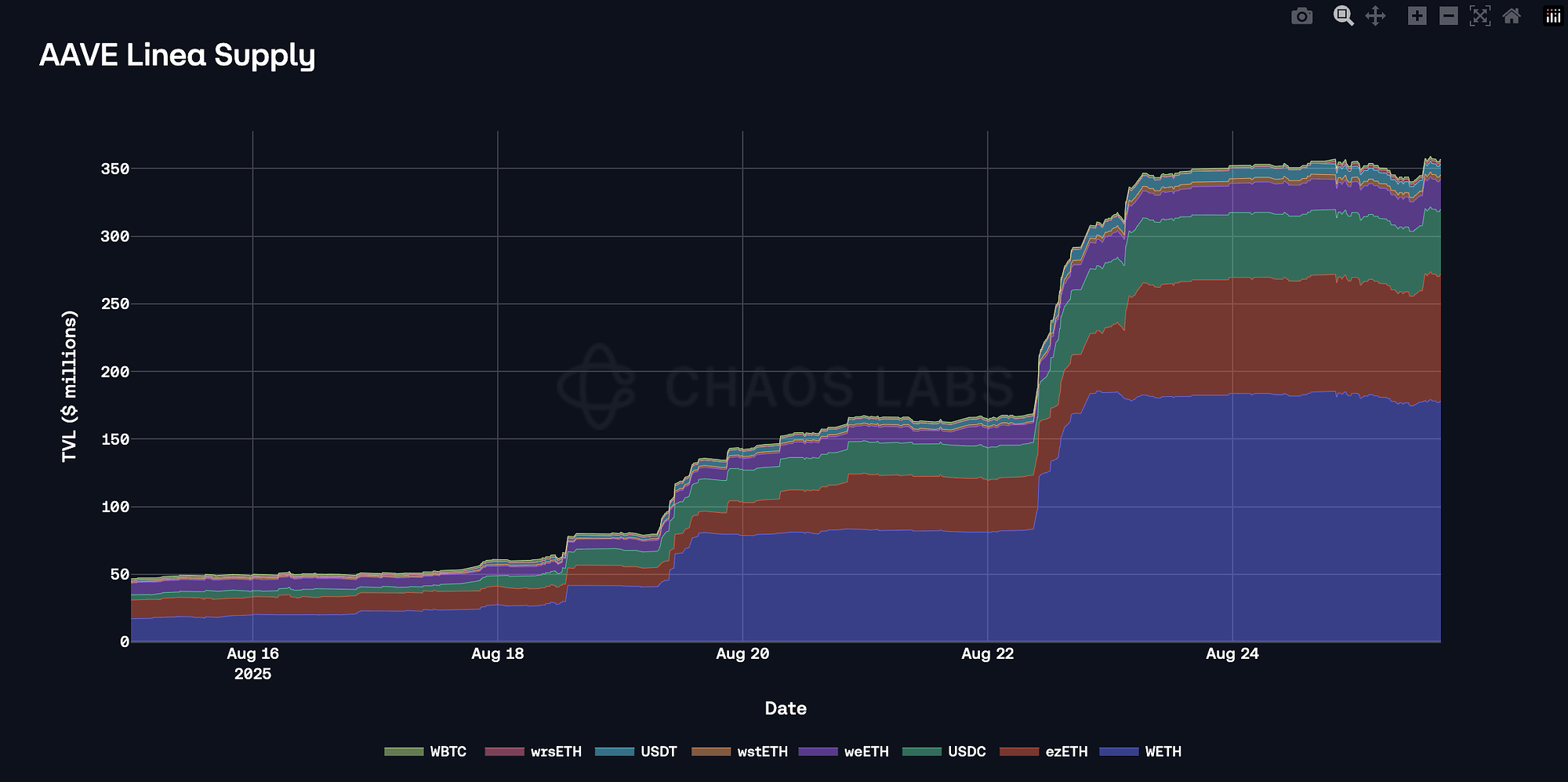

Aave’s TVL on Linea has increased substantially following the recent adjustments to borrow and supply caps. Since August 21st, supply has grown by more than $200 million, driven primarily by inflows of WETH and stablecoins (USDT, USDC).

Currently, suppliers on Linea are not adjusting for the discounted supply rates relative to Ethereum Core. WETH suppliers earn approximately 75 basis points less, while stablecoin suppliers face a discount of roughly 250 basis points. This user behavior implies that suppliers are not sensitive to APR fluctuations.

Additionally, the borrowing on the Linea instance has grown significantly, though at a smaller scale compared to supply growth. This increase has been driven primarily by WETH borrowing, supported by lower effective rates and wider spreads in LRT/LST leveraged strategies.

The overall market dynamics, including user behavior, elasticity to supply rates, and rapid growth, indicate persistent supply-side demand.

WETH

At present, WETH supply on Linea poses minimal risk. The majority of top suppliers do not maintain debt positions and therefore face no liquidation exposure. A smaller subset of suppliers carries borrow positions, primarily in USDC and USDT. While these positions could become vulnerable under adverse price movements, user health factors remain in the safe range (1.38 - 3.81), substantially limiting the probability of significant liquidations.

Stablecoins

Both USDC and USDT have experienced notable growth on Linea, with combined supply increasing by $28M to $56M, and total borrows rising by approximately $6M to $29M. Importantly, only a small portion of these stablecoin deposits is used to collateralize debt. The overwhelming majority of suppliers have no borrow positions, which significantly limits the risk of liquidations.

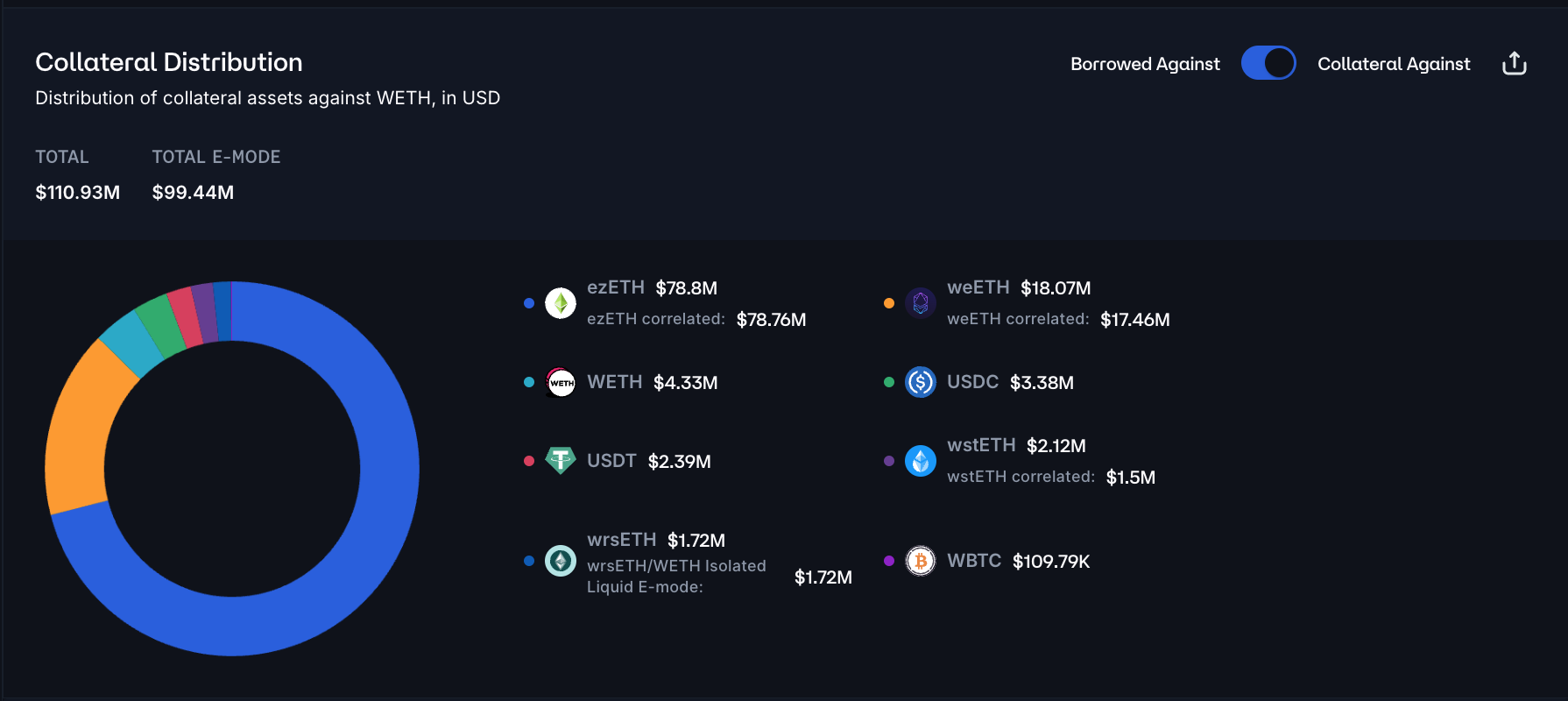

For both USDT and USDC collateral, the most borrowed asset is WETH, which presents moderate risk due to limited DEX liquidity while representing a minor share of the overall supply. At the moment, a sell order of 1000 WETH for USDC would result in 4% slippage. Nevertheless, the borrower’s health factors are in safe ranges, limiting the risk of large-scale liquidations.

LRTs and LSTs

The majority of WETH borrowing demand is facilitated by persistent LRT/LST looping. As the borrow rates for WETH are on average 75 basis points lower on Linea than Ethereum Core, the effective net APY in the leveraged positions is an order of magnitude higher, resulting in elevated demand.

While health scores are in the lower part of the range (1.03-1.06), the risk of liquidation is minimal due to the high correlation of the collateral and debt prices.

Overall, WETH borrowing presents minimal risk as the wstETH, ezETH, weETH, and wrsETH pools with WETH are among some of the deepest pools on Linea with the aggregate liquidity of $75M, supporting an increase of the supply caps.

Recommendation

The market is showing persistent demand for supplying and borrowing assets on the Linea instance. The majority of supplied capital is highly elastic to the supply rates and is subject to a net discount on the rates compared to markets like Ethereum Core. The discounted rates encourage elevated demand for LRT/LST-based WETH borrowing, which poses limited liquidation risk, due to the high correlation of debt and collateral prices coupled with deep onchain liquidity.

Given the additional adjustment of risk parameters proposed in our previous post, safe user behavior, and persistent supply and borrow demand on the Linea instance, we recommend doubling the supply and borrow caps for USDC, USDT, WETH, and wstETH, along with increasing the supply caps for ezETH and wrsETH to facilitate additional borrowing demand.

Additionally, we recommend increasing the Loan-to-Value risk parameter for ezETH from 72% to 72.5% to align it with other listed LRTs.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Linea | USDC | 48,000,000 | 96,000,000 | 43,200,000 | 86,400,000 |

| Linea | USDT | 8,000,000 | 16,000,000 | 7,200,000 | 14,400,000 |

| Linea | WETH | 38,400 | 76,800 | 35,200 | 70,400 |

| Linea | ezETH | 19,200 | 38,400 | - | - |

| Linea | wstETH | 600 | 1,200 | 150 | 300 |

| Linea | wrsETH | 400 | 800 | - | - |

| Deployment | Asset | Current LTV | Proposed LTV |

|---|---|---|---|

| Linea | ezETH | 72% | 72.5% |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.