Overview

Based on the observed improvements in USDe market structure, supply stickiness, distribution, and resilience, Chaos Labs recommends increasing the uOptimal for USDe on Core from 80% to 85%.

Our recent research paper, “Stress Testing Ethena: A Quantitative Look at Protocol Stability,” examines how rapidly growing deposits of Ethena’s USDe, sUSDe and especially Pendle Principal Tokens are reshaping Aave’s collateral pool and funding dynamics. It maps out both on‑chain liquidity hazards (e.g., thin PT markets, leveraged looping, rehypothecation) and backing‑side tail risks (exchange or custodian failure, collateral de‑peg, prolonged negative funding) via scenario modeling and Monte‑Carlo simulations, while proving that Aave’s current risk‑oracle floors, eMode parameterization and liquidation controls would absorb most plausible shocks. The proposed cap increases reflect and incorporate the insights from this paper.

Finally, our most recent paper, “Aave’s Growing Exposure to Ethena: Risk Implications Throughout the Growth and Contraction Cycles of USDe ,” shows that contraction and stabilization dynamics within the Aave-Ethena ecosystem are closely linked. When sUSDe yields decline, leveraged positions unwind, freeing up significant stablecoin liquidity in Aave through repayments. Simultaneously, PT/USDe borrowers shift their debt into other stablecoins, generating upward price pressure on USDe precisely when redemption demand rises. Crucially, stablecoin repayments from leverage unwinders typically outweigh PT debt migration into stablecoins, creating a natural liquidity buffer. Our analysis indicates this dynamic effectively stabilizes Aave markets, comfortably absorbing potential stress even during Ethena’s withdrawal of backing assets. Overall, the current market structure supports increased exposure, provided backing deployment into Aave remains prudently managed. The proposed cap increases reflect and incorporate the insights from the aforementioned papers.

For more insight into how the PT Risk Oracle operates, please consult the following post and its follow up. In addition, the Risk Oracles outputs can be monitored live at the following page.

Motivation

The USDe market on Aave is unique in that both the supply and borrow sides are heavily driven by highly leveraged participants. On the supply side, a substantial share (**~**60%) of USDe originates from USDe/Stablecoin leveraged positions in a “Liquid Leverage” strategy. Liquid Leverage refers to promotional rewards introduced by Ethena on Aave. In this setup, users who deposit 50% USDe and 50% sUSDe and loop their positions with other stablecoins like USDC or USDT earn additional promotional rewards on the USDe portion of the position. Currently, these promotional rewards on USDe are set to match the sUSDe yield, effectively boosting returns.

This dual-sided leverage has historically resulted in greater interest rate volatility for USDe compared to other stablecoin markets. Small shifts in rates on either side of the market can create amplified feedback loops, leading to abrupt changes in utilization and yield levels.

The introduction of liquid leverage rewards has significantly altered supply-side dynamics. When these rewards are combined with USDe supply rates, the supply side has become less elastic to the downside. This has proven effective in preventing USDe supply contraction, in conjunction with billions of USDe are locked in PTs. Maintaining attractive combined yields from liquid leverage rewards and USDe supply rates has emerged as one of the primary mechanisms for minimizing USDe supply contraction and dampening rate volatility in low sUSDe yield environments.

Driven by the improvements from liquid leverage, making the USDe supply side stickier and enhancing resilience through broader supplier distribution, we recommend increasing the uOptimal for this market to 85%, contingent on the liquid leverage program remaining in its current form, and in recognition that a further increase to 90% will be considered if the program remains effective.

Benefits of uOptimal Increase

Raising the uOptimal for USDe will have several positive impacts on market dynamics.

Increased Borrowing Capacity

Raising the uOptimal for USDe increases the amount of available liquidity for borrowing. This is particularly important for positions borrowing USDe against USDe-based PTs, as it allows these positions to operate more efficiently. This in turn, enables more PT loopers to borrow USDe with enhanced capital efficiency compared to other stablecoins.

Stronger Liquid Leverage Yields and Stickier Supply

A higher uOptimal supports more competitive liquid leverage yields, even when sUSDe yields are low. By allowing loopers to earn more USDe supply rate, the net returns from liquid leverage strategies remain attractive, making USDe supply stickier and reducing the risk of supply contraction during less favorable yield environments.

A 5% increase in uOptimal is expected to result in approximately a 25 bps increase in the USDe supply rate, directly boosting liquid leverage returns.

As shown in the chart below, even in a low sUSDe yield environment of 4%, combined 10x liquid leverage yields can reach around 6.76% when uOptimal is set to 85%, assuming a market utilization of 88%, stablecoin borrowing costs are 5.3%, and Ethena maintains liquid leverage rewards in line with the sUSDe yield. This demonstrates the resilience of the strategy’s net returns, even when base yields are compressed.

Increased Revenue

The increase in uOptimal will also generate more revenue for the Aave DAO. With current market conditions, a 5% increase in uOptimal is expected to increase USDe borrowing by approximately $71 million, which would generate an additional $1.15 million in annual income for the DAO.

Risks

The uOptimal parameter primarily determines the utilization threshold at which the borrow rate curve steepens, effectively influencing how much of a reserve’s liquidity remains readily available for suppliers to withdraw or for executing liquidations. While raising uOptimal can improve capital efficiency, it also reduces the liquidity buffer in the reserve, which may heighten certain market risks.

In the case of USDe, these risks are closely tied to two key factors: supply concentration and USDe liquidity mechanics. High supplier concentration can magnify the impact of large withdrawals or position unwinds, particularly if liquidity is already constrained by a higher uOptimal. The rehypothecation of supplied collateral means that most deposits are actively used to collateralize external debt, further reducing available idle liquidity and increasing reliance on active borrowers to repay during stress scenarios.

The following subsections examine each of these risks in detail.

Supply Concentration

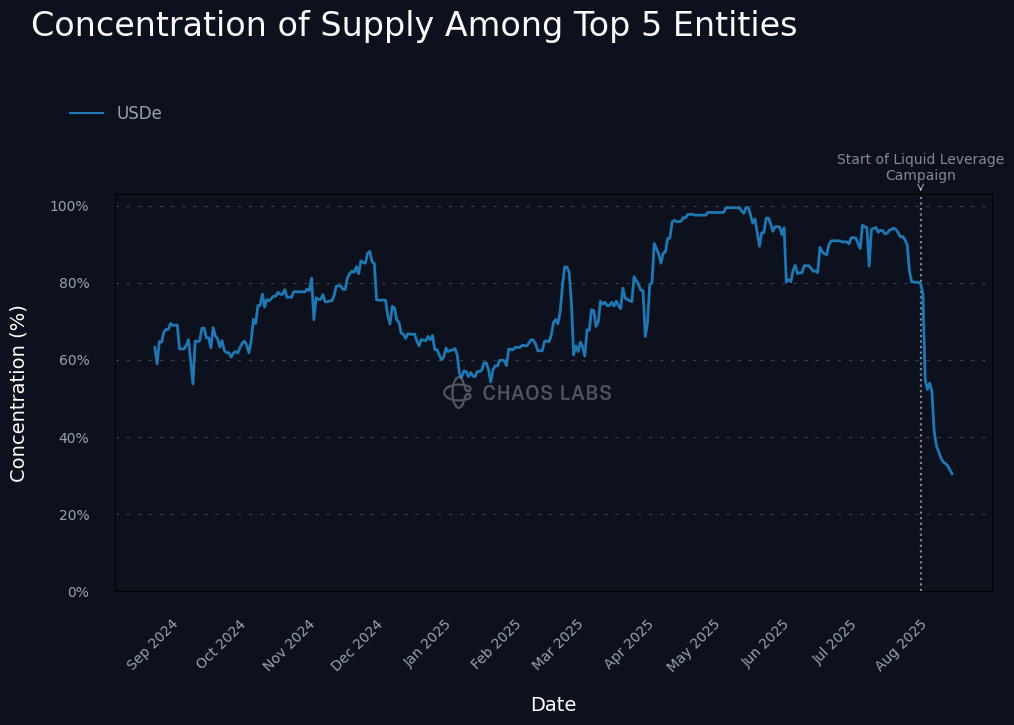

The USDe market on Aave has been highly concentrated since its inception, with the majority of supply controlled by a small number of large entities. Historically, participants such as Abraxas Capital and FBG Capital have been the primary supplier of USDe, resulting in extreme concentration levels. At its peak in May 2025, the top 5 entities accounted for 99.5% of the total USDe supply on Aave.

The introduction of liquid leverage in late July 2025 significantly improved this distribution. As the strategy gained adoption, the supply concentration of the top 5 entities dropped to as low as 30%, and this figure is projected to continue declining. This shift has made USDe one of the most widely distributed stablecoin on Aave, with a broader base of suppliers mitigating the risks posed by large individual participants.

When analyzing the Available Liquidity Ratio (defined as the top 5 entities’ total supply divided by available liquidity) the current value is 1.35. This means that 74% of the top five entities’ total supply would need to be withdrawn simultaneously to push the market to maximum utilization, an extremely unlikely scenario. This ratio reflects the market’s ability to service redemptions even for its largest participants.

While increasing uOptimal will naturally raise the Available Liquidity Ratio, all else being equal, the projected value of 1.73 (assuming all additional borrowing capacity is used) remains within a low and manageable range.

USDe Liquidity Risk

Supplied USDe on Aave is predominantly lent out to leveraged PT loopers. Out of the current ~$931 million in total USDe borrowing, approximately 82% is tied to PT-based looping strategies. These strategies typically involve supplying USDe-based PTs, borrowing USDe (or other stablecoins), minting more USDe-based PTs, and repeating the cycle. While this structure amplifies yield, it also amplifies the USDe liquidity risk in the USDe market.

Borrowing activity for USDe has accelerated sharply in recent months. Following the introduction of USDe eMode for PT collateral, borrowing climbed to approximately $931 million, driven by leveraged PT yield strategies due to ability to offer better capital efficiency. This shift has pushed USDe utilization consistently toward the optimal range, tightening liquidity and increasing the market’s reliance on loopers.

This borrowing is concentrated across a set of PT maturities, which have relatively limited on-chain liquidity relative to the amount supplied on Aave. In a stress scenario, this imbalance could make it difficult for loopers to unwind positions without significant slippage. Such conditions could push PT prices toward their oracle floor, trigger a risk oracle freeze, and result in negative yields. In turn, borrowers may be unable to repay USDe debt, and liquidity constraints could prevent suppliers from withdrawing, adding further pressure to Aave’s liquidity layer.

Importantly, the current USDe market structure on Aave contains a mitigating factor: when USDe supply begins to contract, for every 1 USDe withdrawn, there is approximately $1.5 worth of stablecoin repayment into the reserve because of liquid leverage positions. This repayment dynamic gives PT loopers the ability to migrate into other stablecoin debt (via the Debt Swap feature) without causing a sharp spike in borrow rates for other stablecoins. While this does not eliminate liquidity risk, it reduces the likelihood of severe cross-asset liquidity stress during a USDe-specific unwind.

Overall, the rehypothecation of USDe into PT loop strategies creates a dependency loop between supply stability and PT profitability. If large loopers exit abruptly, utilization could spike and supply could contract, but the stablecoin repayment offset and debt swap pathways provide meaningful buffers to prevent this from cascading into broader Aave market instability.

Recommendation

We recommend increasing the uOptimal for USDe on Aave Core 85% as an initial step. This staged approach balances the benefits of higher utilization with prudent risk management.

The decision to begin with a 5% increase reflects Ethena’s stated plan at the launch of liquid leverage: after one month, the USDe promotional rate may be reduced so that the sum of Aave’s native USDe lending rate and the promotional rate roughly approximates the sUSDe APY. This change could modestly reduce supply-side stickiness, due to the expected outflows associated with unprofitable looping rates as sUSDe yields contract, making a gradual adjustment the safer course.

Even at 85%, the benefits are meaningful. The change will expand borrowing capacity, improve liquid leverage yields, support supply stickiness, and generate additional revenue for the DAO. Risks from a smaller idle liquidity buffer, such as reduced capacity to meet large withdrawals or execute liquidations in stress events, are mitigated by recent improvements in market structure, including the sharp decline in supply concentration, the tendency for liquid leverage participants to repay more stablecoins than the amount of USDe they withdraw (due to their 50/50 USDe–sUSDe deposit structure), and Aave’s existing safeguards such as the PT risk oracle and the Debt Swap feature.

Specification

| Instance | Asset | Current Uoptimal | Recommended Uoptimal |

|---|---|---|---|

| Ethereum Core | USDe | 80% | 85% |

Implementation Note: Changes to uOptimal will be executed via Aave’s Risk Stewards and are subject to their operational constraints, which for uOptimal adjustments allow a maximum absolute change of 3% with a minimum delay of 3 days. As such, the parameter will first be raised from 80% to 83%, and then to 85% after the required delay.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation. Our pre-launch risk reports on Ethena, published over a year ago, represented a temporary compensated engagement, bear no implications on the current state of the protocol and can be viewed here on our website. We additionally provide proof-of-reserve attestations for the Ethena Protocol, which periodically reflect the aggregate state of the portfolio relative to the underlying USDe shares emitted.