Overview

In line with the Principal Token Risk Oracle framework outlined here, we present risk parameter recommendations for listing PT-USDe-7MAY2026 and PT-sUSDe-7MAY2026, including initialDiscountRatePerYear and maxDiscountRatePerYear derived from the dynamic linear discount rate oracle methodology described here. Our research paper, “Stress Testing Ethena: A Quantitative Look at Protocol Stability,” examines how rapid growth in USDe, sUSDe, and Pendle PT deposits impacts Aave’s collateral mix and funding dynamics. Using scenario analysis and Monte Carlo simulations, it evaluates liquidity, leverage, and backing-side tail risks, while showing that Aave’s existing risk-oracle , E-Mode configurations, and liquidation controls absorb most shocks. The upcoming native mechanism to offload Ethena-collateralized debt, enabled by Aave’s whitelisted redeemer status, further strengthens stress resilience for duration-sensitive assets such as PTs, as detailed here. Finally, “Aave’s Growing Exposure to Ethena: Risk Implications Throughout the Growth and Contraction Cycles of USDe” shows that falling sUSDe yields drive leverage unwinds, releasing stablecoin liquidity into Aave. At the same time, PT/USDe borrowers shift debt into other stablecoins, supporting USDe pricing during redemption pressure. Repayments from unwinders generally exceed PT debt migration, creating a natural liquidity buffer that stabilizes Aave markets.

Risk Oracle Parameter Evolution

Through our rigorous quantification of the algorithm, we find that the integration risk decays as the PT approaches maturity. This justifies the utilization of progressively less conservative risk parameters over time. Taking into account the underlying configuration of USDe E-Mode within Aave, we outline the projected evolution of the LT, LTV, and LB, with the initial parameterization of the Stablecoin and USDe specific E-Modes for USDe and sUSDe May-expiry principal tokens approximately as follows:

Stablecoin E-Mode

PT-USDe-7MAY2026 — LTV: 87.2%, LT: 89.2%, LB: 4.4%

PT-sUSDe-7MAY2026 — LTV: 86.4%, LT: 88.4%, LB: 5.5%

USDe E-Mode

To improve capital efficiency, we propose a dedicated USDe E-Mode for PT-USDe-7MAY2026 and PT-sUSDe-7MAY2026. As both the PT underlying and debt asset are anchored to USDe, risk parameters should primarily reflect Pendle AMM liquidity and PT pricing dynamics rather than traditional underlying asset risk. Initial LT, LTV, and LB parameters are outlined below.

PT-USDe-7MAY2026 — LTV: 88.1%, LT: 90.1%, LB: 3.4%

PT-sUSDe-7MAY2026 — LTV: 87.2%, LT: 89.2%, LB: 4.5%

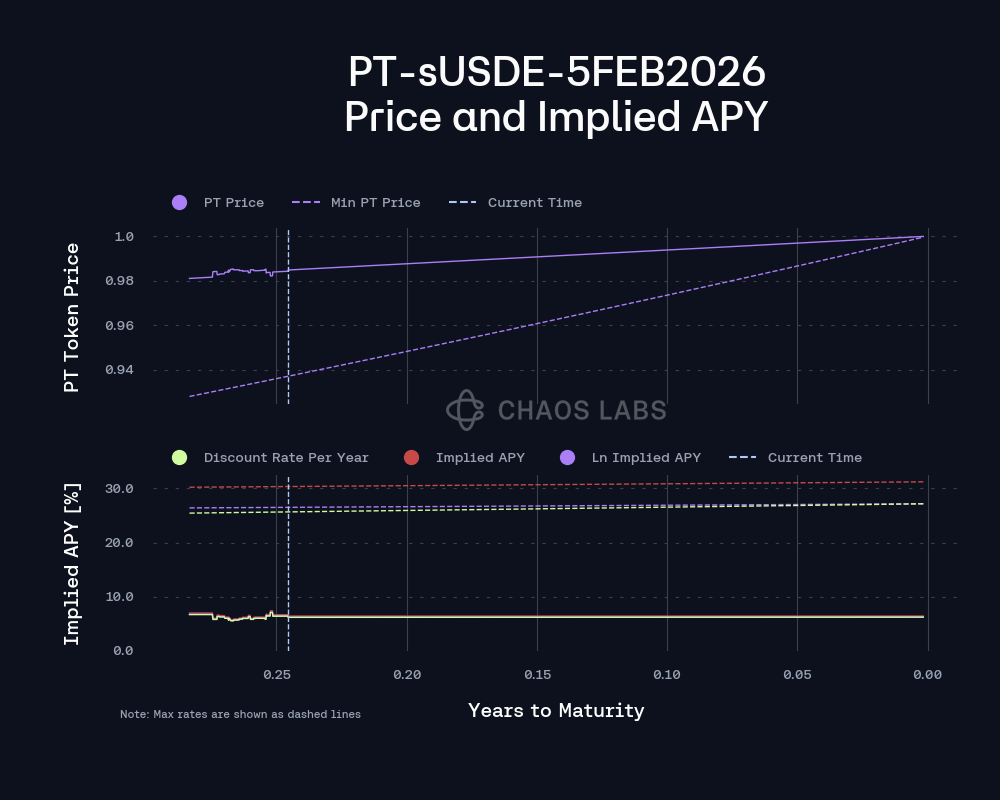

Discount Rates

Based on historical observed data and the pricing configuration of the market, our initial recommendations for the discount rate parameters are as follows:

PT-USDe-7MAY2026

initialDiscountRatePerYear: 4.95%, maxDiscountRatePerYear: 25.69%

PT-sUSDe-7MAY2026

initialDiscountRatePerYear: 5.02%, maxDiscountRatePerYear: 25.67%

Supply Caps

Liquidity for PT-sUSDe-7MAY2026 and PT-USDe-7MAY2026 is driven by both underlying USDe market depth and Pendle’s PT/SY AMM, with current liquidity at moderate levels. As shown in the plots, slippage declines materially as maturity approaches, reflecting reduced convexity in PT pricing. Under current AMM conditions, swaps of up to $5.5M (PT-sUSDe) and $2.1M (PT-USDe) can be executed within 3% slippage. Assets with lower scalarRoot values exhibit greater slippage sensitivity earlier in the lifecycle, but this effect compresses significantly closer to expiry.

The SY Liquidity in PT-sUSDe-7MAY2026 and PT-USDe-7MAY2026’s AMM has reached $6M and $2.5M. While the liquidity expansion is extremely recent, we expect the depth to persist over time. Additionally, the expected evolution of AMM depth, typical of such markets, further decreases the risk of failed liquidations.

Migration of Existing PTs

To support a seamless migration from other PT-USDe and sUSDe assets maturing in February to PT-sUSDe-7MAY2026 and PT-USDe-7MAY2026, we recommend including PT-USDe-5FEB2026 and PT-sUSDe-5FEB2026 in the newly created E-Modes.

Underlying Oracle

As the underlying PT-USDe is anchored to USDe, we recommend leveraging the Capped USDT/USD feed as the underlying ASSET_TO_USD_AGGREGATOR within the PT-USDe PendlePriceCapAdapter.

Specification

| Parameter | Value | Value |

|---|---|---|

| Asset | PT-USDe-7MAY2026 | PT-sUSDe-7MAY2026 |

| Isolation Mode | No | No |

| Borrowable | No | No |

| Collateral Enabled | No | No |

| Supply Cap | 30,000,000 | 70,000,000 |

| Borrow Cap | - | - |

| Debt Ceiling | - | - |

| LTV | - | - |

| LT | - | - |

| Liquidation Bonus | - | - |

| Liquidation Protocol Fee | 10.00% | 10.00% |

| E-Mode Category | PT-USDe Stablecoins, PT-USDe USDe | PT-sUSDe Stablecoins, PT-sUSDe USDe |

PT-USDe-7MAY2026

Initial E-Mode Risk Oracle

| Parameter | Value | Value |

|---|---|---|

| E-Mode | Stablecoins | USDe |

| LTV | 87.2% | 88.1% |

| LT | 89.2% | 90.1% |

| LB | 4.4% | 3.4% |

Linear Discount Rate Oracle

| Parameter | Value |

|---|---|

| initialDiscountRatePerYear | 4.95% |

| maxDiscountRatePerYear | 25.69% |

PT-USDe Stablecoins E-Mode

| Asset | PT-USDe-7MAY2026 | PT-USDe-5FEB2026 | USDe | USDC | USDT | USDtb |

|---|---|---|---|---|---|---|

| Collateral | Yes | Yes | Yes | No | No | No |

| Borrowable | No | No | Yes | Yes | Yes | Yes |

| LTV | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - | - | - |

| LT | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - | - | - |

| Liquidation Bonus | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - | - | - |

PT-USDe USDe E-Mode

| Asset | PT-USDe-7MAY2026 | PT-USDe-5FEB2026 | USDe |

|---|---|---|---|

| Collateral | Yes | Yes | Yes |

| Borrowable | No | No | Yes |

| LTV | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle |

| LT | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle |

| Liquidation Bonus | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle |

PT-sUSDe-7MAY2026

Initial E-Mode Risk Oracle

| Parameter | Value | Value |

|---|---|---|

| E-Mode | Stablecoins | USDe |

| LTV | 86.4% | 87.2% |

| LT | 88.4% | 89.2% |

| LB | 5.5% | 4.5% |

Linear Discount Rate Oracle

| Parameter | Value |

|---|---|

| initialDiscountRatePerYear | 5.02% |

| maxDiscountRatePerYear | 25.67% |

PT-sUSDe Stablecoins E-Mode

| Asset | PT-sUSDe-7MAY2026 | PT-sUSDe-5FEB2026 | sUSDe | USDC | USDT | USDe | USDtb |

|---|---|---|---|---|---|---|---|

| Collateral | Yes | Yes | Yes | No | No | No | No |

| Borrowable | No | No | No | Yes | Yes | Yes | Yes |

| LTV | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - | - | - | - |

| LT | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - | - | - | - |

| Liquidation Bonus | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - | - | - | - |

PT-sUSDe USDe E-Mode

| Asset | PT-sUSDe-7MAY2026 | PT-sUSDe-5FEB2026 | sUSDe | USDe |

|---|---|---|---|---|

| Collateral | Yes | Yes | Yes | No |

| Borrowable | No | No | No | Yes |

| LTV | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - |

| LT | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - |

| Liquidation Bonus | Subject to Risk Oracle | Subject to Risk Oracle | Subject to Risk Oracle | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0