Overview

Chaos Labs supports the proposal to increase supply caps of Ethena’s November PT expiries on Aave V3’s Core Instance. However, we do note some concerns regarding the available liquidity on the market and recommend a cautious approach going forward.

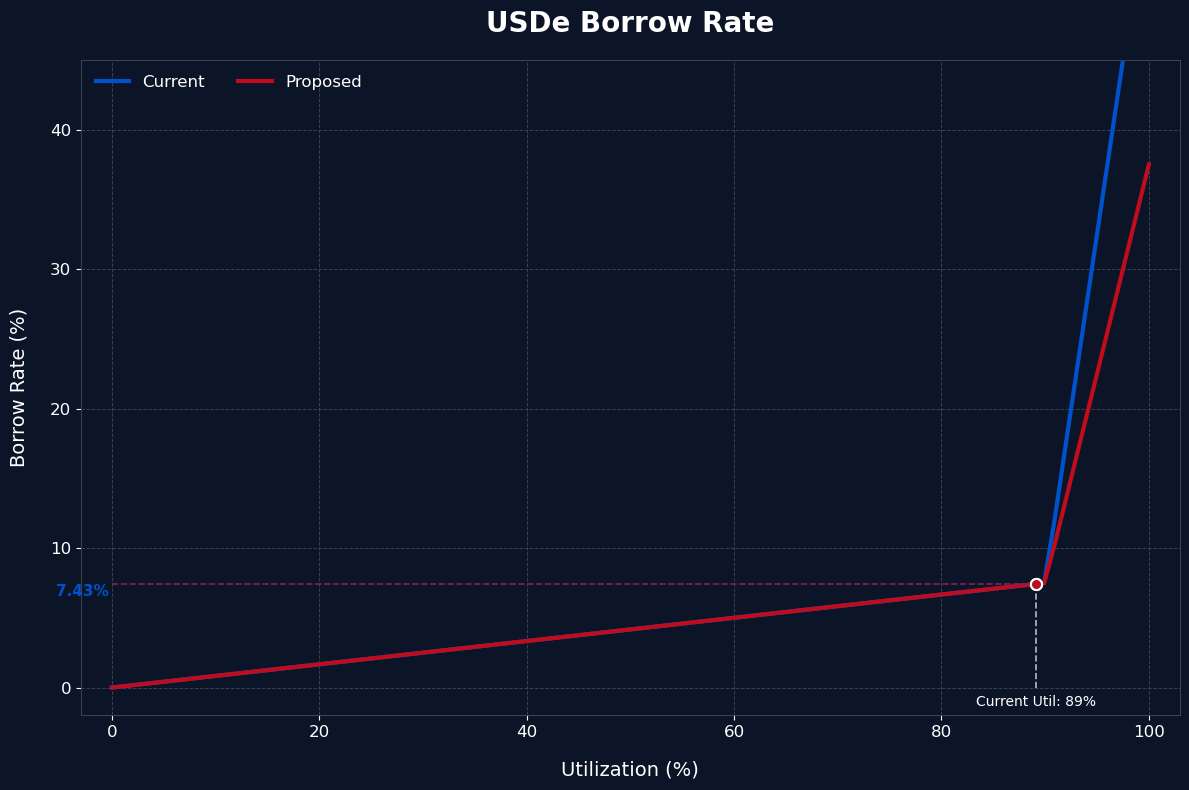

Additionally, we recommend decreasing the Slope 2 of USDe prior to the increase of the supply caps in order to minimize the borrow rate volatility of the asset.

Motivation

The PT-sUSDe and PT-USDe November expiries’ initial supply caps have been determined within their respective initial listing proposals (PT-USDe, PT-sUSDe); those listing recommendations were made prior to our coordination plan, outlined with Ethena, regarding its Aave-related prevention of system-wide risk and Aave market disruption. Specifically, we outlined a framework in which USDe’s backing supplied into Aave functions as “last capital standing” capital while whitelisting Aave as USDe redeemer in order to enable internalized liquidations of Ethena’s collateral in cases of adverse scenarios, as detailed in the original post here. These changes significantly improve Ethena’s collateral risk profile and enable us to support increased exposure to the PT assets mentioned.

Our recent research paper, “Stress Testing Ethena: A Quantitative Look at Protocol Stability,” further examines how rapidly growing deposits of Ethena’s USDe, sUSDe and especially Pendle Principal Tokens are reshaping Aave’s collateral pool and funding dynamics. It maps out both on‑chain liquidity hazards (e.g., thin PT markets, leveraged looping, rehypothecation) and backing‑side tail risks (exchange or custodian failure, collateral de‑peg, prolonged negative funding) via scenario modeling and Monte‑Carlo simulations, while proving that Aave’s current risk‑oracle floors, eMode parameterization and liquidation controls would absorb most plausible shocks.

And, “Aave’s Growing Exposure to Ethena: Risk Implications Throughout the Growth and Contraction Cycles of USDe ,” shows that contraction and stabilization dynamics within the Aave-Ethena ecosystem are closely linked. When sUSDe yields decline, leveraged positions unwind, freeing up significant stablecoin liquidity in Aave through repayments. Simultaneously, PT/USDe borrowers shift their debt into other stablecoins, generating upward price pressure on USDe precisely when redemption demand rises. Crucially, stablecoin repayments from leverage unwinders typically outweigh PT debt migration into stablecoins, creating a natural liquidity buffer. Our analysis indicates this dynamic effectively stabilizes Aave markets, comfortably absorbing potential stress even during Ethena’s withdrawal of backing assets.

Additionally, since our initial recommendations were published, a significant gap of time passed before listings went live, effectively reducing their distance to time of maturity by roughly one third for the upcoming November PTs and, by extension, reducing their duration risk further. As PTs approach maturity, their price sensitivity to rate shocks compresses non-linearly, reducing price risk for loopers and liquidity constraints for liquidations. This materially improves the risk-reward of facilitating supply caps increases now versus at listing, as the shorter remaining term lowers the probability-weighted loss in stress and narrows basis volatility of the PTs.

Liquidity conditions have also strengthened meaningfully. sUSDe PT now benefits from approximately $45 million of concentrated LP depth. In parallel, Ethena is directing additional incentives toward the USDe PT pool, and we expect that LP to scale rapidly in the near term, with a reasonable base case of reaching around $30 million within the next week.

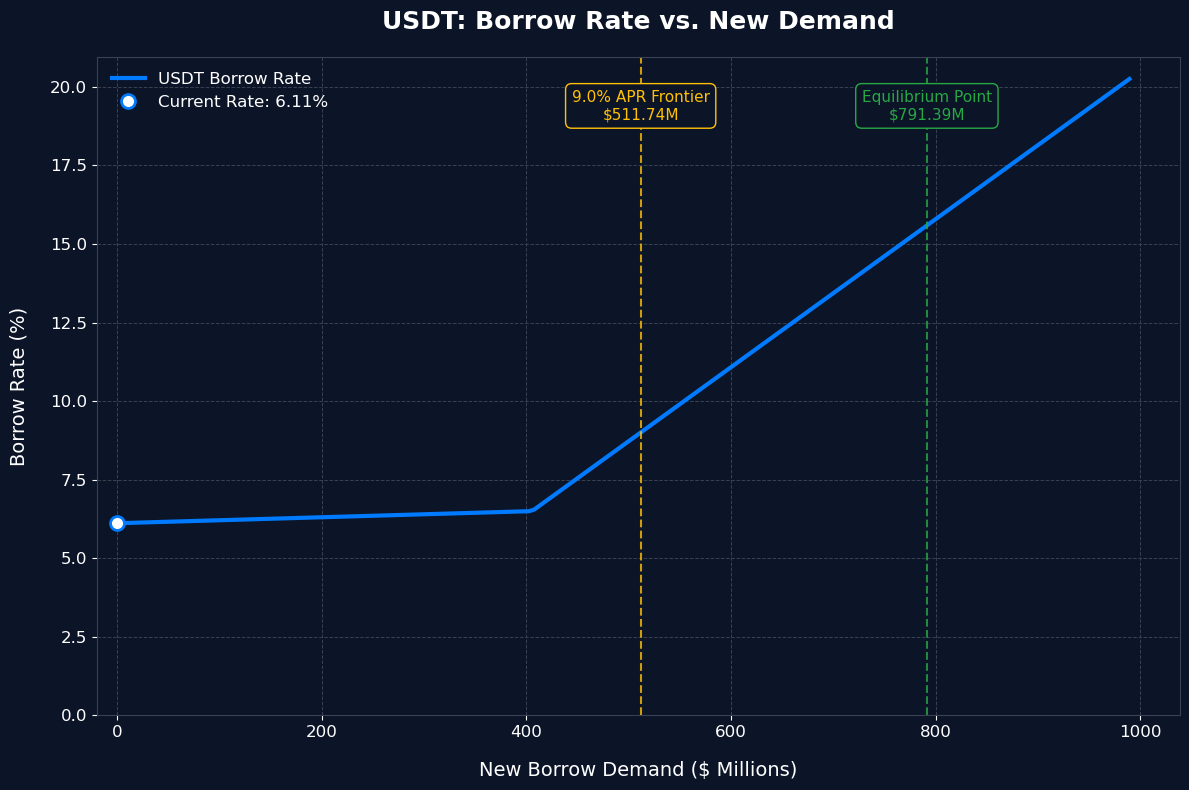

We note, however, that available stablecoin supply on Aave is currently constrained at roughly $1.0 billion across major reserves (about $510 million USDT, $370 million USDC, and $120 million USDe) prior to surpassing their UOptimal point. If the new PT caps were to be rapidly utilized, the associated loop financing could create up to $1.8 billion in incremental stablecoin demand during the deposit window, which may induce short-term spikes in stablecoin borrow rates.

To minimize this transitory volatility and protect user experience, we recommend a temporary, 20% reduction in USDe’s Slope2. Smoothing the tail of the IR curve during the expected deposit surge reduces the risk of rate volatility and discourages reflexive deleveraging, while an adjustment to the interest curve back to its current value can be performed once the rollover normalizes, if necessary.

Finally, we do not expect the proposed caps to be filled immediately. Pendle-side liquidity to acquire PTs remains finite; as buy pressure increases during the rollover, implied PT yields should mechanically compress. That rate compression is a natural stabilizer: once PT yields fall, the incremental carry from looping on Aave becomes less attractive relative to financing costs, which should slow the pace of cap utilization.

Specifications

| Asset |

Chain |

Current Supply Cap |

Recommended Supply Cap |

| PT_sUSDe_27NOV2025 |

Ethereum |

300,000,000 |

1,200,000,000 |

| PT_USDe_27NOV2025 |

Ethereum |

200,000,000 |

1,000,000,000 |

| Asset |

Chain |

Current Slope 2 |

Recommended Slope 2 |

| USDe |

Ethereum |

50% |

30% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0