Summary:

A proposal to:

- Increase supply and borrow caps for USDC on the Linea instance

- Increase supply and borrow caps for USDT on the Linea instance

- Increase supply and borrow caps for WETH on the Linea instance

- Increase supply and borrow caps for wstETH on the Linea instance

- Increase supply cap for wrsETH on the Linea instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

Motivation

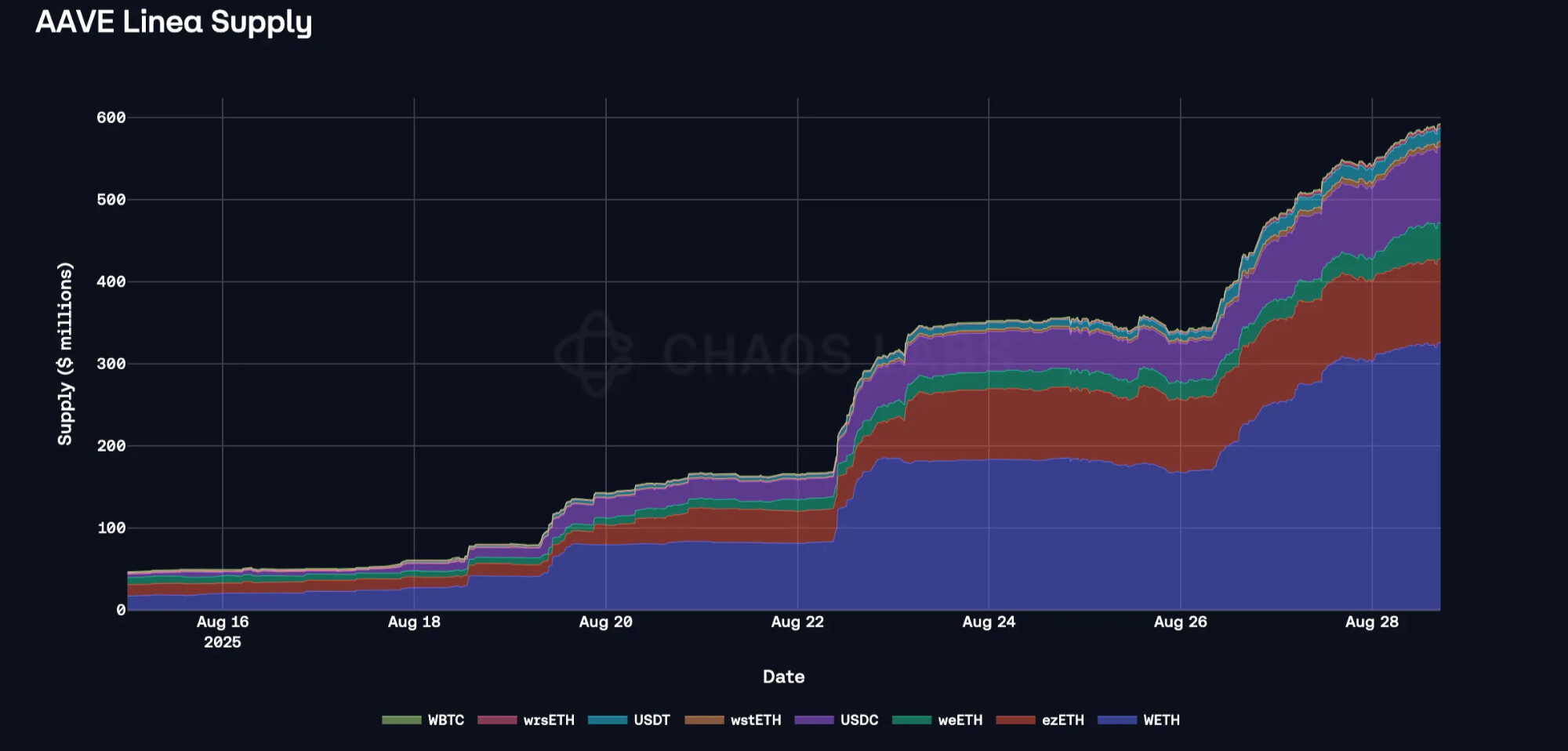

Following the recent increase of supply caps on the Linea instance, the total supply has increased by $240 million over the past 3 days, reaching $590 million. The growth was driven primarily by inflows of WETH, USDC and LRTs.

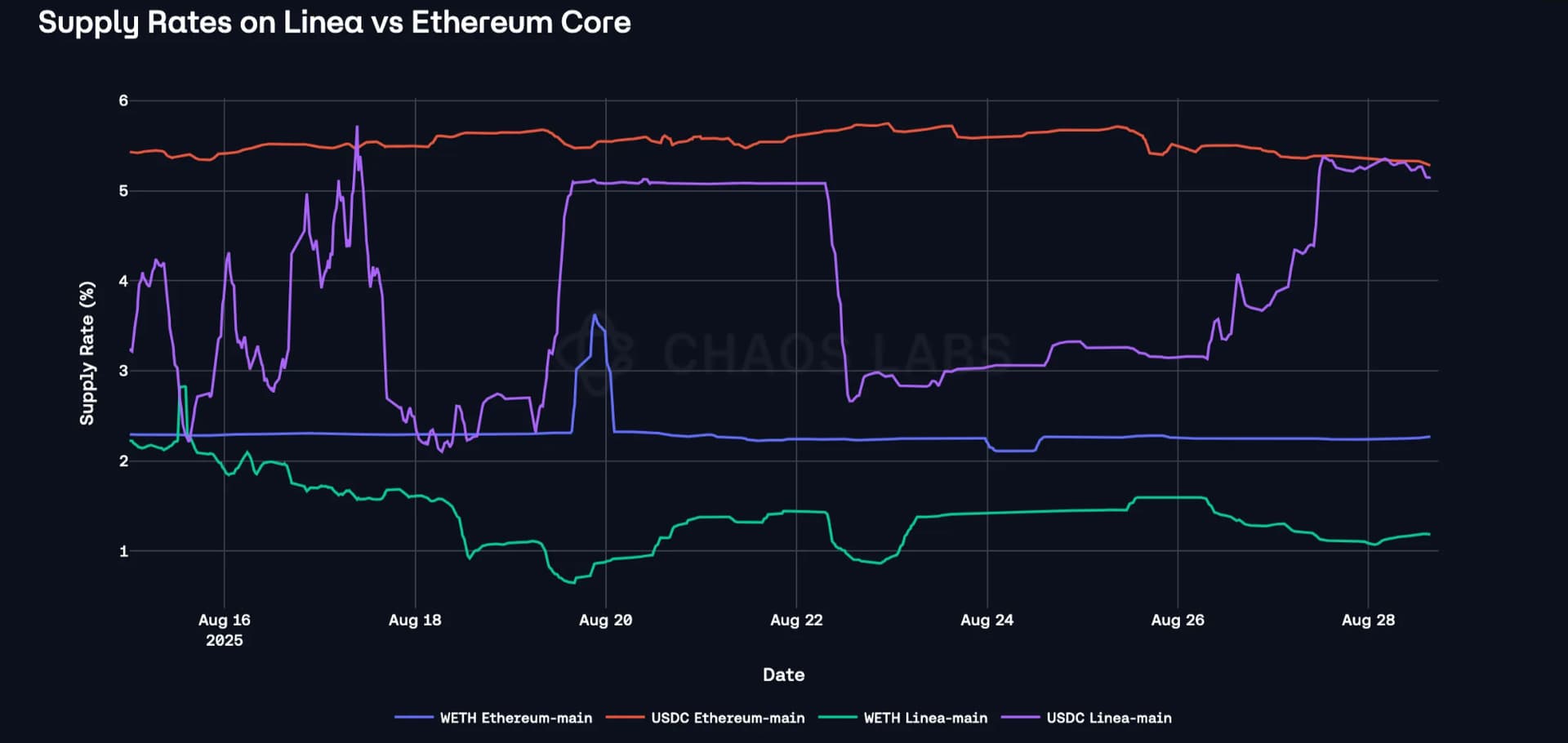

As mentioned in the previous analysis, a substantial proportion of users have not adjusted to the relatively discounted supply rates compared to Ethereum Core. At the moment, USDC supply rates have converged as the spread decreased from 250 basis points to 10; nevertheless, WETH suppliers are facing a 100 basis point discount, suggesting high elasticity of suppliers to the supply APR.

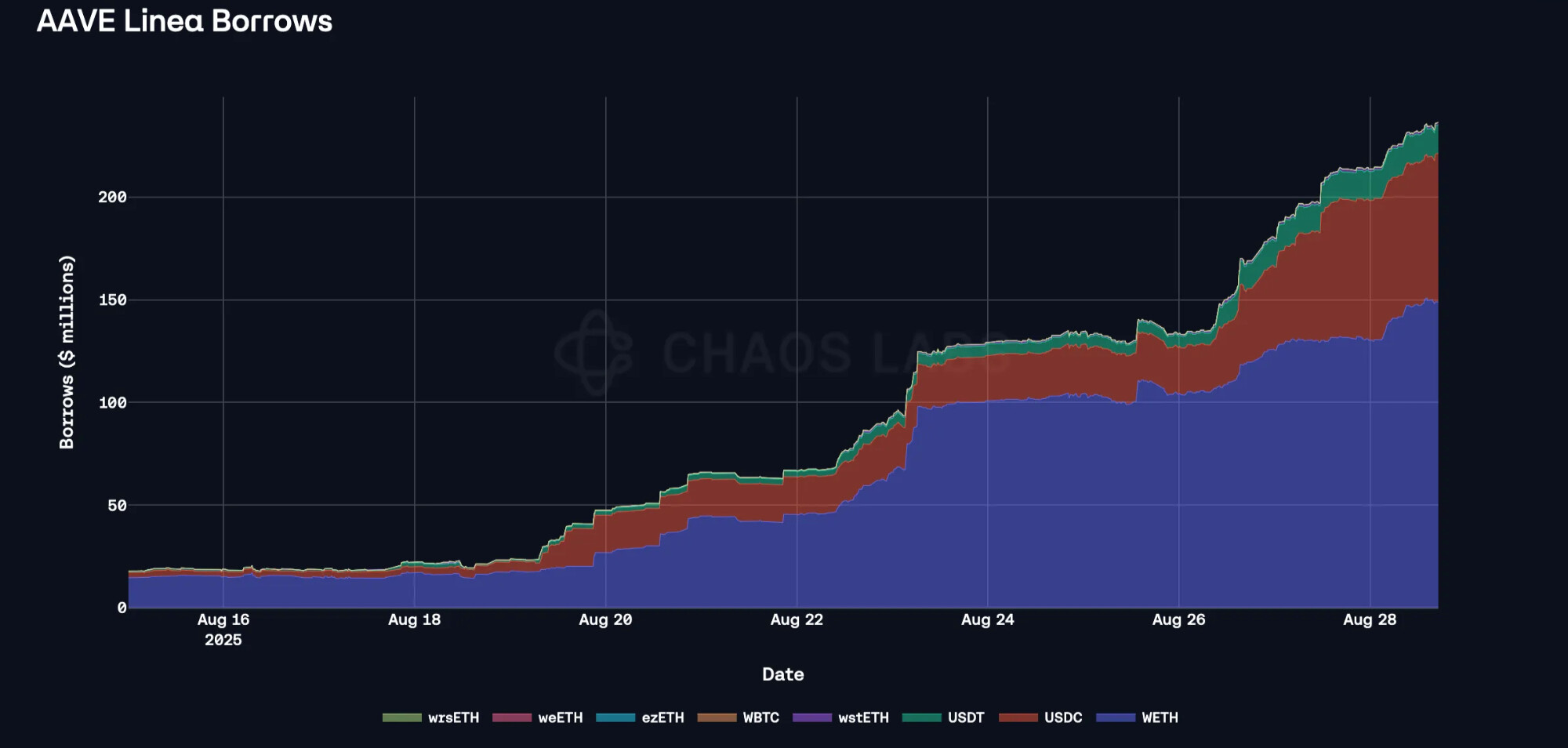

The increase in total borrows is less significant compared to supply, as the market has added over $50 million in WETH borrowing and $80 million in aggregate stablecoin borrowing, split between USDC and USDT.

The observed user behavior, imbalanced supply and borrowing demand, and low sensitivity to supply rates, combined with substantial growth over the past 3 days, indicate sustained demand and significant potential for expansion.

WETH

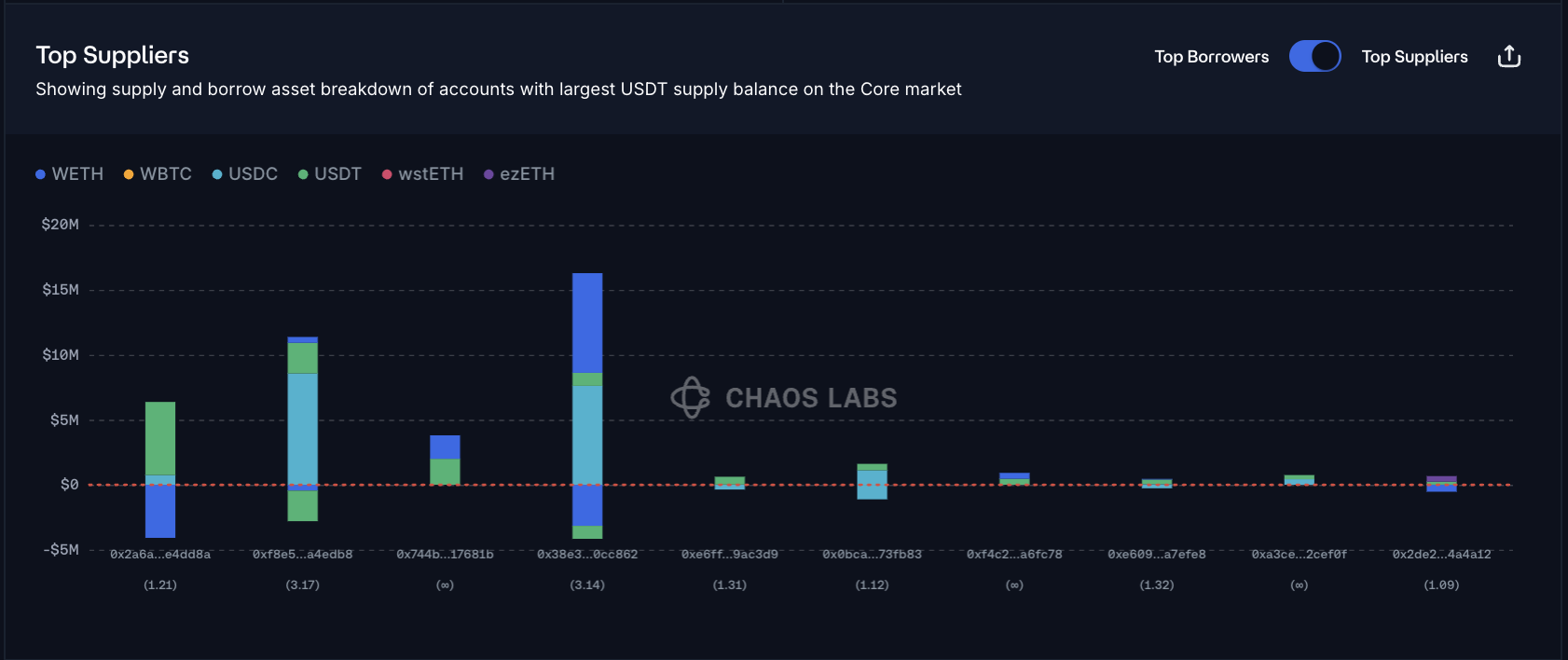

WETH has experienced substantial growth in both supply and borrow volumes. The majority of suppliers currently do not maintain any borrowing positions, and, consequently, do not face any liquidation risk. Additionally, 4 of the top 10 suppliers have USDC debt positions with health factors ranging from 1.17 to 2.31, also limiting liquidation risk.

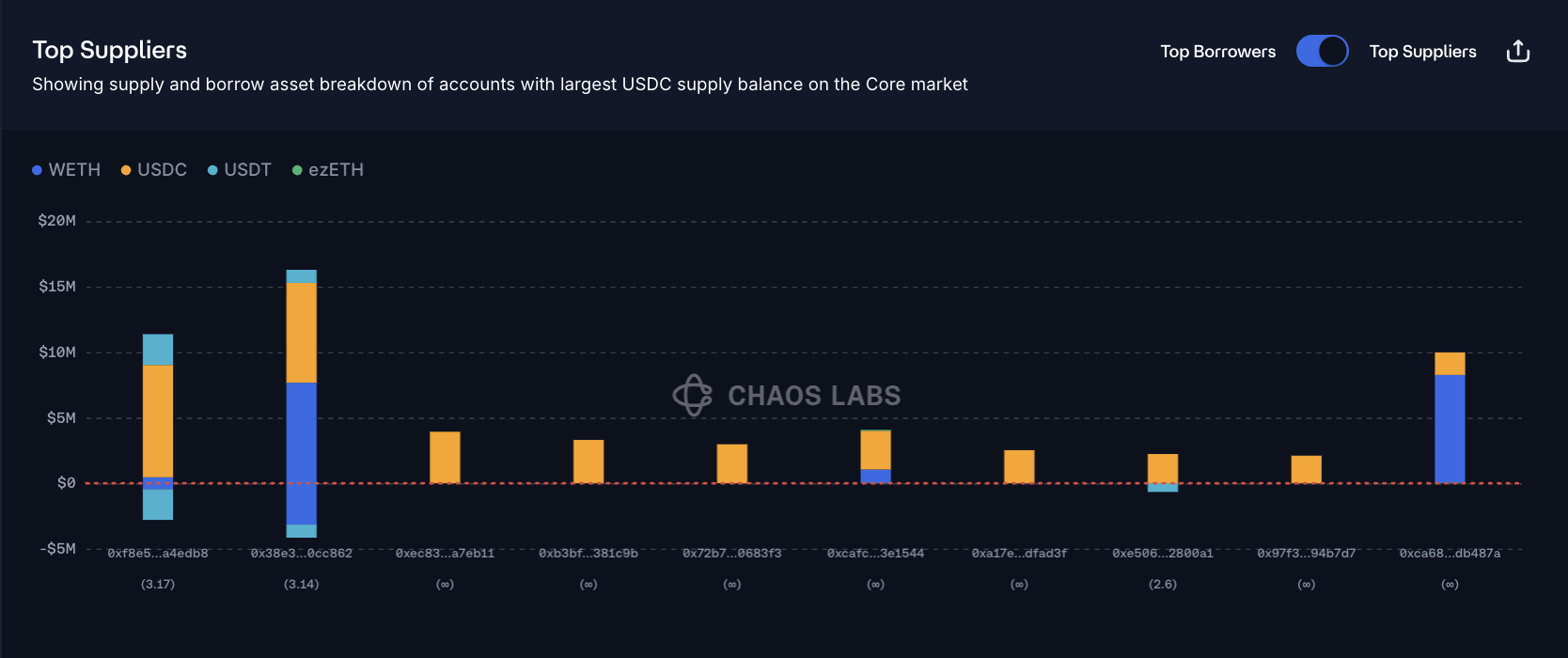

Stablecoins

As mentioned previously, stablecoins have increased both in supply and borrow volumes to $108.5 million and $86 million, respectively. It is important to note that only a minor portion of the tokens are used to collateralize debt at a cumulative sum of $26 million, as the overwhelming majority of suppliers have either no borrowing positions or minimal debt with safe health factors.

For stablecoin borrowing positions, WETH is the dominant collateral asset, representing over 90% of all posted collateral at a total of $77 million. This presents a moderate risk due to limited DEX liquidity. Currently, the liquidity depth is sufficient to handle a sell order of 1100 WETH with only 3% slippage. Given the safe range of health factors maintained by stablecoin borrowers, the risk of significant liquidations remains minimal.

LRTs/LSTs

Although the supply of LRTs and LSTs has expanded substantially since the last cap increase, only wstETH and wrsETH have reached the caps, whereas other assets retain capacity for further growth. As previously indicated, these assets are utilized as collateral to facilitate leveraged staking/restaking. Since the borrow rates for WETH on Linea are significantly lower than on Ethereum Core, the loopers are able to amplify their net yields substantially, creating a strong demand for WETH borrowing.

While health scores for the looping positions are in the lower range (1.02-1.1), the positions generally face minimal liquidation risk due to the high price correlation between debt and collateral. Additionally, these correlated assets have the deepest liquidity pools on Linea, at the time of writing, a sell order of 2,000 wstETH for WETH would incur less than 1% slippage.

Recommendation

The Linea instance continues to see strong supply and borrow demand across WETH, stablecoins, and LRT/LSTs. Borrowing remains conservative, with safe health factors and minimal liquidation risk supported by deep liquidity. Meanwhile, wstETH and wrsETH utilization highlights steady growth in leveraged staking loops, presenting limited risk due to high price correlation and liquidity depth. Given this sustained demand, user behavior, and favorable liquidity conditions, we recommend increasing the supply and borrow caps for USDC, USDT, WETH, and wstETH, along with the supply cap for wrsETH, to accommodate growth while maintaining robust risk management.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Linea | USDC | 96,000,000 | 192,000,000 | 86,400,000 | 172,800,000 |

| Linea | USDT | 16,000,000 | 32,000,000 | 14,400,000 | 28,800,000 |

| Linea | WETH | 76,800 | 153,600 | 70,400 | 140,800 |

| Linea | wstETH | 1,200 | 2,400 | 300 | 600 |

| Linea | wrsETH | 800 | 1600 | - | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.