Summary

This post analyzes the rapid growth of the Linea instance and its evolving risk profile, and additionally proposes parameter updates to balance demand with protocol safety:

- Increase the supply and borrow caps for WETH on the Linea Instance

- Increase supply and borrow caps for USDC on the Linea Instance

- Increase supply and borrow caps for USDT on the Linea Instance

- Increase supply and borrow caps for wstETH on the Linea Instance

- Increase the supply cap for weETH on the Linea Instance

- Increase the supply cap for ezETH on the Linea Instance

- Increase the borrow cap for ezETH on the Ethereum Core Instance

- Increase the supply cap for WETH on the Celo Instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

Linea Overview

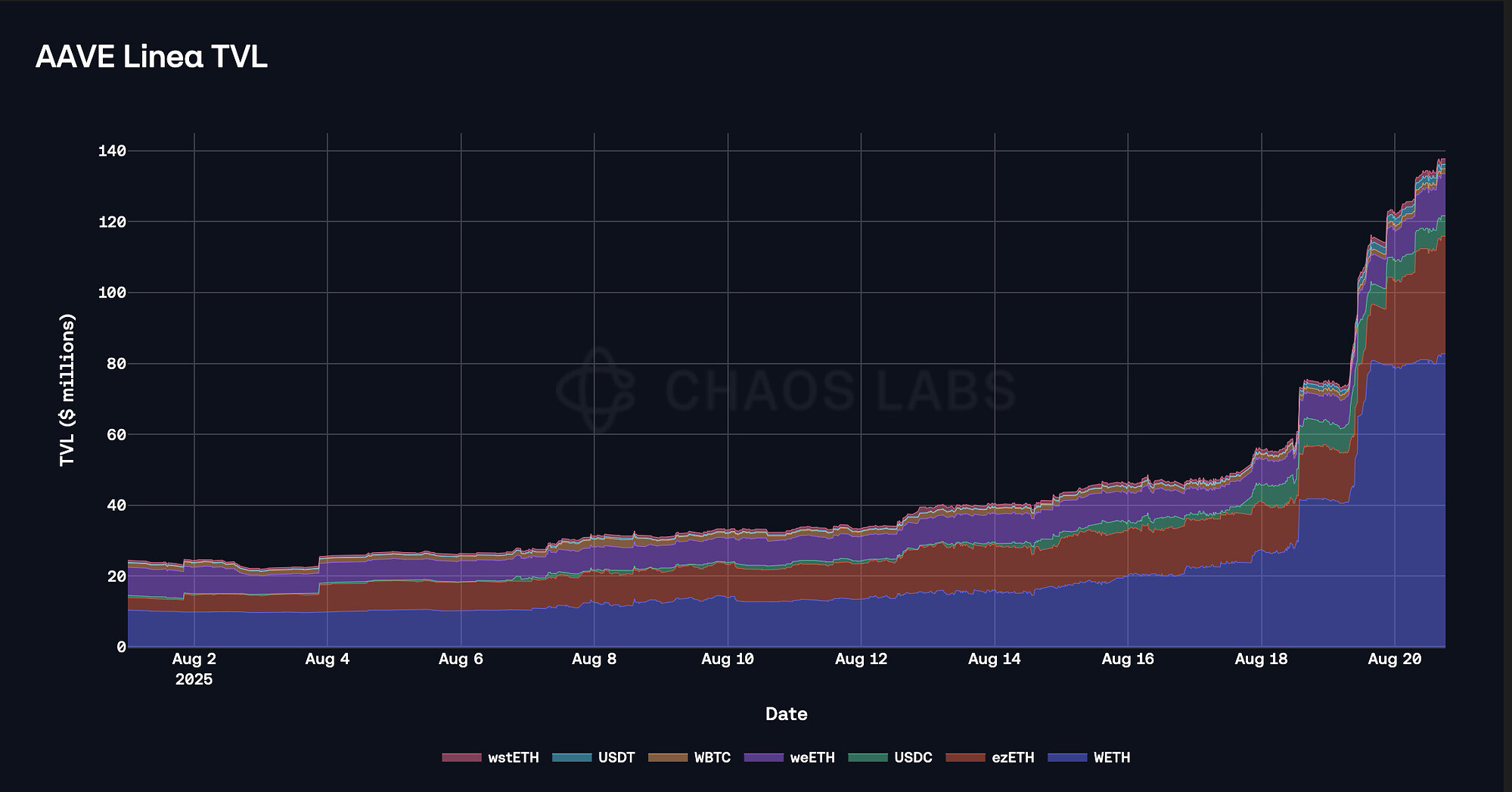

Linea has emerged as one of the fastest-growing instances of Aave. Over the past ten days alone, the deployment has attracted more than $100 million in deposits, while outstanding debt has grown by over $40 million. Several assets, including WETH, USDC, USDT, and ezETH, have already reached their recently increased supply caps, underscoring the persistence of demand and the rate of market expansion. This rapid growth highlights the increased user attention and liquidity migration toward the Linea deployment, which is primarily driven by a combination of incentive programs and speculative positioning in expectation of an airdrop.

While the instance’s TVL has been growing rapidly, the risk profile has shifted as market demand has outpaced available liquidity. In our analysis, we highlight the underlying sources of rapid growth, assess the sustainability of incentive-driven flows, and evaluate the potential risks that may emerge from limited liquidity and speculative positioning.

Incentives

The growth of Aave on Linea has been partially influenced by exogenous factors that have attracted both suppliers and borrowers. Linea’s native staking has been announced but is not yet active, and anticipation of its launch has encouraged some liquidity providers to bridge the capital in advance. In addition, USDC incentives in collaboration with MetaMask are active, offering 2.4%-2.5% incentives on lending activity, capped by a $5,000 cumulative volume per user. This initiative is also tied to the MetaMask/Metalend integration, where idle USDC in card accounts is yield-bearing by default and automatically withdrawn from Aave when utilized for spending. Linea’s ecosystem also offers highly lucrative LP opportunities, with some pools exhibiting mid-triple-digit APRs. These returns drive users to borrow stablecoins from Aave and redeploy them externally, amplifying both supply and borrow dynamics. Collectively, these factors support and enhance the supply and borrow dynamics described in the following section.

Demand

Since the beginning of August, Aave’s instance on Linea has experienced significant growth in TVL, with a net increase of over $130 million on the supply side and $48 million on the demand side. The largest contributor to this growth has been WETH, as both its supply and borrowing have increased substantially.

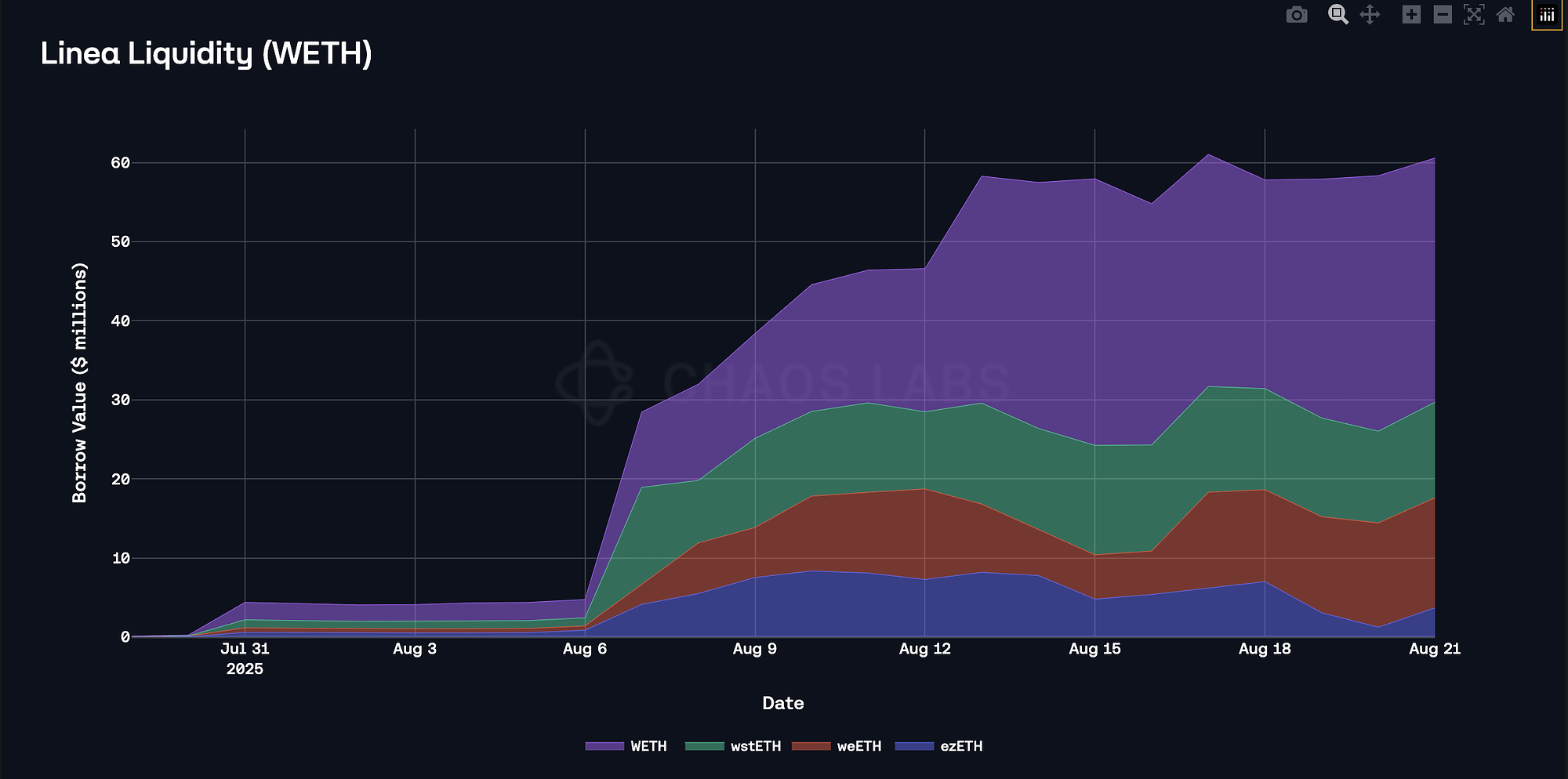

WETH

While the WETH supply has increased from 2.8K to 19.2K tokens and borrowing has risen by 6.3K tokens, the rates have decreased. The overwhelming majority of suppliers have no debt against their WETH collateral, presenting minimal liquidation risk.

Additionally, a significant proportion of users borrow stablecoins such as USDC and USDT against WETH collateral to participate in highly incentivized liquidity provision or other yield-driven activities. Current yields across Linea’s DEXs and liquidity pools are unusually elevated, with several pools offering APRs well above 100% and, in extreme cases, exceeding 500%. These outsized returns provide a powerful incentive for users to borrow stablecoins on Aave and immediately deploy them into external strategies.

LRTs

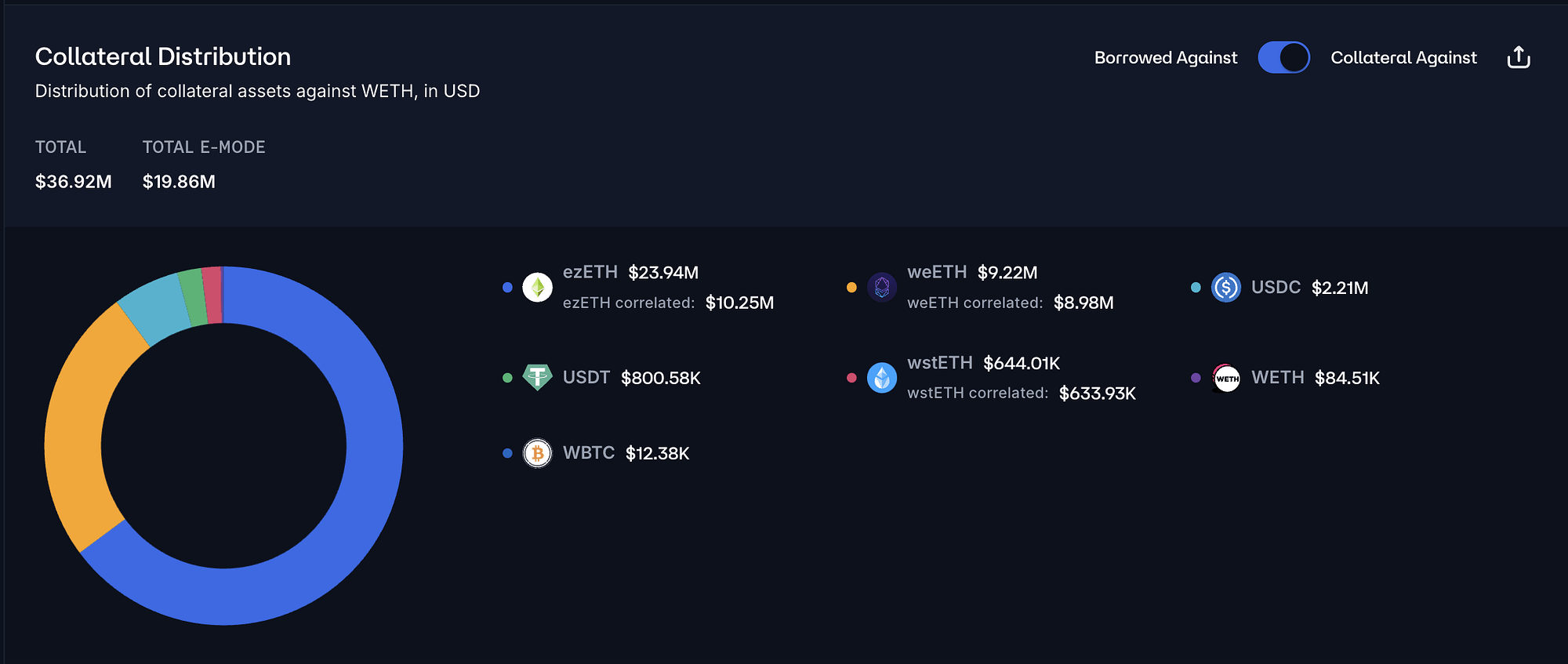

The supply of Liquid Restaking Tokens (LRTs) on Linea has grown rapidly, driven by the comparatively lower cost of borrowing WETH on the Linea instance relative to Ethereum Core. Since the majority of WETH borrowing is collateralized with LRTs, it is evident that users are taking advantage of favorable rate spreads to enhance returns through leveraged staking strategies.

In practice, participants borrow WETH at relatively low rates, convert it into restaked derivatives such as weETH or ezETH, and redeploy these assets as collateral. This looping process allows users to leverage their positions, targeting an optimized risk–reward profile by capturing the spread between staking yields and the effective cost of borrowing.

While these positions utilize high leverage, they pose minimal liquidation risk as the prices of debt and collateral typically move in tandem; nevertheless, in the event of a validator failure, the risk of slashing would materialize, directly impairing the value of the collateral and exposing positions to sudden liquidation.

Stablecoins

As mentioned earlier in the WETH section, a significant portion of suppliers borrow stablecoins against their WETH collateral.

While the ongoing MetaMask stablecoin borrowing incentives do not directly affect this activity, there is growing evidence that the borrowed stablecoins are being deployed into liquidity provision strategies across several of Linea’s decentralized exchanges. This behavior aligns with typical DeFi market dynamics, where users employ borrowed stablecoins in yield-generating activities such as providing liquidity in stablecoin or WETH pools, participating in incentive campaigns on DEXs, or capturing trading fees in high-volume pairs. Notably, many of these pools currently offer unusually high APYs, further reinforcing the incentive to borrow and redeploy assets.

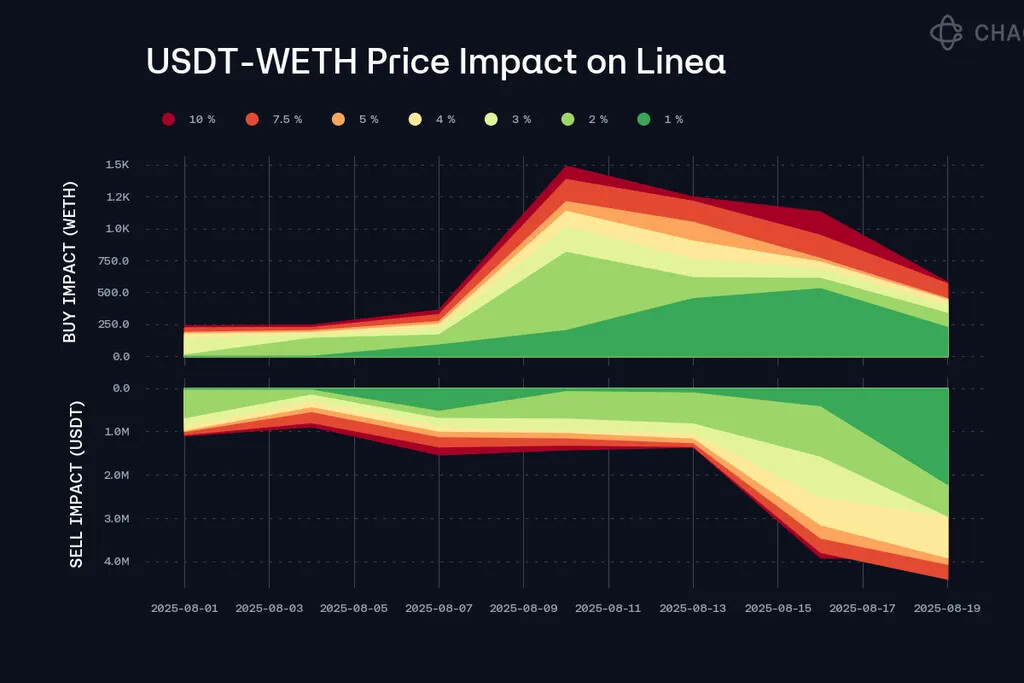

Liquidity risks

While activity on the Linea instance has expanded significantly, liquidity depth has not yet scaled proportionally. The majority of available liquidity on Linea’s DEXs is concentrated in correlated asset pools like ezETH/WETH or USDC/USDT. At the same time, demand for stablecoin borrowing has increased, leaving utilization rates elevated and reducing the proportion of collateral that can be liquidated instantaneously. This imbalance assumes potential stress areas where WETH price volatility could trigger significant liquidations of collateralized stablecoin debt, which, given the limited liquidity, might result in failed liquidations and bad debt for the protocol.

On the other hand, LRT-based activity, in particular, leveraged staking strategies, pose minimal liquidation risks, as the collateral (primarily ezETH and weETH) and debt (WETH) are highly correlated in price. This correlation reduces the likelihood of adverse price action, consequently decreasing the liquidation risks. Nevertheless, adverse scenarios with LRTs remain possible, such as validator-level failures or depegging events, which impact the collateral price.

Recommendation

For WETH, we recommend doubling the caps, as it remains the primary driver of market activity and its associated user behavior has remained conservative. Higher caps will also enable more LRT/LST-collateralized borrowing, increasing yields for both users and the protocol.

We likewise propose doubling the stablecoin (USDC/USDT) caps to match the expected rise in liquidity, as high LP yields continue to draw borrowing demand. Expanding borrow capacity will direct additional stablecoin flow into LP pools, helping to deepen liquidity, strengthen trading venues, and support broader market growth.

Finally, higher limits for LRTs (ezETH, weETH) and LSTs (wstETH) are warranted given the strong user appetite and favorable rate differentials compared to Ethereum Core. These adjustments balance growth with prudent safeguards, ensuring Aave on Linea can scale sustainably.

Additional Supply Cap Adjustments

ezETH (Ethereum Core)

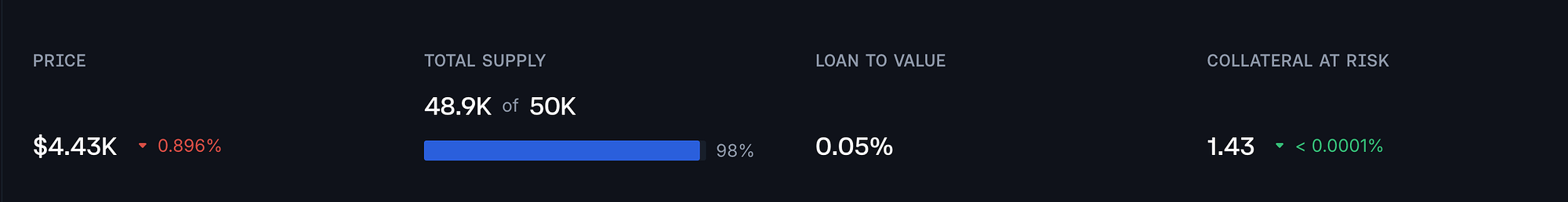

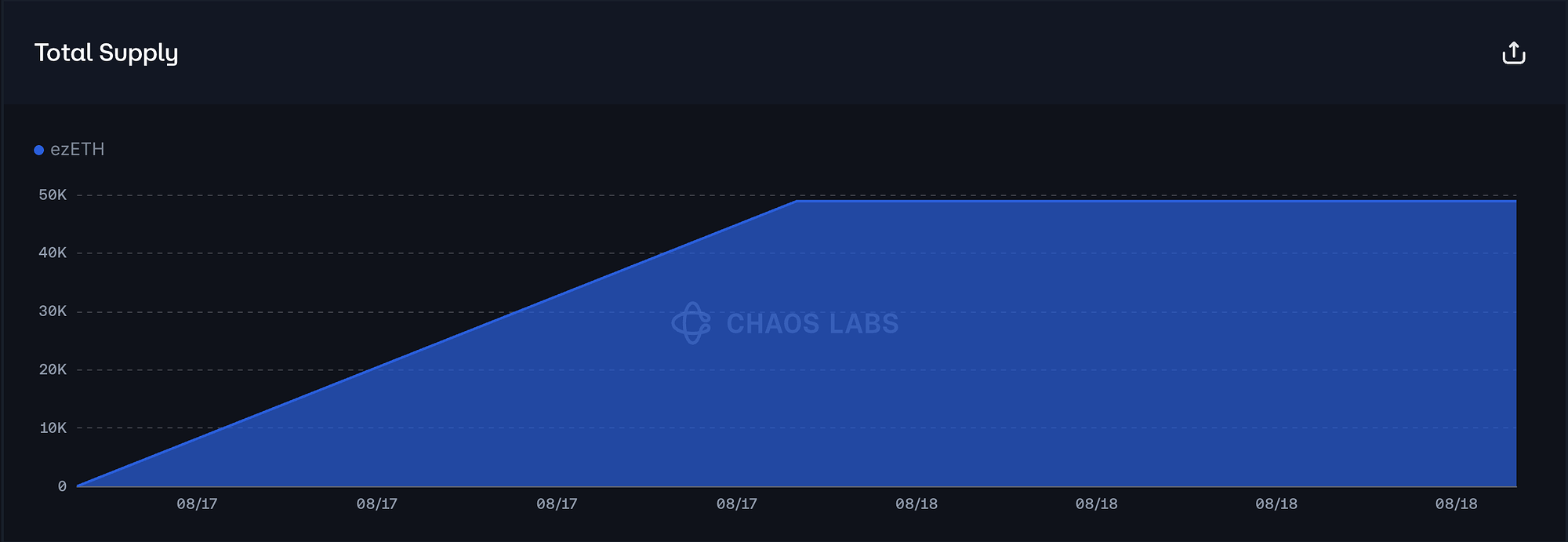

ezETH has reached 98% supply cap utilization.

Supply Distribution

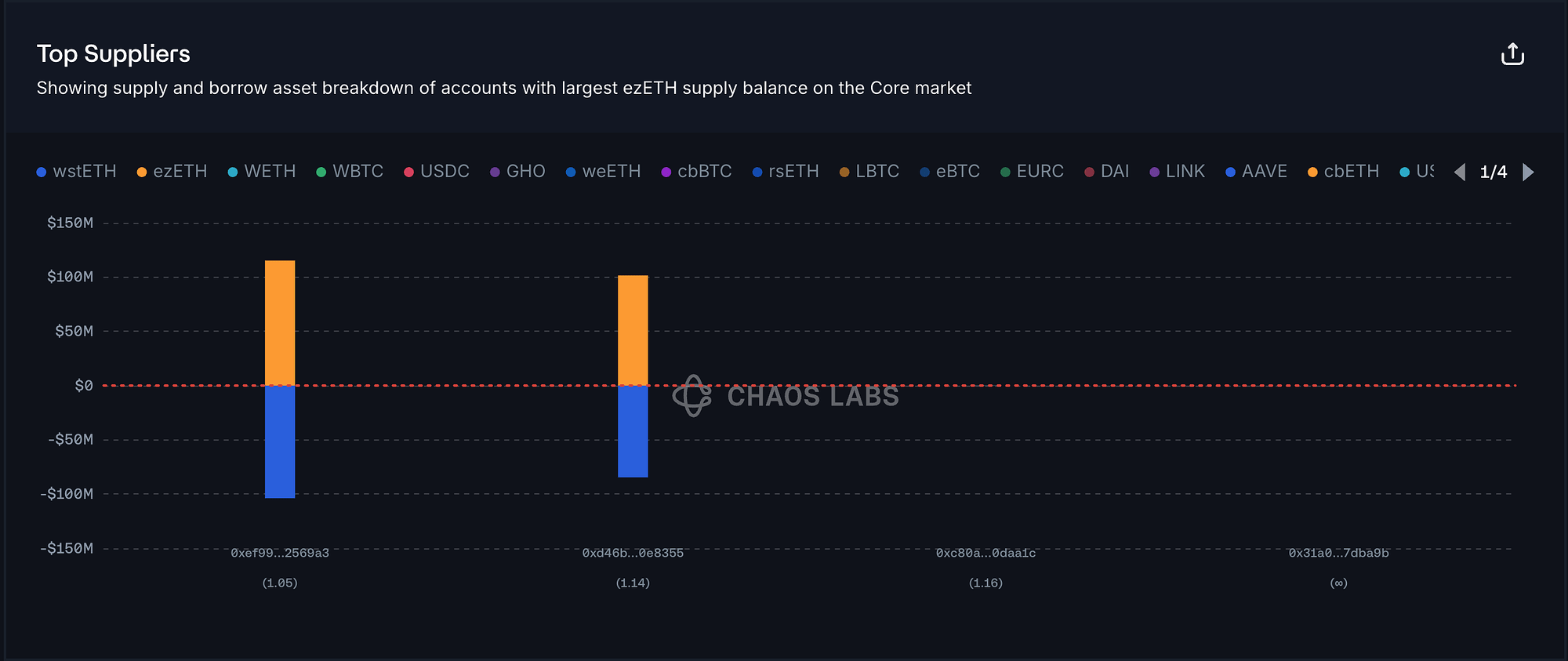

ezETH’s supply presents a concentration risk, with the top two suppliers accounting for approximately 99% of the total distribution. However, since both are borrowing wstETH, a highly correlated asset, we believe the risk of immediate liquidation is low.

Liquidity

Currently, selling 2K ezETH to WETH on Ethereum would incur less than 5% price slippage. While this liquidity is somewhat limited relative to the current supply cap scale, we believe a supply cap increase remains viable given the safe user behavior.

Recommendation

Given the safe user behavior, we recommend increasing ezETH’s supply cap.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Linea | USDC | 24,000,000 | 48,000,000 | 21,600,000 | 43,200,000 |

| Linea | USDT | 4,000,000 | 8,000,000 | 3,600,000 | 7,200,000 |

| Linea | WETH | 19,200 | 38,400 | 17,600 | 35,200 |

| Linea | ezETH | 9,600 | 19,200 | - | - |

| Linea | weETH | 8,000 | 16,000 | - | - |

| Linea | wstETH | 300 | 600 | 75 | 150 |

| Ethereum Core | ezETH | 50,000 | 75,000 | - | - |

| Celo | WETH | 2,000 | 2,200 | 900 | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.