Summary

LlamaRisk supports listing PT-USDe-15JAN2026 and PT-sUSDe-15JAN2026 on the Aave Plasma instance. At the time of this analysis, the assets mature in approximately 103 days. The market environment, characterized by high demand for Ethena’s USDe and its yield-bearing counterpart, sUSDe, has generated significant user demand for products that allow for fixed-rate exposure.

Onboarding these PTs allows users to acquire the underlying assets at a discount for future delivery. This effectively allows users to:

- Lock in a fixed rate on USDe in exchange for forgoing the “sats” (points) until maturity, in addition to the rewards being given by Plasma.

- Lock in a fixed rate on sUSDe in exchange for forgoing the underlying yield, “sats” and Plasma rewards until maturity.

Given the demonstrated demand for Ethena-related assets and the healthy liquidity profiles of these new pools, adding these assets presents a minor incremental risk to the Aave Plasma market while offering users the ability to benefit from the current incentives being distributed on Plasma.

Assessment of PT base asset: Link

Assessment of Pendle PTs: Link

Considered PT asset maturities: PT-USDe-15JAN2026, PT-sUSDe-15JAN2026

Asset State

Asset Growth

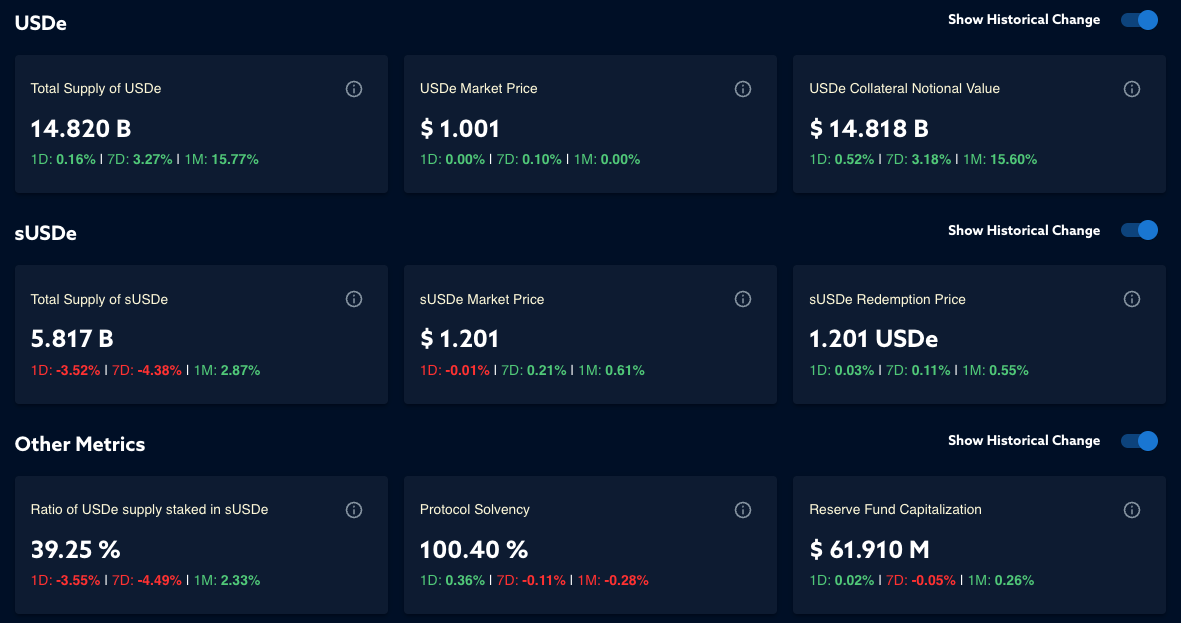

The Ethena ecosystem has demonstrated aggressive growth recently, partially fueled by the large Aave adoption. The total supply of USDe has surged to over 14.8 billion. A significant portion of this is staked for sUSDe, with the total supply of the yield-bearing sUSDe reaching over 5.8 billion, reflecting a staking ratio of approximately 39.25%.

Source: LlamaRisk Ethena Risk Portal, October 3, 2025

Underlying Stability

The stability of the underlying USDe peg and the overall health of the Ethena protocol are critical risk parameters. The market price of USDe remains tightly pegged to $1.00. From a protocol health perspective, Ethena maintains a solvency ratio of 100.40% and is supported by a Reserve Fund capitalized at over $61.9 million. The historical price chart shows tight sUSDe & USDe secondary market peg stability, with an exception of a single depeg instance during Bybit exploit.

Source: LlamaRisk, October 3, 2025

Underlying Yield Source

The primary incentives for holding USDe and sUSDe are the Ethena “sats” program and the native yield from sUSDe. The sats system provides users with multipliers for different activities.

- USDe deposited on Pendle generates a 60x sats multiplier and also benefit from an extra 3.7% yield in wXPL, as of October 6.

- sUSDe deposited on Pendle generates a 20x sats multiplier on top of its underlying yield and an extra 2.8% yield in wXPL, as of October 6.

These sats are highly sought after by users. The Pendle markets for PT-USDe and PT-sUSDe allow users to trade the principal of these assets separately from their yield/sats-generating potential. The “implied yield” observed in the market is effectively the price users are willing to pay for future rewards, creating an opportunity for others to buy the underlying at a discount (by purchasing PT tokens) if they are willing to forgo the rewards until maturity.

Market State

Total Supply

Both the PT-USDe-15JAN2026 and PT-sUSDe-15JAN2026 maturity pools have demonstrated sustained growth since their very recent inception. Analysis of the pools’ liquidity shows a healthy ramp-up over this short period. The supply is expected to continue increasing as the assets are deployed on Aave Plasma.

Source: LlamaRisk, October 3, 2025

Source: LlamaRisk, October 3, 2025

As of October 3, 2025, the composition of the pools is as follows:

- PT-USDe Pool:

- Total Liquidity: $26.90M

- SY USDe: $21.79M (81.03%)

- PT USDe: $5.10M (18.97%)

- PT-sUSDe Pool:

- Total Liquidity: $32.19M

- SY sUSDe: $25.81M (80.18%)

- PT sUSDe: $6.38M (19.82%)

These liquidity levels indicate strong market demand for these specific maturities and support the pools’ stability.

Source: Pendle, October 3, 2025

Source: Pendle, October 3, 2025

Market Depth

The order books for both assets reflect healthy and deep liquidity.

- PT-sUSDe: The bid-ask spread on the implied yield is approximately 0.77% (10.24% sell vs 11.01% buy), as of October 3.

- PT-USDe: The bid-ask spread on the implied yield is approximately 0.99% (9.51% sell vs 10.50% buy), as of October 3.

While these spreads are slightly higher than what we see on more established PTs, we expect them to tighten as the market gets more usage.

Price and Yield

The implied yields for PT-USDe and PT-sUSDe reflect the market’s discount rate on the underlying assets based on the opportunity cost of earning yield and sats. These rates have remained stable and attractive, albeit are now lower than the market rates a month ago.

Source: LlamaRisk, October 3, 2025

Source: LlamaRisk, October 3, 2025

As of this review (103 days to maturity), the implied yields are:

- PT-USDe: ~9.43% APY

- PT-sUSDe: ~10.25% APY

The pools have the following parameters on Pendle:

PT-sUSDe

- Liquidity Yield Range: 5-35%

- Input Tokens: sUSDe

- AMM Fee: 0.12%

- Orderbook Fee: 0.16%

PT-USDe

- Liquidity Yield Range: 5-35%

- Input Tokens: USDe

- AMM Fee: 0.11%

- Orderbook Fee: 0.15%

Maturities

The existence of multiple USDe and sUSDe-based maturities on Pendle, with a combined total TVL of over $2.5 billion, signals strong and persistent user interest in the product. This availability of multiple maturities ensures a more natural rollover of the PT pools, which is also relevant for Aave’s exposure. Before the January pool expires, a new maturity pool will likely be created, letting users migrate continuously.

Source: Pendle, October 3, 2025

Integrated Venues

PT-USDe-15JAN2026 and PT-sUSDe-15JAN2026 have been deployed on Euler, with a total combined supply of $137M.

Recommendations

We have aligned the risk parameter recommendations for the PT-USDe-15JAN2026 and PT-sUSDe-15JAN2026 listings with @ChaosLabs, which has already been published in this thread.

Price Feed Recommendation

For pricing both PTs tokens on Aave, a specific dynamic linear discount rate oracle has been developed by BGD Labs. It is recommended that both, PT-USDe-15JAN2026 and PT-sUSDe-15JAN2026 tokens be priced using it.

Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded partly by the Aave DAO. LlamaRisk serves as Ethena’s Risk Committee member and an independent attestor of Ethena’s PoR solution. LlamaRisk did not receive compensation from the protocol(s) or their affiliated entities for this work. The information should not be construed as legal, financial, tax, or professional advice.