TL;DR | Key Insights

-

Trend as Cornerstone:

ETH_price_gap is the most immediate driver of USDe fund flows. However, the model’s overall predictive power relies more heavily on the mid-term trend context provided by ETH_price_lag15. -

Non-linear Risk:

The market isn’t simply “the higher it goes, the riskier it gets.”

Data shows that the highest risk of extreme redemptions tends to emerge during moderate but rapid price increases (7-day returns between 7% and 40%), not during peak market euphoria. -

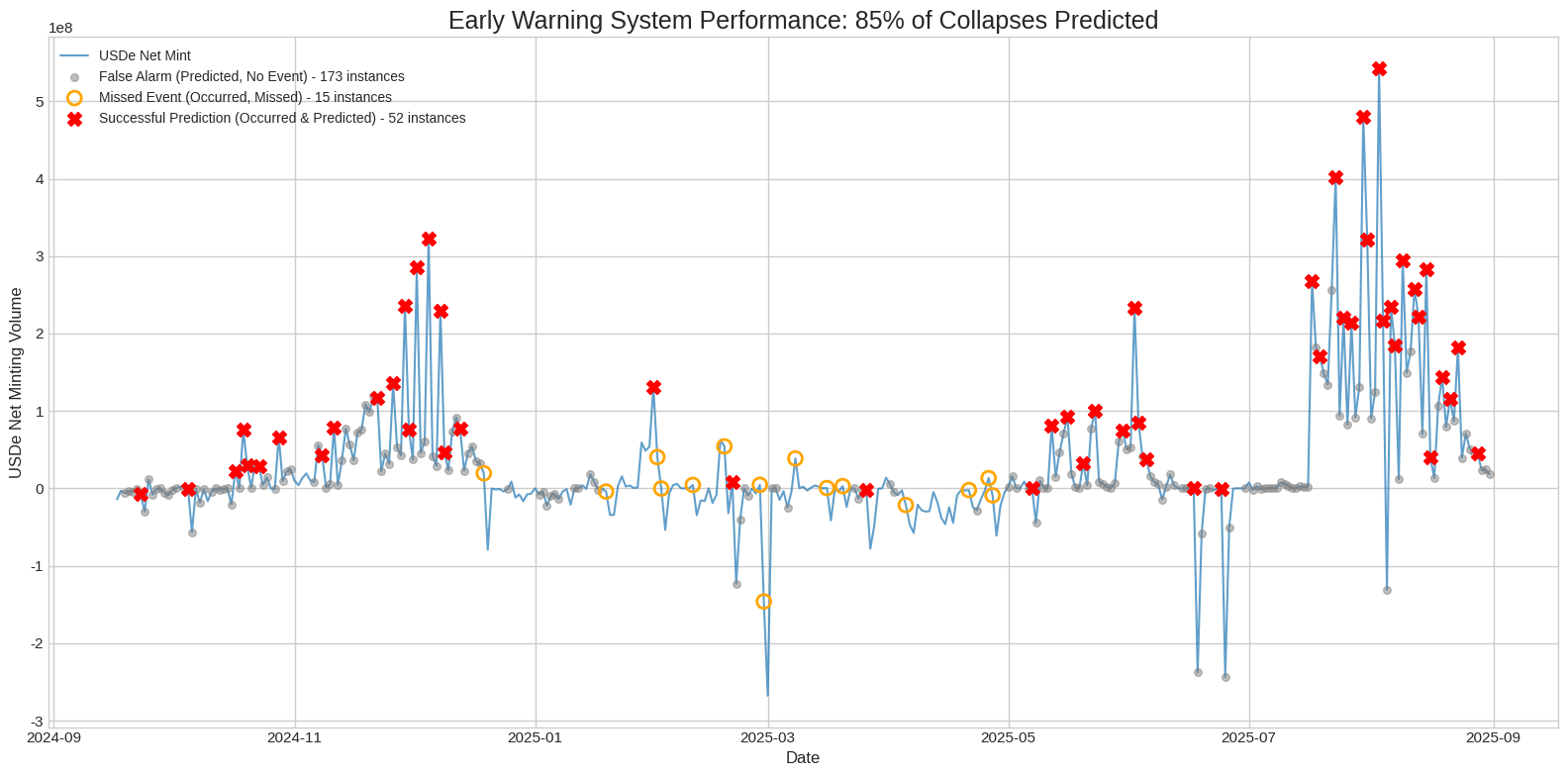

Proven Performance:

Our PoC Early Warning System, when operating in defensive mode (threshold = 0.40), successfully captured 85% of historical collapse events (Recall = 0.85)—demonstrating strong practical value. -

Explore Now:

Dune Dashboard: USDe Collapse Risk Monitor

Dune Dashboard: USDe Collapse Risk Monitor

This post aims to spark further discussion around market-driven risk detection models for Aave. Community feedback and critique are highly welcomed.

Overview: From Static Defense to Dynamic Early Warning

The Aave community has recently engaged in deep and multifaceted discussions around the integration of Ethena/sUSDe. Among these, reports such as “Strengthening Stability Between Aave and Ethena” by Chaos Labs have laid a solid quantitative foundation for protocol-level risk management—focusing primarily on internal mechanisms like reserve buffers and liquidation sequencing to construct a strong line of defense.

These mechanisms are critical reactive measures, designed to define how the protocol should respond once a crisis unfolds. However, this also raises a more forward-looking question:

Can we detect early signals—originating from the broader market—before a full-blown crisis erupts?

If the current risk controls are like reinforcing the doors and windows, our work aims to provide Aave with a real-time weather forecast.

This report follows that line of thinking and aims to answer one fundamental question through data modeling:

What truly triggers risk events involving USDe?

Our quantitative findings offer a clear answer:

It is not internal protocol settings (e.g., borrow rates) that act as the tipping point, but rather external market momentum.

Based on this insight, we developed a Proof-of-Concept Early Warning System that—when operating in defensive mode—was able to successfully detect 85% of historical extreme redemption events.

Thus, the core objective of this report is to introduce a market-driven dynamic risk alert dimension, designed to augment Aave’s existing static defenses with a forward-facing “risk radar” for a more resilient approach to protocol risk management.

Key Findings

This section summarizes the core risk mechanisms uncovered in our analysis—highlighting how trend dynamics, behavioral non-linearity, and flexible thresholding can support early warning in real-world conditions.

Finding 1: Dual Role of Trend – Foundation of the Model

USDe fund flows are governed by a two-factor structure: a trend anchor and a deviation driver.

-

Trend Anchor:

ETH_price_lag15

The most important variable in the model. It reflects the market’s memory of mid-term ETH price trends and forms the contextual baseline for interpreting current movements. -

Deviation Driver:

ETH_price_gap

The strongest direct driver. It measures how far the market has deviated from its 30-day trend, acting as a proxy for sentiment, hype, or momentum—driving mint/redeem behavior.

Finding 2: Nonlinear Risk – The Tactical Core

ETH_return_7d reveals a distinct nonlinear risk pattern, exposing how redemption risk peaks before the peak.

| ETH 7D Return | Collapse Probability | Risk Level | Insight |

|---|---|---|---|

| ≥ 40% (High) | 0.00% | At extreme highs, holders tend to HODL rather than exit. | |

| 7% ~ 40% (Mid) | 28.75% | Profit-taking zone : Risk peaks during sharp mid-level rallies. | |

| 0% ~ 7% (Low) | 14.66% | Stable conditions, low redemption pressure. |

This “inverted U-shape risk curve” suggests that the real stress emerges during acceleration toward the top, not at the top itself.

Finding 3: PoC Performance – A Practical Early Warning System

Finding 3: PoC Performance – A Practical Early Warning System

Our four-factor model isn’t meant to predict with perfection—it’s designed as a tunable smoke detector. The DAO can choose between two defensive strategies based on current needs:

| Strategy Goal | Maximize Detection | Minimize Governance Noise |

|---|---|---|

| Detection Threshold | 0.40 | 0.50 |

| Model Outcome | Recall = 85% | False alarms reduced to 25 |

| Total Alerts / False Alarms | 51 / 40 | 33 / 25 |

| Strategic Value | Prioritize coverage, catch all possible crises | Reduce noise, enhance signal quality for governance |

This trade-off enables DAOs to calibrate context-aware risk responses, choosing flexibility over rigidity.

Conclusion & Future Directions

Conclusion

This report demonstrates—through data—that incorporating external market momentum into Aave’s risk framework is both necessary and feasible.

A key insight is that while day-to-day fund flows are noisy (R² ≈ 45%), the signals that trigger extreme risk events are relatively clear and identifiable, with our model achieving a Recall of 85%.

Future Directions

This analysis is only a starting point. We hope it sparks further discussion within the community across two important dimensions:

-

Expanding Analytical Depth

-

More signals : Should we incorporate metrics like funding rates, arbitrage behavior, or L2 flows?

-

Smarter models : Could techniques such as XGBoost or unsupervised anomaly detection offer better early detection?

-

Finer time granularity : Can analyzing 15- or 30-minute intervals capture more real-time market stress?

-

-

Exploring Governance Applications

-

Risk dashboards : Can this type of model serve as a non-binding market risk dashboard to inform DAO decision-making?

-

Mechanism coordination : How might these external early warnings integrate with Aave’s internal safeguards like the USM (Unbacked Safety Module)?

-

Framework evolution : Should Aave’s risk governance process standardize the evaluation of dynamic trigger conditions?

-

A Reflexivity Insight

A Reflexivity Insight

Let us close with a thought experiment on reflexivity

If a public “storm warning” causes all ships to return to port early, and as a result, no shipwrecks occur—then the warning system has achieved its highest purpose.

The long-term value of tools like this may lie not in flawless prediction, but in changing collective behavior before disaster strikes.

Analytical Framework & Workflow

Analytical Framework & Workflow

To provide full transparency on our methodology, the diagram below visualizes the end-to-end workflow of this research project, from raw data to governance insights.

This workflow can be summarized in three key stages:

- Data Sourcing & Engineering: Combining on-chain data (AAVE GraphQL, Dune) with off-chain market signals to generate a comprehensive feature set.

- Modeling & Signal Extraction: Applying statistical methods and machine learning models (OLS, Logistic Regression) to select core variables and extract predictive risk signals.

- Outputs & Delivery: Translating the model’s findings into a governance-facing report (this post) and a real-time monitoring tool (the Dune Dashboard).

Full Report & Technical Details

Full Report & Technical Details

To maintain clarity and focus in this post, all detailed analysis and technical modeling have been published in our full Medium report.

We warmly invite data scientists, risk analysts, and developers in the community to critically review, challenge, and contribute to our methodology.

We believe that transparent and open peer review is the most effective path forward for advancing risk science in DeFi.

![]() Dune Dashboard: USDe Collapse Risk Monitor

Dune Dashboard: USDe Collapse Risk Monitor

Disclaimer

- Independence Statement:

This analysis represents an independent research effort. It was not sponsored, commissioned, or endorsed by Aave, Ethena, or any affiliated entity. - Not Investment Advice:

All content, data, and model outputs presented in this report are intended solely for academic exploration and governance discussion. Nothing herein should be construed as financial advice or as a basis for automated execution. - Governance Prerequisite:

Any potential application of the models described in this report must undergo Aave DAO’s full governance process — including deliberation, debate, and collective consensus. This report should not be interpreted as a directly executable proposal.

Report Metadata & Author

PoC Version: v0.1

Date Published: September, 2025

Author: Haysen Lin (Independent On-chain Risk Researcher)

Contact / Professional Profile: LinkedIn

License: CC BY 4.0 (This work is open for discussion, adaptation, and contribution with attribution).