Summary:

A proposal to:

- Increase supply and borrow caps for USDC on the Linea instance

- Increase supply and borrow caps for USDT on the Linea instance

- Increase the supply and borrow caps for WBTC on the Linea instance

- Increase the supply and borrow caps for wstETH on the Linea instance

- Increase the supply cap for weETH on the Linea instance

- Increase the supply cap for ezETH on the Linea instance

- Increase the supply cap for wrsETH on the Linea instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

Motivation

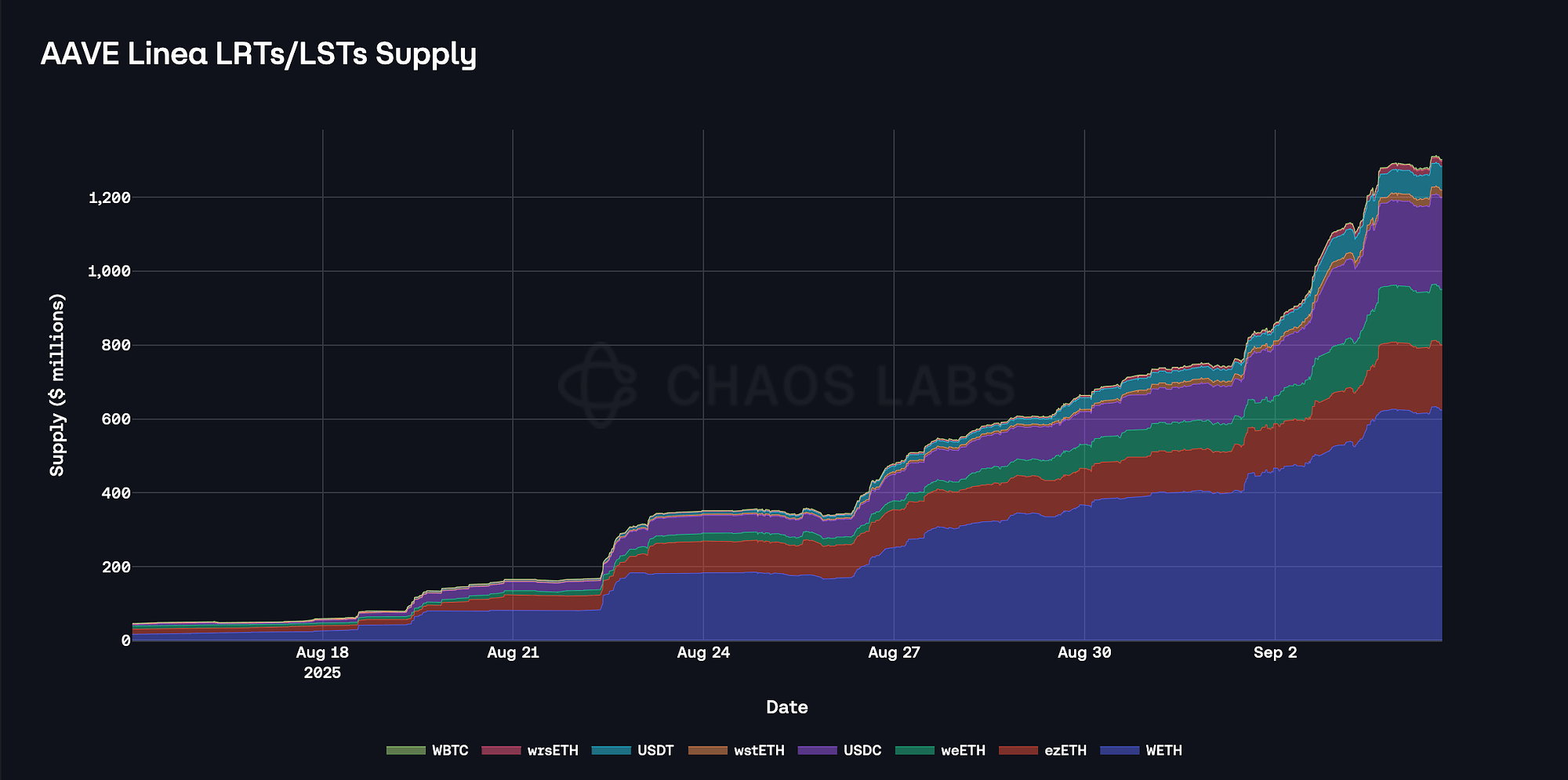

Aave’s aggregate supply on Linea has increased substantially following recent adjustments to borrow and supply caps. Since August 25, total supply has risen from approximately $390 million to $1.3 billion—an expansion of more than $900 million. Growth has been primarily led by inflows of WETH, USDC, USDT, ezETH, and weETH.

In prior analyses of the Linea deployment, we noted that suppliers of WETH, USDC, and USDT were earning significantly discounted supply rates—up to ~250 basis points for stablecoins and ~100 bps for WETH. Over the past week, these spreads have narrowed; current levels are ~25–45 bps for stablecoins and ~80 bps for WETH.

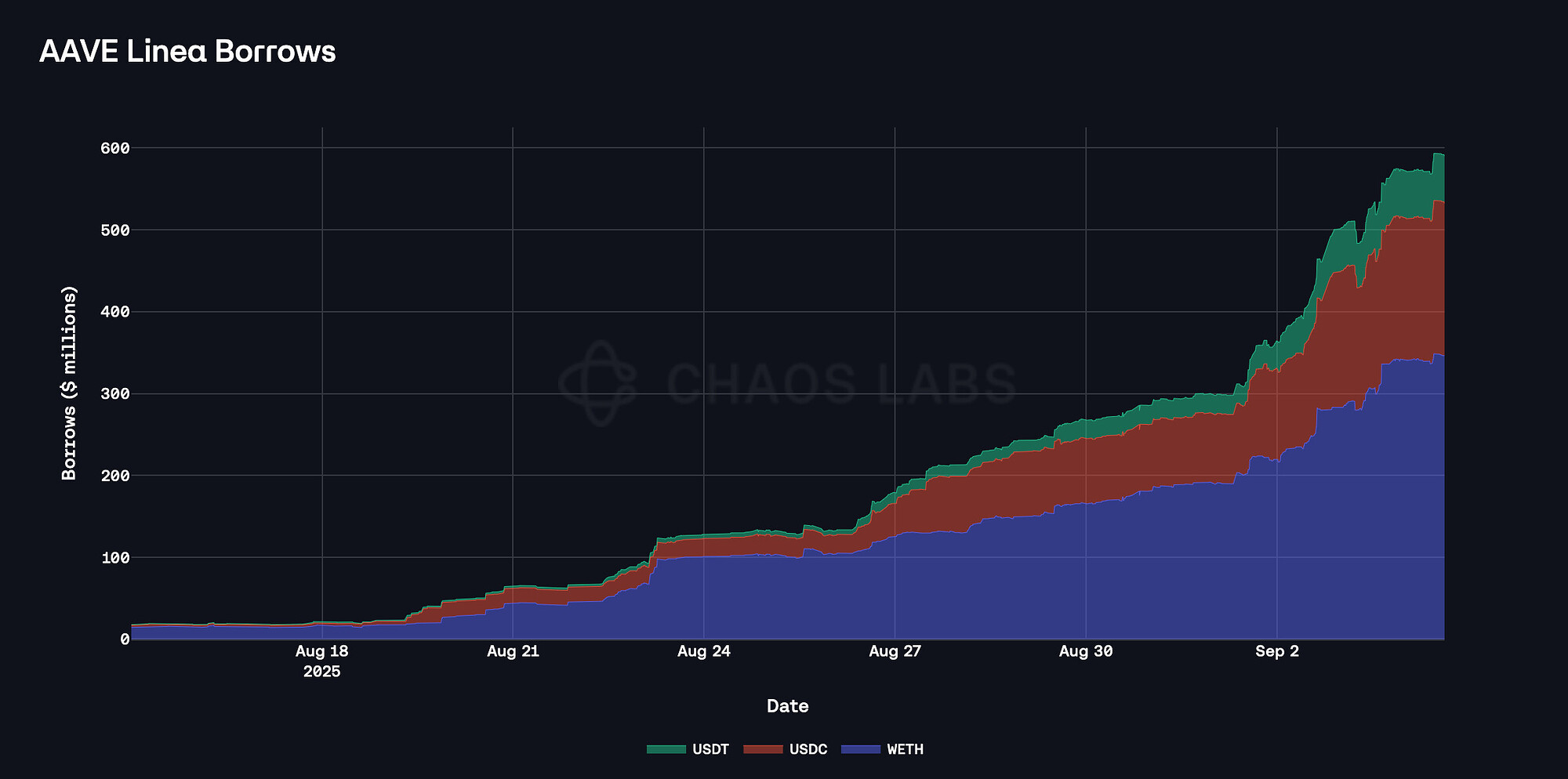

Borrowing demand on the Linea instance has also accelerated, with more than $450 million in additional debt accumulated. This increase has been driven primarily by WETH and stablecoin borrowing, with stables adding $210 million and WETH $250 million. The borrowing demand is fueled by the ongoing incentives and elevated spread between WETH borrowing rates and LRT/LST intrinsic yields, which make leveraged staking/restaking strategies more appealing.

In aggregate, the post-adjustment expansion of supply and debt, the convergence of supply-rate spreads, and ongoing incentives indicate persistent supply and borrowing demand on the Linea instance.

LRTs and LSTs

WETH borrowing demand on Linea is largely driven by persistent looping strategies involving liquid restaking and staking tokens (LRTs/LSTs). With WETH borrow rates on Linea averaging ~70–80 bps below Ethereum Core, the net APY on leveraged positions is substantially higher, sustaining elevated borrow demand.

While health scores are in the lower part of the range (1.03—1.15), the liquidation risk is minimal due to the high correlation of the collateral and debt prices.

The overwhelming majority of WETH borrowing presents minimal liquidation risk. Due to the high correlation between debt and collateral prices, the probability of significant liquidations is minimal. Additionally, the liquidation capacity for ezETH, weETH, wstETH, and wrsETH is high, as their DEX pools with WETH are among the deepest on Linea with aggregate liquidity of ~$70 million. This combination of factors, along with safe user behavior, supports an increase in caps for the listed LRTs and LST.

Stablecoins

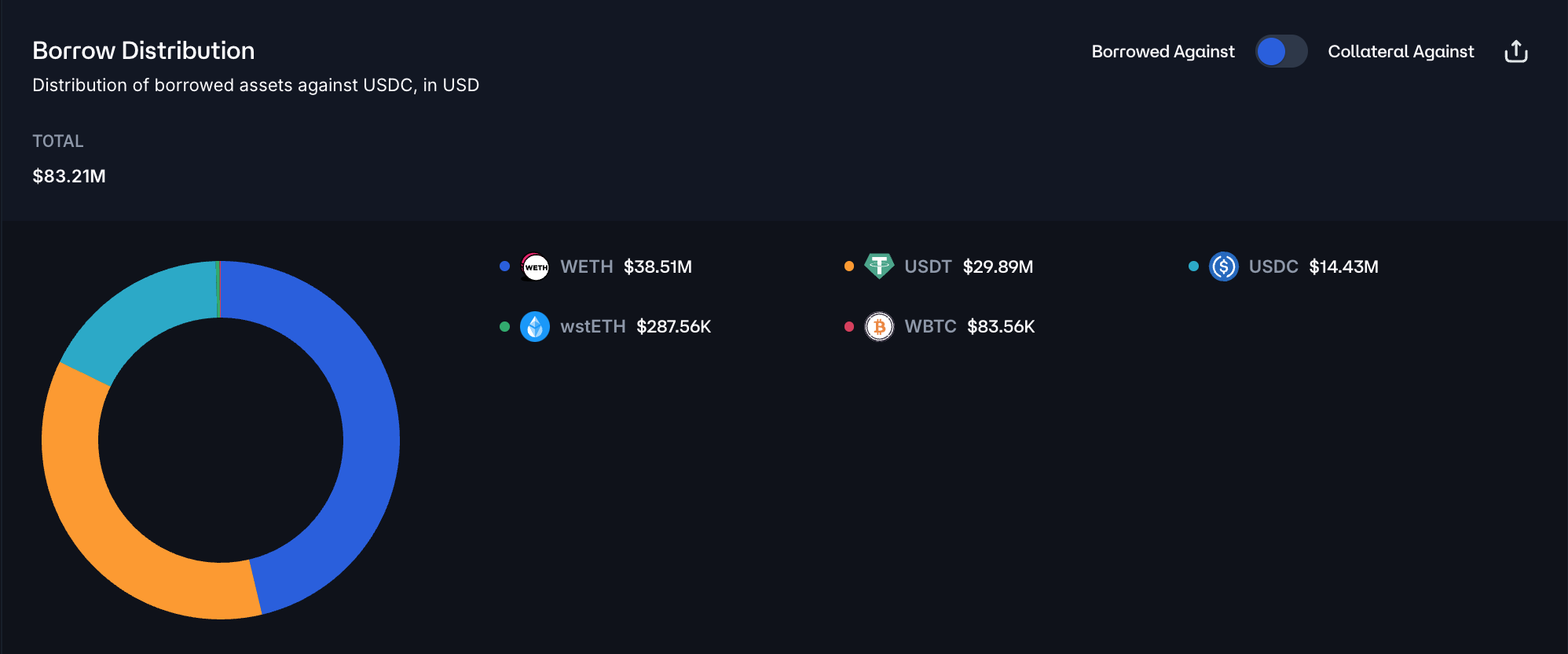

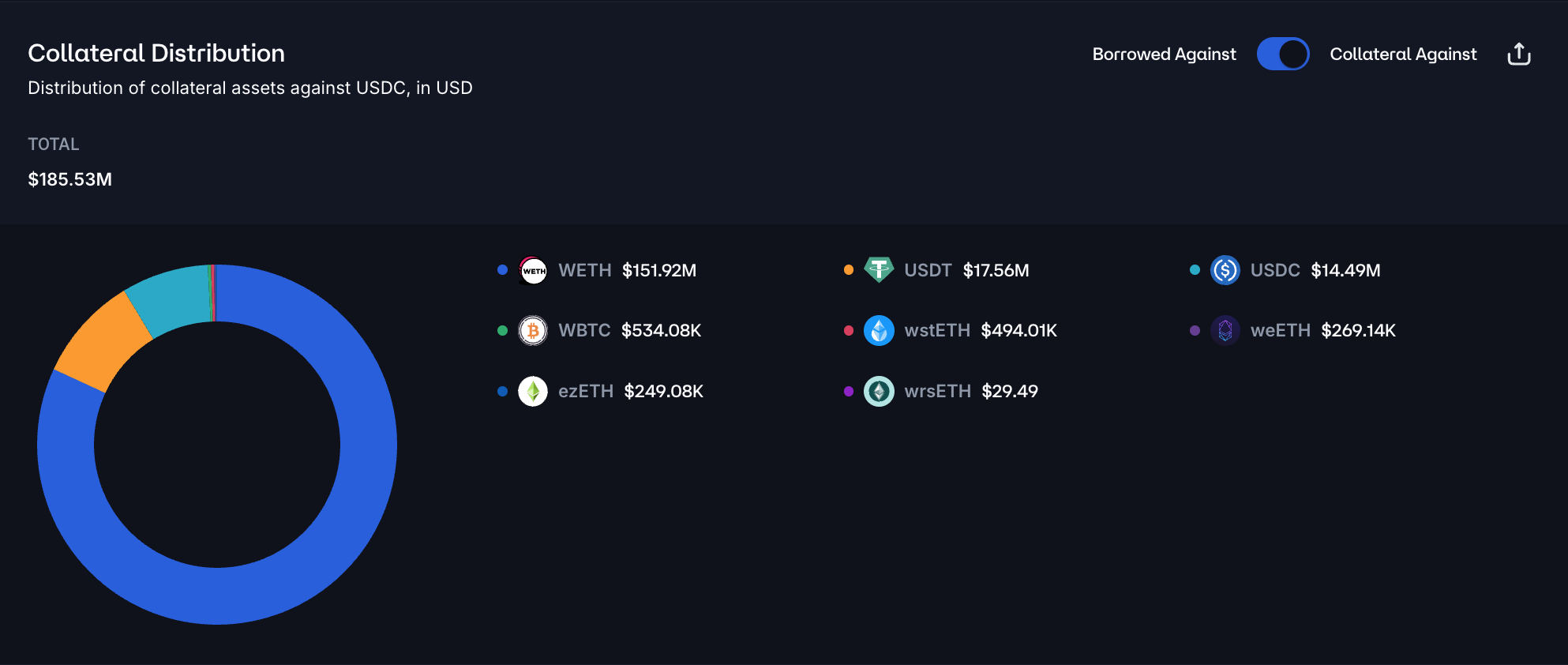

USDC and USDT have experienced notable growth on Linea, with combined supply increasing by over $250 million to ~$314 million, and total borrows rising by approximately $210 million to $245 million. Only a minor share of the stablecoin supply is used as collateral. For USDC, less than 33% of tokens serve as collateral, and half of this collateralized debt is in stablecoins, presenting minimal risk.

Stablecoin borrowing presents moderate liquidation risk as the majority of the volume is collateralized by WETH, which has a dominance of ~82%.

While such volatile debt-collateral pairs can be subject to liquidations during periods of increased WETH volatility or broader market stress, the distribution of health factors for top borrowers is clustered in the 1.25 - 3.0 range, substantially limiting the liquidation capacity. Nevertheless, if liquidations were to occur, USDC and USDT DEX pools on Linea have sufficient depth to liquidate 3,000 WETH for either USDT or USDC at 5% slippage.

Recommendation

In light of the significant supply and borrow demand, increased DEX liquidity, and the additional adjustment of risk parameters proposed in our previous post, we recommend doubling the supply and borrow caps for USDC, USDT, wstETH, and WBTC, along with increasing the supply caps for weETH, ezETH, and wrsETH to facilitate further growth of the instance.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Linea | USDC | 300,000,000 | 600,000,000 | 280,000,000 | 560,000,000 |

| Linea | USDT | 64,000,000 | 128,000,000 | 57,600,000 | 115,200,000 |

| Linea | wstETH | 4,800 | 9,600 | 1,200 | 2,400 |

| Linea | WBTC | 40 | 80 | 4 | 8 |

| Linea | weETH | 32,000 | 64,000 | - | - |

| Linea | ezETH | 38,400 | 76,800 | - | - |

| Linea | wrsETH | 3,200 | 6,400 | - | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.